Do You Get Tax Return For Donations Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations You can only claim a tax deduction for a gift or donation to an organisation that has the status of a deductible gift recipient DGR To claim a deduction you must

Do You Get Tax Return For Donations

Do You Get Tax Return For Donations

https://www.gannett-cdn.com/-mm-/3b8b0abcb585d9841e5193c3d072eed1e5ce62bc/c=0-30-580-356/local/-/media/2018/01/02/USATODAY/usatsports/donate-charity-coin-cash-tax-give-deduction-getty_large.jpg?width=3200&height=1680&fit=crop

2009 Tax Return Guide

https://s3.studylib.net/store/data/008304968_1-123cadaf7cffcbbdc4d895a8aa8104f2-768x994.png

Tracking Down Donation Substantiation Wessel Company

https://www.wesselcpa.com/wp-content/uploads/2024/02/Donation.jpg

Looking for a tax efficient way to give to your favorite charities When you contribute cash securities or other assets to an IRS qualified 501 c 3 public charity like Fidelity Charitable you are generally eligible to take If you have donated to an NFP you may be able to claim a tax deduction The following information will help you determine if you can claim how much you can

You should keep records of all tax deductible gifts donations and contributions you make However if you made one or more small cash donations each As long as the church is a qualified charitable organization to the IRS your donations are tax deductible You can check using the Tax Exempt Organization Search tool on the IRS website

Download Do You Get Tax Return For Donations

More picture related to Do You Get Tax Return For Donations

Belated Filing Of Income Tax Return FY 2019 20 Onlineideation

https://www.onlineideation.in/files/Belated-Filing-of-Income-Tax-Return-for-AY-2019-20-Onlineideation.jpg

When Preparing Your Tax Return A Tax Attorney Is A Wise Investment

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgfSVlHBxwSOPsX5JYS9Fw-p69B2dOz2KcfxgdIrFeAngFCWNtU4dlHMn7CloFCV-JTmawrYsU6uNThetdEXBqOsEm43wZprDLAQlFNbmLl-KETcWCDxz16ay5t_UGLZUgymFc0d2hqQh1AM8eYCT-6wGeTrsZCKoNWJN4d7nX2geVyG66yKn-jmR_L/s16000/istockphoto-1412397719-612x612.webp

How To File Income Tax Return For The Deceased Person By Legal Heir

https://wealth4india.com/blogs/wp-content/uploads/2022/07/income-tax-return-for-the-deceased-person-2048x1152.png

When you donate money to a qualifying public charity you can deduct up to 60 of your income alleviating your tax burden Here s what you need to know If you re planning on making a charitable Your charitable donations can become tax deductions that help you lower your taxable income which lowers your tax bill But before you go off and donate even

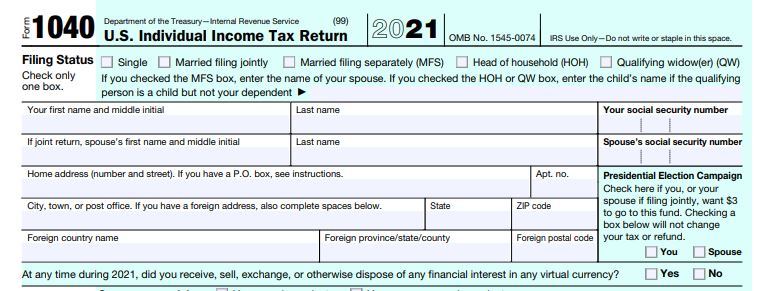

In the United States ever changing tax laws can make it difficult for donors to know which gifts are tax deductible and how charitable giving can benefit your tax situation We Cash or property donations of 250 or more require a receipt from the charity Fill out and attach Form 8283 Noncash Charitable Contributions to your tax return if

Canadian Personal Tax Return I Have Missed Filing My Tax Return What

https://bomcasca.files.wordpress.com/2021/06/personal-tax.png?w=1024

Are You Exempt From Submitting A Tax Return For 2023 Moonstone

https://www.moonstone.co.za/wp-content/uploads/Tax_return_button_V2-1.jpg

https://www.irs.gov/credits-deductions/individuals...

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Schedule A Form 1040 Itemized Deductions PDF To see if the

https://money.usnews.com/money/pers…

To get the charitable deduction you usually have to itemize your taxes You must make contributions to a qualified tax exempt organization You must have documentation for cash donations

Do I Need To Do A Tax Return For A Deceased Estate In Queensland

Canadian Personal Tax Return I Have Missed Filing My Tax Return What

How To Check You Tax Return Agencypriority21

32 Steps In Completing A Tax Return For Physicians MedTax ca

Donation Letter For Taxes Template In PDF Word Set Of 10 Donation

J K Lasser s Your Income Tax 2023 For Preparing Your 2022 Tax Return

J K Lasser s Your Income Tax 2023 For Preparing Your 2022 Tax Return

Income Tax Return For Assessment Year 2021 22 Latest News Photos And

Tax Return For Employees By Steuerbot On Dribbble

The CRA Has Flagged My Tax Return For Review Now What Genesa CPA Corp

Do You Get Tax Return For Donations - Nearly nine in 10 taxpayers now take the standard deduction and could potentially qualify to claim a limited deduction for cash contributions These individuals