Does Montana Tax Your Social Security Once income exceeds 34 000 85 percent of Social Security benefits will be taxed With these ideas in mind Montana residents may discover that they are paying two different sums of money

Social Security is taxable in Montana but there is a deduction available for taxpayers below a certain income level For single filers with an adjusted gross income AGI of less than 25 000 and joint filers with an AGI of less 32 000 all Social Security retirement income is deductible Income Tax on Taxable Income Low of 2 on up to 500 for single filers and 1 000 for joint filers and a high of 5 on more than 3 000 for single filers and 6 000 for joint filers Social

Does Montana Tax Your Social Security

Does Montana Tax Your Social Security

https://img-aws.ehowcdn.com/600x600p/s3-us-west-1.amazonaws.com/contentlab.studiod/getty/01509d6dd3154d6d8b4d438906adabeb.jpg

Montana Lawmakers Revisit Tax Exemption For Social Security Income

https://npr.brightspotcdn.com/dims4/default/bb9d046/2147483647/strip/true/crop/400x400+0+0/resize/880x880!/quality/90/?url=http:%2F%2Fnpr-brightspot.s3.amazonaws.com%2Flegacy%2Fsites%2Fkufm%2Ffiles%2F202101%2Fpaul-fielder.jpg

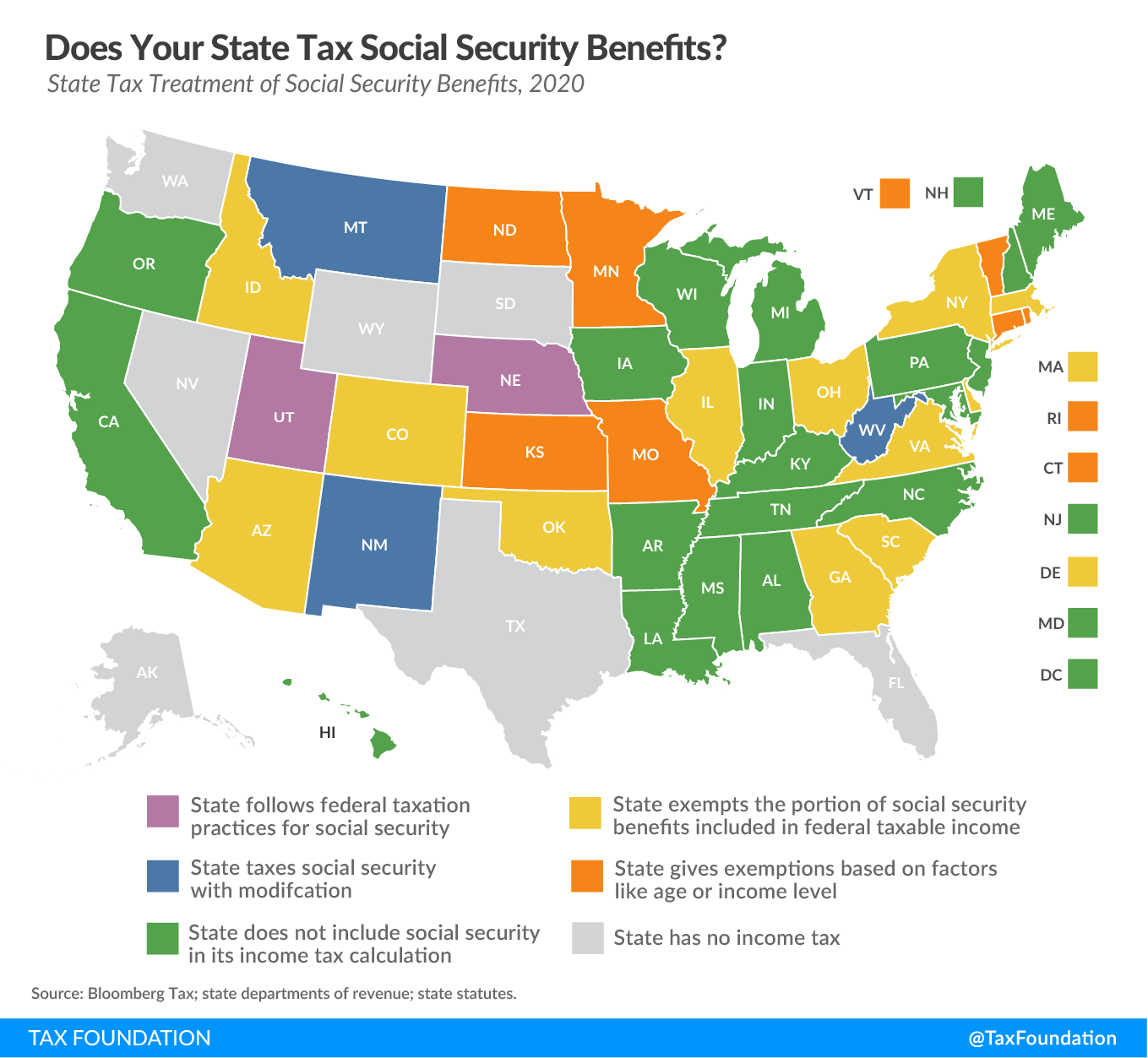

Find Out Which States May Tax Your Social Security Benefits

https://rssa.com/wp-content/uploads/2020/09/john-mark-smith-gtCWBwbZNpM-unsplash-scaled-e1600874124526.jpg

They are Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah Vermont and West Virginia As of 2023 Colorado taxes Social Security benefits but makes Which States Tax Social Security Benefits Here s what you need to know if you live in one of the nine states tax Social Security income in 2024 By Cheryl Lock Updated Mar 4 2024

Not all retirees who live in states that tax Social Security benefits have to pay state income taxes Will your benefits be taxed Like the federal government Montana does not tax Social Security for people with overall incomes of less than 25 000 for a single filer and 32 000 for a couple filing jointly Residents who make more are liable for tax on their benefits but the state uses a different method than the feds to determine the taxable amount

Download Does Montana Tax Your Social Security

More picture related to Does Montana Tax Your Social Security

13 States That Tax Social Security Benefits Tax Foundation

https://files.taxfoundation.org/20210526131259/How-Does-Your-State-Treat-Social-Security-Income-Does-Your-State-Tax-Social-Security-Benefits-Compare-States-that-tax-Social-Security-benefits1.png

States That Tax Social Security Benefits Tax Foundation

https://files.taxfoundation.org/20210205100507/States-that-tax-social-security-benefits.-does-my-state-tax-social-security-benefits-01-01.png

States That Tax Social Security Benefits Tax Foundation

https://files.taxfoundation.org/20200408100401/Social-Security-Benefits-FV-011.png

For the 2023 tax year 11 states tax Social Security benefits Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah and Vermont All other Montana tax on retirement benefits Montana does tax Social Security retirement benefits but the amount taxed may differ from the federal taxable amount Railroad Retirement

Published January 28 2021 at 5 23 PM MST Listen 2 05 Montana Legislature Montana lawmakers will take another crack at changing how the state collects taxes on Social Security income A similar proposal was vetoed by Democratic Gov Steve Bullock If an individual Montana senior makes between 25 000 and 34 000 in Social Security income half of that income may be taxable under Montana law If a senior makes over 34 000 85 of that Social Security income may be taxable

13 U S States That Tax Your Social Security Benefits Here s How

https://cdn.legalguidancenow.com/wp-content/uploads/2020/02/5-states.jpg

.jpg)

Don t Want To Pay Taxes On Your Social Security Benetfit Here s Where

https://www.compareremit.com/ckfinder34/userfiles/images/Blog images/blogs/21-CR-Infographics-Does-Your-State-Tax-Social-Security (1).jpg

https://finance.zacks.com/montana-residents-pay...

Once income exceeds 34 000 85 percent of Social Security benefits will be taxed With these ideas in mind Montana residents may discover that they are paying two different sums of money

https://smartasset.com/retirement/montana-retirement-taxes

Social Security is taxable in Montana but there is a deduction available for taxpayers below a certain income level For single filers with an adjusted gross income AGI of less than 25 000 and joint filers with an AGI of less 32 000 all Social Security retirement income is deductible

13 U S States That Tax Your Social Security Benefits Here s How

13 U S States That Tax Your Social Security Benefits Here s How

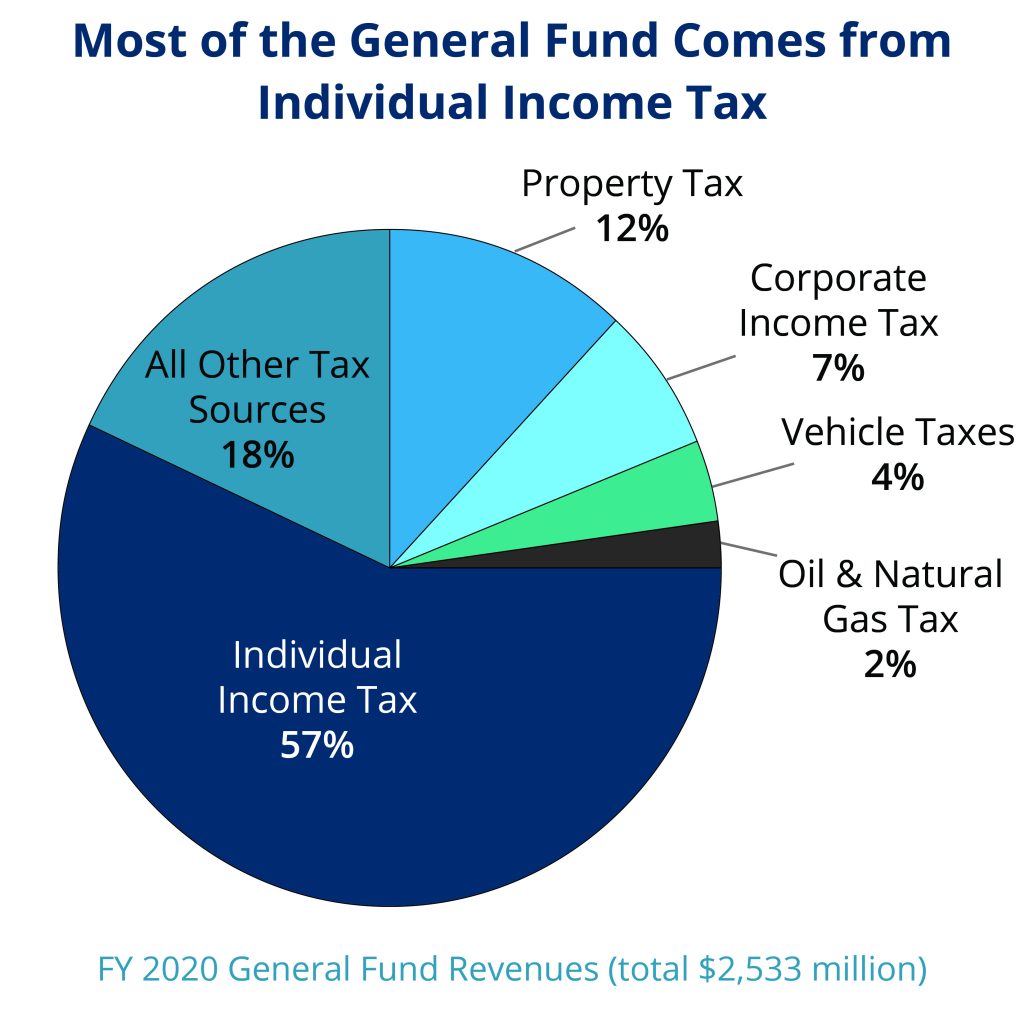

Policy Basics Individual Income Taxes In Montana Montana Budget

Montana Income Tax Information What You Need To Know On MT Taxes

These 13 States Tax Your Social Security Benefits Page 6 Of 13

Montana Income Tax Information What You Need To Know On MT Taxes

Montana Income Tax Information What You Need To Know On MT Taxes

10 U S States That Tax Your Social Security Benefits and How Legal

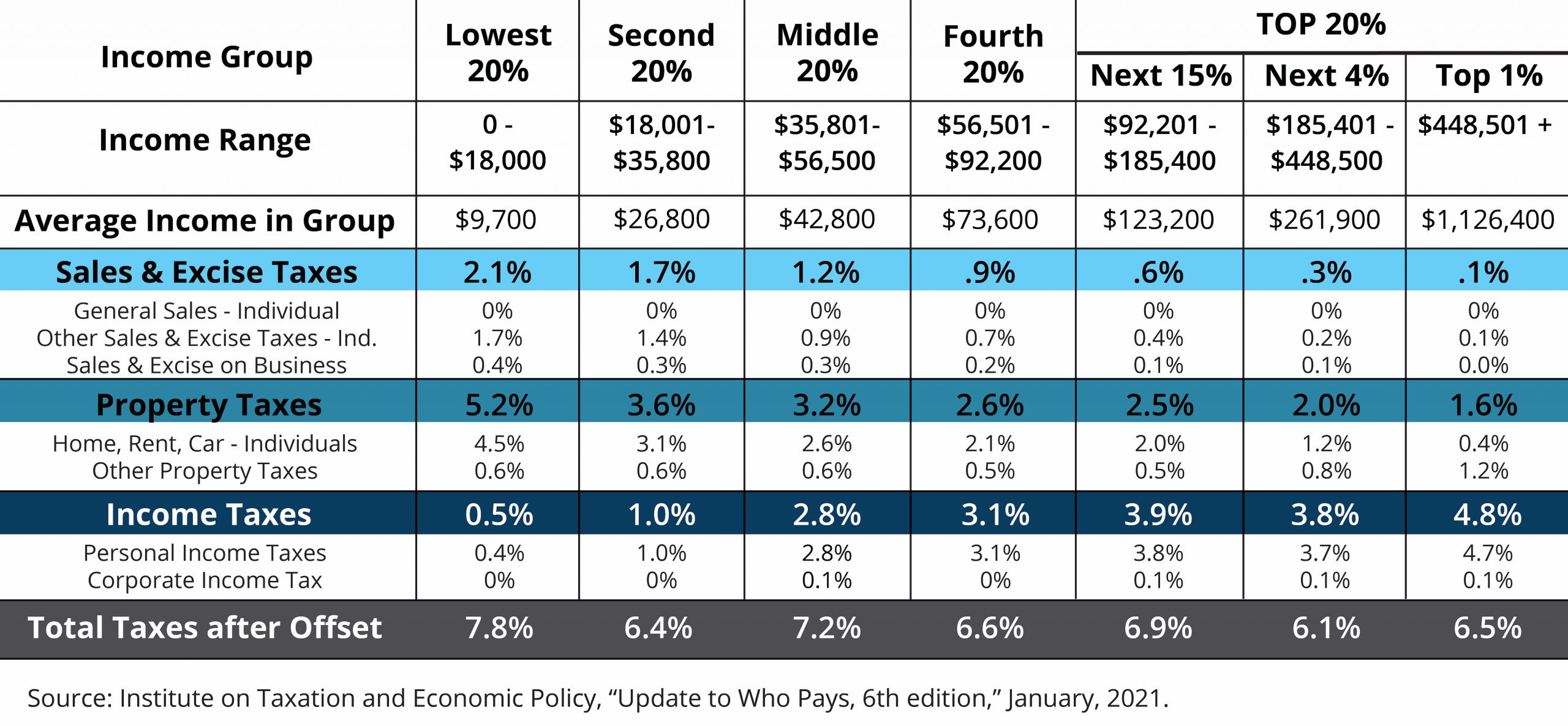

Policy Basics Who Pays Taxes In Montana Montana Budget Policy Center

What Is The Taxable Amount On Your Social Security Benefits

Does Montana Tax Your Social Security - Which States Tax Social Security Benefits Here s what you need to know if you live in one of the nine states tax Social Security income in 2024 By Cheryl Lock Updated Mar 4 2024