Does Cpp Get Deducted From Ei Payments All employers are required by law to deduct Canada Pension Plan CPP contributions and employment insurance EI premiums from most amounts they pay to their employees

Whether CPP contributions EI premiums deducted during the year can be considered following employer restructuring succession Indian workers and the Canada Pension CPP is not withheld on the business income earned so the person is required to make the contribution by April 30th or if required as quarterly instalments They would have to

Does Cpp Get Deducted From Ei Payments

Does Cpp Get Deducted From Ei Payments

https://myopencourt.org/wp-content/uploads/2021/06/kelly-sikkema-wgcUx0kR1ps-unsplash-1024x683.jpg

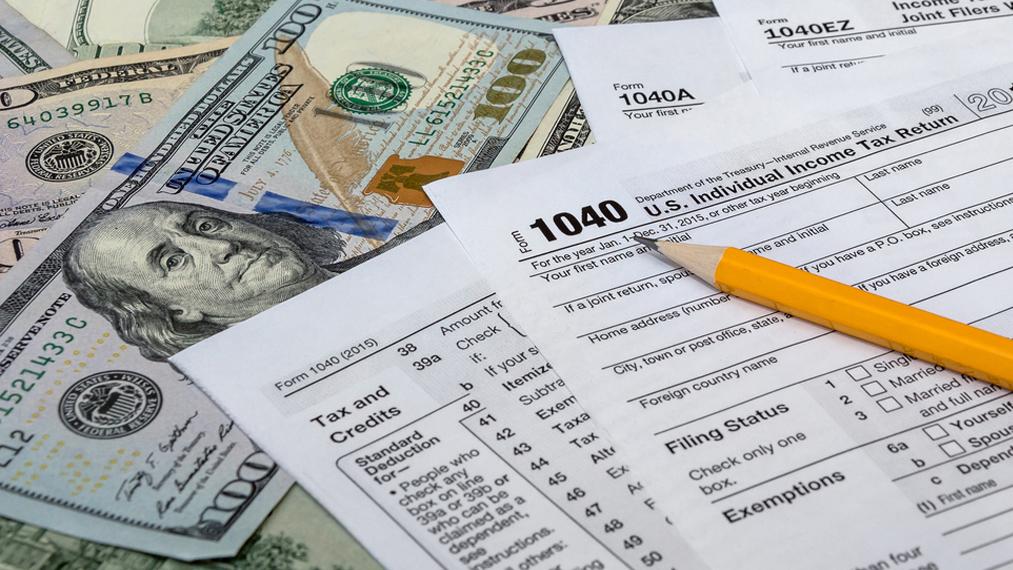

EI CPP Premiums Are On The Rise But There Is More To The Story Than

https://smartcdn.gprod.postmedia.digital/nationalpost/wp-content/uploads/2022/09/0103-biz-gz-cppib_68703816-w.jpg

Why Are Taxes And EI Being Deducted From My Pay YouTube

https://i.ytimg.com/vi/sgh0sXoDh3A/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AHUBoAC4AOKAgwIABABGGUgZShlMA8=&rs=AOn4CLBtu2t-sqKCWSnOx2AJI14p2N9fQw

CPP QPP and employer pensions generally constitute earnings that reduce your entitlement to EI benefits and must be reported to Service Canada These types of earnings are deducted from Normally for residents of Canada there is no tax deducted from payments of CPP retirement pension However you can request that tax be deducted by visiting

Your pay stub summarizes employment earnings and other amounts deducted for income tax EI and CPP Depending on how you get paid your pay stub may be a While you are able to apply for EI if able to work and looking for employment most or all of the EI benefit would be deducted due to the reported

Download Does Cpp Get Deducted From Ei Payments

More picture related to Does Cpp Get Deducted From Ei Payments

Money Deducted From My Account But Receiver Does Not Get It Consumer

https://consumercomplaintscourt.com/wp-content/uploads/Screenshot_20211006_211705.jpg

CPP And EI For 2023

https://coachingbusinessowners.com/images/blog/thumbnails/202211/img_26110515250.jpg

Payroll Deductions In Alberta Canada Simplified Weekly Income Tax

https://i.ytimg.com/vi/Q8AqcgJTp5Y/maxresdefault.jpg

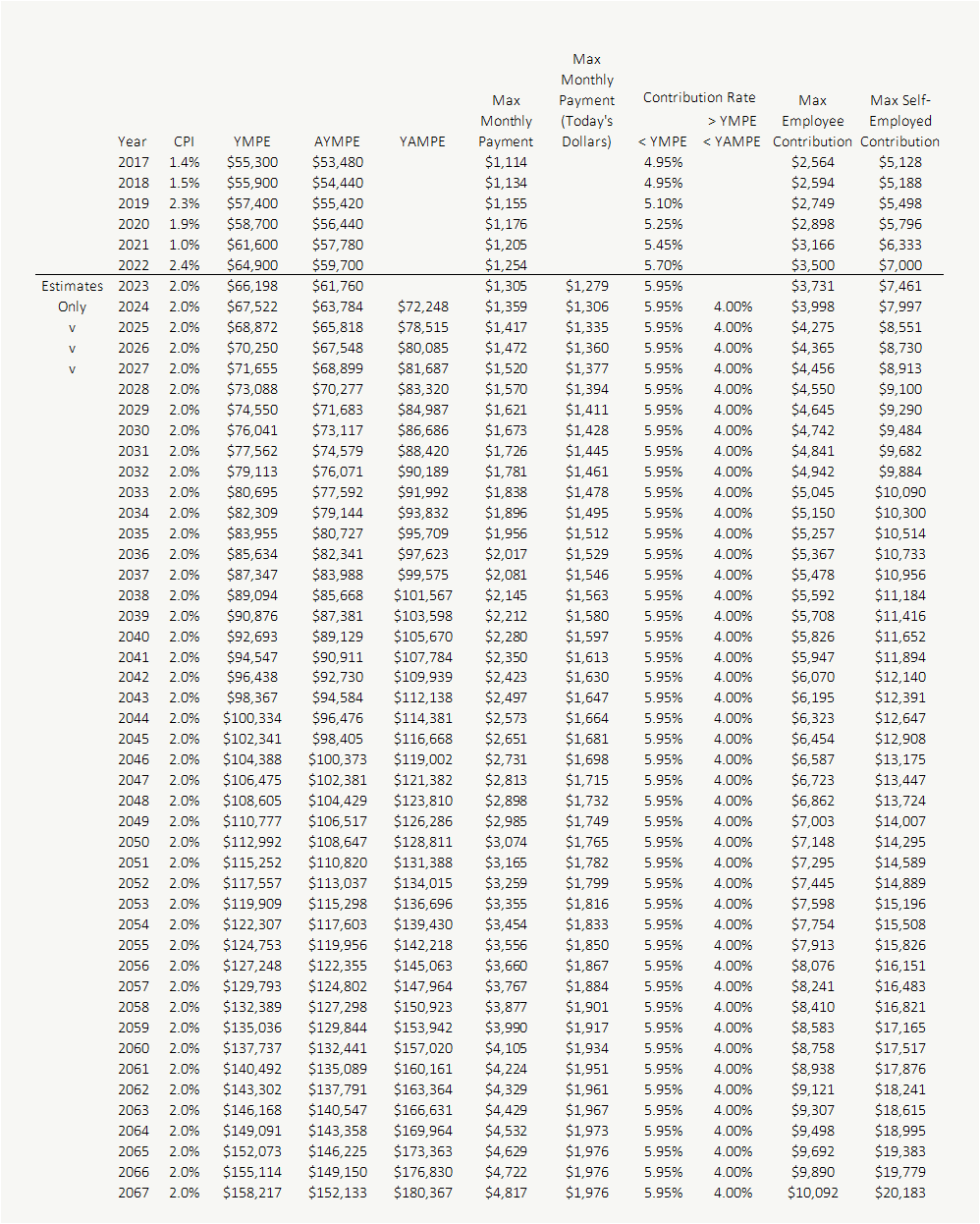

CPP is what it is based on your entitlement from your historical contributions I suppose you could say that it is indirectly reduced by income tax payable on your pension so planning when to As of 2024 wages paid and earnings received by workers age 73 and older will no longer be subject to QPP contributions This was announced as part of the March 21 2023

Our Detailed Income Tax RRSP Savings Calculators will display the amount of CPP or EI that you should have paid in the year You can deduct this from what you actually paid This chart will help you determine whether or not to deduct Canada Pension Plan CPP contributions employment insurance EI premiums and income tax on the special

Where Does My CPP Money Go After It Gets Deducted From My Paycheque

https://i.pinimg.com/736x/b8/b6/d8/b8b6d8fb9b8b91dab9a0fe1d7adcc26a.jpg

EI Payments FAQ

https://www.kingstonnationalbank.com/ContentImageHandler.ashx?ImageId=158180

https://www.canada.ca/en/revenue-agency/services/...

All employers are required by law to deduct Canada Pension Plan CPP contributions and employment insurance EI premiums from most amounts they pay to their employees

https://www.canada.ca/.../cpp-ei-explained.html

Whether CPP contributions EI premiums deducted during the year can be considered following employer restructuring succession Indian workers and the Canada Pension

Can I Deduct My Tax prep Fees Fox Business

Where Does My CPP Money Go After It Gets Deducted From My Paycheque

What Does CPP Mean CPP Definitions Abbreviation Finder

CPP And EI Contributions Snap Projections Support 1 888 758 7977

Margaret Lykaios Is The President And Major Shareholder Course Hero

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

35 Tfsa Contribution Limit Calculator ZhuoZaibha

Got A CP05 Notice From The IRS What Should I Do Digest Your Finances

Payroll Online Payroll Online Calculator Ontario

Does Cpp Get Deducted From Ei Payments - So how is CPP calculated As an employer you must deduct CPP contributions from your employee s pensionable earnings CPP payments are typically due monthly