Do You Get A Tax Break For Home Improvements As a homeowner you may be asking Do I get a tax break for all the money I ve spent fixing up my house The answer depends on the kinds of improvements you ve made and how well you ve kept track of your expenses Here s an overview of how home improvements can affect your taxes

Most home improvements and repairs aren t tax deductible with some exceptions Capital improvements can increase the cost basis of your home which lowers your tax bill if you make a profit when you sell Home improvements are generally not tax deductible under the US tax code There are two instances in which you may qualify for a tax break for making specific additions or

Do You Get A Tax Break For Home Improvements

Do You Get A Tax Break For Home Improvements

https://flamingo-accounting.co.uk/wp-content/uploads/2020/01/piggy-2889044_1920.jpg

How To Score A Tax Break For Your Charitable Giving

https://image.cnbcfm.com/api/v1/image/106268833-1574881176855gettyimages-522951298.jpeg?v=1574881259&w=1920&h=1080

529 Plans Are A Tax Break For The Rich YouTube

https://i.ytimg.com/vi/g013T9yBoPA/maxresdefault.jpg

Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are home improvements that could save Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a tax professional before

Download Do You Get A Tax Break For Home Improvements

More picture related to Do You Get A Tax Break For Home Improvements

Getting A Tax Break For Donating To Charity YouTube

https://i.ytimg.com/vi/M2XIqP4kHNo/maxresdefault.jpg

Its Time To Prepare Your Taxes Read My Blog Post Here Http www

https://i.pinimg.com/originals/61/b6/2d/61b62d6b05ac657484a5c60ae6de517d.jpg

How To Get A TAX BREAK For Your SPECIAL NEEDS Education YouTube

https://i.ytimg.com/vi/wIJTSrHgIWA/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGDMgTChyMA8=&rs=AOn4CLBm6HSusLRgXvABfYgXQnyEpwgIBg

The IRS has extensive rules about the tax breaks available for homeowners Let s dive into the tax breaks you should consider as a homeowner 1 Mortgage Interest If you have a mortgage on your home you can take advantage of the mortgage interest deduction You can lower your taxable income through this itemized deduction of Energy improvements to your home such as solar or wind generation biomass stoves fuel cells and new windows may qualify you for credits expanded in 2022 If you make energy improvements to your home tax credits are available for a portion of qualifying expenses

Unfortunately most home improvements aren t deductible the year you make them But even if they aren t currently deductible they ll eventually have a tax benefit when you sell your home However if you re a homeowner and you renovated or did some upgrades last year we have some good news for you You might be able to save some money on your taxes this year depending on the project Below we ll walk you through the basics about deducting home renovation and upgrade expenses

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

https://salemroofers.com/wp-content/uploads/2016/02/roofing-tax-credits.jpg

The Electric Car Tax Credit What You Need To Know OsVehicle

https://cdn.osvehicle.com/can_i_claim_the_ev_tax_credit_every_year.png

https://turbotax.intuit.com/tax-tips/home...

As a homeowner you may be asking Do I get a tax break for all the money I ve spent fixing up my house The answer depends on the kinds of improvements you ve made and how well you ve kept track of your expenses Here s an overview of how home improvements can affect your taxes

https://www.thebalancemoney.com/are-home...

Most home improvements and repairs aren t tax deductible with some exceptions Capital improvements can increase the cost basis of your home which lowers your tax bill if you make a profit when you sell

Should You Get A Property Tax Break If Your House Burns Down Inside

Can You Get A Tax Credit For Your Energy Saving Roof Slate Slate

Pin On Tax Tips

Do You Get A Tax Break For Starting A Business A Comprehensive Guide

6 Improvements For Filing Your Freelance Taxes Next Year

First Time Tax Filing Procedure 101 David York s Tax Service

First Time Tax Filing Procedure 101 David York s Tax Service

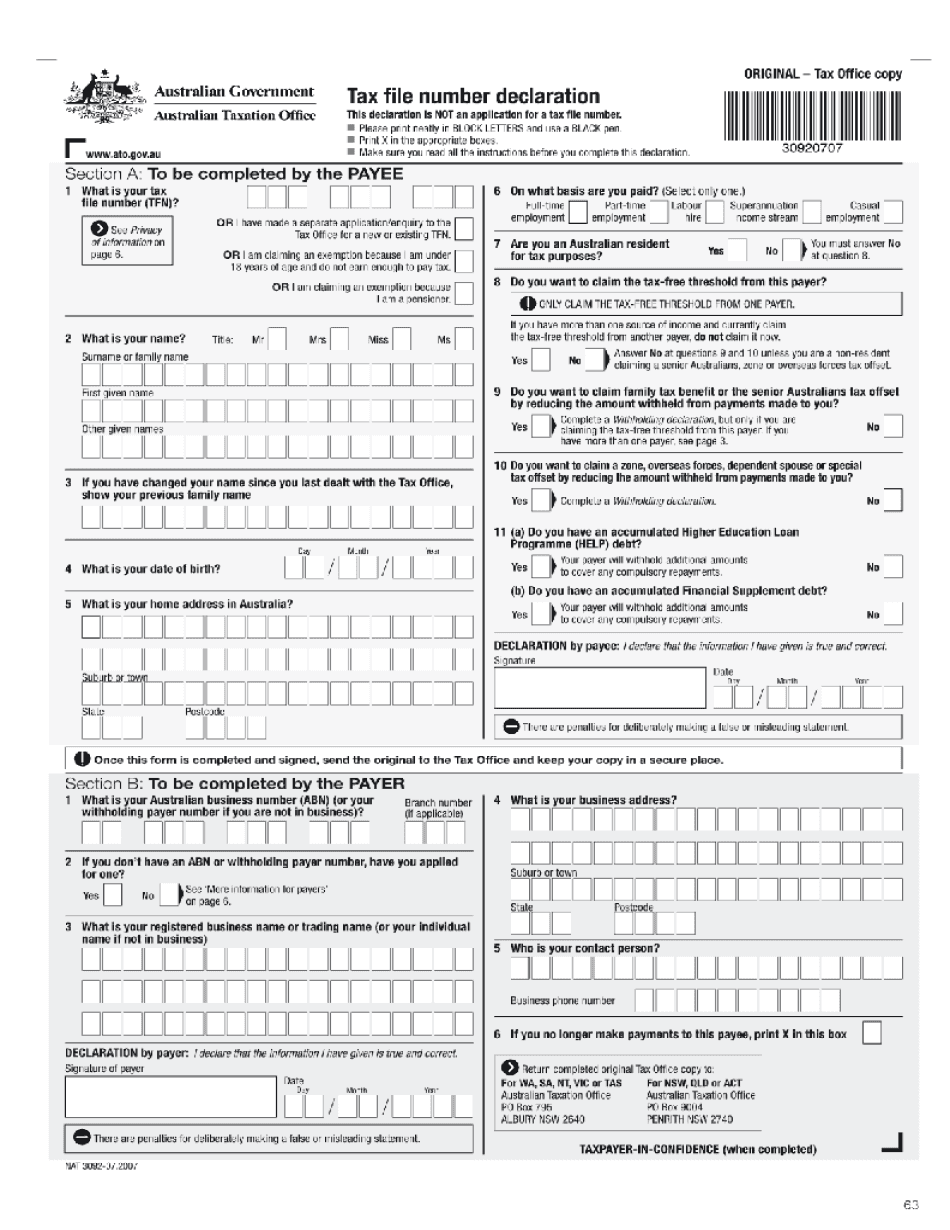

Create Fillable Tax Declaration Form And Keep Things Organized

Tax Break For Home Short Sellers At Risk Real Estate News Insights

Did You Get A Tax Refund You Might Have Overpaid Withholding Taxes

Do You Get A Tax Break For Home Improvements - Good news the IRS offers several tax breaks for homeowners from deductions for the interest on your mortgage to credits if you improve your home s energy efficiency in certain ways The key