Does Military Pay Sales Tax On Cars Check with your insurer to make sure you have the right coverage Buying the right vehicle for your needs and one that fits your budget can help make car ownership a positive

Tennessee Tax Free Motor Vehicle Sales to Service Members Motor vehicles sold to certain U S Armed Forces service members and registered in Tennessee are exempt from sales and use When a military member with Texas as their home state of record purchases a motor vehicle in Texas the 6 25 percent motor vehicle sales tax is due When sold by a dealer in Texas the

Does Military Pay Sales Tax On Cars

Does Military Pay Sales Tax On Cars

https://www.toyotasouth.com/inventoryphotos/10420/5yfbu4ee8dp144707/ip/1.jpg

does Military Pay Sales Tax On Cars In Kentucky Shirly Iverson

https://www.gatesnissan.net/inventoryphotos/11137/wba3b3c51fj984050/ip/1.jpg

does Military Pay Sales Tax On Cars In Kentucky Kif Profile Photo Gallery

https://pictures.dealer.com/d/dvgrandstrandnissan/1819/eccb5505402b86b2d62558d9022d196bx.jpg?impolicy=downsize_bkpt&imdensity=1&w=520

Servicemembers are granted special exemptions from certain vehicle taxes by Kentucky and Federal laws To understand how these exemptions work you must clearly define and Purchase price is an estimate of what you will pay for the vehicle and does not include dealer fees destination charges taxes title registration or optional equipment It also does not include additional savings that are only available

Purchase price is an estimate of what you will pay for the vehicle and does not include dealer fees destination charges taxes title registration or optional equipment It also does not As a result cars owned by military members and qualifying spouses are not subject to Nebraska wheel tax also called vehicle tax or personal property tax provided

Download Does Military Pay Sales Tax On Cars

More picture related to Does Military Pay Sales Tax On Cars

Car Sales Tax On New And Used Vehicles In Canada Loans Canada

https://loanscanada.ca/wp-content/uploads/2021/12/Car-Sales-Tax.png

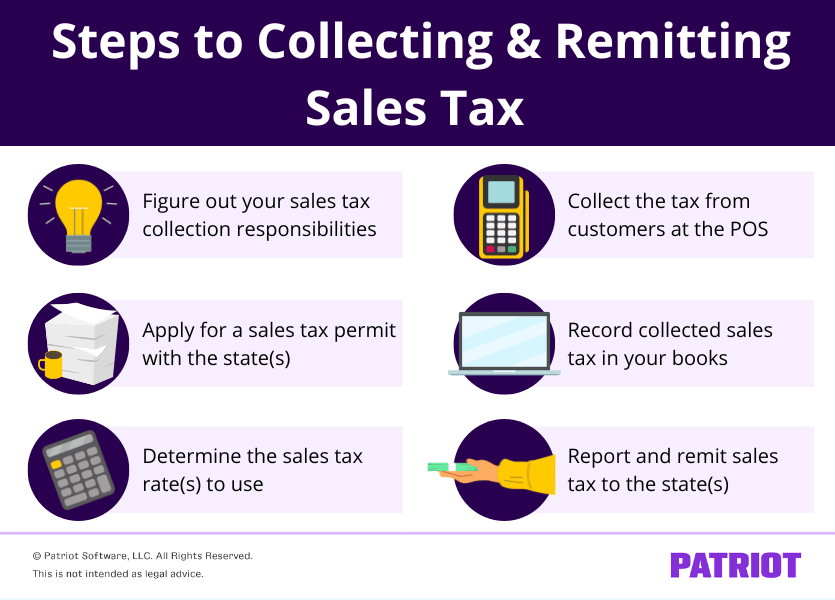

Do I Have Sales Tax Risk

https://media.licdn.com/dms/image/C4E12AQEc3gmQ18KMSg/article-cover_image-shrink_720_1280/0/1536079496381?e=2147483647&v=beta&t=_nxZ3A_sBfSDDee7MfGZbxjD5V5OEw05p24MjMRWW20

How Much Are Used Car Sales Taxes In Nevada PrivateAuto

https://privateauto.com/blog/content/images/2023/04/Blog-Post-Headers-2---2023-04-13T121043.315.jpg

Buying a Car in the Military Everything You Need to Know Military personal are often eligible for special loans and discounts on car purchases When buying a car in the military For example a disabled veteran in Georgia is eligible to receive a 60 000 exemption from tax on a primary residence In Idaho the disabled veteran must have had a certain

Taxes Your vehicle purchase is tax free while you are overseas provided you complete all necessary applications at the time of purchase The auto dealer s staff should be able to assist Tenn Code Ann 67 6 303 exempts from sales and use tax the sale of motor vehicles to members of the armed forces who fall into any one of the following five categories Members

Lower Sales Tax On Food Expand Medicaid In Kansas Legislative Session

https://www.gannett-cdn.com/presto/2022/01/08/NTCJ/aff22627-8c32-49ba-9b5e-a3c3045210be-Bill_Pannbacker_June_5_2.jpg?crop=3647,2052,x0,y185&width=3200&height=1801&format=pjpg&auto=webp

Sales Use Taxes Deadline March 17th 2023

https://pasfirm.com/wp-content/uploads/2023/02/blog-calendar-sales-use-taxes-0317.jpg

https://www.militaryonesource.mil/military-basics/...

Check with your insurer to make sure you have the right coverage Buying the right vehicle for your needs and one that fits your budget can help make car ownership a positive

https://myarmybenefits.us.army.mil/Be…

Tennessee Tax Free Motor Vehicle Sales to Service Members Motor vehicles sold to certain U S Armed Forces service members and registered in Tennessee are exempt from sales and use

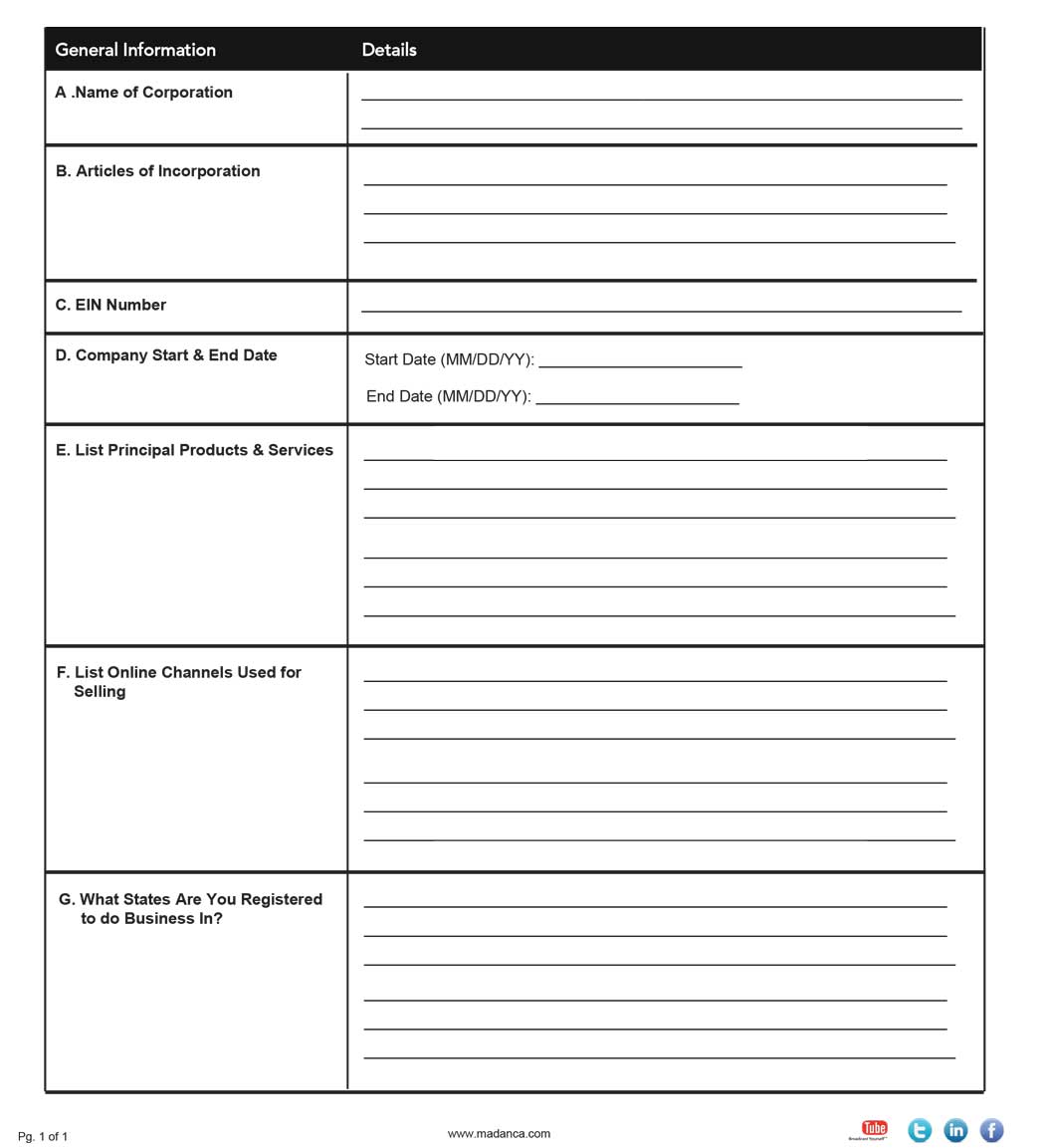

US Sales Tax Checklist Madan CA

Lower Sales Tax On Food Expand Medicaid In Kansas Legislative Session

Sales Tax Vs VAT Explained Yonda Tax

Sales Tax By State Here s How Much You re Really Paying Sales Tax

How To Pay Sales Tax For Online Business The Mumpreneur Show

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

6 3 3 Adjusting The Sales Tax On An Invoice On Vimeo

Pay Scale Military GS Pay Scale 2022 2023

What Is Sales Tax And How Do I Calculate It Sellercloud

Do I Have To Pay Sales Tax On A Car That Was Gifted NJMoneyHelp

Does Military Pay Sales Tax On Cars - Purchase price is an estimate of what you will pay for the vehicle and does not include dealer fees destination charges taxes title registration or optional equipment It also does not include additional savings that are only available