Does Sale Consideration Include Gst The sale is therefore neither GST inclusive nor exclusive The criteria to be met for the going concern exemption to apply includes that the purchaser is registered for GST that the parties agree in writing that the sale is of a going

No adjustment on account of sale return or discount or indirect taxes including GST is required to be made for collection of tax under section 206C 1H of the Act since the No adjustment on account of sale return or discount or indirect taxes including GST is required to be made for collection of tax under section 206C 1H of the Act since the collection is made with reference to receipt of

Does Sale Consideration Include Gst

Does Sale Consideration Include Gst

https://cajiteshtelisara.com/blog/wp-content/uploads/2021/06/sale-of-property-at-lower-than-stamp-duty-value-770x367.jpg

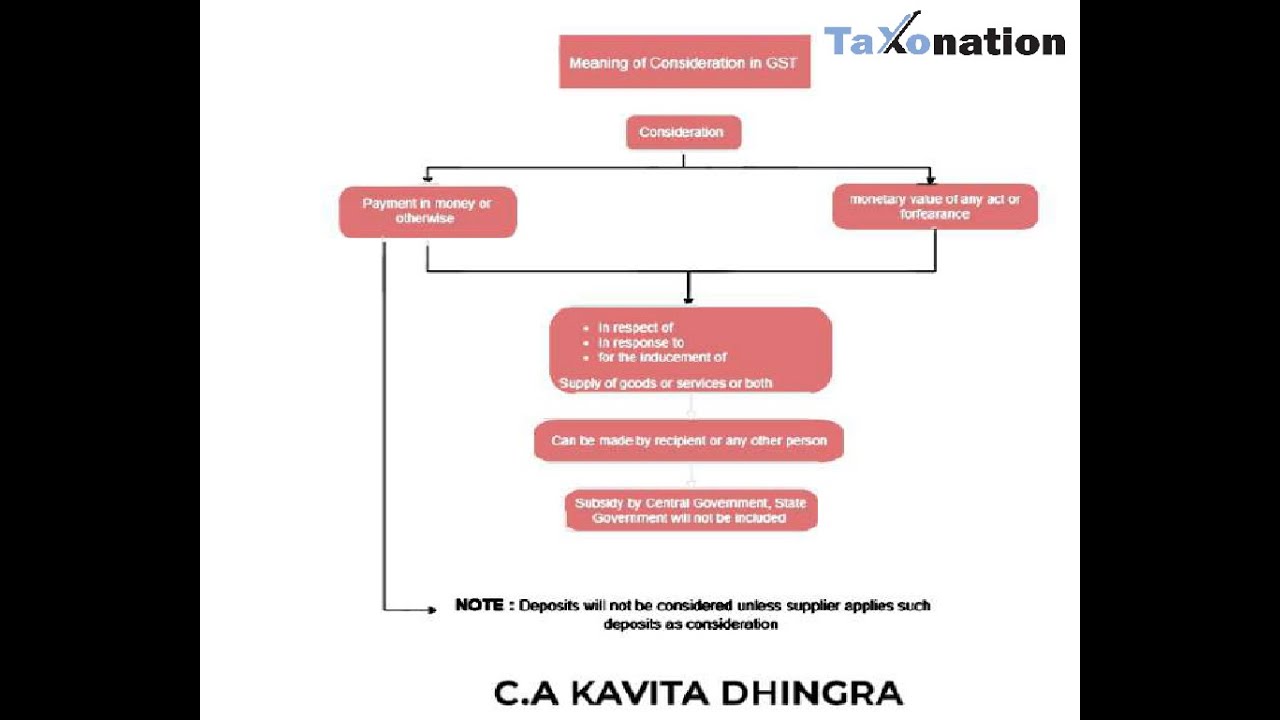

Meaning Of Consideration In GST I Can 3rd Party Pay Consideration In

https://i.ytimg.com/vi/dATeKq4VUvA/maxresdefault.jpg

GST Schedule I No Consideration But Supply Employment Service

https://i.ytimg.com/vi/TRYFI-ZogTY/maxresdefault.jpg

2 Interplaybetween the GST and the Sale of Goods Act 1930 SG Act 2 1 GST is a comprehensive multi stage destination based tax which is levied on the supply of goods Whether TCS is to be collected on the total invoice value including the GST Section 206C 1H provides that TCS shall be collected on the consideration for sale of any goods

Receipt of Consideration from buyer including or excluding GST The receipt of sale consideration from a buyer towards sale of goods shall include the GST amount also This has been clarified by the CBDT in the guidelines Therefore TCS that is collected on the sale consideration must include GST In the withholding tax group you can include the GST tax component and charges in the base amount for TCS calculation PAN based

Download Does Sale Consideration Include Gst

More picture related to Does Sale Consideration Include Gst

Sale Deed Not Void For Non Payment Of Part Of Sale Consideration

https://legalserviceindia.com/legal/uploads/saledeednotvoidfornonpaymentofpartofsaleconsideration_4890344739.jpg

Section 2 31 CGST Act What Is CONSIDERATION Under GST

https://i.ytimg.com/vi/vIvL3I8Q6wM/maxresdefault.jpg

Contract Law 4 Of 10 Consideration Capacity ICLR YouTube

https://i.ytimg.com/vi/MPsdiqqp7bw/maxresdefault.jpg

The Central Board of Direct Taxes CBDT has clarified that 0 1 per cent Tax Collected at Source TCS on sale of goods and services worth more than Rs 50 lakh a year As per Circular No 17 of 2020 issued by CBDT no GST adjustments should be made for calculating TCS due to indirect taxes or discounts as tax is deducted on receipt of

However in respect of Section 206C 1H the CBDT vide Circular No 17 dated 29 09 2020 has clarified that since the collection is made with reference to receipt of the Permanent transfer or sale of business assets on which input tax credit has been availed will also be treated as supply even if there is no consideration received GST is

Does The Consideration Amount Stated In The Contract Include Any Amount

https://hfs.sro.vic.gov.au/sites/default/files/GST-02.png

Agreement Vs Stamp Duty Value ITAT Discusses Scope Of Exception To

https://taxguru.in/wp-content/uploads/2021/09/Agreement-Vs-Stamp-Duty-Value.jpg

https://thesmallbusinesslawyer.com.au › …

The sale is therefore neither GST inclusive nor exclusive The criteria to be met for the going concern exemption to apply includes that the purchaser is registered for GST that the parties agree in writing that the sale is of a going

https://taxguru.in › goods-and-service-tax › tcs-gst-vis-vis.html

No adjustment on account of sale return or discount or indirect taxes including GST is required to be made for collection of tax under section 206C 1H of the Act since the

Difference B w Sale Consideration And Stamp Duty Valuation Is Less Than

Does The Consideration Amount Stated In The Contract Include Any Amount

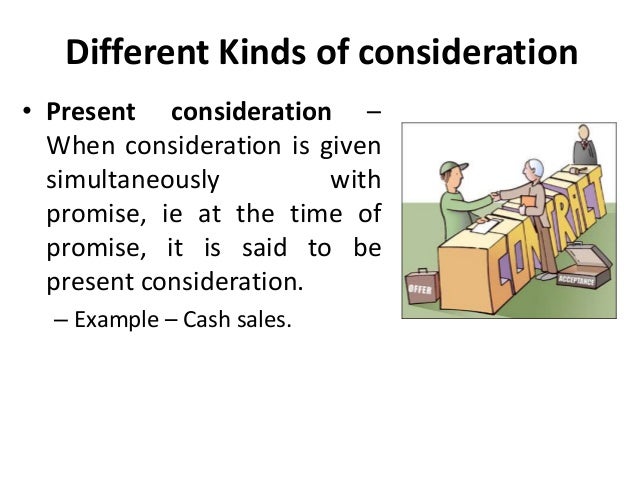

Kinds Of Consideration What Does Consideration Mean Definition

What Is Consideration In GST

What does GST include 1 Certicom

GST Supply Without Consideration CMA CA Inter YouTube

GST Supply Without Consideration CMA CA Inter YouTube

Will GST Be Applicable If Consideration Passed On By Society Member To

Taxability Where Stamp Duty Value Higher Than Sale Consideration

Does GST Apply To Me

Does Sale Consideration Include Gst - Receipt of Consideration from buyer including or excluding GST The receipt of sale consideration from a buyer towards sale of goods shall include the GST amount also This has been clarified by the CBDT in the guidelines