Do You Get A Tax Write Off For Buying A New Car Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and This deduction only applies to sales taxes paid on new cars and trucks not used ones that weigh less than 8 500 pounds plus motorcycles and motor homes If

Do You Get A Tax Write Off For Buying A New Car

Do You Get A Tax Write Off For Buying A New Car

https://images.squarespace-cdn.com/content/v1/5a1efe26914e6b83e9456629/1582581779280-IL3MNWGKUNKHXL5A4790/TFG_IG-post_7-Tax-Deductions-You-Shouldn't-Miss.jpg

Is Pre K Tax Deductible Juiced Site Pictures

https://img.emg-services.net/HtmlPages/HtmlPage/prof-dev-tax-write-off-page-001-embed.jpg

Small Business Tax Write Offs Imperfect Concepts Small Business Tax

https://i.pinimg.com/originals/80/ec/a4/80eca439e7061305a615108474f330bf.jpg

To deduct vehicle sales tax you can either Save all sales receipts and deduct actual sales taxes paid throughout the year or Use the IRS sales tax tables to figure your deduction In conclusion the tax deductibility of a new car purchase depends on its usage For personal use the cost of a new car is generally non deductible However potential tax

Before deciding to claim the standard deduction it s a good idea to compare your standard deduction amount with your total itemized deductions For the 2023 tax No writing off a vehicle does not pay the car off especially considering the type of financing or loan you re committed to However you could write off part of the

Download Do You Get A Tax Write Off For Buying A New Car

More picture related to Do You Get A Tax Write Off For Buying A New Car

Texas Sales Tax Exemption Certificate From The Texas Human Rights

https://digital.library.unt.edu/ark:/67531/metadc967514/m1/1/high_res/

Insurance Articles Information Car Buying New Cars Car Buying Tips

https://i.pinimg.com/originals/e5/76/01/e57601a4606781e9a73e368f19efae66.png

What Can You Write Off On Your Taxes SoundOracle Sound Kits

https://cdn.shopify.com/s/files/1/1042/7832/t/95/assets/tax-write-offs-1641387329585.jpg?v=1641387334

7 Earned income tax credit This earned income tax credit EITC is a refundable tax break for low income taxpayers with and without children For 2023 taxes filed in 2024 the credit ranges Ultimate Guide to Car Tax Deductions and Mileage by Keeper Staff Updated January 3 2024 If your freelancing 1099 contracting or small business involves driving then you can claim car

The election enables you to write off the entire cost of the purchase in the first year rather than depreciating it over its useful life The 179 deduction extends to automobiles as well with the only caveat being You can write off light Section 179 vehicles under 6000 lbs for a vehicle tax break of 10 200 the first year and continue for the next five years Can an LLC write off a

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

http://blog.turbotax.intuit.com/wp-content/uploads/2010/12/writeoff.png?resize=1200,630

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png)

Can You Write Off Transaction Fees Leia Aqui Are Transaction Costs

https://www.investopedia.com/thmb/zuhlYXIsDK_BZw_Ff0dsc6qkq5o=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/write-off-4186686-FINAL-2-7eaa5af39eec457e898ccf77a0f6a4b9.png

https://www.lendingtree.com/auto/buying-c…

Buying a car for personal or business use may have tax deductible benefits The IRS allows taxpayers to deduct either local and

https://www.thebalancemoney.com/vehicle-ta…

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and

10 Tips For Buying A New Car Ageas

What Is A Tax Write Off Tax Deductions Explained The TurboTax Blog

101 Tax Write Offs For Business What To Claim On Taxes Small

Tax Write Offs Your Guide To All Itemized Deductions Tax Write Offs

Tax Write Off Cheat Sheet Get Everything You Need To Know Before You

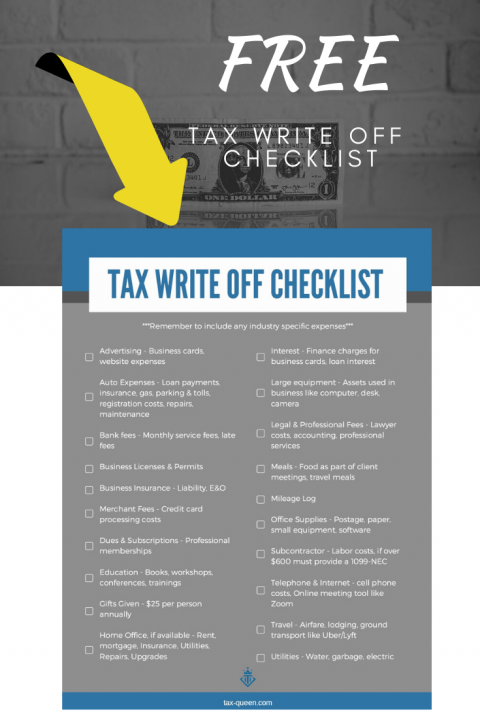

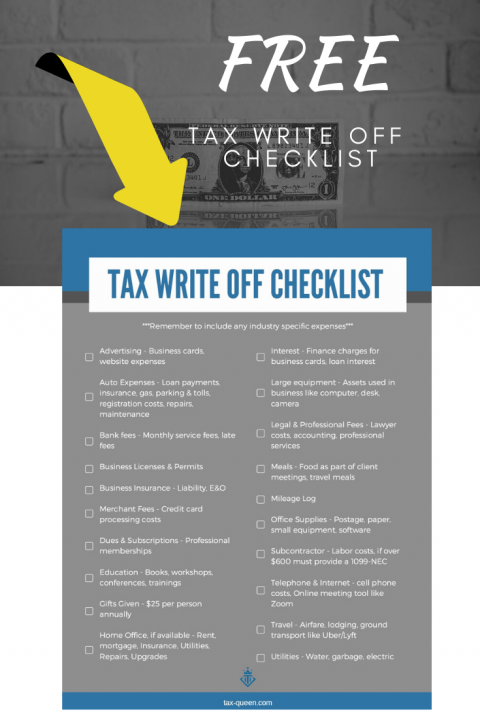

Small Business Tax Write Off Checklist Tax Queen

Small Business Tax Write Off Checklist Tax Queen

What Can I Write Off On My Taxes Business Tax Deductions Tax Write

Example Of Taxable Supplies Jspag

Printable Tax Deduction Cheat Sheet

Do You Get A Tax Write Off For Buying A New Car - If you spend 7 000 on a car and an additional 1 000 on improvements but you sell the car for 7 000 it s considered a capital loss and you don t need to pay tax on the sale