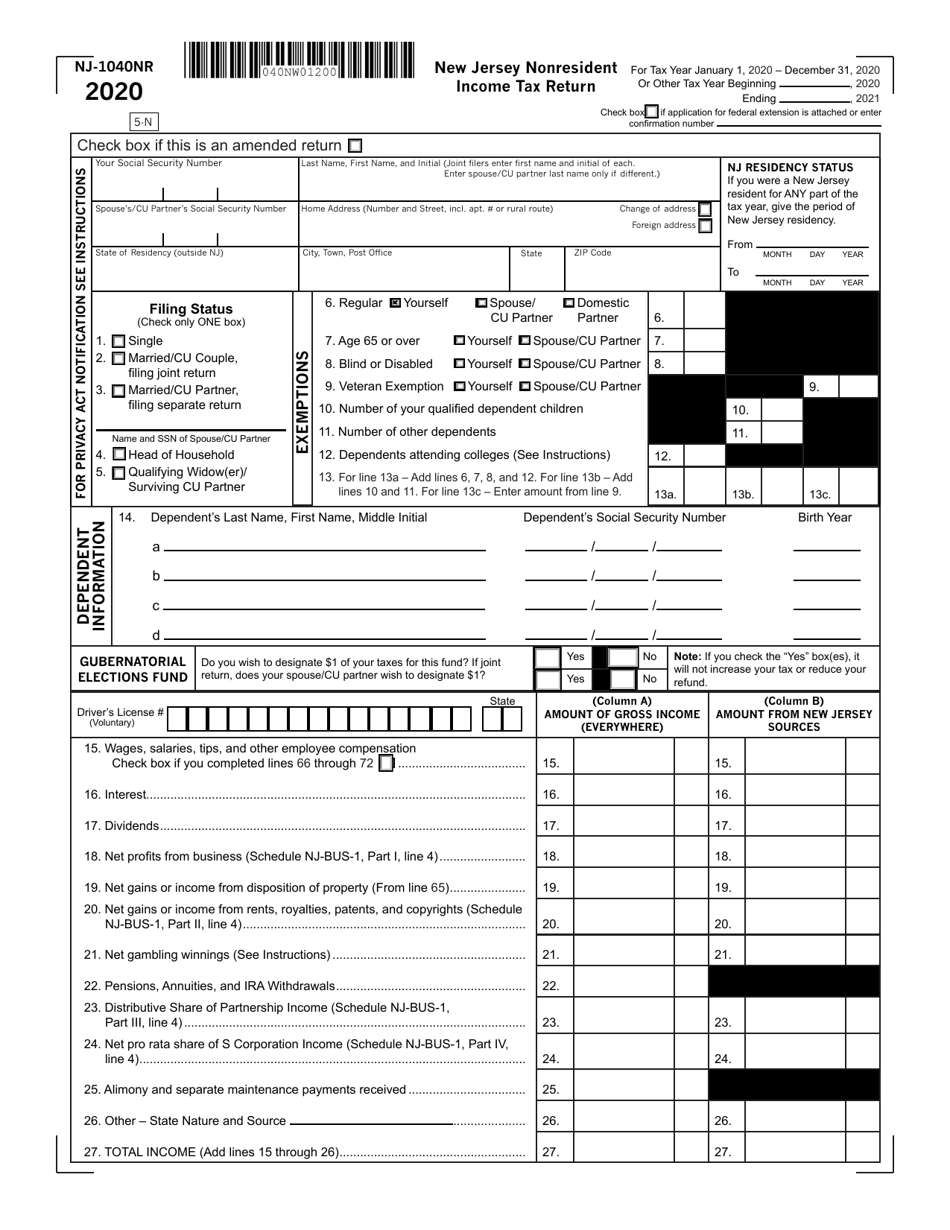

Does Nj Tax Out Of State Pensions The law says No State may impose an income tax on any retirement income of an individual who is not a resident or domiciliary of such State In short Wolfe said this law prohibits any state from taxing non

Social Security is not taxed at the state level in New Jersey State income taxes will also be low for any retirees with income from retirement accounts and pensions below 75 000 for single filers or 100 000 for joint filers Taxation of Retirement Benefits This fact sheet contains general information about federal and New Jersey State income taxes and your retirement benefits from the New Jersey Divi sion of

Does Nj Tax Out Of State Pensions

Does Nj Tax Out Of State Pensions

https://njmoneyhelp.com/wp-content/uploads/2018/05/tax-morguefile.jpg

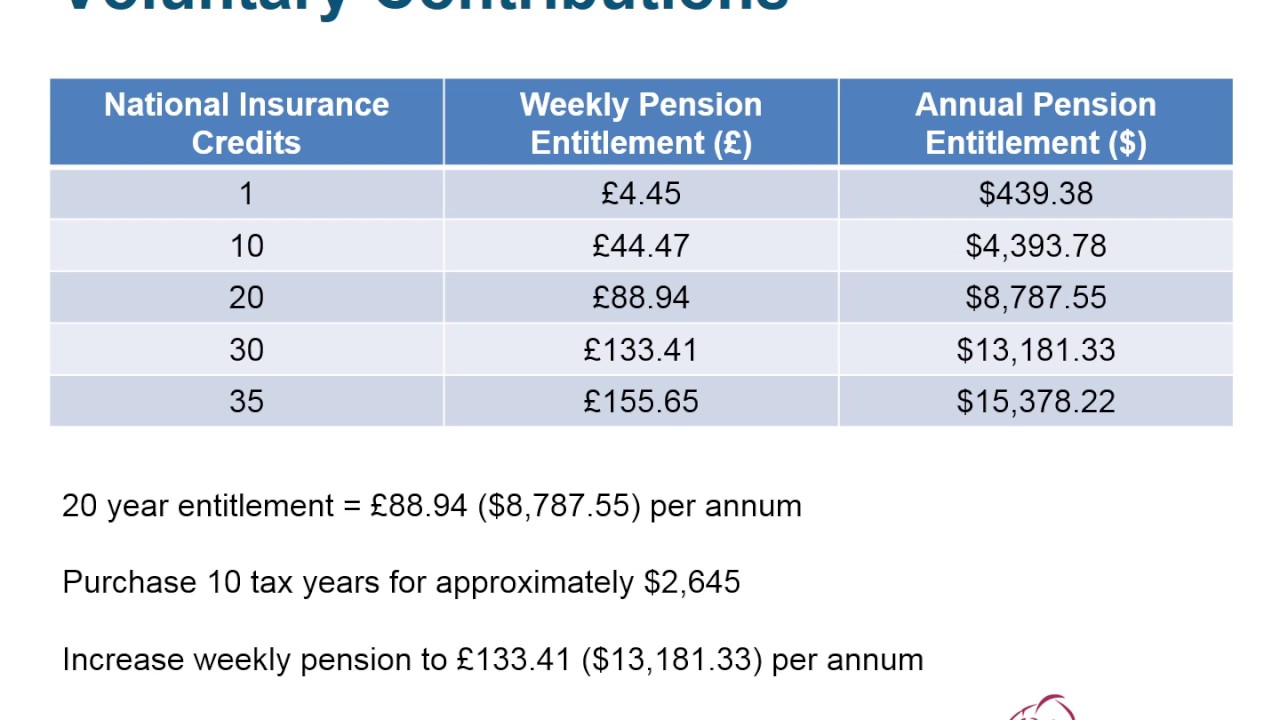

How Much State Pension Will I Be Entitled To

http://d2f0ora2gkri0g.cloudfront.net/a7/13/a7133d52-83fc-4ab2-a22d-363bf2e13603.jpg

Britain Ranks Bottom On State Pensions Among Advanced Nations

https://d.ibtimes.co.uk/en/full/1564292/pension.jpg?w=736

Under federal law pensions regardless of the source are only taxable to the state in which you live said Michael Karu a certified public accountant with Levine Jacobs Co in If you are a New Jersey resident your pensions annuities and certain IRA withdrawals are taxable and must be reported on your New Jersey tax return However the

New Jersey provides several avenues for retirees to potentially exclude a portion of their pension income from taxation Individuals aged 62 or older may qualify for New Jersey s pension exclusion if their New Jersey gross Is my retirement income taxable to New Jersey New Jersey allows you to exclude some or all of your retirement income In order to exclude all or part of the retirement income on your New

Download Does Nj Tax Out Of State Pensions

More picture related to Does Nj Tax Out Of State Pensions

State Pension MbarakDaeney

https://files.taxfoundation.org/20210602144601/2021-State-Pension-Funding-Gap-and-State-Pension-Plan-State-Public-Pension-Funding-Finances.png

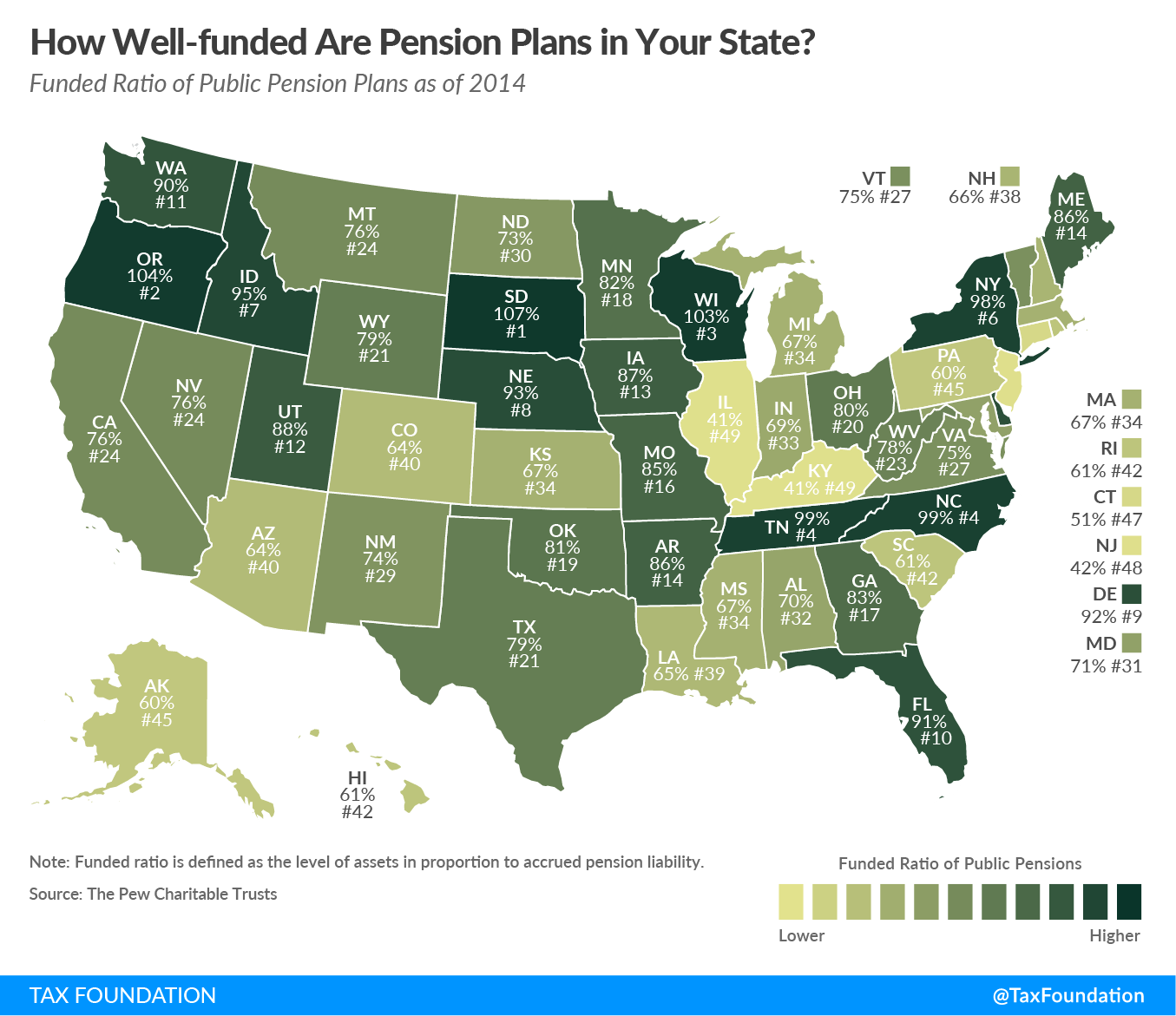

How Well Funded Are Pension Plans In Your State Tax Foundation

https://i.pinimg.com/originals/43/a7/4c/43a74c3df6cb5861991706c64d0acfb2.png

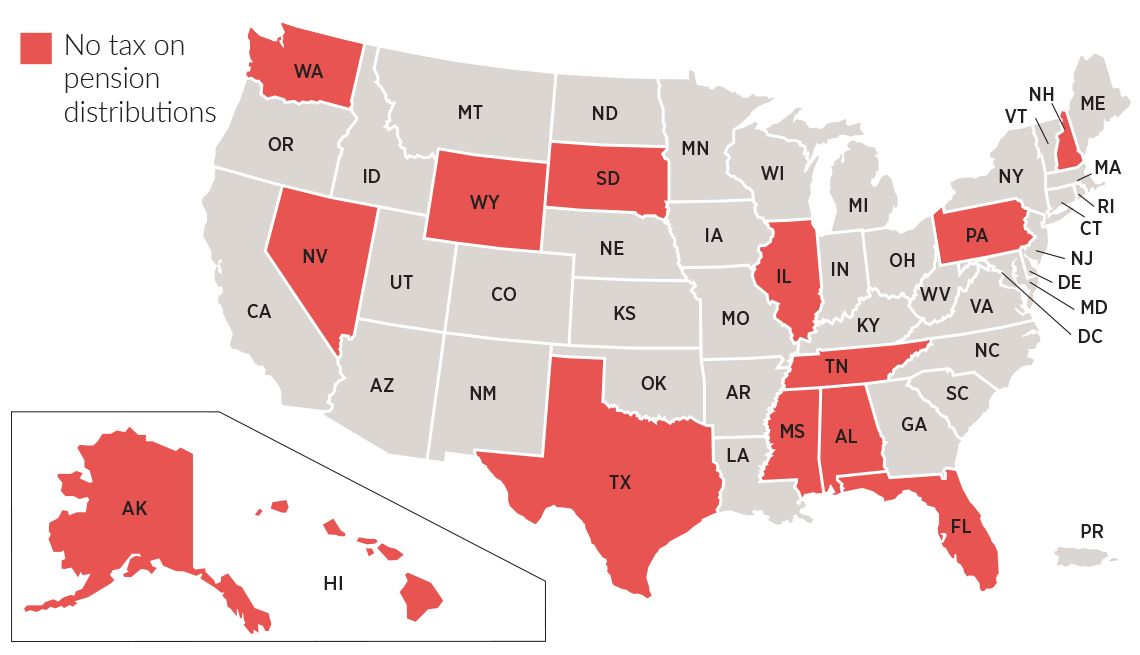

States That Don t Tax Pensions 2023 Wisevoter

https://wisevoter.com/wp-content/uploads/2023/03/States-That-Dont-Tax-Pensions.png

In New Jersey an employee s pension contribution to the state plan is tax deferred for federal purposes said Steven Gallo a certified public accountant and personal New Jersey still has the pension exclusion It allows single filers to exclude all or part of retirement income if they re age 62 or are disabled on the last day of the year as long

A It depends First the New Jersey pension tax exclusion allows qualified New Jersey taxpayers to exclude all or part of the income received during the year from taxable Pensions Nevada won t tax your pension income because it doesn t have an income tax 401 k s and IRAs With no income tax there s also no tax on 401 k or IRA

Key Changes Affecting Five Types Of State Pension In

https://images.inkl.com/s3/article/lead_image/17935698/1_JAJ_TEM_210223Trending_004JPG.jpg

Pension Re enrolment Is Here EPayMe

https://www.epayme.co.uk/wp-content/uploads/2016/10/Pensions.jpg

https://njmoneyhelp.com/2019/09/how-d…

The law says No State may impose an income tax on any retirement income of an individual who is not a resident or domiciliary of such State In short Wolfe said this law prohibits any state from taxing non

https://smartasset.com/.../new-jersey-re…

Social Security is not taxed at the state level in New Jersey State income taxes will also be low for any retirees with income from retirement accounts and pensions below 75 000 for single filers or 100 000 for joint filers

Nj Tax Abatement Letter Onvacationswall

Key Changes Affecting Five Types Of State Pension In

14 States Don t Tax Retirement Pension Payouts

As Pension Debt Crests 1 5 Trillion States Are Headed Toward Crisis

Local Government Pensions The 95k Cap On Exit Payments

How Did The State Pension Change In 2015 Saga

How Did The State Pension Change In 2015 Saga

UK State Pension YouTube

Nj Tax Refund Status Skylasem

7 States That Do Not Tax Retirement Income

Does Nj Tax Out Of State Pensions - Under federal law pensions regardless of the source are only taxable to the state in which you live said Michael Karu a certified public accountant with Levine Jacobs Co in