Do Supplier Rebates Have Gst When a vendor accepts a reimbursable coupon or a non reimbursable coupon which is being treated as a reimbursable coupon an input tax credit ITC can be claimed for the

At a basic level a rebate is an arrangement in which suppliers agree to return a portion of a purchase price to customers if they buy a specified value of products within an allotted period Many rebates A supplier rebate is effectively a discount on the cost of goods sold the difference being that the discount is awarded as a rebate not up front but at a later

Do Supplier Rebates Have Gst

Do Supplier Rebates Have Gst

https://website-assets.enable.com/images/seo/page_supplier_rebates.png

Is GST Mandatory For Udyam Registration Compulsory Or Not

https://udyamregistrationform.com/wp-content/uploads/2021/09/is-gst-mandatory-for-udyam-registration.jpg

Rebates Are Available

https://s2.studylib.es/store/data/006704116_1-c88289a7183370d12db56e1d769b4e05-768x994.png

Rebates on invoices how to deal with GST and QST Miller Thomson LLP Canada April 16 2020 The current economic circumstances straining the liquidity of Canadian Paragraph 181 2 a of the Act applies where a supplier pays a rebate to a particular person in respect of a supply of property or service taxable at the rate of seven per

Understand what a rebate is and the way you apply GST to rebates Making an adjustment because of a rebate Information for purchasers and suppliers on making A supplier rebate is simply a payment that a business makes to its suppliers in order to incent them to continue supplying the company The size and shape of the rebate

Download Do Supplier Rebates Have Gst

More picture related to Do Supplier Rebates Have Gst

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

Consumer Rebates Are You Getting Your Fair Share A Rebate Is An

https://i.pinimg.com/originals/24/2f/eb/242febcbd7f7183a96e09f0202d1b8e1.jpg

Supplier Management

https://precoro.com/blog/content/images/2021/05/Supplier-Management-table.jpg

To claim your rebate use Form GST189 General Application for GST HST Rebate You can only use one reason code per rebate application If you are eligible to Small suppliers those with gross taxable sales of less than 30 000 in the previous twelve months are not required to register for GST and will not assess GST on their invoices

You have received a cash rebate of 100 on 2 Jan 2024 from your supplier GST should be accounted for on the full amount received GST 100 9 109 8 26 For this You can claim a GST HST or QST rebate for a reason listed below for example an amount was paid in error In general you must claim the rebate using form FP 2189 V General

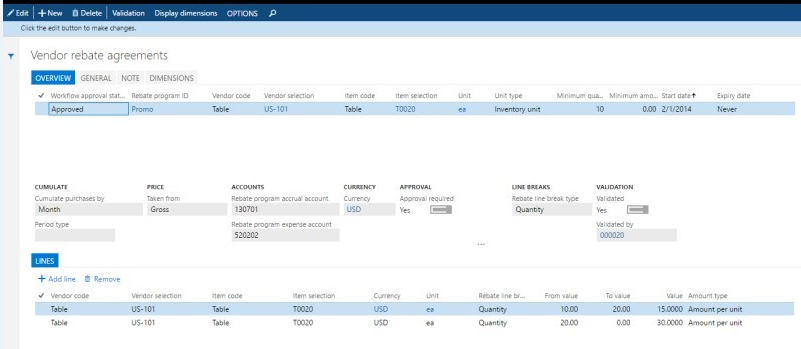

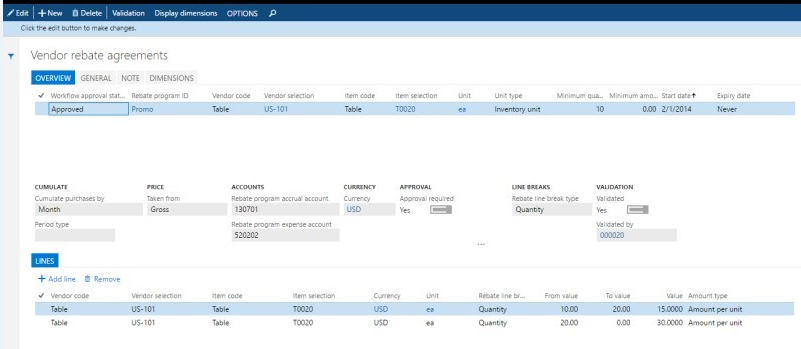

Vendor Rebates Supply Chain Management Dynamics 365 Microsoft Learn

https://learn.microsoft.com/en-us/dynamics365/supply-chain/procurement/media/purchase-agreement.png

10 Days GST Return Service Accounts Details Rs 1000 month RCS GST

https://5.imimg.com/data5/SELLER/Default/2022/11/PD/QI/GO/31985580/gst-return-service-1000x1000.jpg

https://www.taxtips.ca/gst/coupons.htm

When a vendor accepts a reimbursable coupon or a non reimbursable coupon which is being treated as a reimbursable coupon an input tax credit ITC can be claimed for the

https://enable.com/blog/what-is-a-suppli…

At a basic level a rebate is an arrangement in which suppliers agree to return a portion of a purchase price to customers if they buy a specified value of products within an allotted period Many rebates

Billionaire CEO Of Military Technology Supplier Palantir Advocates For

Vendor Rebates Supply Chain Management Dynamics 365 Microsoft Learn

Savings Rebates Application BWFL

Integration Dematel And ANP For The Supplier Selection In The Textile

6 Ways You Can Ensure Supplier Rebates Drive ROI Enable

Customer Rebates Vs Supplier Rebates What You Need To Know Enable

Customer Rebates Vs Supplier Rebates What You Need To Know Enable

Tips For Buyers Setting Up Your Supplier Rebates E bate io

Singapore Company GST Registration Procedure Importance And

Supplier Free Of Charge Creative Commons Handwriting Image

Do Supplier Rebates Have Gst - GST HST recovering HST not paid on sales incentives My two clients were sales representatives who worked for a store that sold appliances Several appliance