Does Air Conditioner Qualify For Residential Energy Credit 2022 The residential clean energy property credit is a 30 percent credit for certain qualified expenditures made by a taxpayer for residential energy efficient property

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you

Does Air Conditioner Qualify For Residential Energy Credit 2022

Does Air Conditioner Qualify For Residential Energy Credit 2022

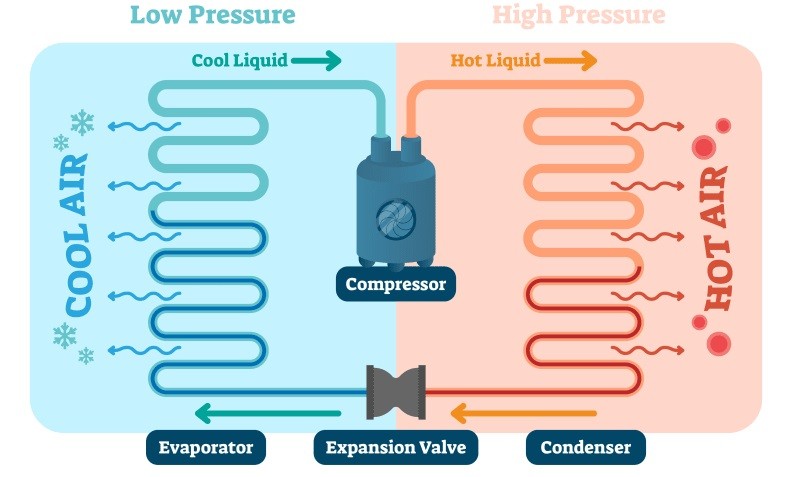

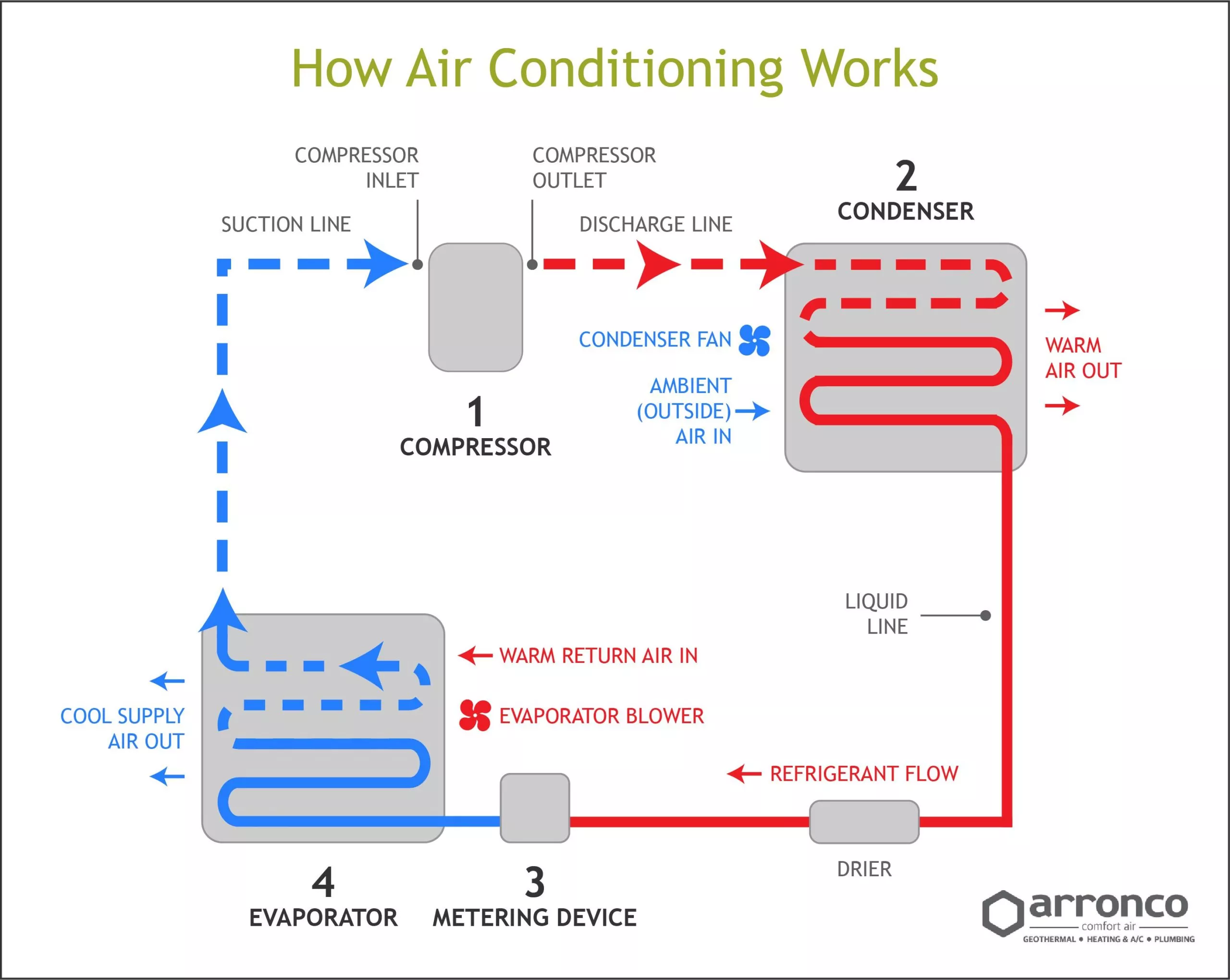

https://balmainairconditioning.com.au/wp-content/uploads/2021/07/how-air-conditioning-works.jpg

Residential Energy Credit Application 2024 ElectricRate

https://www.electricrate.com/wp-content/uploads/2021/04/how-to-calculate-residential-energy-credit.jpg.png

15 Best Air Conditioner In 2022 Findallbest

https://images-na.ssl-images-amazon.com/images/I/81CslYXnuHL._SL1500_.jpg

If you invest in renewable energy for your home solar wind geothermal fuel cells or battery storage technology you may qualify for an annual residential clean energy tax credit of 30 of the costs for qualified Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q

Roofs no longer qualify but air sealing insulation does You can claim the credit for not only a primary residence but also a secondary one Beginning in 2025 you should include the product ID on tax forms to claim the Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential

Download Does Air Conditioner Qualify For Residential Energy Credit 2022

More picture related to Does Air Conditioner Qualify For Residential Energy Credit 2022

Do Air Conditioners Qualify For Residential Energy Credit

https://homequeries.com/wp-content/uploads/2021/12/Do-Air-Conditioners-Qualify-For-Residential-Energy-Credit.jpg

What You Need To Know About Energy Efficient Property Credits

https://tax.thomsonreuters.com/blog/wp-content/uploads/sites/17/2022/11/AdobeStock_440097569-scaled.jpeg

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://i0.wp.com/hvacseer.com/wp-content/uploads/2022/04/Carrier-air-conditioner-unit-at-office-2-e1649250081331.jpg

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement In December the IRS released Fact Sheet 2022 40 detailing the general requirements for both credits available under sections 25C and 25D as well as several FAQs regarding energy efficient home

Effective Jan 1 2023 Provides a tax credit to homeowners equal to 30 of installation costs for the highest efficiency tier products up to a maximum of 600 for qualified air Items that can be qualified energy property provided they meet the energy efficient criteria for that specific component are Electric or natural gas heat pump water

Residential Energy Efficient Property Credit Qualification Form 5695

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEjcZNXb8Omm6oz8cRmTNi38IrOY0Boo5AfXIP_jfX8VPD6EEJX9UM6tv21sPKx1vHo-Avpib5HIBDQ7ti07b28DwqsbKuw-qbajUUKXL1sYRZHQbdbnru97J2hoJuHwivgRHrXSY56B_GMXul22s_yV8jm-v1Cw_A0P6lczrMdlIkAyApVdgFQz7640/s864/REC.jpg

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://hvacseer.com/wp-content/uploads/2022/04/Minimalist-living-room-with-sofa-and-air-conditioner-1024x683.jpg

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

The residential clean energy property credit is a 30 percent credit for certain qualified expenditures made by a taxpayer for residential energy efficient property

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements

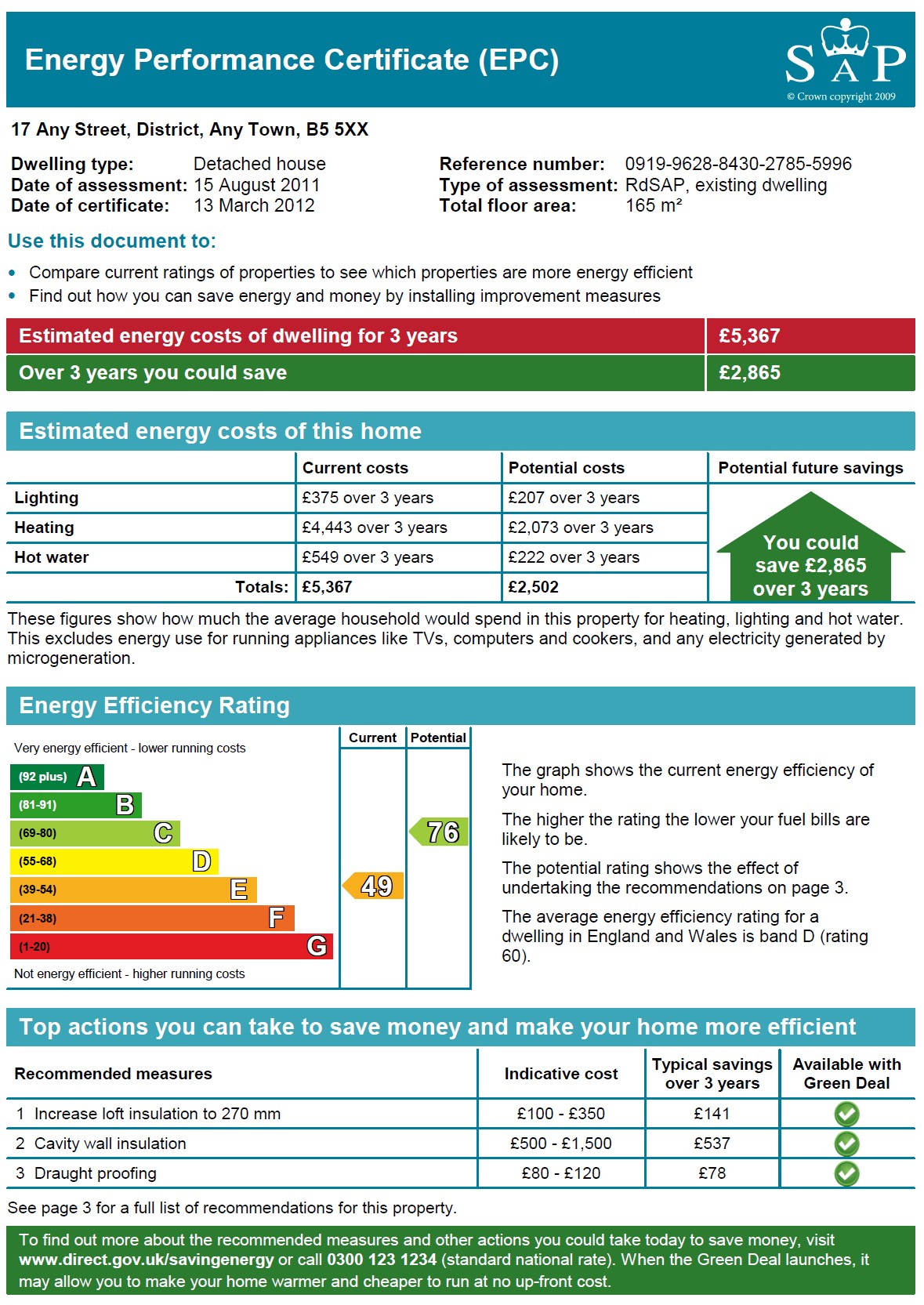

Energy Performance Certificates Building Compliance Testing

Residential Energy Efficient Property Credit Qualification Form 5695

Apa Itu Air Conditioner Pengertian Air Conditioner Dalam Kamus The

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Radiant Barrier Insulation That Reflects Heat Americover

Solar Tax Credit What You Need To Know NRG Clean Power

Solar Tax Credit What You Need To Know NRG Clean Power

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

How Does A Water Cooled Centralized Air Conditioning System Works

Does Air Conditioner Qualify For Residential Energy Credit 2022 - Key Takeaways The Energy Efficient Home Improvement Credit provides tax credits for the purchase of qualifying equipment home improvements and energy audits to reduce your taxes The Residential