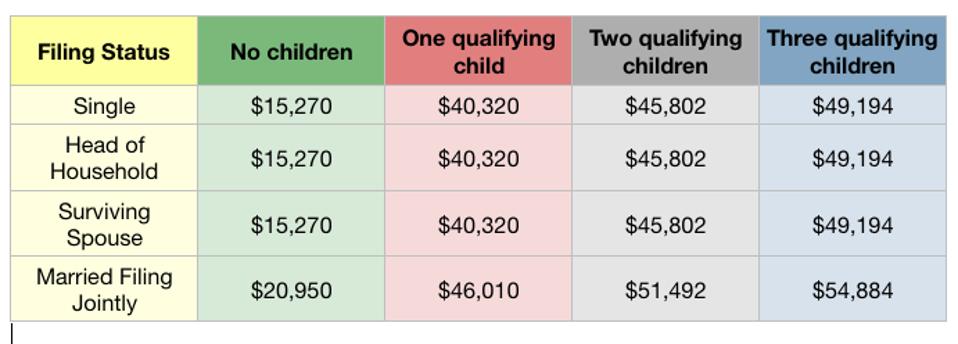

Earned Income Tax Credit Rules 2022 To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years Use the EITC tables to look up maximum credit amounts by

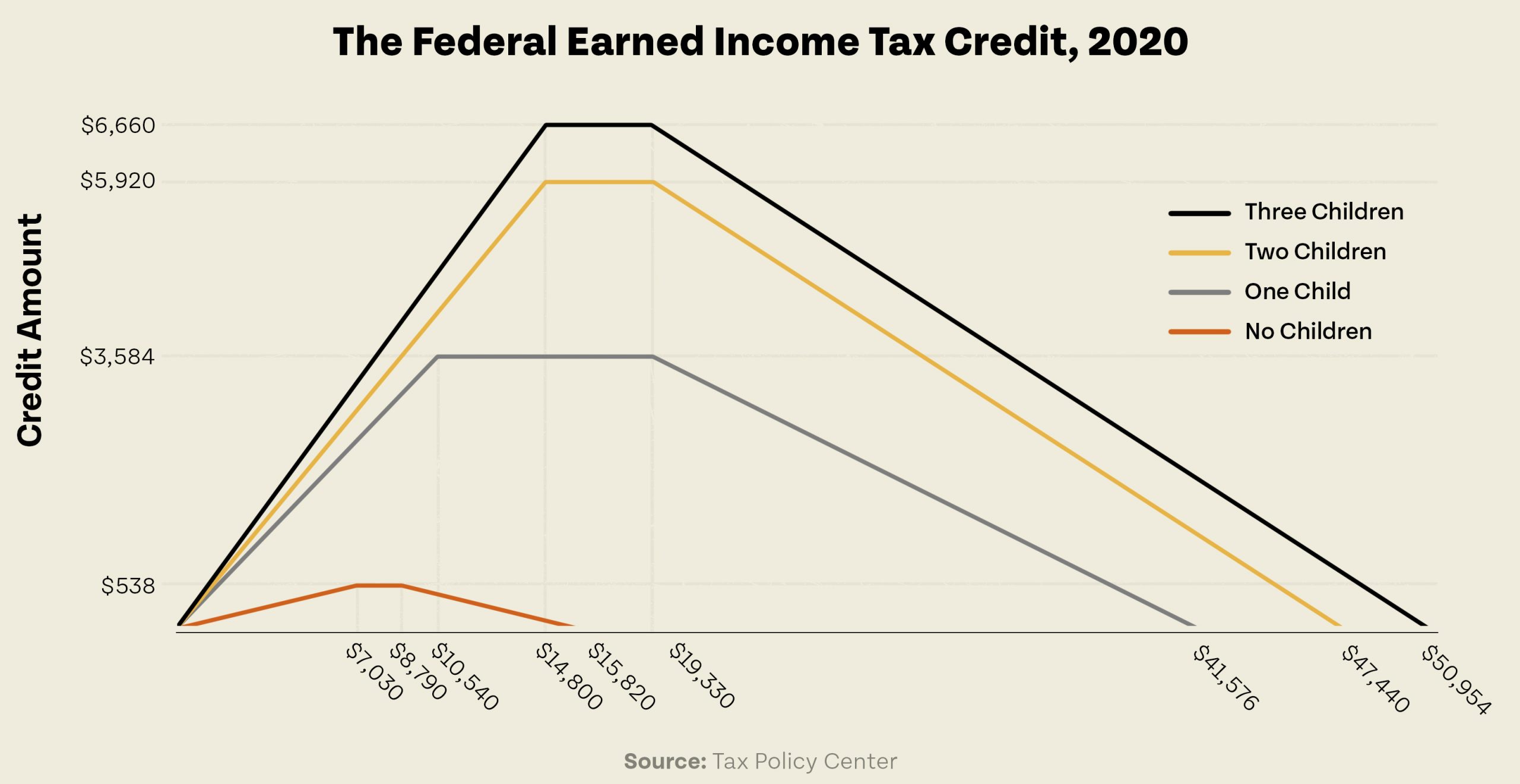

The EITC is one of the federal government s largest refundable tax credits for low to moderate income families The recent expansion of this credit means that more people may qualify to have some much needed money put back in their pocket If the person s can t agree on who claims the child as a qualifying child and more than one person claims tax benefits using the same child the tiebreaker rule explained below applies Ignore this rule if you and your spouse both claim the same qualifying child and you

Earned Income Tax Credit Rules 2022

Earned Income Tax Credit Rules 2022

http://files.constantcontact.com/f90ae796be/2cca4a40-d069-4cf1-b2cf-0b4955760889.jpg

Earned Income Credit Calculator 2021 DannielleThalia

https://i2.wp.com/www.taxpolicycenter.org/sites/default/files/model-estimates/images/T05-0195.gif

Does The Child And Dependent Care Credit Phase Out Completely Latest

https://i2.wp.com/static.twentyoverten.com/5afae91ee233a94fd2b8b963/AyQa5SwvUG/1616431432591.png

Your earned income must be less than 16 480 22 610 for married filing jointly if you do not have a qualifying child The Earned Income Tax Credit EITC is a refundable tax credit available to eligible workers with relatively low earnings Because the credit is refundable an EITC recipient need not owe taxes to

See Who Qualifies for the EITC The income limits for earned income adjusted gross income and investment income are adjusted for cost of living each year Find the dollar amounts here The child cannot have filed a joint return unless the child and the child s spouse The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people not taking advantage of this valuable credit Help us reach the workers who qualify but miss out on thousands of dollars every year without the EITC

Download Earned Income Tax Credit Rules 2022

More picture related to Earned Income Tax Credit Rules 2022

5 Printable EIC Worksheet Worksheeto

https://www.worksheeto.com/postpic/2009/12/irs-earned-income-credit-worksheet_560796.png

Earned Income Credit Table 2019 Awesome Home

https://specials-images.forbesimg.com/imageserve/5c8f8ef2a7ea43206f12798c/960x0.jpg?fit=scale

2022 Tax Brackets Irs Calculator

https://i1.wp.com/www.apnaplan.com/wp-content/uploads/2021/03/Income-Tax-Slabs-for-FY-2021-22-AY-2022-23-1024x719.png

Below are the latest Earned Income Tax Credit EITC tables and income qualification thresholds adjusted for recent tax years and new legislation These limits are adjusted annually in line with inflation and other government mandates Earned Income Tax Credit EITC Assistant The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify

One of the major changes that taxpayers will need to plan for are the new changes to the Earned Income Tax Credit EITC effective for tax year 2022 What is the EITC The EITC is one of the largest refundable tax credits available on a federal tax return The earned income tax credit EITC is a tax break available to low and moderate income wage earners It is a refundable tax credit that reduces the amount of taxes owed on a

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

https://i2.wp.com/thesecularparent.com/wp-content/uploads/2020/04/california-earned-income-tax-credit-worksheet.jpg

ARPA Liberalizes The Earned Income Tax Credit Rules MYCPAPRO CPA

https://mycpapro.com/wp-content/uploads/2021/04/arpa.jpg

https://www.irs.gov › credits-deductions › individuals...

To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years Use the EITC tables to look up maximum credit amounts by

https://www.irs.gov › newsroom

The EITC is one of the federal government s largest refundable tax credits for low to moderate income families The recent expansion of this credit means that more people may qualify to have some much needed money put back in their pocket

Earned Income Tax Credit EITC Rules Liberalized By ARPA TaxMedics

California Earned Income Tax Credit Worksheet Part Iii Line 6 Worksheet

2022 Child Tax Credit Chart Latest News Update

Why Tax Credits For Working Families Matter

Louisiana Earned Income Credit Worksheet 2019 Worksheet Resume Examples

2022 Income Tax Tables Printable Forms Free Online

2022 Income Tax Tables Printable Forms Free Online

CHILDCTC The Child Tax Credit The White House

T22 0250 Tax Benefit Of The Earned Income Tax Credit EITC Baseline

KemCents Do You Qualify For The Earned Income Tax Credit Here Are The

Earned Income Tax Credit Rules 2022 - The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people not taking advantage of this valuable credit Help us reach the workers who qualify but miss out on thousands of dollars every year without the EITC