Does My Carrier Air Conditioner Qualify For Tax Credit Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and Rebates and tax credits for eligible equipment purchases are both great ways to reduce the overall expense of installing an HVAC system in your home Learn about heat pump rebates and more

Does My Carrier Air Conditioner Qualify For Tax Credit

Does My Carrier Air Conditioner Qualify For Tax Credit

https://hvacseer.com/wp-content/uploads/2022/03/Air-ConditioningCARRIER.Air-conditioning-outside-the-building..jpg

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://i0.wp.com/hvacseer.com/wp-content/uploads/2022/04/Interior-wall-thermal-insulating.jpg

Does My Carrier Air Conditioner Qualify For Tax Credit HVACseer

https://hvacseer.com/wp-content/uploads/2022/04/Does-My-Carrier-Air-Conditioner-Qualify-For-Tax-Credit.png

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 How To Qualify For and Claim HVAC Tax Rebates You can claim your residential energy tax incentive when you file your federal income taxes For federal tax returns filed between 2023 and 2032 you are eligible to claim a credit equal to 30 of the cost of your installation

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and provides examples of how the credit limitations work Reduction Act of 2022 many of our products qualify for 25C tax credits making it more affordable for homeowners to get into a higher efficiency system Let s take a look at the 25C tax credits and current Carrier systems that qualify

Download Does My Carrier Air Conditioner Qualify For Tax Credit

More picture related to Does My Carrier Air Conditioner Qualify For Tax Credit

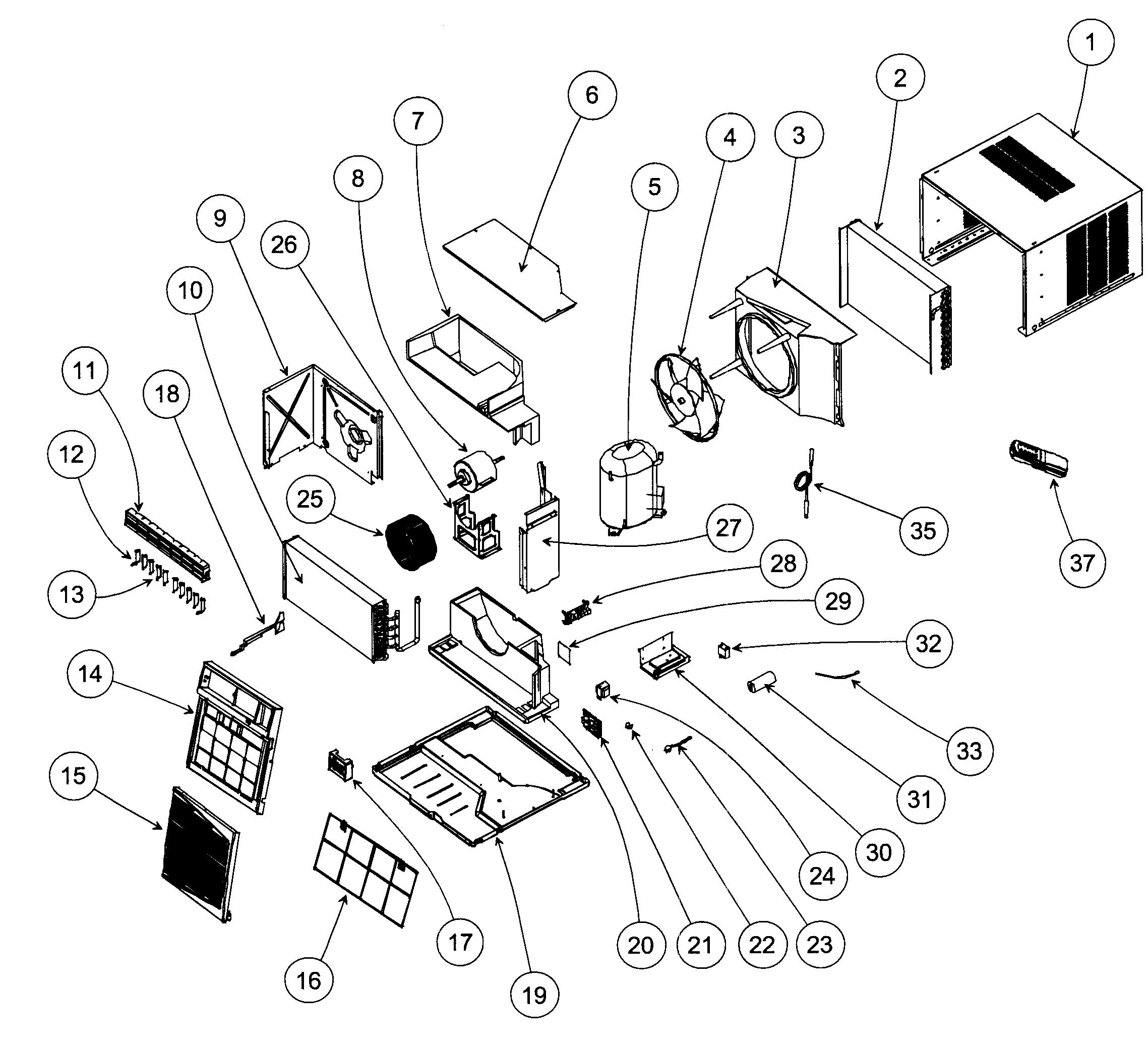

Carrier Air Conditioner 38AE012 User Guide ManualsOnline

http://pdfasset.owneriq.net/1/b3/1b3ff4d4-d0c0-4ad8-917e-919692ae5787/1b3ff4d4-d0c0-4ad8-917e-919692ae5787-bg1.png

Carrier 38BRC030 SERIES310 User Manual CONDENSING UNIT Manuals And

https://usermanual.wiki/Carrier/38BRC030SERIES310.2114672901-User-Guide-Page-1.png

Carrier 38TRA018 SERIES300 User Manual CONDENSING UNIT Manuals And

https://usermanual.wiki/Carrier/38TRA018SERIES300.3713973621-User-Guide-Page-1.png

Credits IRA extends and expands existing 25C and 25D tax credits a credit toward reducing taxes owed to homeowners for installing applicable high efficiency HVAC equipment Each credit has specific qualification requirements So any new purchases of Carrier air conditioners no longer qualify for tax credits unless Congress approves the retroactive extension However any Carrier unit bought between January 1 2021 to December 31 2021 is still eligible for a tax credit that can be claimed until April 15 2022

If you make energy improvements to your home tax credits are available for a portion of qualifying expenses The credit amounts and types of qualifying expenses were expanded by the Inflation Reduction Act of 2022 We ll help you compare the credits and decide whether they apply to expenses you ve already paid or will apply to A broad selection of high efficiency heating and cooling equipment is eligible for the tax credits Many of Lennox products ranging from air conditioners and heat pumps to gas furnaces and mini splits qualify for the 25C tax credit

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

https://www.nicksairconditioning.com/wp-content/uploads/2023/01/Adjusting-HVAC-System-Temperature.jpg

Carrier Harmony Split System Air Conditioner Service Manual

https://new2.steprightupmanuals.com/wp-content/uploads/2021/03/Carrier-Air-Conditioner-Service-Manual-15-724x1024.jpg

https://airconditionerlab.com/what-hvac-systems-qualify-for-tax-credit

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits

https://www.energystar.gov/about/federal-tax...

The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and

Carrier Split Air Conditioner Error Codes carrier air conditioner u

Does My New Air Conditioner Qualify For Energy Credit Smart AC Solutions

Carrier Air Conditioner Parts Diagram My Wiring DIagram

Carrier Air Conditioning 21 000 BTU Inverter 42TVAA024 Pipe

Do Air Conditioners Qualify For Residential Energy Credit

Wiring Diagram Carrier Air Conditioner Wiring Draw And Schematic

Wiring Diagram Carrier Air Conditioner Wiring Draw And Schematic

Carrier Air Conditioner Prices Cost By Model REthority

Carrier Air Conditioner Parts Parts Town

Carrier Bus Air Conditioner Service Manual For Model EM 1

Does My Carrier Air Conditioner Qualify For Tax Credit - If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022