Does A New Hvac System Qualify For Tax Credit If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

Does A New Hvac System Qualify For Tax Credit

Does A New Hvac System Qualify For Tax Credit

https://static01.nyt.com/images/2022/12/29/multimedia/29EV-LIST-1-7403/29EV-LIST-1-7403-videoSixteenByNine3000.jpg

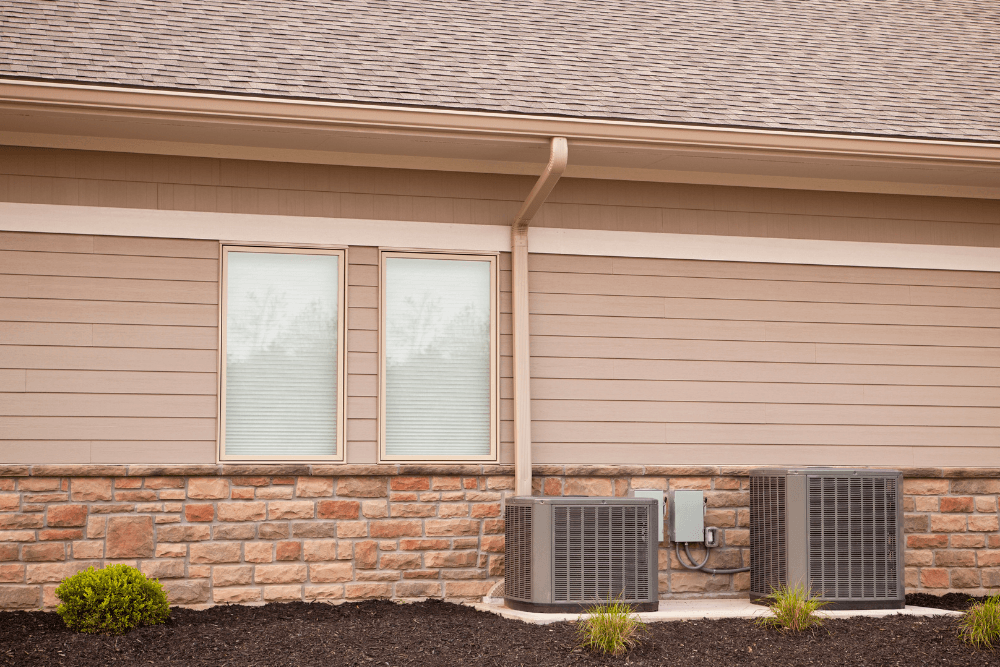

Understanding HVAC System Costs Tennessee Mechanical Corporation

https://tmcservice.com/wp-content/uploads/2021/02/Understanding-HVAC-system-costs.jpg

4 Signs It s Time For To Replace Your HVAC System

http://www.samahvac.com/wp-content/uploads/2018/09/replace-HVAC-system.jpeg

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work For qualified HVAC improvements homeowners might be able to claim 25c tax credits equal to 10 of the install costs up to a maximum of 500 If you re unsure of how to get the tax credit you might be eligible for don t worry We ve got you covered

If you have a cooling system purchased or installed in 2023 or beyond you will be eligible for the updated tax credit Split systems meeting a SEER2 rating of 16 or higher are eligible for a tax credit and all Energy Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032

Download Does A New Hvac System Qualify For Tax Credit

More picture related to Does A New Hvac System Qualify For Tax Credit

How Much Should A New HVAC System Cost Interior Magazine Leading

https://interior.tn/wp-content/uploads/2022/06/How-much-should-a-new-HVAC-system-cost-2048x1410.jpg

There Is No Way To Know For Sure What Rebates You May Qualify For Until

https://i.pinimg.com/originals/cf/4e/b0/cf4eb0aa79cf6b9c7bb5d50b72b21667.jpg

Does Your Commercial Space Need A New HVAC System

https://www.q1es.com/wp-content/uploads/2022/06/commercialHVACsystem.jpg

Save Up to 2 000 on Costs of Upgrading to Heat Pump Technology These energy efficient home improvement credits are available for 30 of costs up to 2 000 and can be combined with credits up to 1 200 for other qualified upgrades made in one tax year The amended Energy Efficient Home Improvement Credit which begins in 2023 and extends through 2032 increases the tax credits as high as 600 for qualified air conditioner or gas furnace and up to 2000 for qualified heat pump heat pump water heater or boiler

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air conditioners and furnaces and a maximum of 2 000 for qualified heat pumps

Benefits Of A New HVAC System OHA Home Service

https://fixmyair.com/wp-content/uploads/2020/11/benefits-of-a-new-hvac-system.jpg

Signs That You Need A New HVAC System AFM Heating Cooling

https://www.afmheatcool.com/wp-content/uploads/signs-that-you-need-a-new-hvac-system.jpg

https://www.irs.gov/credits-deductions/energy...

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022

https://todayshomeowner.com/hvac/guides/hvac-tax-credit

How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

Buying A New HVAC System Online Pros And Cons FACT HVAC

Benefits Of A New HVAC System OHA Home Service

Is There A Best Time Of Year To Replace My HVAC System Comfort

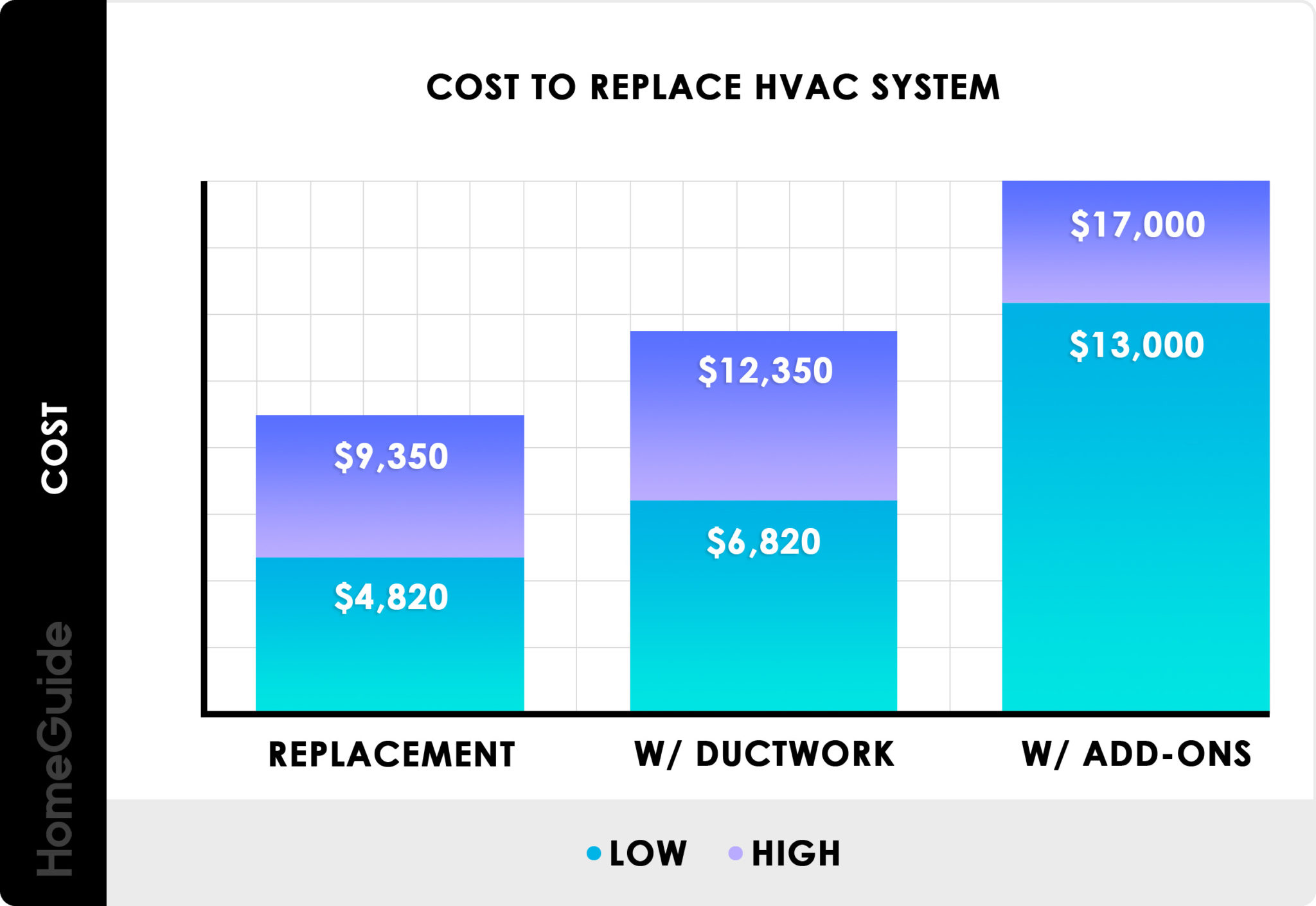

How Much Does It Cost To Install A New HVAC System

/https://www.forbes.com/wheels/wp-content/uploads/2022/08/New-EV-Tax-Credit-Program_Rivian.png)

New Clean Vehicle Tax Credit Plan Means Most EVs No Longer Qualify 2022

Does My HVAC System Qualify For A Tax Deduction YouTube

Does My HVAC System Qualify For A Tax Deduction YouTube

SAVE BIG With HVAC Tax Credits Sun Heating Cooling Inc

When Is The Best Time To Buy A New HVAC System

How Much Does HVAC Unit Replacement Cost 2023 Bob Vila

Does A New Hvac System Qualify For Tax Credit - Which Tax Credits Are Potentially Available for HVAC Systems The rebates would apply for heating and cooling systems installed between Jan 1 2023 and Dec 31 2032