Do You Have To Report Hsa Spending On Taxes Note that if you re over 65 you can spend your HSA dollars on nonqualified expenses but you ll face ordinary income tax on the distribution like a traditional IRA If you re under 65 HSA dollars spent on non qualified expenses would incur a 20 penalty

What HSA information do I need to report on my taxes When you file your tax return you have to report any withdrawals you made during the year also known as The contributions to an HSA are tax deductible and the account s earnings if invested are tax free as are withdrawals for eligible medical expenses The maximum amount you can contribute to

Do You Have To Report Hsa Spending On Taxes

Do You Have To Report Hsa Spending On Taxes

http://www.goldstandardtax.com/wp-content/uploads/2022/09/2023-HSA-Limits.png

5 Things To Know About Health Savings Accounts ThinkHealth

http://thinkhealth.priorityhealth.com/wp-content/uploads/2015/11/Priority-Health-education-HSA-vs-FSA-difference-between-HSA-and-FSA.jpg

Chapter 13 Bankruptcy North Metro Litigators

https://northmetrolitigators.com/wp-content/uploads/2023/01/a.jpg

Deposits paid directly to your health savings account HSA can result in an HSA tax deduction However contributions paid through your employer are already excluded Verification of expenses is not required for HSAs However total withdrawals from your HSA are reported to the IRS on Form 1099 SA You are responsible for reporting

Yes you read that correctly even if you accidentally paid for a burger with your HSA debit card you will have to report it on your annual income tax return and pay taxes on it You can receive distributions from an HSA even if you are not currently eligible to have contributions made to the HSA However any part of a distribution not used to pay qualified medical expenses is includible in gross income and is subject to an additional 20 tax unless an exception applies

Download Do You Have To Report Hsa Spending On Taxes

More picture related to Do You Have To Report Hsa Spending On Taxes

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

How Much Can You Contribute To An Hsa In 2022 2022 CGR

https://i2.wp.com/hrworkplaceservices.com/wp-content/uploads/2021/05/HRWS.2022-Limits-for-HSAs.Chart-A3.jpg

How Long After You Move To Michigan Do You Have To Get A License

https://townsquare.media/site/44/files/2023/04/attachment-Thinking-Ticket-Michigan-Canva.jpg?w=1200&h=0&zc=1&s=0&a=t&q=89

If you answer Yes the entire distribution in box 1 of your 1099 SA is nontaxable However if you answer No the portion that wasn t used for qualified If you use a distribution from your HSA for qualified medical expenses you don t pay tax on the distribution but you have to report the distribution on Form 8889 However the

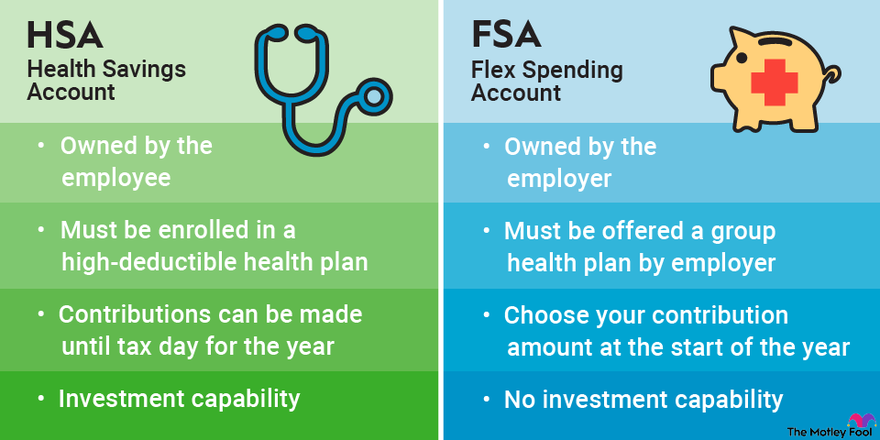

You can open an HSA if you have a qualifying high deductible health plan For the 2022 tax year the maximum contribution amounts are 3 650 for individuals and 7 300 for family coverage For Unlike HSAs or Archer MSAs which must be reported on Form 1040 or Form 1040NR there are no reporting requirements for HRAs FSAs or Commuter Benefits on your income tax return Therefore HSA Bank will not send you any tax forms for these

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

What You Need To Know About Health Savings Accounts HSAs

https://irp-cdn.multiscreensite.com/207226d8/dms3rep/multi/Depositphotos_317550154_l-2015.jpg

https://www.fidelity.com/learning-center/personal-finance/hsa-tax-form

Note that if you re over 65 you can spend your HSA dollars on nonqualified expenses but you ll face ordinary income tax on the distribution like a traditional IRA If you re under 65 HSA dollars spent on non qualified expenses would incur a 20 penalty

https://1040.com/.../hsas-and-your-tax-return

What HSA information do I need to report on my taxes When you file your tax return you have to report any withdrawals you made during the year also known as

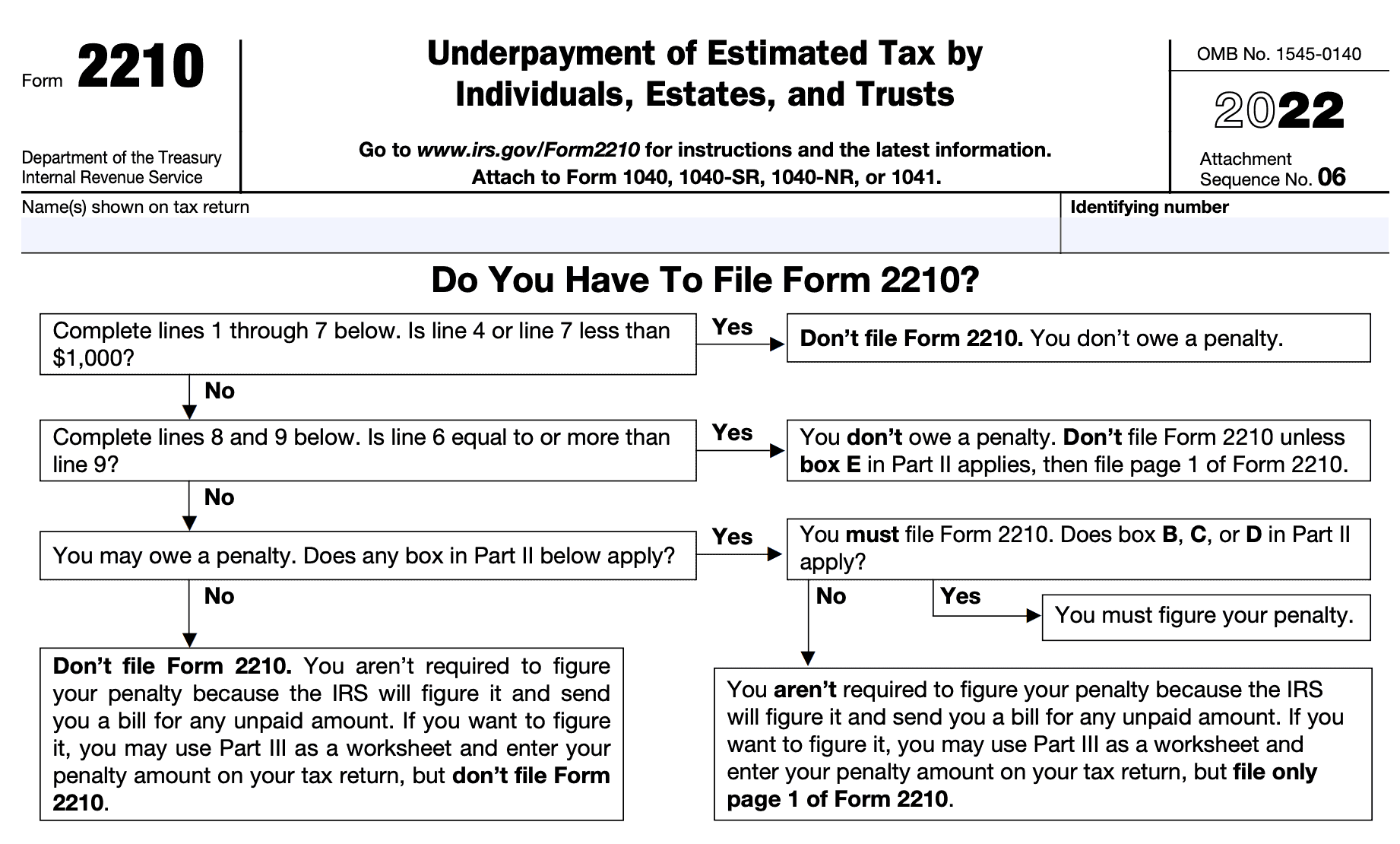

Form 2210 Instructions 2023 Printable Forms Free Online

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

Do You Have To Pay Taxes On Crypto NFTs Simply Explained

Can I Use My Hsa To Pay Insurance Premiums

Health Equity 2023 Hsa Form Printable Forms Free Online

How Much Can You Put In Hsa 2024 Donni Natividad

How Much Can You Put In Hsa 2024 Donni Natividad

How To Contribute To A SIPP Step By Step Guide Step By Step Guide

Comparison Of HSA health Savings FSA Flexible Spending HRA

Tax Free Investing The True Secret Behind Health Savings Accounts

Do You Have To Report Hsa Spending On Taxes - You can receive distributions from an HSA even if you are not currently eligible to have contributions made to the HSA However any part of a distribution not used to pay qualified medical expenses is includible in gross income and is subject to an additional 20 tax unless an exception applies