Does Gst Count As Income On your Income Tax Return you are only taxed on the net income excluding HST GST collected on CRAs behalf and paid on business related expenses But you must disclose the HST GST collected on the income tax return

GST is also a flat tax unlike income tax which is a progressive tax system This means that the GST tax rate 10 doesn t change no matter how much you earn what you buy or how much it costs Unless the product you re selling is GST free GST is generally considered to be a regressive tax meaning that it takes a relatively larger percentage of income from lower income households compared to higher income households

Does Gst Count As Income

Does Gst Count As Income

https://www.workerscomplawyerhelp.com/wp-content/uploads/2022/09/income_MWCL_Blog_1200-x-628.jpg

What Counts As Income For A Mortgage YouTube

https://i.ytimg.com/vi/_X1jHrcRW9g/maxresdefault.jpg

Do Student Loans Count As Income Check Out Here

http://awajis.com/wp-content/uploads/2020/04/Do-Student-Loans-Count-As-Income_.png

Line 101 of the GST HST return is the line where registrants are to report Total Sales Lots of questions arise as to what exactly is meant by Total Sales Does that include only sales on which GST HST is collected How much is GST The current GST rate is 10 percent and is charged on the supply of most goods and services There are two methods of accounting for GST on a cash basis or a non cash accrual basis The method you use affects when you must account for GST and when you are able to claim GST credits What does ex GST mean

As a registered company in India all traders and businessmen must obtain a GSTIN GST Identification Number and In this article we shall take a close look at the calculation of GST the different tax slabs under GST and many more related and essential aspects of GST calculation This is because when income is tax exempt that is exempt from GST HST you can t claim back the GST HST on expenses relating to earning that exempt income Moreover exempt income doesn t count towards the 30 000 threshold so you re not obliged to register

Download Does Gst Count As Income

More picture related to Does Gst Count As Income

![]()

Income Tax GST Calculators On The App Store

https://is5-ssl.mzstatic.com/image/thumb/Purple125/v4/09/01/25/0901254c-0db5-40fa-a010-810aa8ee9b17/AppIcon-1x_U007emarketing-85-220-1.png/1200x630wa.png

Passive Income Can Make Money Work For You

https://s.hdnux.com/photos/01/31/36/10/23454255/5/rawImage.jpg

https://blog.faradars.org/wp-content/uploads/2021/03/what-is-tax.jpg

The GST and Income Tax rates vary considerably GST adopts a multi tiered structure with rates of 5 12 18 and 28 while Income Tax rates are progressive rising with higher income levels ranging from 5 to 30 If your business earns more than 30 000 in gross income what you earn before you deduct business expenses during any 12 month period you must get a GST HST number and collect GST HST from your customers There s some income that doesn t count for GST HST collection including salary from a job grants and sales outside of Canada

So GST and Income tax are not the same thing You are not being taxed on money twice GST is charged on top of your pricing and is not taken out of your profits as it never formed part of your profits to start with and income tax is based on your annual taxable income and comes out of your salary or wage if you are an employee or out of These three benefits are non taxable For single widowed or divorced Canadians aged 65 or older and earning an annual net income of less than 21 768 the maximum GIS payment per month for the

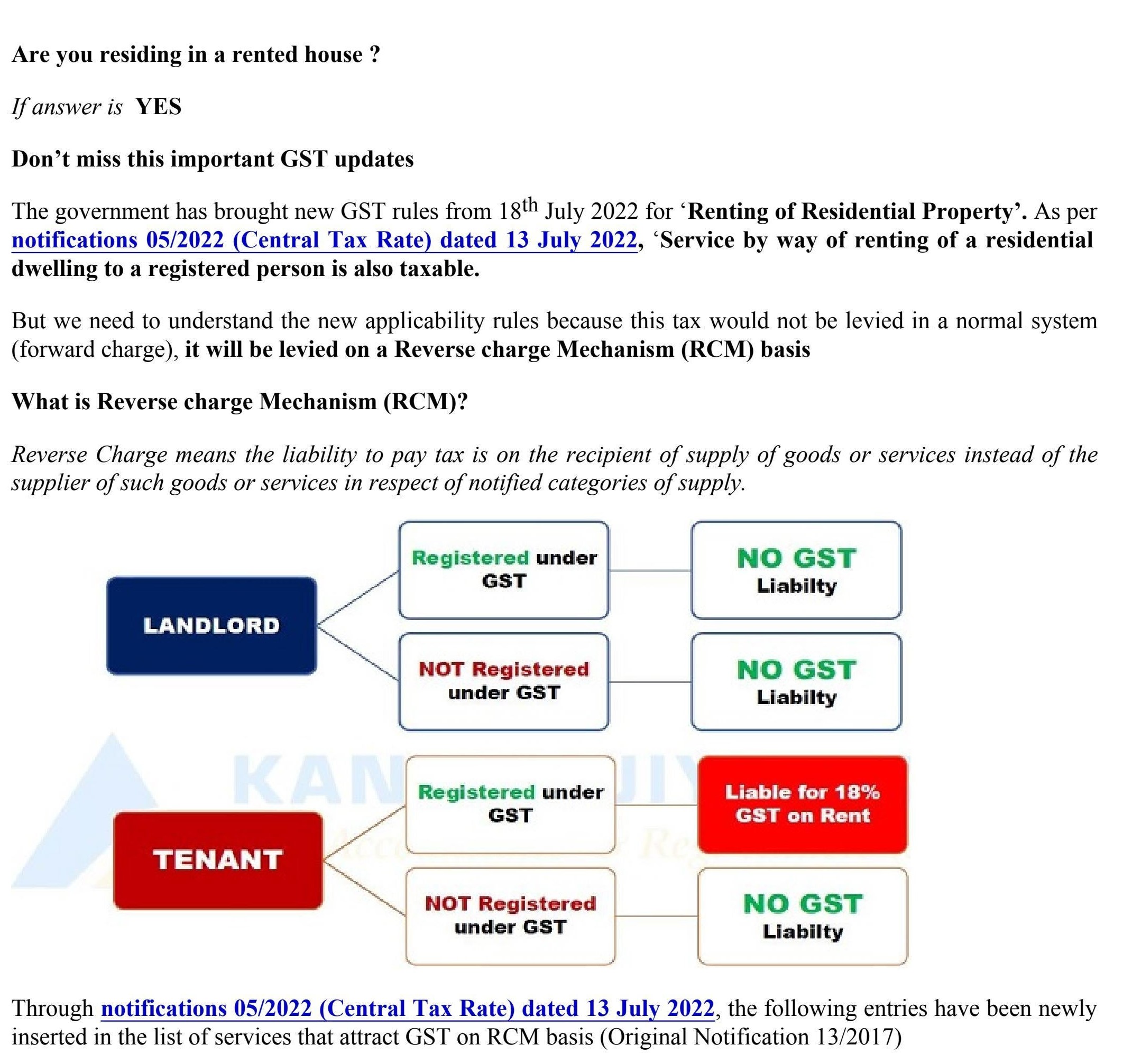

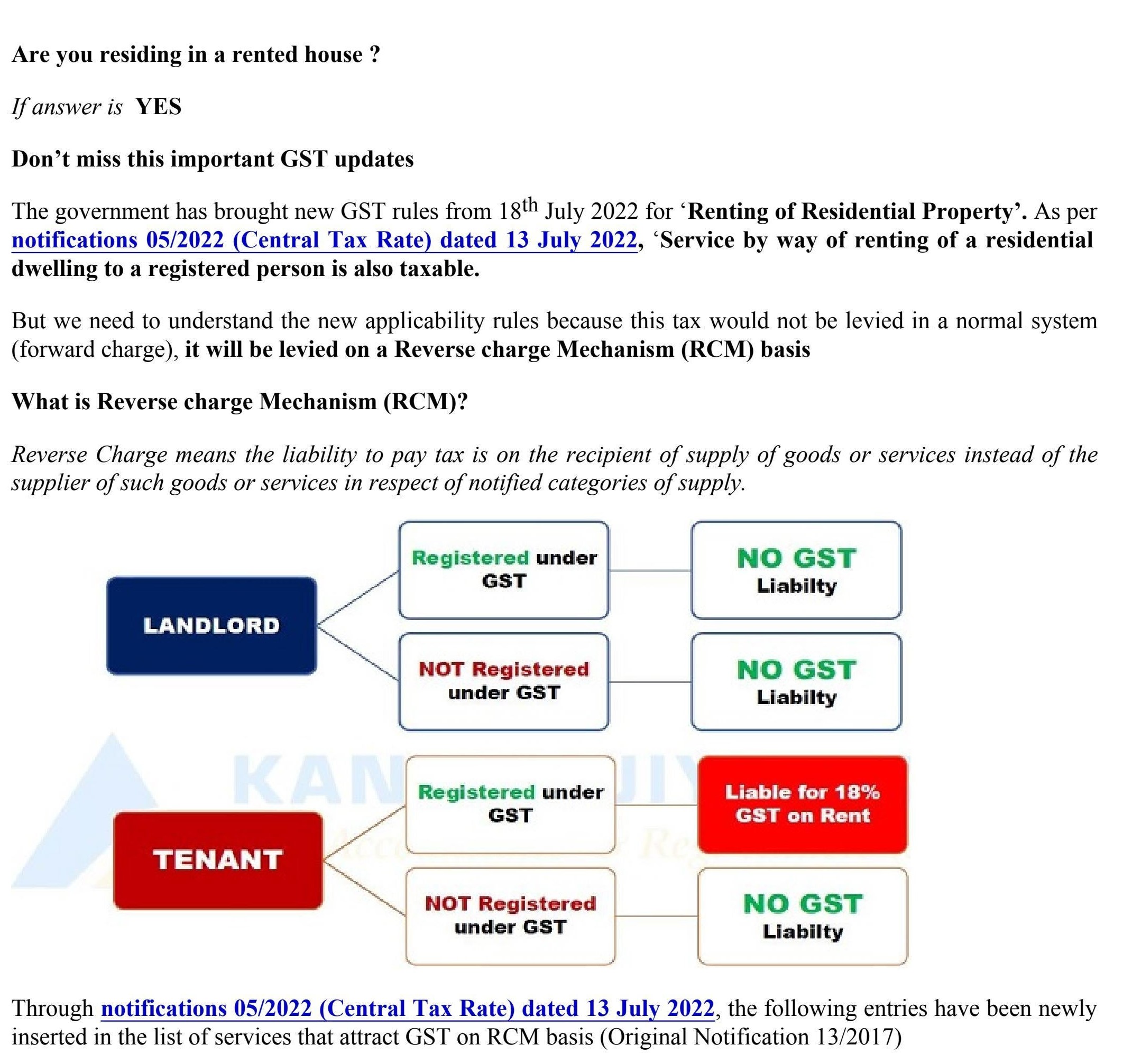

Key Note On Applicability Of GST 18 On Rent CA Rajput Jain

https://carajput.com/blog/wp-content/uploads/2022/07/GST-on-rent-applicablity-.jpg

1 If A s Income Is 20 Of B s Income Then Express B s Income As A

https://hi-static.z-dn.net/files/d93/e83974b5b1c7b3f2448e6e2e60755c19.jpg

https://www.tyagigroup.ca/blog/tax-connection

On your Income Tax Return you are only taxed on the net income excluding HST GST collected on CRAs behalf and paid on business related expenses But you must disclose the HST GST collected on the income tax return

https://hnry.com.au/tax-resources/what-is-gst-and-how-does-it-work

GST is also a flat tax unlike income tax which is a progressive tax system This means that the GST tax rate 10 doesn t change no matter how much you earn what you buy or how much it costs Unless the product you re selling is GST free

What Is GST

Key Note On Applicability Of GST 18 On Rent CA Rajput Jain

GST Vs Income Tax What Does GST Mean For India s Income Tax Collection

How Can I Add Income

Does Unemployment Income Count Toward Health Insurance

Basics Of GST On Advance Income Easily Explained

Basics Of GST On Advance Income Easily Explained

Do Student Loans Count As Income For Taxes LendEDU

Does Scholarship Count As Income YouTube

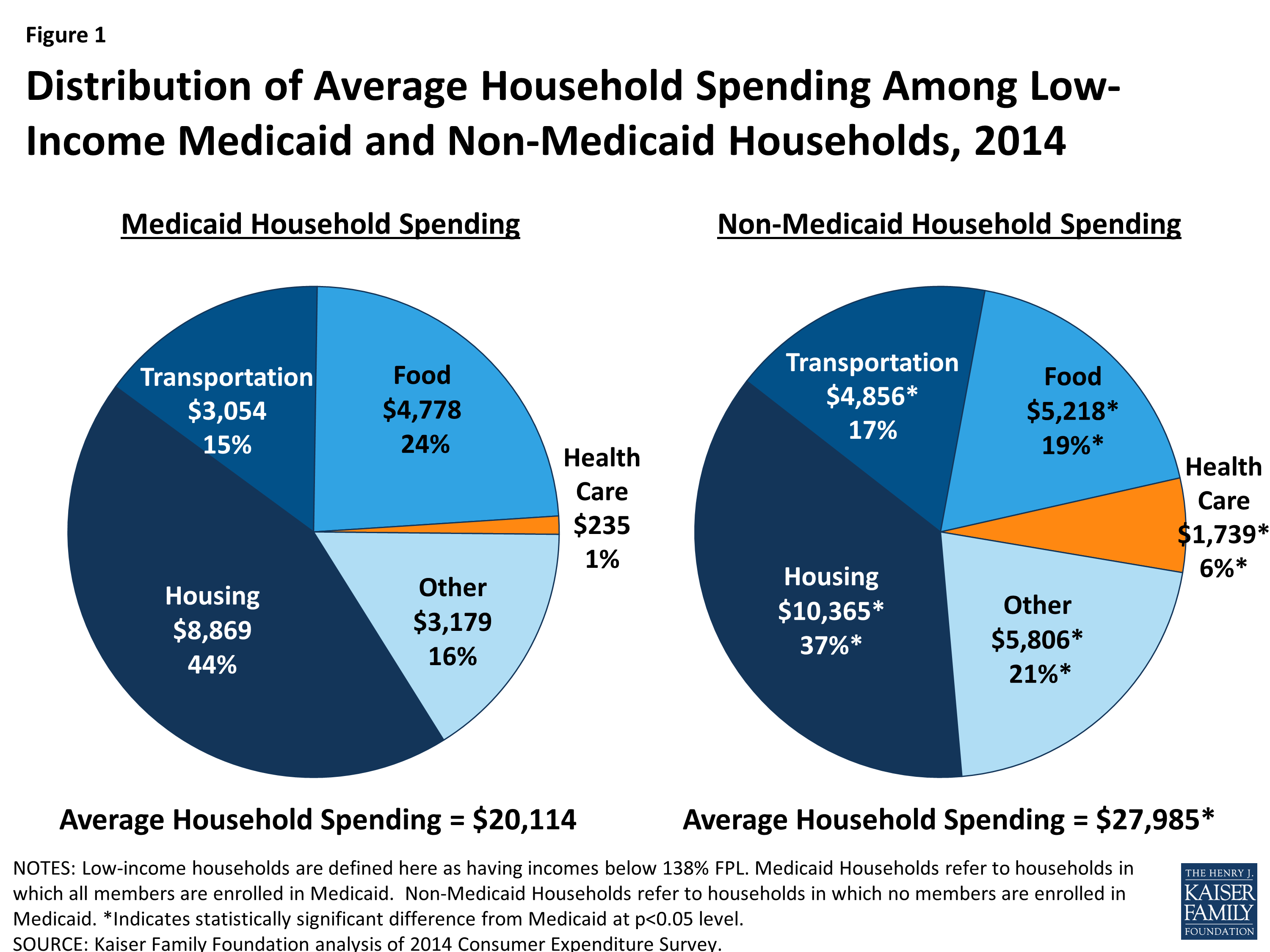

Health Care Spending Among Low Income Households With And Without

Does Gst Count As Income - By that measurement the United States led the field as of 12 p m ET with 28 medals total according to standings on the NBC Olympics website But some countries and organizations outside