Does Wisconsin Have A Solar Tax Credit Does Wisconsin have a tax credit for solar Wisconsin itself does not offer a tax credit for homeowners but they can take advantage of the 30 federal solar tax credit when making the

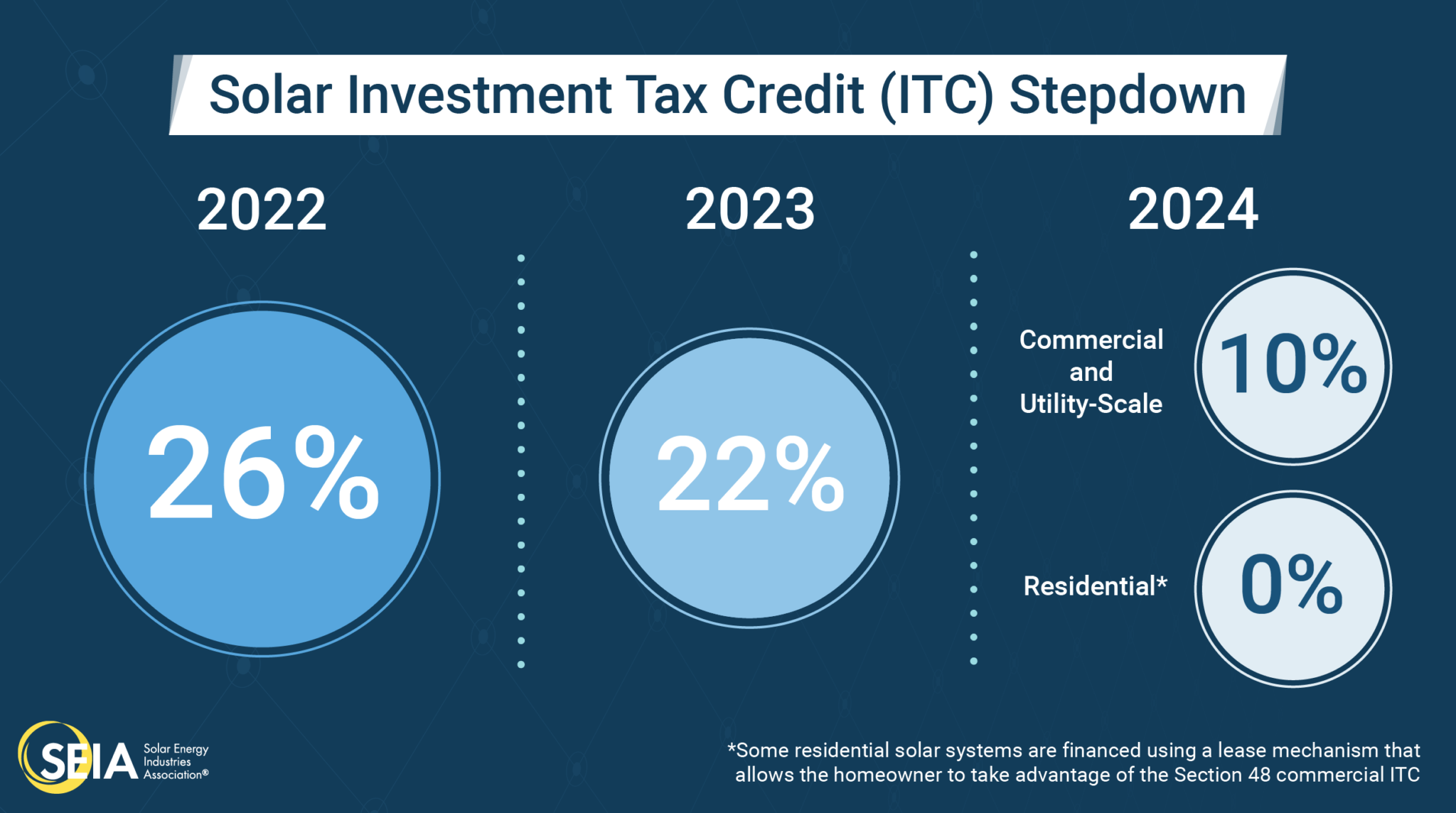

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Wisconsin If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system This is 30 off the entire cost of the system including equipment labor and permitting Wisconsin has many federal state and local financial incentives for purchasers of solar energy systems These include the Federal Solar Investment Tax Credit ITC the Wisconsin Sales Tax Exemption the Wisconsin Property Tax Exemption and many private or non government incentive programs

Does Wisconsin Have A Solar Tax Credit

Does Wisconsin Have A Solar Tax Credit

https://www.solardailydigest.com/wp-content/uploads/2022-federal-solar-tax-credit-solarproguide-com.png

Solar Tax Credit What You Need To Know NRG Clean Power

https://nrgcleanpower.com/wp-content/uploads/2022/05/ITC-Step-Down-2022-01.png

Does Wisconsin Have Any Chance Against Ohio State YouTube

https://i.ytimg.com/vi/gpWDQnMXoVY/maxresdefault.jpg

Learn how to save thousands on solar panels in Wisconsin with the federal tax credit Focus on Energy rebate and other state specific incentives Find out how to claim the ITC get a rebate and benefit from net metering with different utilities Does Wisconsin have a solar tax credit Wisconsin residents who purchase solar with cash or finance can take advantage of the 30 federal tax credit called the Residential Clean Energy Credit This tax credit is available nationwide

Does Wisconsin offer a solar tax credit Wisconsin doesn t offer a state specific solar tax credit However Wisconsin homeowners can qualify for the federal solar tax credit which allows you to claim 30 of your system cost on your federal income taxes After the full federal solar investment tax credit the average cost to install a solar power system is 10 850 to 21 700 in Wisconsin You might also be eligible for additional tax

Download Does Wisconsin Have A Solar Tax Credit

More picture related to Does Wisconsin Have A Solar Tax Credit

Does Wisconsin Have Dram Shop Or Social Host Liability Laws Legal Reader

https://www.legalreader.com/wp-content/uploads/2022/05/Man-holding-bottle-of-alcohol-image-by-Paul-Einerhand-via-Unsplash.com_..jpg

A Short Guide To Federal Solar Tax Credits Eighty MPH Mom Lifestyle

https://eightymphmom.com/wp-content/uploads/2022/06/Screen-Shot-2022-06-25-at-9.26.29-PM-900x600.png

New Bill That Increases Tax Credit For Solar Roofing

https://mydividedsky.com/wp-content/uploads/2022/10/solar-sunset.jpg

The Solar Federal Investment Tax Credit ITC also known as the Green Energy Tax Credit is a program in Wisconsin that provides financial benefits to individuals and businesses installing solar energy systems Through the ITC you can claim a tax credit equal to 30 of the total cost of your solar system Declining costs coupled with federal tax credits and state incentives have enabled solar energy to become affordable and cost effective all across Wisconsin TODAY S SOLAR ECONOMICS Installed cost of an average size 5 kW residential solar electric system before incentives and tax credits Focus on Energy incentive

The Federal Tax Credit The Federal ITC Investment Tax Credit is available to all homeowners with a federal tax liability who install a solar system provided they are not leasing the system The tax credit is for 30 off the total cost of your solar system sources Energy gov and the Wisconsin State Legislature Stat 236 292 Federal solar energy tax credit ITC The federal solar tax credit also known as the investment tax credit ITC allows you to deduct 30 of the cost of installing a solar energy system from your federal taxes

Homeowner s Guide To The Federal Tax Credit For Solar Photovoltaics

https://moneyofficials.com/wp-content/uploads/2023/05/install-solar-750x350.jpg

Everyone Should Pay A Solar Tax Solar Go Green Tax

https://i.pinimg.com/originals/7d/85/81/7d8581e38c5fc4ac0f6f129cc4a953a8.png

https://www.forbes.com/.../wisconsin-solar-incentives

Does Wisconsin have a tax credit for solar Wisconsin itself does not offer a tax credit for homeowners but they can take advantage of the 30 federal solar tax credit when making the

https://www.solarreviews.com/solar-incentives/wisconsin

The federal solar investment tax credit will have the biggest impact on the cost you will face to go solar in Wisconsin If you install your photovoltaic system before the end of 2032 the federal tax credit is 30 of the cost of your solar panel system This is 30 off the entire cost of the system including equipment labor and permitting

Solar Tax Credit Information Solar Wholesale Denver

Homeowner s Guide To The Federal Tax Credit For Solar Photovoltaics

Federal Solar Tax Credit What It Is How To Claim It For 2023

How Does The Solar Tax Credit Work SolarPower Guide Article

Orange County Solar Tax Credit Federal Solar Panel Tax Credit

Understanding Solar Tax Credits For Homes Businesses

Understanding Solar Tax Credits For Homes Businesses

Does Wisconsin Have A Strong Agricultural Economy Updated 2022

Does New Mexico Have A Solar Tax Credit Go Right Diary Photogallery

Solar Tax Credits By State SolarDailyDigest

Does Wisconsin Have A Solar Tax Credit - Does Wisconsin have a solar tax credit Wisconsin residents who purchase solar with cash or finance can take advantage of the 30 federal tax credit called the Residential Clean Energy Credit This tax credit is available nationwide