Donation Tax Deduction Limit Key Takeaways The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Internal Revenue Service

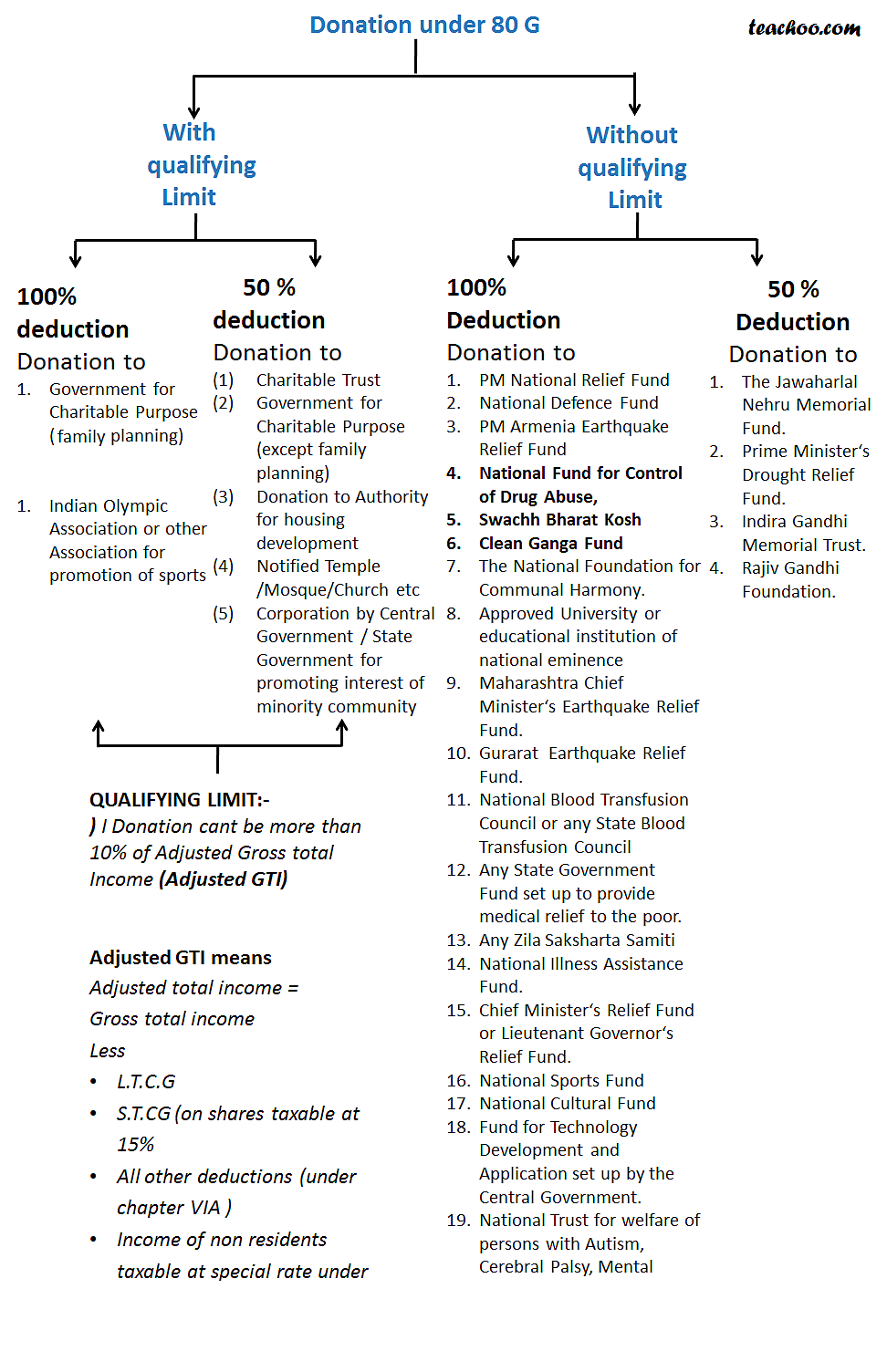

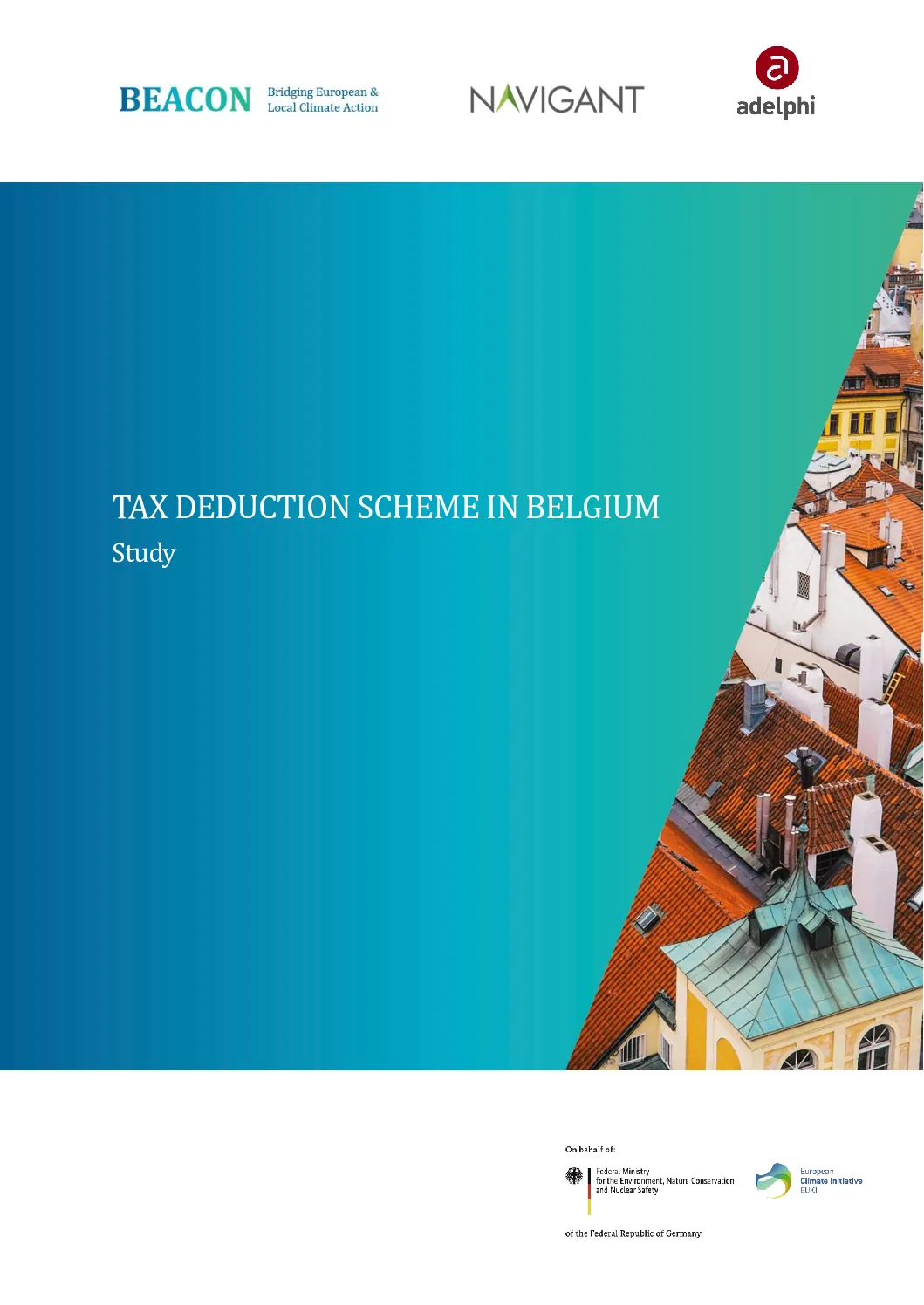

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section 80G apart from Section 80C and save maximum taxes A corporation may deduct qualified contributions of up to 25 percent of its taxable income Contributions that exceed that amount can carry over to the next tax year To qualify the contribution must be a cash contribution made to a qualifying organization made during the calendar year 2020

Donation Tax Deduction Limit

Donation Tax Deduction Limit

https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/75f8ccf9-5626-4c24-bf62-37a2b4aa9032/80g-new.png

Tax deduction checklist Etsy

https://i.etsystatic.com/37903484/r/il/61e14b/5462529921/il_1080xN.5462529921_cvyy.jpg

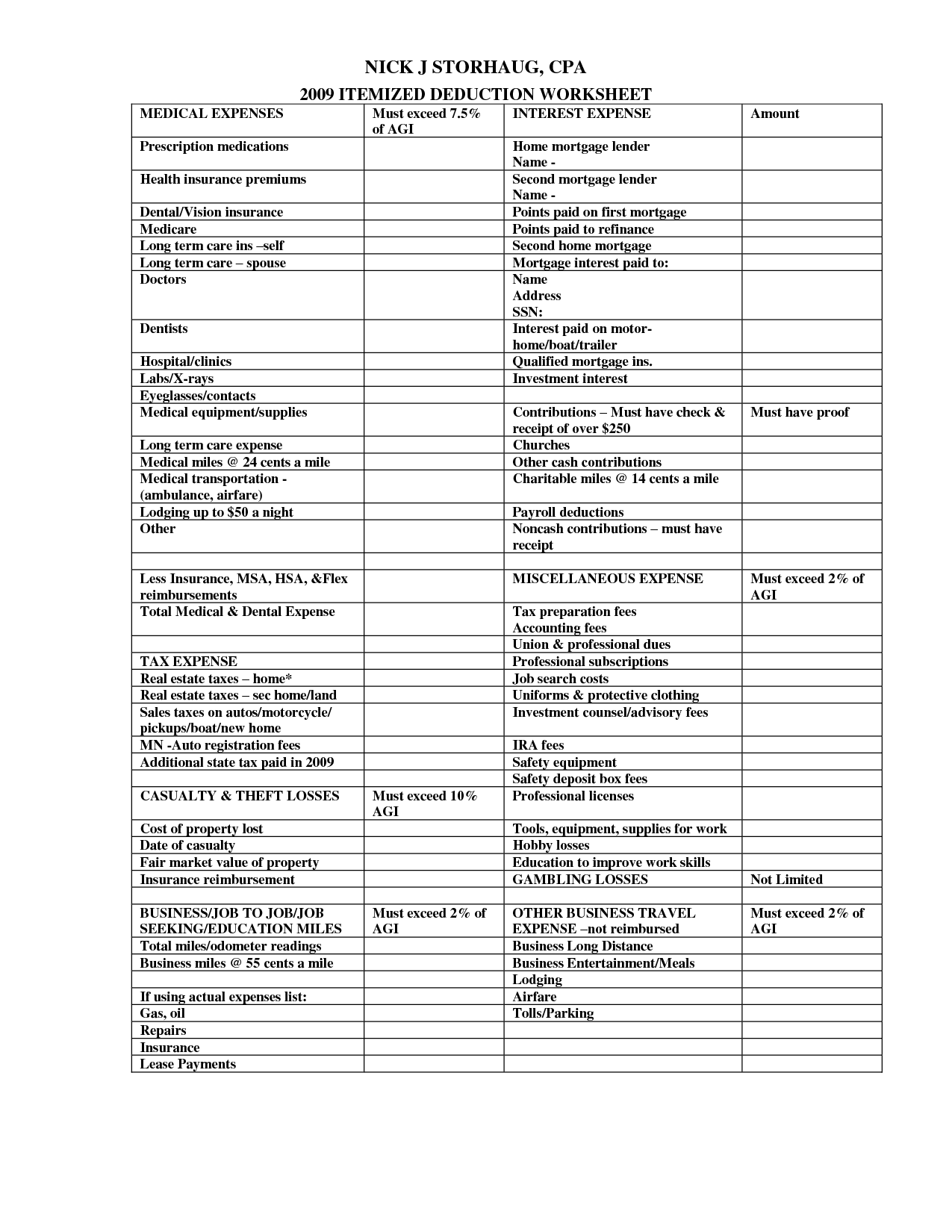

Tax Deduction Template

https://i.pinimg.com/736x/38/95/23/3895234c11f69e3c00ad9daf603064c2.jpg

There are maximum IRS charitable donation amounts but they are a percentage and not a defined dollar amount The percentages are based off what you donate and who you donate it to with a maximum qualified charitable contribution of 60 of your adjusted gross income The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of contribution and the type of charity The law now allows taxpayers to apply up to 100 of their AGI for

The law now permits C corporations to apply an increased limit Increased Corporate Limit of 25 of taxable income for charitable contributions of cash they make to eligible charities during calendar year 2021 What Is the Charitable Donations Deduction Limit For taxpayers who itemize their deductions the limit for cash donations is 60 of adjusted gross income AGI

Download Donation Tax Deduction Limit

More picture related to Donation Tax Deduction Limit

What Will My Tax Deduction Savings Look Like The Motley Fool

https://g.foolcdn.com/editorial/images/436120/tax-deduction_gettyimages-515708887.jpg

10 Business Tax Deductions Worksheet Worksheeto

https://www.worksheeto.com/postpic/2011/08/tax-itemized-deduction-worksheet_472223.png

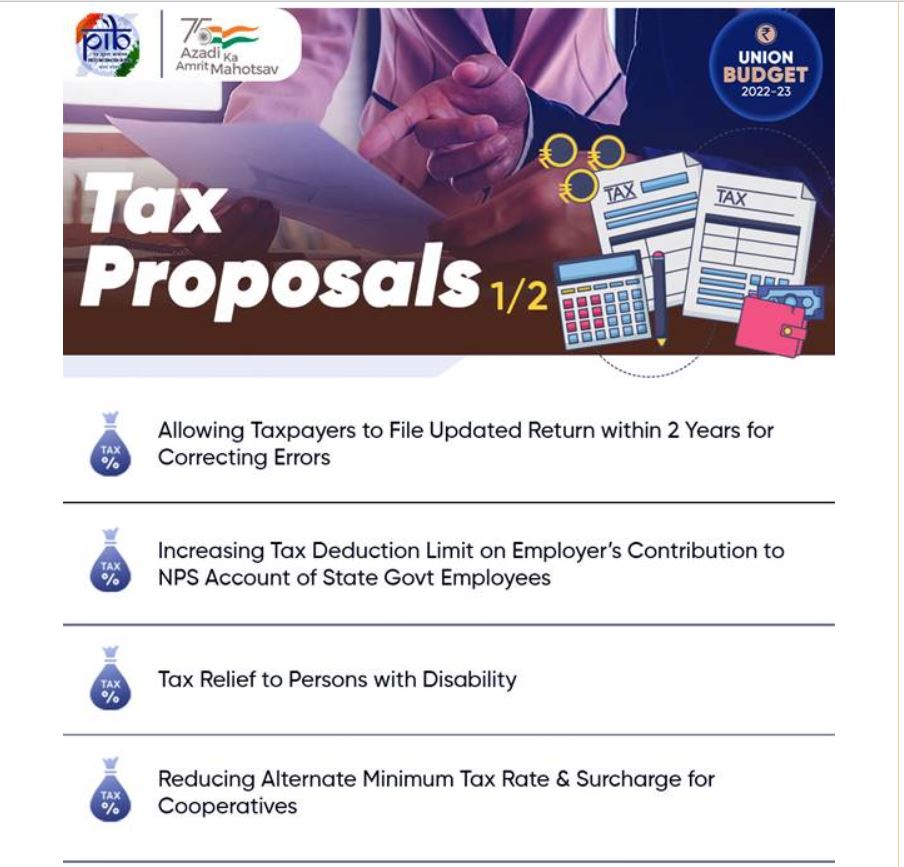

Income Tax Return Deduction Limit In Budget 2022 23

https://gservants.com/wp-content/uploads/2022/02/1.jpg

To claim a tax deductible donation you must itemize on your taxes The amount of charitable donations you can deduct may range from 20 to 60 of your AGI You generally must itemize your deductions to claim charitable contributions For your 2020 you can deduct up to 300 of donations per tax return if you take the standard deduction In 2021 you can claim up to 300 for a single filer or

[desc-10] [desc-11]

Kurzstudie Tax Deduction Scheme Belgien EUKI

https://www.euki.de/wp-content/uploads/2019/09/20180827_BE_Tax-deductions_Study-pdf.webp

Section 80C Deductions List To Save Income Tax FinCalC Blog

https://fincalc-blog.in/wp-content/uploads/2022/09/section-80C-deductions-list-to-save-income-tax-video.webp

https://www.investopedia.com/terms/c/charitable...

Key Takeaways The charitable contributions deduction allows taxpayers to deduct donations of cash and property given to qualified charitable organizations There are Internal Revenue Service

https://cleartax.in/s/donation-under-section-80g-and-80gga

Section 80G of the Indian Income Tax Act allows a tax deduction for contributions to certain relief funds and charitable institutions Thus you can claim tax deductions in Section 80G apart from Section 80C and save maximum taxes

Tax Deductions You Can Deduct What Napkin Finance

Kurzstudie Tax Deduction Scheme Belgien EUKI

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Section 194K Tax Deduction On Income From Mutual Fund Units

What Are Pre tax Deductions Before Tax Deduction Guide

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Tax Deduction On Cash Loss Mar 18 2021 Johor Bahru JB Malaysia

Tax Deduction At Rs 50 hour In Mumbai ID 19044943762

Section 80G Deduction For Donation To Charitable Organizations

Donation Tax Deduction Limit - The deduction is typically limited to 20 to 60 of their adjusted gross income and varies depending on the type of contribution and the type of charity The law now allows taxpayers to apply up to 100 of their AGI for