Do You Report Your Hsa On Taxes HSA tax reporting requires specific documentation Account holders receive Form 1099 SA from their HSA custodian detailing distributions for the tax year It is crucial to

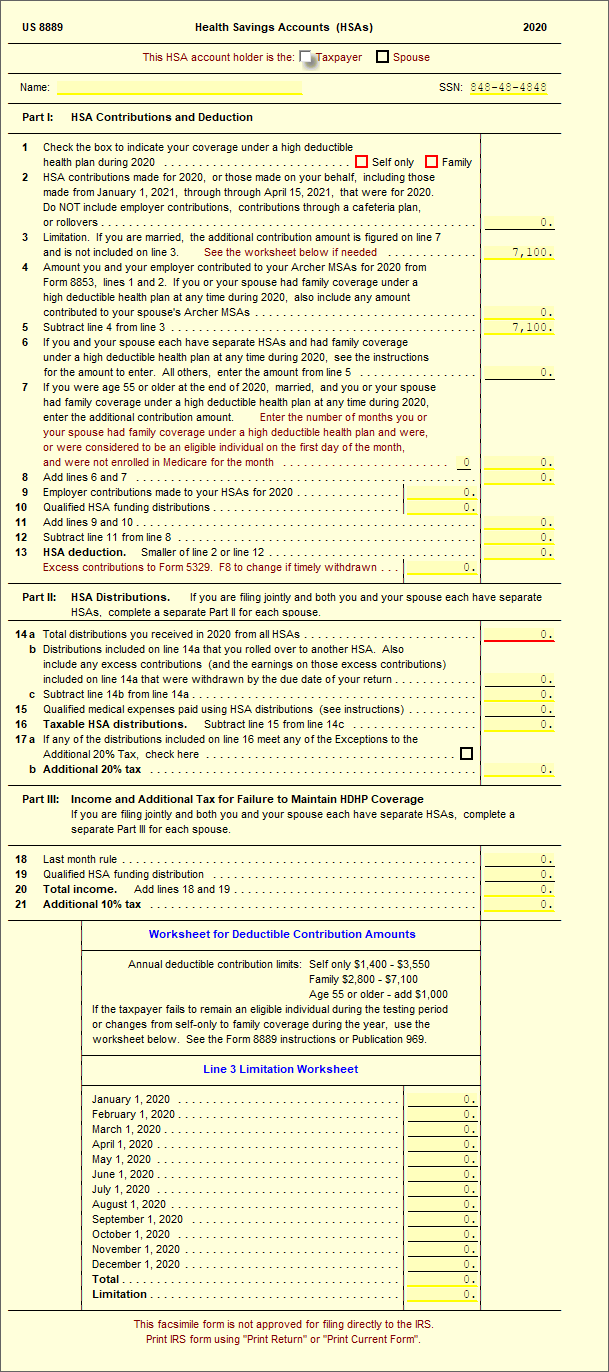

Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction Report distributions from HSAs Figure In order to enjoy the full tax benefits of an HSA and stay compliant with IRS rules you need to complete and file Form 8889 each year you contribute to or distribute money from

Do You Report Your Hsa On Taxes

Do You Report Your Hsa On Taxes

https://blog.cmp.cpa/hubfs/HSA Tax Deduction How Your HSA Can Lower Your Taxes - Outside Blog-1.jpg#keepProtocol

Health Savings Account HSA Workest

https://www.zenefits.com/workest/wp-content/uploads/2022/12/HSA-e1677100040197.jpg

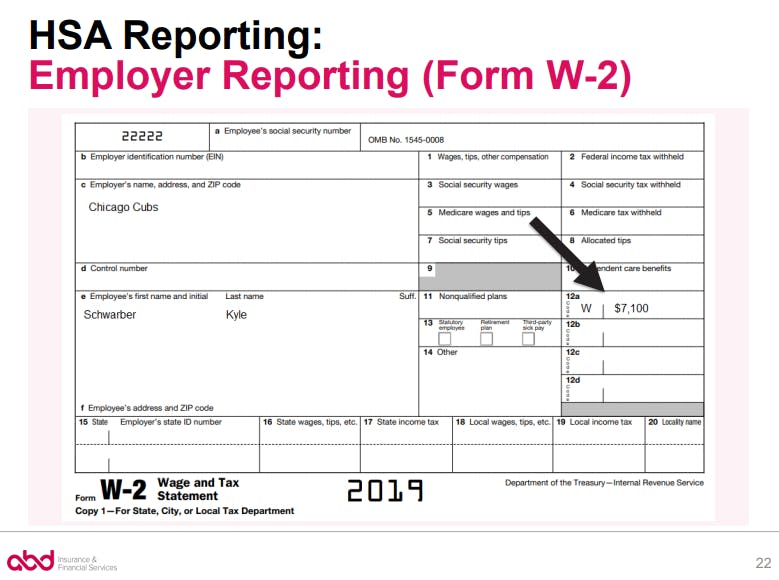

HSA Form W 2 Reporting

https://images.prismic.io/newfront/NmUwZDEzZDgtY2E4Ni00NDVlLTgwY2MtOThiNDgxZDUzZDM3_4_24_20_chart1.png?auto=compress,format&rect=0,0,779,580&w=779&h=580

When filing taxes you must report taxable distributions from HSAs and MSAs on your tax return and calculate the additional 20 tax on the taxable portion of your distributions If you have a health savings account HSA you ll receive tax forms from your HSA provider to show how much you ve contributed and withdrawn from your account Be on the lookout for Form 1099 SA to report

If you have an HSA you are required to report any contributions made to your HSA and any distributions received from your HSA during the 2022 calendar year Specifically you are required to report this information on Form You ll use Form 8889 which is fairly short and sweet as far as tax forms go instructions for Form 8889 are here Part I is where you report your contributions to your HSA and Part II is where

Download Do You Report Your Hsa On Taxes

More picture related to Do You Report Your Hsa On Taxes

There s Still Time To Get 2022 Tax Savings By Contributing To Your HSA Now

https://images.ctfassets.net/0rtn79ifmgv3/4GufKGbzoFDeI269pIb5f5/1062c52ae582e8e4b8a1ac4d39758ebe/TaxChecklistv3.jpg

How Much Can You Contribute To An Hsa In 2022 2022 CGR

https://i2.wp.com/hrworkplaceservices.com/wp-content/uploads/2021/05/HRWS.2022-Limits-for-HSAs.Chart-A3.jpg

8889 Health Savings Accounts HSAs UltimateTax Solution Center

https://support.ultimatetax.com/hc/article_attachments/4407002058263/8889.png

For example if you earn 60 000 for the year and contribute 3 000 to an HSA you ll only pay income taxes on 57 000 As long as you use your HSA funds for qualified medical expenses Several employees have asked how they should report their HSAs on their federal tax returns What do they have to do ANSWER Employees with HSAs must file a Form 8889 Health Savings Accounts HSAs as an

In most cases your HSA contribution has already been reported in Box 12 of your W 2 with code W Employer Contributions to Health Savings Account Despite the misleading HSA distributions taken to pay for eligible medical expenses are not taxable but they still must be reported to the Internal Revenue Service IRS

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

https://i.ytimg.com/vi/Bi4oWopz_UM/maxresdefault.jpg

What Is A Health Savings Account HSA HSA Search

https://www.hsasearch.com/wp-content/uploads/hsavsretirementaccounts-1024x660.png

https://accountinginsights.org › hsa-and-taxes-how...

HSA tax reporting requires specific documentation Account holders receive Form 1099 SA from their HSA custodian detailing distributions for the tax year It is crucial to

https://www.irs.gov › forms-pubs

Report health savings account HSA contributions including those made on your behalf and employer contributions Figure your HSA deduction Report distributions from HSAs Figure

Does FSA Cover Incontinence Products Adult Diapers Tranquility

Health Savings Account HSA Tax Forms And Tax Reporting Explained YouTube

How Much Can You Put In Hsa 2024 Donni Natividad

Tax Free Investing The True Secret Behind Health Savings Accounts

Taxes News Latest Taxes Tips Deductions Reports And Updates

IRS Courseware Link Learn Taxes

IRS Courseware Link Learn Taxes

5 Things To Know About Health Savings Accounts ThinkHealth

TrackHSA About HSA Record Keeping

Are You Healthy I HOPE You re Using An HSA Pacific Crest Management

Do You Report Your Hsa On Taxes - You ll use Form 8889 which is fairly short and sweet as far as tax forms go instructions for Form 8889 are here Part I is where you report your contributions to your HSA and Part II is where