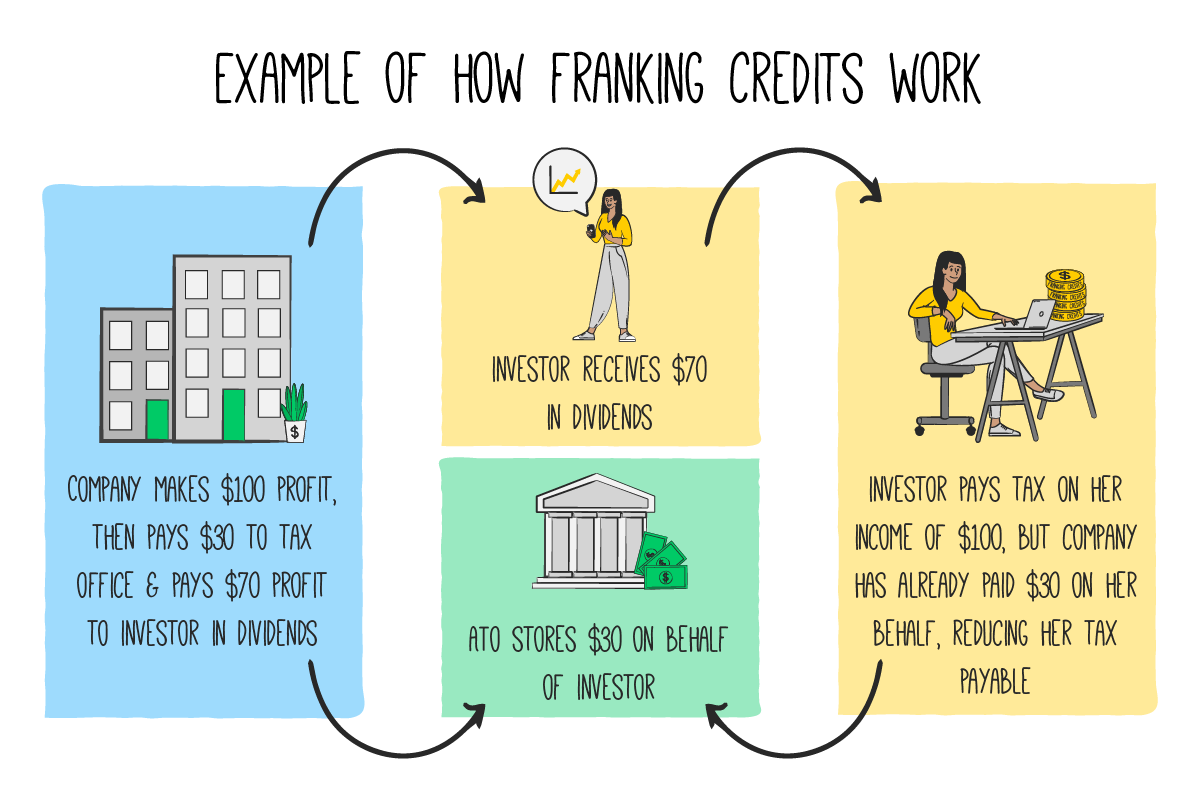

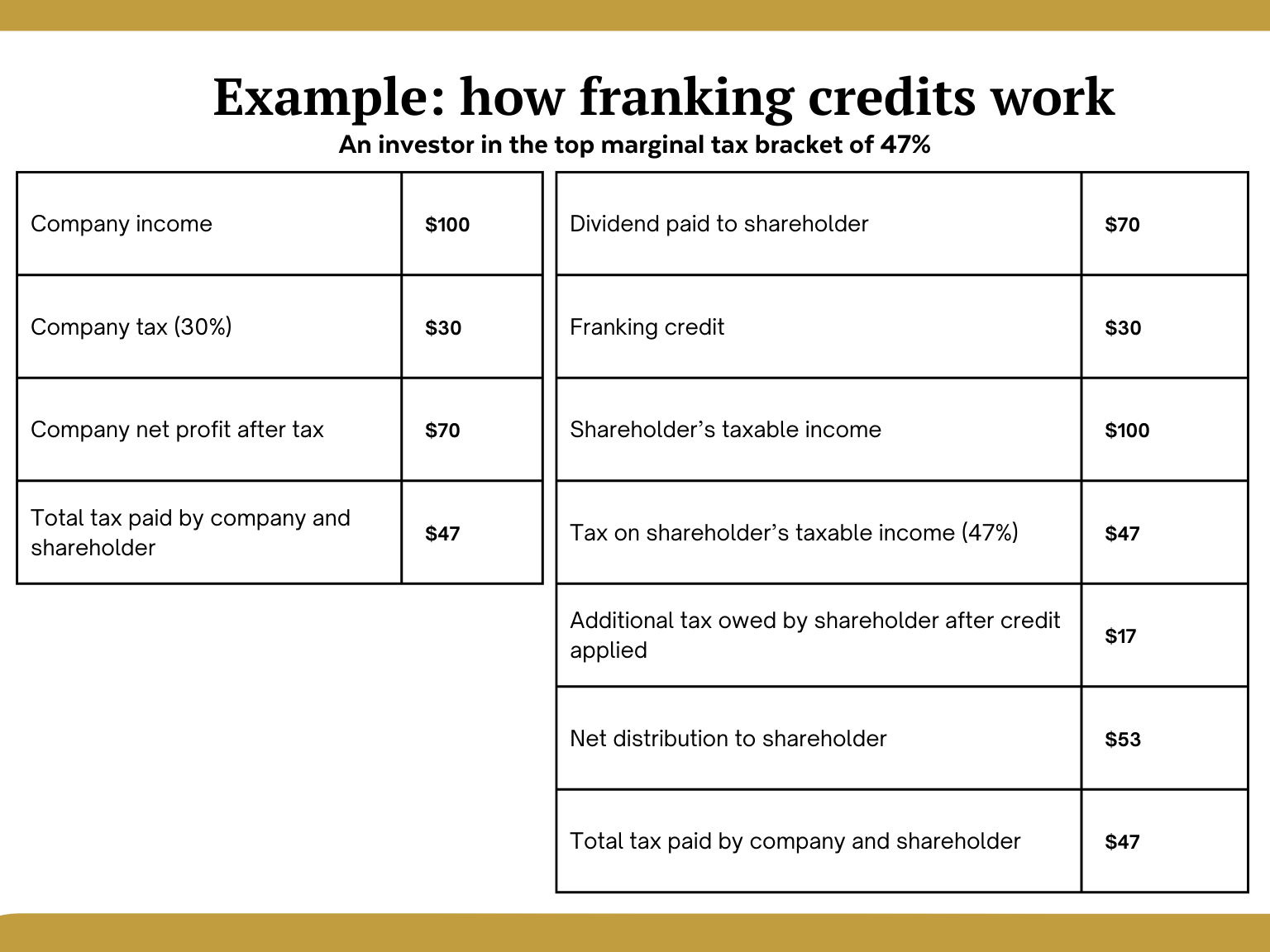

Do You Pay Tax On Franking Credits Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an ATO refund

Franking credit is a tax credit used in Australia and other nations used to eliminate double taxation Under this system the Australian Tax Office takes into account that companies pay tax on their profits and thus there s no need to tax shareholders dividends If franking credits didn t exist then a company would pay tax on its profits and the shareholder would also pay tax on the dividends they received However with franking credits shareholders receive a rebate of the tax that was paid by the company

Do You Pay Tax On Franking Credits

Do You Pay Tax On Franking Credits

https://i.ytimg.com/vi/zxG7QzpeIAI/maxresdefault.jpg

How To Pay Your Taxes YouTube

https://i.ytimg.com/vi/bZjTIHPyY94/maxresdefault.jpg

Do You Pay Taxes On Gold And Silver IRA YouTube

https://i.ytimg.com/vi/r3cqtuOYEw0/maxresdefault.jpg

Unique to Australia franking credits are a tax rebate paid to investors with shares in local companies As the company you have invested in has already paid tax on its profits the A franking credit also known as an imputation credit is a type of tax credit that allows the company s income tax to flow through to its shareholders It is a system in place to avoid or eliminate doubling taxing dividends Double taxing is when tax is paid twice on the same income or profit

Do you pay tax on franking credits You do not pay additional tax on franking credits Instead they are used to reduce the tax payable on your dividend income Franking credits are a reflection of tax already paid at the corporate level Attaching franking credits to dividends avoids double taxation of corporate profits distributed as dividends

Download Do You Pay Tax On Franking Credits

More picture related to Do You Pay Tax On Franking Credits

ETF Tax Distributions DRPs And Franking Credits EVERYTHING Explained

https://www.bestetfs.com.au/wp-content/uploads/2022/07/franking-credits-tax-rask.png

Do I Need To Pay Tax On My ERCs YouTube

https://i.ytimg.com/vi/tOKzKXRM0_I/maxresdefault.jpg

Franking Credit Refund 2023 Atotaxrates info

https://atotaxrates.info/wp-content/uploads/2021/11/franking-credit-calculators.jpg

A franking account records the amount of tax paid that a franking entity can pass on to its members as a franking credit Each entity that is or has ever been a corporate tax entity has a franking account A franking credit is a tax credit paid by companies to their shareholders at the same time as dividends are paid Since corporations have already paid taxes on the dividends they distribute to their shareholders the franking credit

Instead your franking credits will act as a discount towards your income tax In these circumstances the franking credit amount will be deducted from your tax rate so you are only required to pay tax on the difference If you have more than 5 000 in franking credits from a single parcel of shares and did not satisfy the holding period rule for those franking credits you have no entitlement to a franking tax offset for the entire franking credits In other words you can t restrict your claim of franking credits to a maximum of 5 000 Because you can t

How Do Franking Credits Work Melior Accounting

https://www.melior.com.au/wp-content/uploads/2016/09/money-1012622__1801-1024x596.jpg

Do You Pay Money Back On A Cash out Refinance YouTube

https://i.ytimg.com/vi/nXISAgOZg7I/maxresdefault.jpg

https://www.marketindex.com.au › franking-credits

Franking credits represent the tax a company has already paid on any profit it distributes to shareholders as a dividend The credits reduce a shareholder s tax liability at the end of the financial year and can result in an ATO refund

https://corporatefinanceinstitute.com › resources › ...

Franking credit is a tax credit used in Australia and other nations used to eliminate double taxation Under this system the Australian Tax Office takes into account that companies pay tax on their profits and thus there s no need to tax shareholders dividends

Will I Have To Pay Tax On My Qualified ESPP Diversified Asset Management

How Do Franking Credits Work Melior Accounting

Do I Have To Pay Tax On Gifts A Guide For Influencers Studio Legal

.png)

The Divide nd Of Income How To Invest For Franking Credits Sara

Do You Pay 7 Or More To Send Money Back Home BCH Ad 2 YouTube

What Are Franking Credits And How Do They Work Financial Autonomy

What Are Franking Credits And How Do They Work Financial Autonomy

Do You Pay Taxes On Money Market Accounts Leia Aqui What Are The

Do You Have To Pay Tax On A Large Inheritance YouTube

Why You Should See The Franking Credits Furore As A Blessing Class

Do You Pay Tax On Franking Credits - How do franking credits work Companies can offer fully franked 100 franked dividends where the full company tax rate of 30 applies to the dividends or partially franked dividends where only a portion of tax might apply In a fully franked dividend that means 30c tax paid for every dollar