Do Seniors Over 65 Pay Property Taxes In Texas For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes The biggest question though is how will schools be

How Much is the Texas Over 65 Tax Exemption All homeowners in Texas can apply for a standard residence homestead exemption that can relieve 40 000 of taxable property value Seniors in Texas can get an additional 10 000 Disabled homeowners also qualify for a 10 000 exemption Persons with an over 65 disability or disabled veterans exemption can spread their tax payments over a year in four installments without penalty or interest To use the installment payment plan option you must include a notice about this with your first payment

Do Seniors Over 65 Pay Property Taxes In Texas

Do Seniors Over 65 Pay Property Taxes In Texas

https://blog.ipleaders.in/wp-content/uploads/2021/09/Laws-of-Property.jpg

Should You Protest Your Property Taxes In Austin

https://activerain-store.s3.amazonaws.com/blog_entries/935/5744935/original/RelayThat_save_on_property_tax_dollars.jpg?1660084904

How To Successfully Protest Your Property Tax Appraisal In Harris

https://res.cloudinary.com/agiliti/image/upload/v1664713064/dilapidated-house-assessed-value.webp

At the age of 65 seniors can apply for an exemption from Texas property taxes If you are eligible for this exemption instead of facing an annual property tax bill your tax obligations will be frozen In order to qualify for the exemption an individual must be 65 or older be an owner or part owner of a property and the property in Are people over 65 exempt from property taxes in Texas Nope seniors are not automatically exempt from property taxes unless they qualify for a total exemption e g a 100 P T veteran Property tax is an obligation you should continue to fulfil so long as you live on the property

Do seniors over 65 pay property taxes in Texas Yes seniors over 65 must pay property taxes in Texas However seniors over 65 can apply for an additional exemption from property taxes and they receive additional benefits Filing a Texas property tax over 65 exemption has no downsides or extra costs and it s a recommended strategy for every senior However it s important to know each of the benefits and protections under the exemption so you have a clear idea

Download Do Seniors Over 65 Pay Property Taxes In Texas

More picture related to Do Seniors Over 65 Pay Property Taxes In Texas

Hecht Group How To Pay Your Kansas Property Taxes Online

https://img.hechtgroup.com/1662909487018.Document

Hecht Group Schenectady Property Taxes How To Pay In Person

https://img.hechtgroup.com/1665371371575.Document

What Happens If You Don t Pay Property Taxes In Texas

https://assets.site-static.com/userFiles/3705/image/del-tax-header.png

If you qualify for the Age 65 or Older or Disability exemptions you may defer or postpone paying property taxes on your home for as long as you live in it This deferral does not cancel your taxes Your property taxes accrue five percent interest annually until the deferral is removed Over 65 Exemption In addition to the 25 000 exemption that all homestead owners receive those age 65 or older qualify for a 10 000 homestead exemption for school taxes You may apply to your local appraisal district for up to one year after the date you become age 65 or up to one year after the taxes are due

A Texas homeowner qualifies for a county appraisal district over 65 exemption if they are 65 years of age or older This exemption is not automatic In Texas seniors who are 65 years of age or older are eligible for certain exemptions if the property is their primary residence homestead Learn more about property tax breaks and exemptions for people 65 and older

CA Parent Child Transfer California Property Tax NewsCalifornia

https://i0.wp.com/propertytaxnews.org/wp-content/uploads/2021/10/California-Property-Taxes-scaled.jpg?resize=2048%2C1192&ssl=1

Is It Cheaper To Own Or Rent Leia Aqui Is It Financially Better To

https://vividmaps.com/wp-content/uploads/2019/05/renting-vs-owning.jpg

https://cbsaustin.com/news/local/new-texas-law...

For the first time in Texas history a new bill is giving property tax breaks to those who are disabled or over the age of 65 CBS Austin is told the new law will help people stay in their homes The biggest question though is how will schools be

https://www.texasrealestatesource.com/blog/texas...

How Much is the Texas Over 65 Tax Exemption All homeowners in Texas can apply for a standard residence homestead exemption that can relieve 40 000 of taxable property value Seniors in Texas can get an additional 10 000 Disabled homeowners also qualify for a 10 000 exemption

The 85th Taxes The Dallas Morning News

CA Parent Child Transfer California Property Tax NewsCalifornia

Hecht Group Elderly Homeowners In Washington May Be Eligible For A

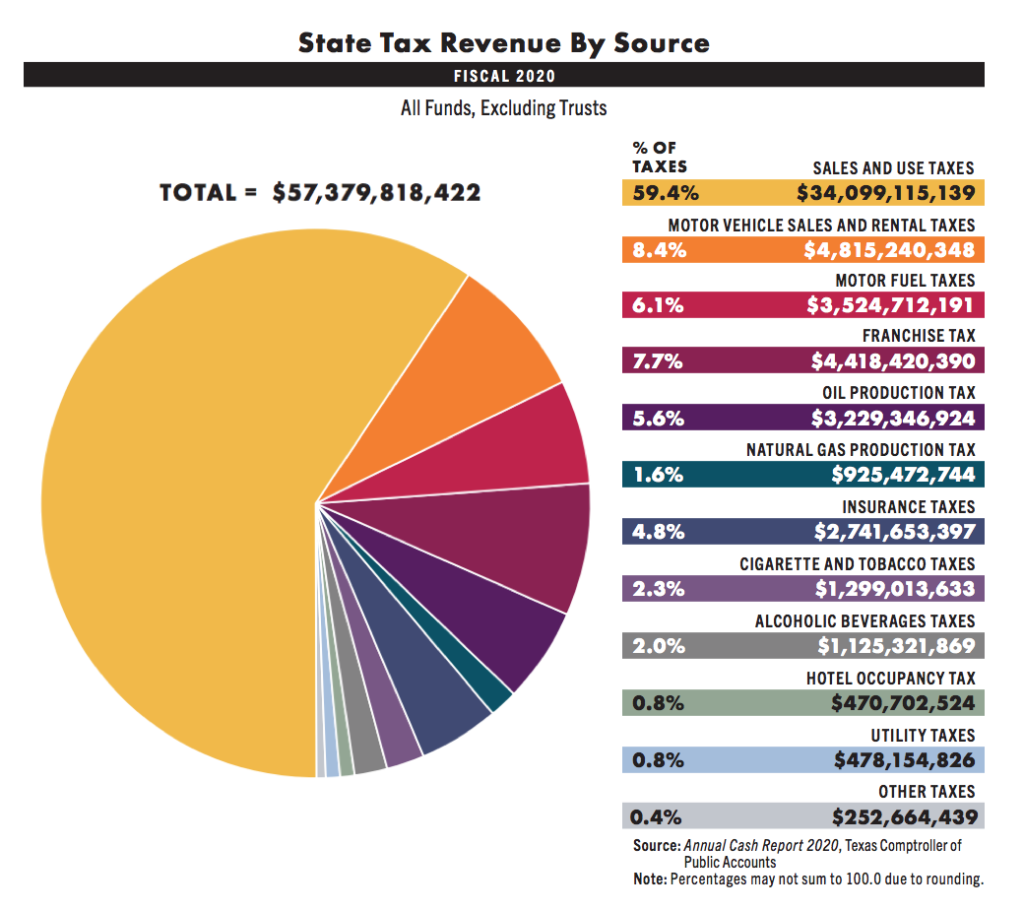

What Are The Tax Rates In Texas Texapedia

Here Is How Much People Pay In Property Taxes In Minnesota 24 7 Wall St

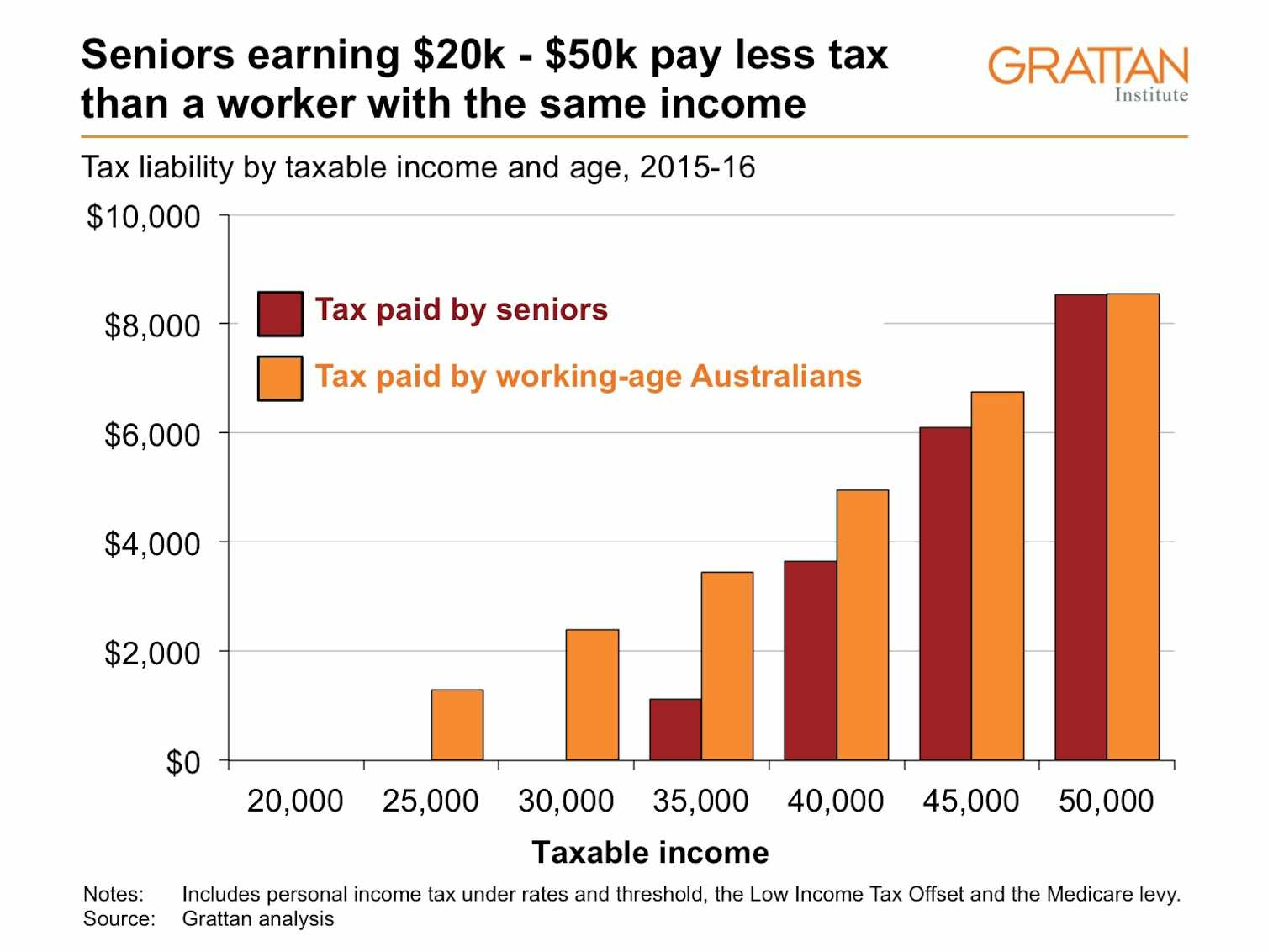

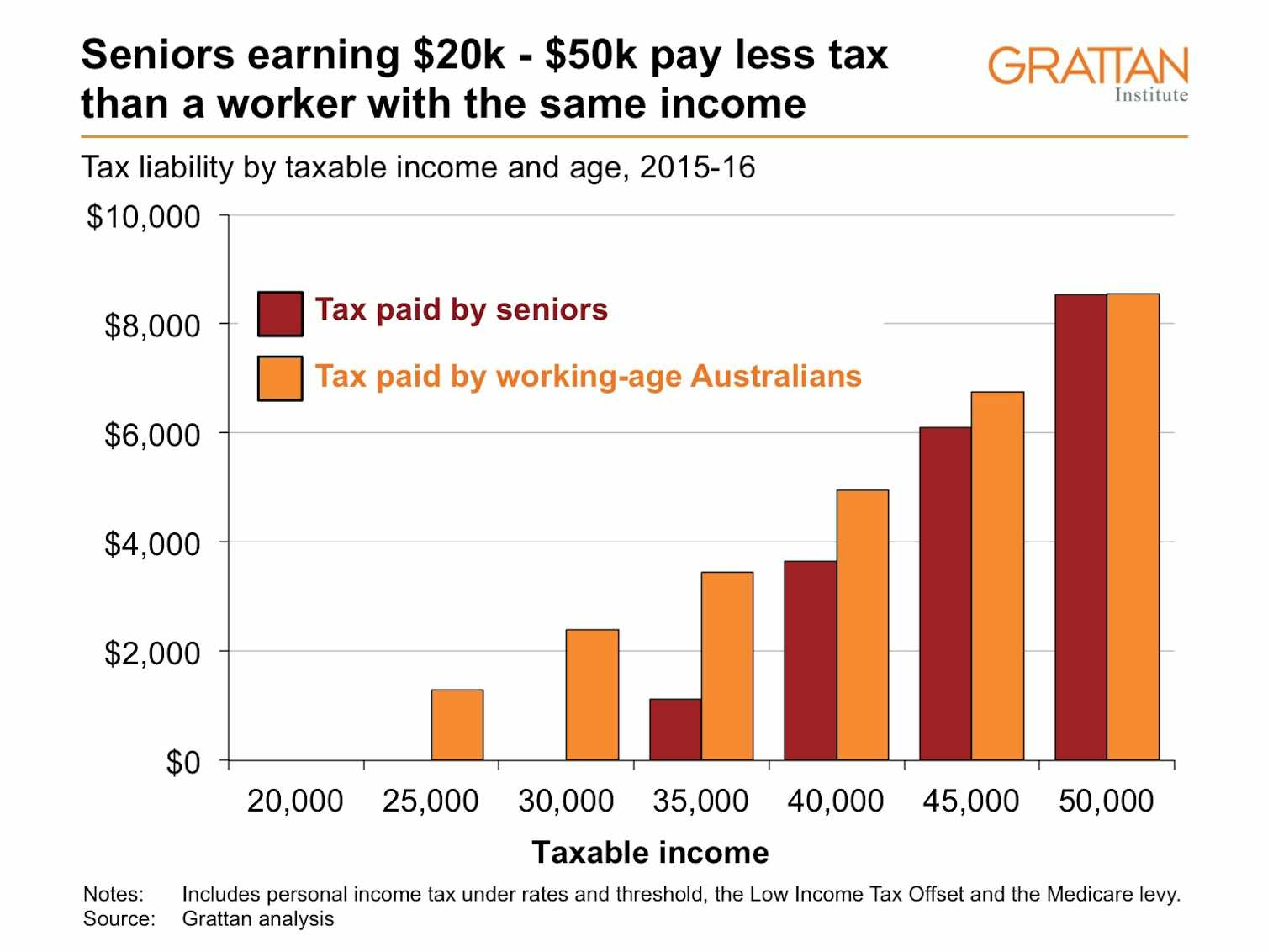

Why Special Tax Breaks For Seniors Should Go

Why Special Tax Breaks For Seniors Should Go

Hecht Group When Do Seniors Stop Paying Property Taxes

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

Property Tax 101 infographic Bizagility

Do Seniors Over 65 Pay Property Taxes In Texas - Filing a Texas property tax over 65 exemption has no downsides or extra costs and it s a recommended strategy for every senior However it s important to know each of the benefits and protections under the exemption so you have a clear idea