Do You Get Tax Deductions For Home Improvements Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that

The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a tax professional before digging When you make a home improvement such as installing central air conditioning or replacing the roof you can t deduct the cost in the year you spend the money But if you keep track of those expenses they may help you reduce your taxes in the year you sell your house

Do You Get Tax Deductions For Home Improvements

Do You Get Tax Deductions For Home Improvements

https://i.etsystatic.com/31990504/r/il/22f689/3639280950/il_fullxfull.3639280950_fitj.jpg

3 Tax Deductions For Home Improvements

http://www.homeandgardeningguide.com/wp-content/uploads/tax-deductions-home-business.jpg

Tax Credits Save You More Than Deductions Here Are The Best Ones

https://www.gannett-cdn.com/-mm-/14ee05d59f10019b9af859e1b8044dff44c16b5c/c=0-64-2118-1261&r=x1683&c=3200x1680/local/-/media/2017/03/28/USATODAY/USATODAY/636262972570306279-tax-credits.jpg

Most home improvements and repairs aren t tax deductible with some exceptions Capital improvements can increase the cost basis of your home which lowers your tax bill if you make a profit when you sell Most home improvements aren t tax deductible but the IRS does specify situations in which you can write off expenses as you improve your home Here are home improvements that could save

In general home repairs are not tax deductible However there are a few exceptions Repairs made after a natural disaster repairs to a rental property and repairs to a home office may also qualify for tax deductions We ll discuss these more in a minute We know that not all home improvements are tax deductible Those that are must meet the specific IRS criteria like medically necessary modifications or energy efficient upgrades

Download Do You Get Tax Deductions For Home Improvements

More picture related to Do You Get Tax Deductions For Home Improvements

List Of Tax Deductions Here s What You Can Deduct

https://s.yimg.com/uu/api/res/1.2/PZHKfKkv5p.BgGeZMfyACA--~B/aD0xMDgwO3c9MTkyMDtzbT0xO2FwcGlkPXl0YWNoeW9u/http://media.zenfs.com/en-US/homerun/gobankingrates_644/d87a23f0b34a2e279043d0f64d549859

Tax Deductions Write Offs To Save You Money Financial Gym

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

5 Tax Deductions Small Business Owners Need To Know

https://www.workinghomeguide.com/wp-content/uploads/2017/12/tax-deductions.jpeg

Unlock tax savings and enhance your home in 2024 with our guide to deductible improvements Learn about eligible renovations and maximize your benefits today You can t deduct the cost of home improvements These costs are nondeductible personal expenses But home improvements do have a tax benefit They can help reduce the amount of taxes you have to pay if and when you sell your home at a profit The cost of home improvements are added to the tax basis of your home

You can deduct that cost and only be taxed on a 7 000 profit Home improvements made for home business reasons energy saving purposes and medical accommodations can be deducted from federal taxes in the same tax year during which you expense them The Short Version Tax breaks on home improvements to your principal residence are generally limited to energy efficient improvements and adaptations for medical care Home improvements for medical purposes are tax deductible once they exceed 7 5 of your adjusted gross income

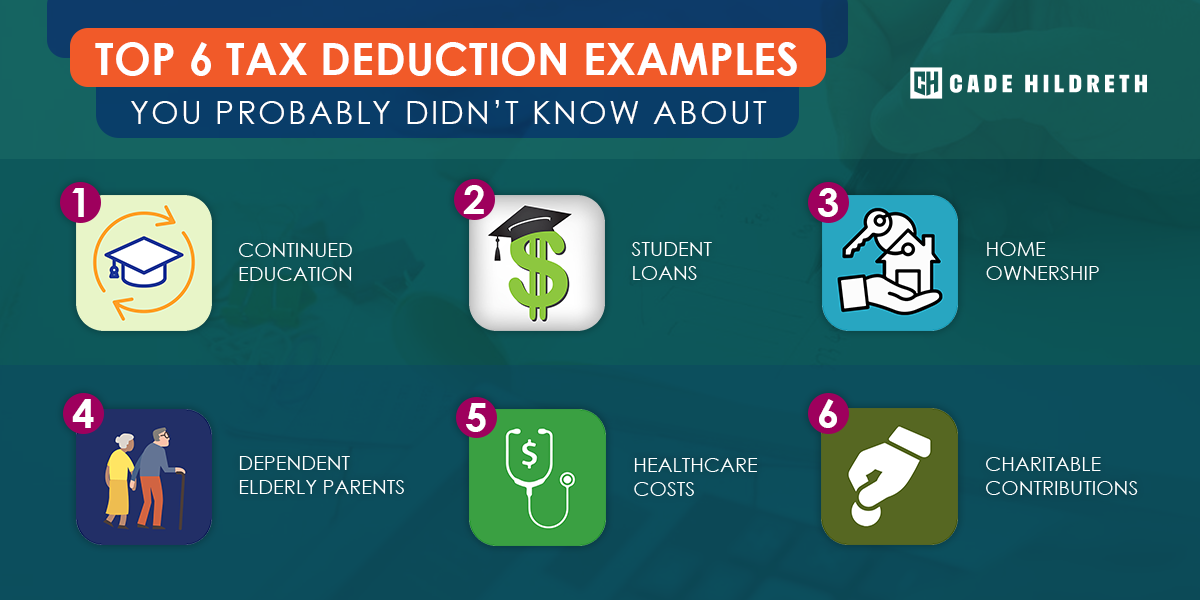

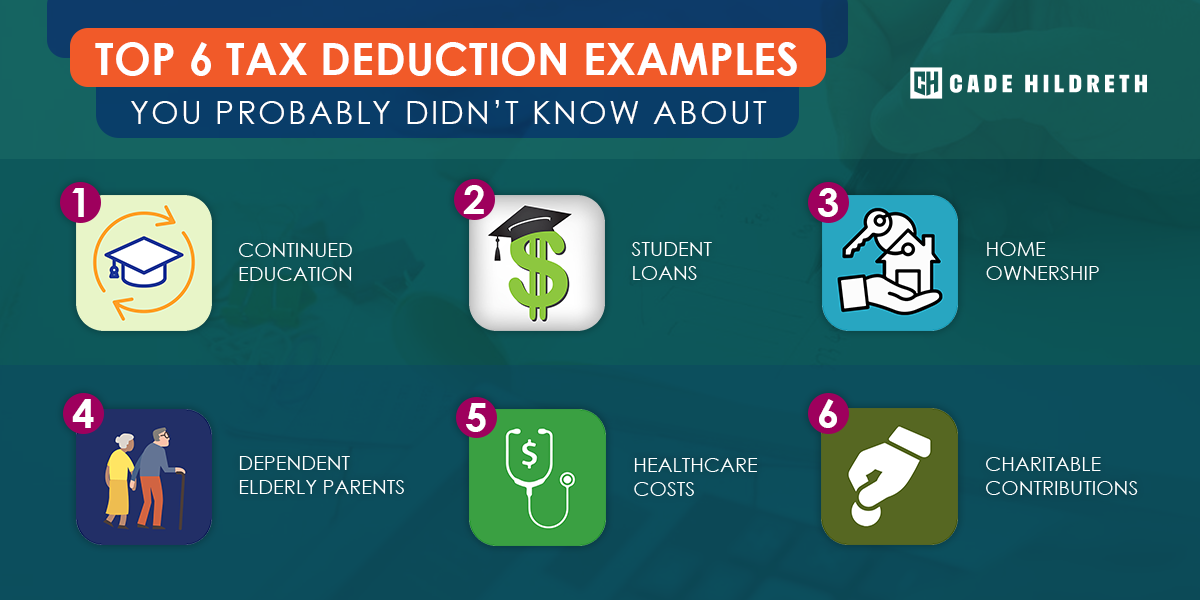

Top 6 Tax Deduction Examples You Probably Didn t Know About

https://cadehildreth.com/wp-content/uploads/2020/01/tax-deduction-examples.png

10 Most Common Small Business Tax Deductions Infographic

https://triplogmileage.com/wp-content/uploads/2018/08/rev02-01-min-33-min.jpg

https://www.investopedia.com/are-home-improvements...

Home improvements are tax deductible if they meet the three qualifying criteria Betterment Amounts paid to repair something that will increase the value of the home or to add a feature that

https://www.forbes.com/home-improvement/home/home...

The general rule is that home improvement is not tax deductible Many exceptions apply to the rule Several rules overlap and change yearly Always talk to a tax professional before digging

Deductible Tax Home Improvements

Top 6 Tax Deduction Examples You Probably Didn t Know About

Tax Deductions For Self Employed Bruce L Anderson CPA CGA

Tax Deductions Template For Freelancers Google Sheets

Small Business Tax Write Off List Authenticwes

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

Society Of Certified Senior Advisors Tax Deductions For Home Health Care

10 Tax Deductions For Homeowners Every Home Buyer Must Know Internal

3 Tax Deductions For Home Improvements

Do You Get Tax Deductions For Home Improvements - We know that not all home improvements are tax deductible Those that are must meet the specific IRS criteria like medically necessary modifications or energy efficient upgrades