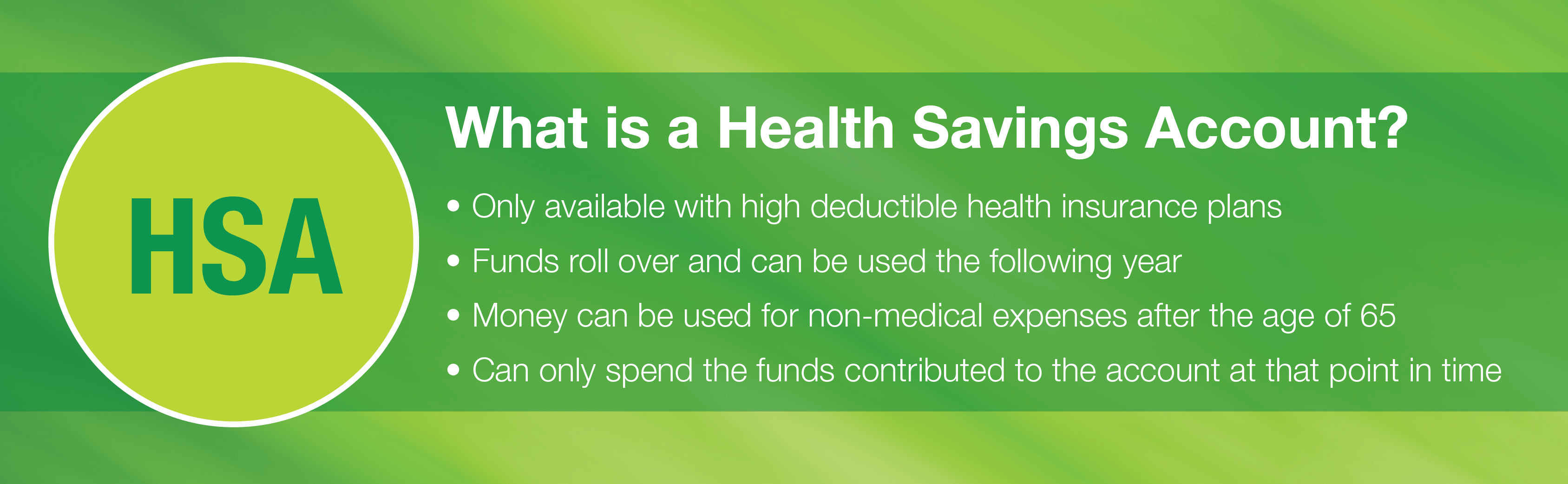

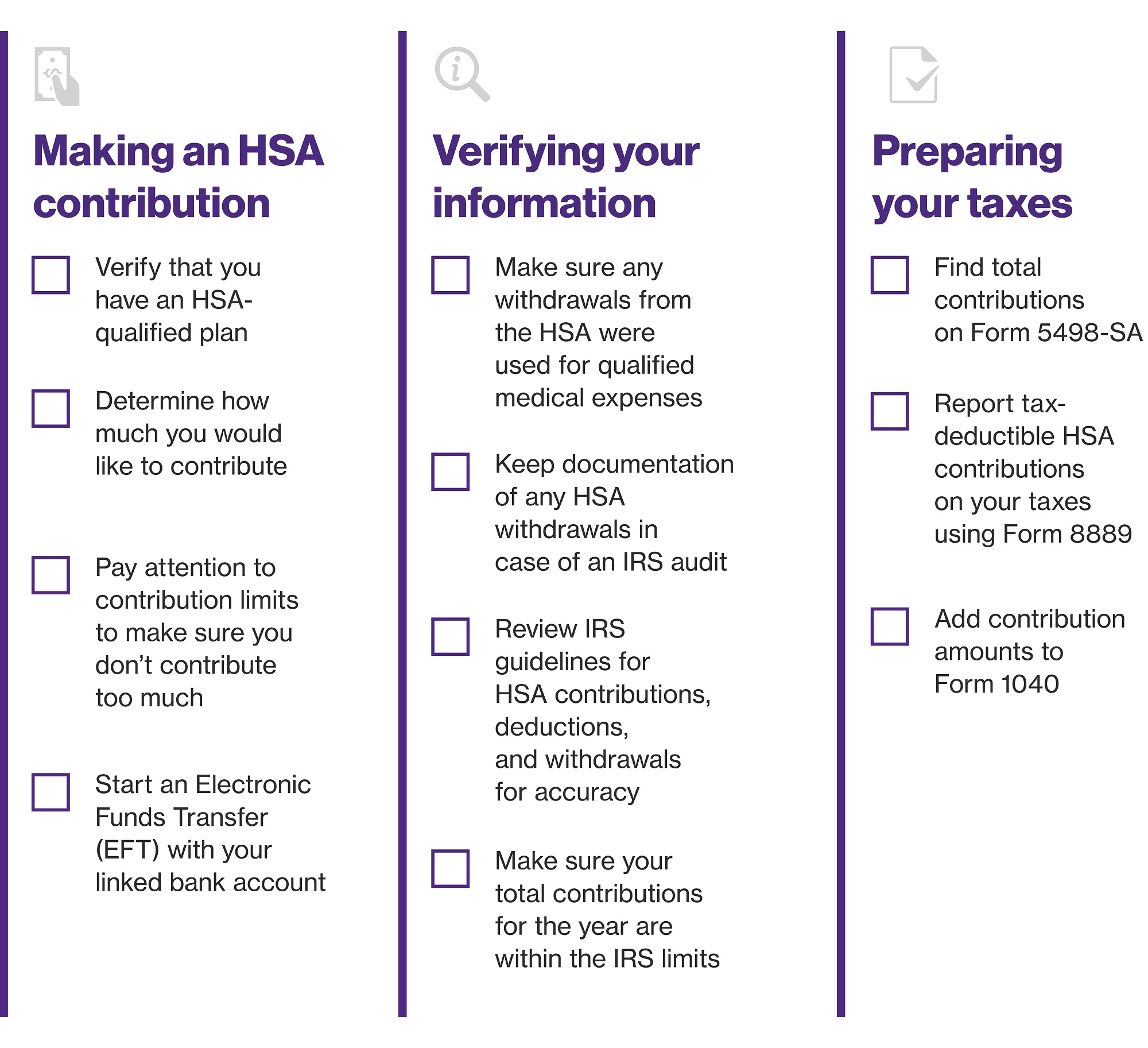

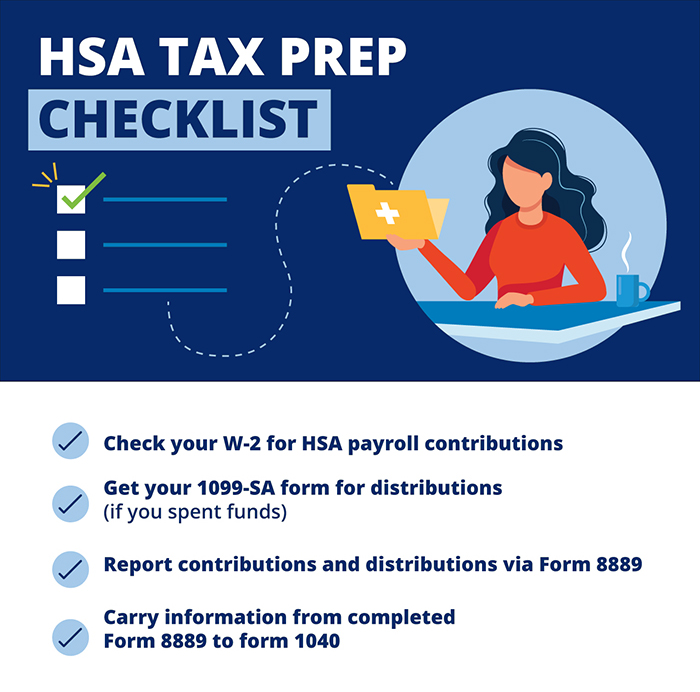

Do You Have To Claim An Hsa On Taxes This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on

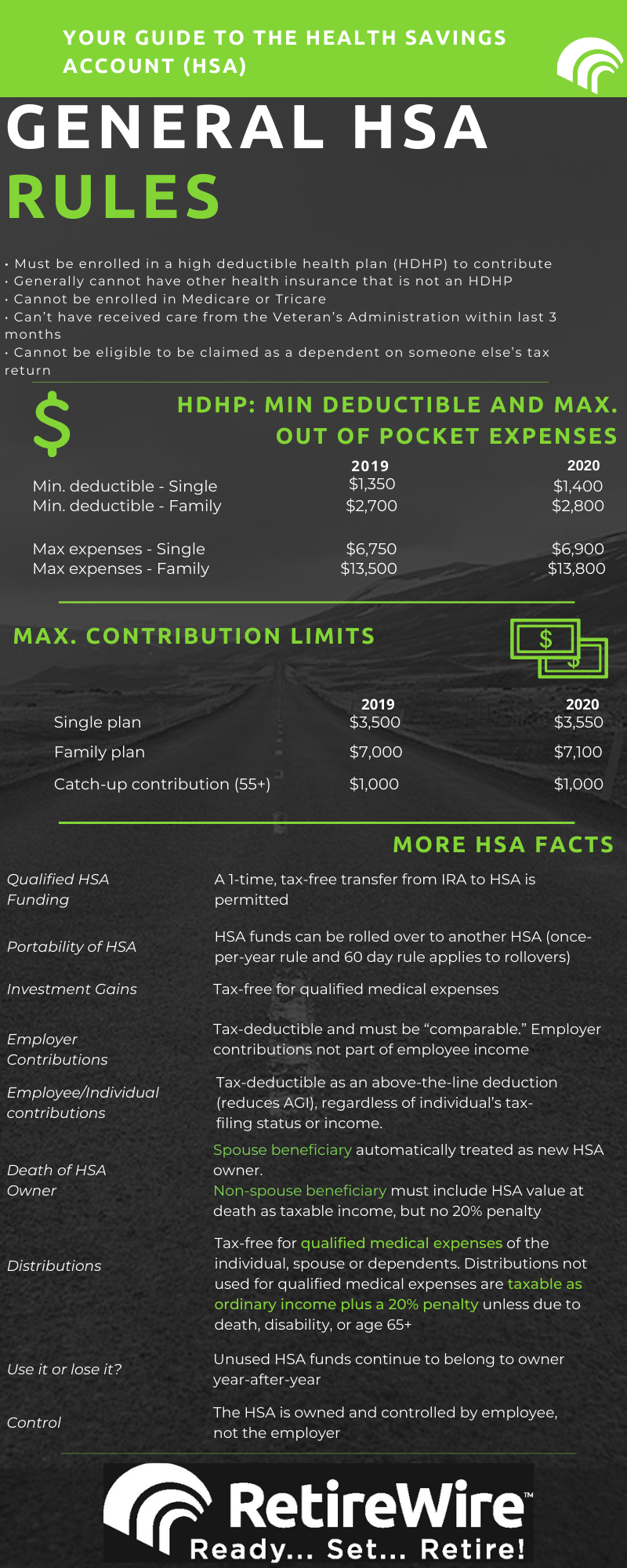

Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction Report distributions from Payroll deductions for contributions are pre tax further reducing taxable income Tax Treatment of Distributions HSA distributions are tax free when used for qualified medical

Do You Have To Claim An Hsa On Taxes

Do You Have To Claim An Hsa On Taxes

https://districtcapitalmanagement.com/wp-content/uploads/2021/10/HSA-vs-FSA.jpg

Do You Have To Pay Tax Selling On Etsy UK Salary Tax Calculator

https://www.income-tax.co.uk/wp-content/uploads/2022/03/Do-I-have-to-pay-tax-selling-on-Etsy-scaled.jpeg

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

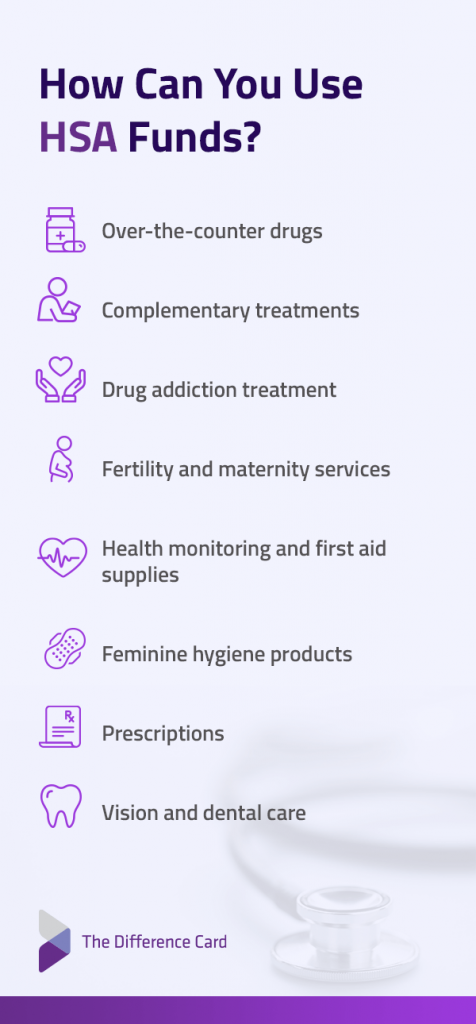

You can receive tax free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA If you receive distributions for other reasons You want to do this because without a completed 8889 the amount of money that your employer contributed will be considered taxable instead of being tax free like it should be Be sure to complete the entire HSA

With an HSA tax deduction comes many rules Here are the top HSA account rules Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However employer contributions are already excluded You can make deductible contributions to your HSA even if your employer made contributions However if you or someone on your behalf made contributions in addition to any employer

Download Do You Have To Claim An Hsa On Taxes

More picture related to Do You Have To Claim An Hsa On Taxes

What Is A Health Savings Account HSA UnitedHealthcare

https://www.uhc.com/content/dam/uhcdotcom/en/Videos/brightcove-video-thumbnails/6266405299001-thumbnail.png/_jcr_content/renditions/cq5dam.web.1280.1280.png

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

Only certain individuals are eligible to contribute to an HSA or MSA You have to be covered under a High Deductible Health Plan HDHP with no coverage under a non HDHP health plan you cannot be enrolled in In short contributions to an HSA made by you or your employer may be claimed as tax deductions even if you don t itemize deductions on a Schedule A Form 1040 Additionally

Do i have to claim my HSA contributions on my taxes i only put around 100 in and have not deducted any since I ve gotten it Probably not as long as they are listed on your W 2 So this is another fun question I know you re judging me now Another tax friendly aspect of HSA contributions is you have until the tax filing deadline usually April 15th to make

Particulars Of Claim 2 IN THE COUNTY COURT MONEY CLAIMS CENTRE Claim

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/bd9aa89ca1e951d58da08fbfc2a6387a/thumb_1200_1698.png

What Is An HSA How Does It Work The Difference Card

https://www.differencecard.com/wp-content/uploads/2021/08/03-How-Can-You-Use-HSA-Funds-Pinterest-476x1024.png

https://www.fidelity.com › ... › hsa-tax-form

This form allows you to claim a tax deduction for any HSA contributions you made outside of payroll deductions and ensures money withdrawn from your account was spent on

https://www.irs.gov › forms-pubs

Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction Report distributions from

Comparison Of HSA health Savings FSA Flexible Spending HRA

Particulars Of Claim 2 IN THE COUNTY COURT MONEY CLAIMS CENTRE Claim

How Employers Can Contribute To HSAs

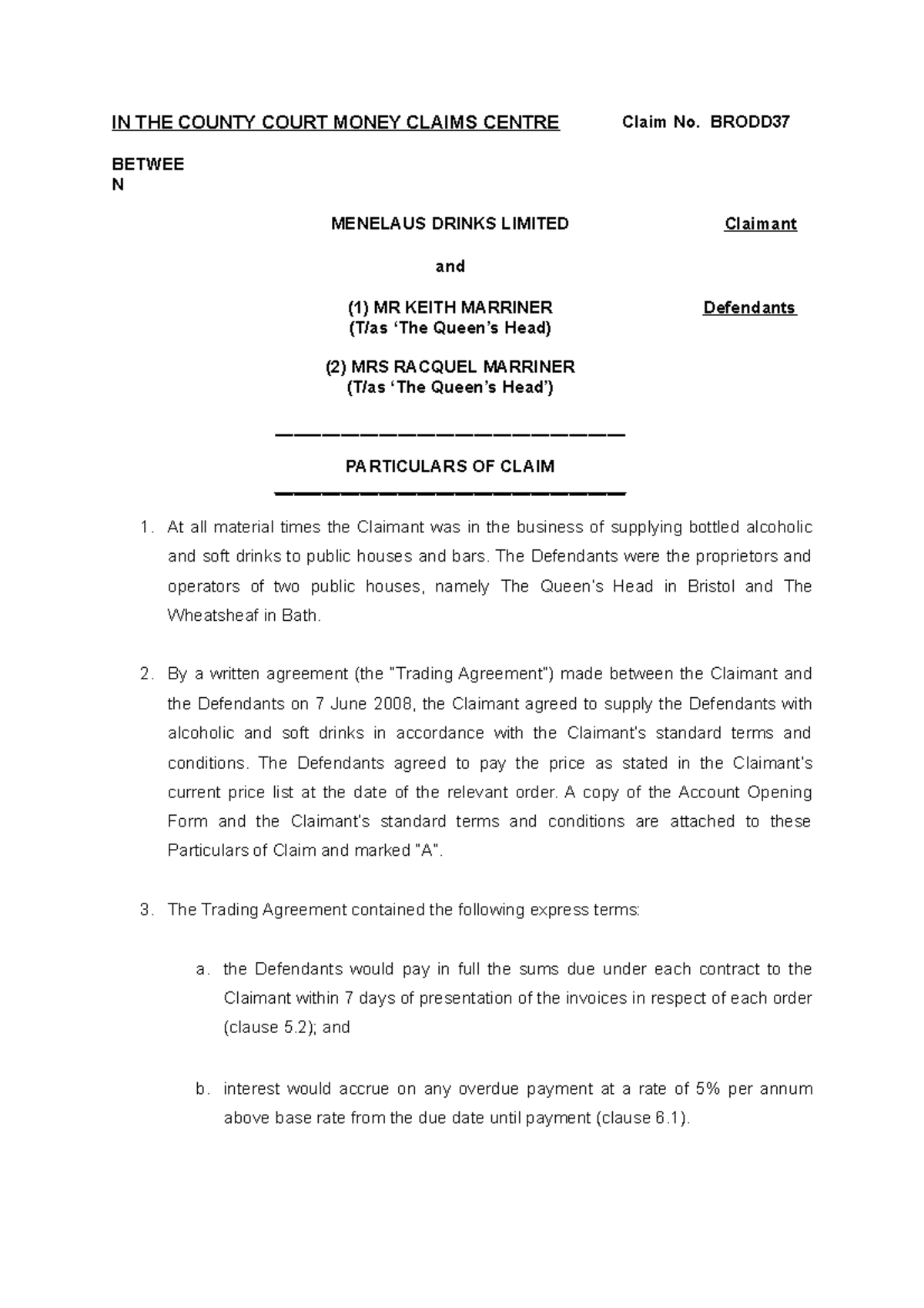

Is An HSA Right For Me

What s The Difference Between An HSA FSA And HRA Medical Health

How To See Messages On Match In 2024 Do You Have To Pay

How To See Messages On Match In 2024 Do You Have To Pay

Want To Reduce Your Taxes Consider An HSA Listen To This Video Byte

How Does An HSA Work The 2020 HSA Rules Strategy RetireWire

Your HSA And Your Tax Return 4 Tips For Filing First American Bank

Do You Have To Claim An Hsa On Taxes - You can make deductible contributions to your HSA even if your employer made contributions However if you or someone on your behalf made contributions in addition to any employer