Do Taxes Count As Income A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized deductions in the year of the tax refund

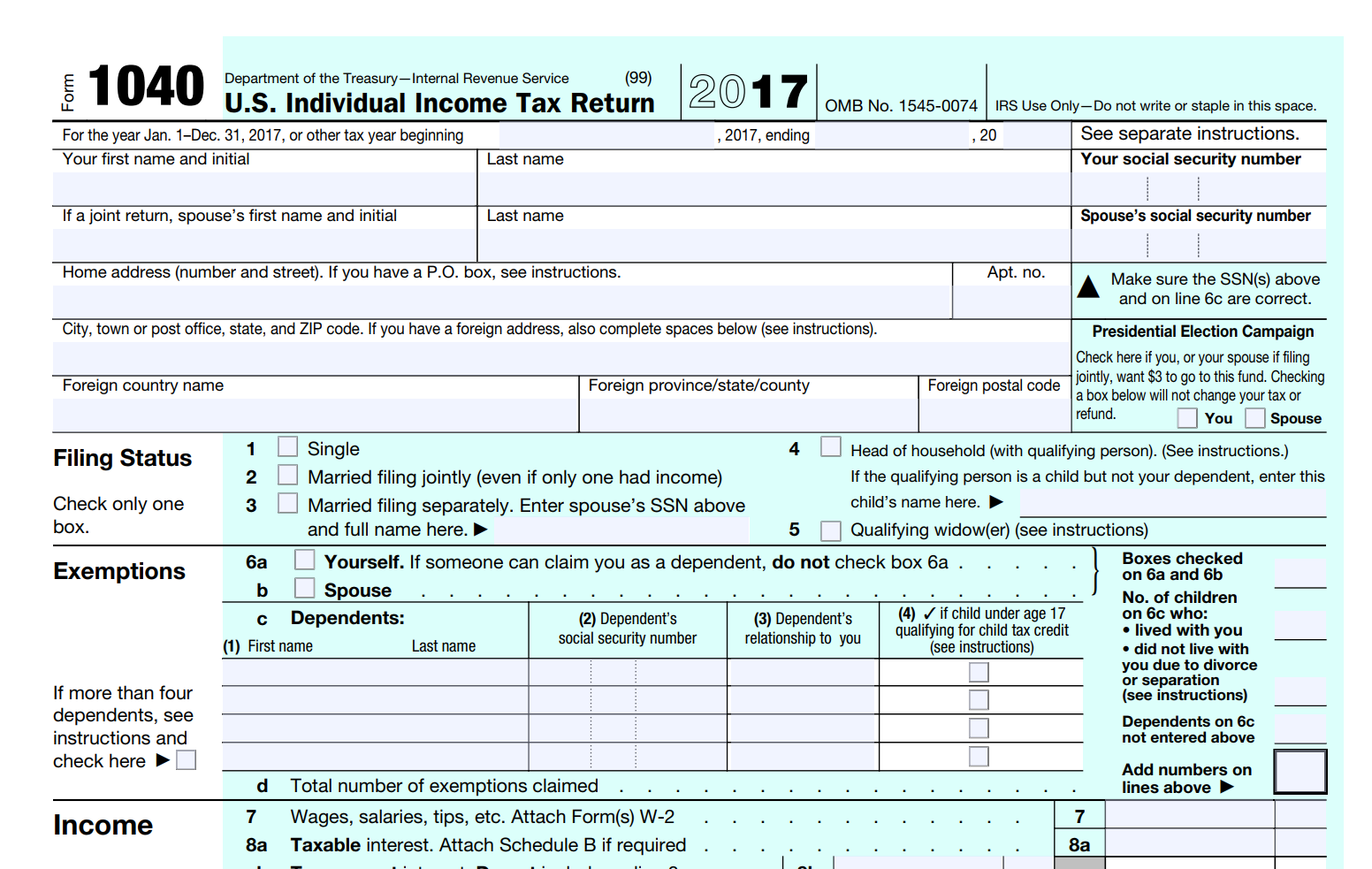

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before First things first If your refund comes from the federal government it s not taxable income You re just getting back your own money that you overpaid in taxes to the government There

Do Taxes Count As Income

Do Taxes Count As Income

https://i.ytimg.com/vi/ieA-bmoFk3k/maxresdefault.jpg

Sales Tax By State Here s How Much You re Really Paying Sales Tax

https://i.pinimg.com/originals/f6/99/3f/f6993f73fae9c87213464fd9ef538b8f.jpg

Here s Where Your Federal Income Tax Dollars Go NBC News

https://media1.s-nbcnews.com/j/streams/2012/april/120404/289542-jschoen57135fcc-03a7-e4b3-f988-fc39db2b8ce9.nbcnews-ux-2880-1000.jpg

Taxable income is the portion of your gross income used to calculate how much tax you owe in a given tax year It can be described broadly as adjusted gross income AGI minus allowable itemized If you receive a refund of or credit for state or local income taxes in a year after the year in which you paid them you may have to include the refund in income in the year you receive it

There are key differences between non taxable income and taxable income Learn what types of income need to be reported to the IRS and which income is exempt from taxation By distinguishing between the two types you can make informed decisions to lower your tax liability and avoid unnecessary payments The refunds you receive from your state income tax returns may be considered income It depends on whether you deducted state and local income taxes in your tax returns the previous year

Download Do Taxes Count As Income

More picture related to Do Taxes Count As Income

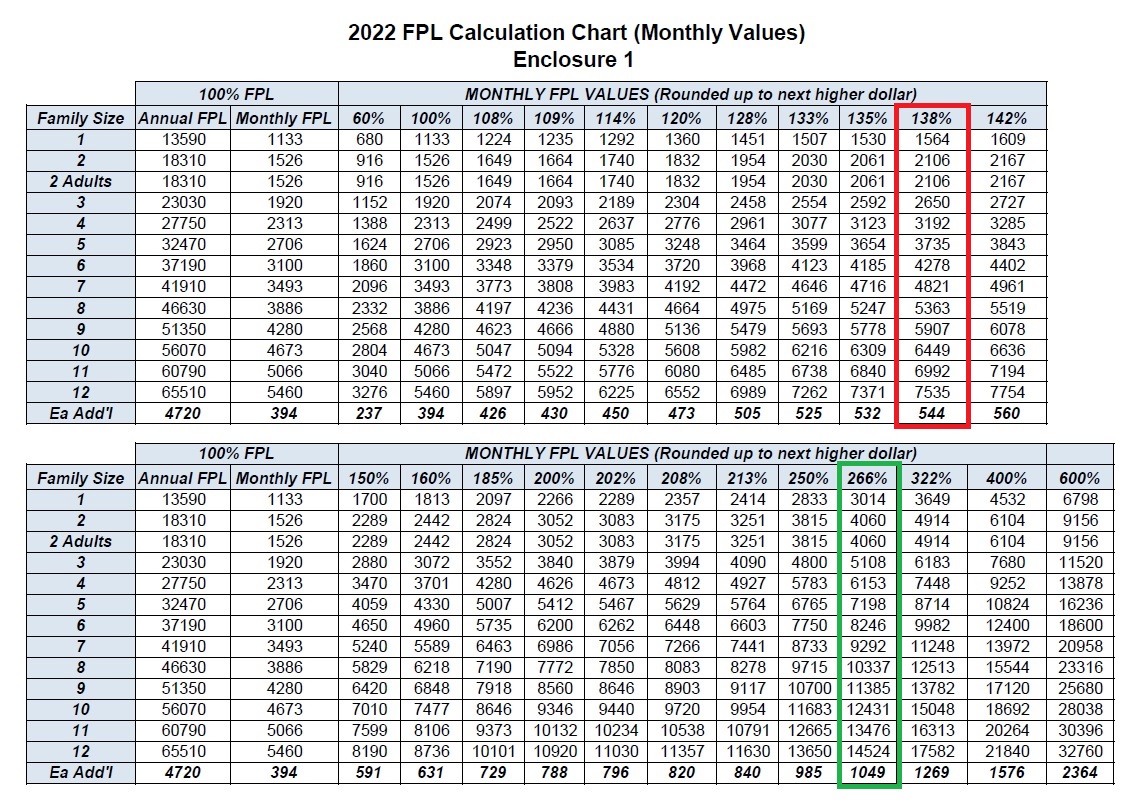

Big Increase For The 2022 Medi Cal Income Amounts

https://insuremekevin.com/wp-content/uploads/2022/02/Monthly-FPL-2022-Income-Chart-Medi_Cal.jpg

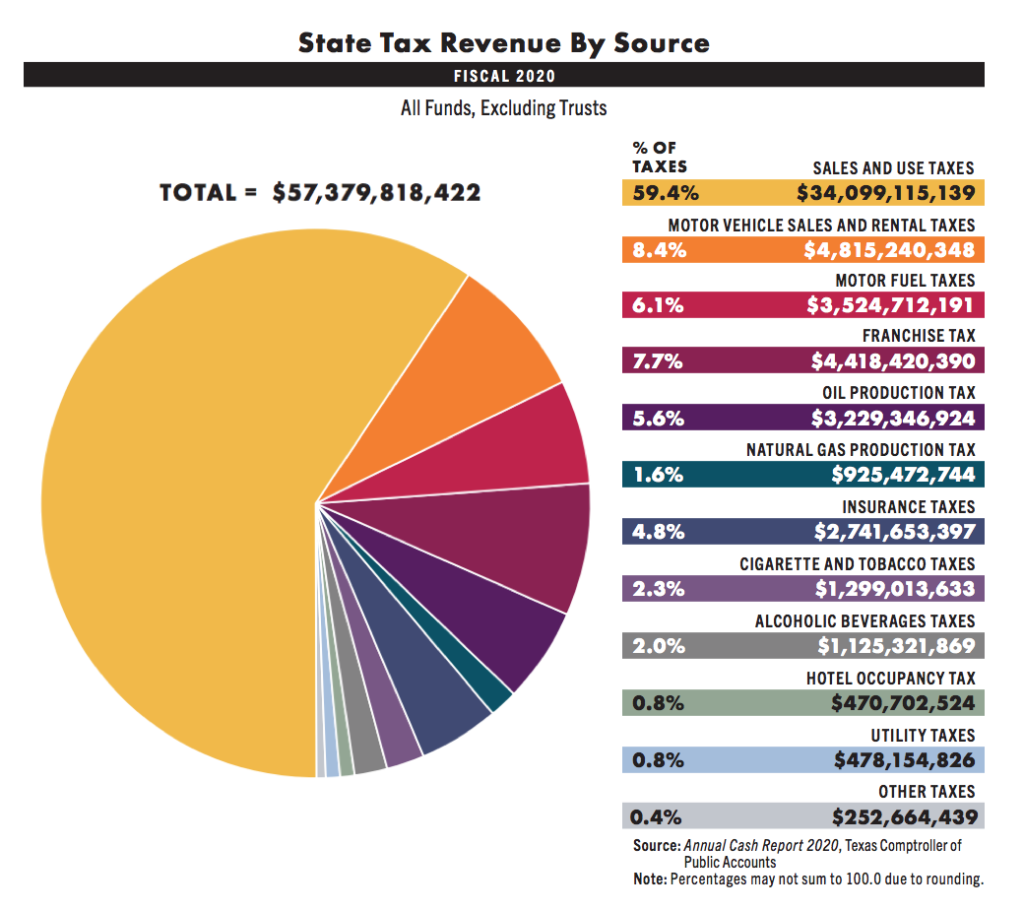

What Are The Tax Rates In Texas Texapedia

https://www.honestaustin.com/wp-content/uploads/2020/02/Texas-Tax-Revenue-by-Source-2020-1024x911.png

Top 3 Percent Of Tax Filers Pay 51 Percent Of Individual Income Taxes

https://fw-d7-freedomworks-org.s3.amazonaws.com/field/image/Taxes.jpeg

Per Bankrate s experts federal income tax refunds are never subject to being taxed so you re in the clear there But remember that there are different level of taxing by level of Some expenses that you can be paid by your employer are tax exempt which means they aren t reported on your P11D aren t treated as income and aren t taxable This could include the basic 4 week for working from home or mileage payments within the

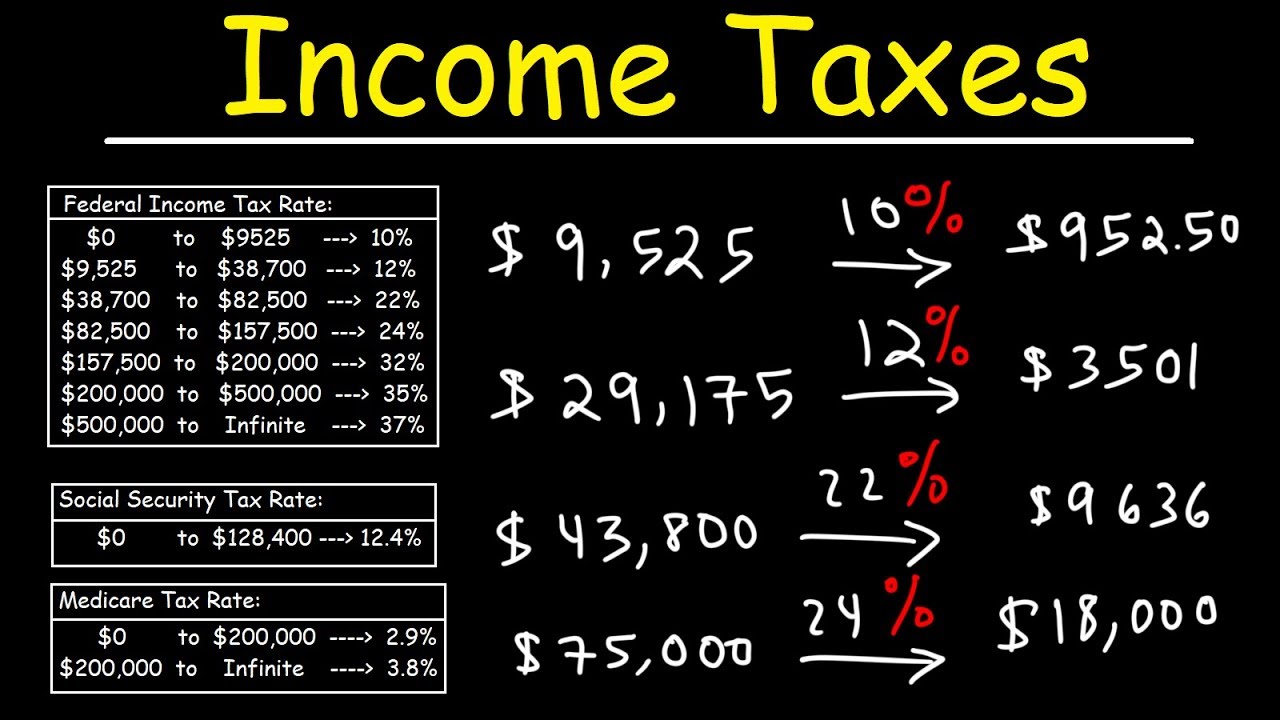

Short term capital gains from assets held for one year or less are taxed at ordinary income tax rates which range from 10 to 37 in 2024 depending on the taxpayer s income level Long term capital gains from assets held for more than one year are taxed at preferential rates of 0 15 or 20 depending on taxable income Most income is taxable unless it s specifically exempted by law Income can be money property goods or services Even if you don t receive a form reporting income you should report it on your tax return Income is taxable when you

Which States Have The Highest And Lowest Income Tax USAFacts

https://staticweb.usafacts.org/media/images/2-lowest-state-income-taxes-usafacts.width-1000.png

Are Maintenance Payments Taxable Does Maintenance Count As Income

https://www.jonesactlaw.com/wp-content/uploads/2015/12/U.S.-taxes-screenshot.png

https://ttlc.intuit.com › community › taxes › discussion › ...

A federal tax refund is not entered on a federal tax return so it is not income A state tax refund can be considered income on a federal tax return if you itemized deductions in the year of the tax refund

https://www.thebalancemoney.com

State income tax refunds can sometimes be considered taxable income according to the IRS You must report them on Schedule A of Form 1040 if you claimed a deduction for state and local taxes the year before

How The Government Spends Your Tax Dollars CHART Business Insider

Which States Have The Highest And Lowest Income Tax USAFacts

Do The Rich Pay Their Fair Share Of Taxes

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

Who Pays Federal Taxes Source

CI Post 2 Do Immigrants Pay Taxes

CI Post 2 Do Immigrants Pay Taxes

State Income Tax Rates And Brackets 2021 Tax Foundation

How High Are Income Tax Rates In Your State

NARSS The Current Tax System Is Unfair To The Middle Class And Lower

Do Taxes Count As Income - If you receive a refund of or credit for state or local income taxes in a year after the year in which you paid them you may have to include the refund in income in the year you receive it