Education Tax Deduction Uk The first list of examples includes the types of scenarios where the cost of training is likely to be an allowable business expense for a self employed individual The second list of

The circumstances in which the expense of external education can be deducted are illustrated in EIM32545 You can claim tax relief on training expenditure for directors and employees providing the training is aimed at improving the skills needed in the business Allowable training costs are claimed as a deduction when

Education Tax Deduction Uk

Education Tax Deduction Uk

https://www.taxmadeeasy.sg/wp-content/uploads/2015/10/PIC-Enhanced-dedution-PArt-2.jpg

The 5 Best Education Related Tax Deductions A M Berk Tax Services

https://berktax.com/wp-content/uploads/2017/03/iStock-496645575-copy-1.jpg

Section 179 Tax Deduction

https://lifttrucksupplyinc.com/wp-content/uploads/2016/05/12369179_537911586377015_8736271735998525545_n.png

Find out what work expenses you can claim tax free including if you work from home and for mileage allowance and how your tax code is used to claim them We explain below some UK tax considerations relevant to international students in the UK with income or gains in the UK or overseas

You can claim tax back on some of the costs of running your business what HMRC calls allowable expenses These appear as costs in your business accounts deducted from the profit you pay tax on Expenses can Tax breaks for private schools will end from 2025 to enable better investment in state education the Chancellor confirmed in the Budget 2024 We re removing the exemption

Download Education Tax Deduction Uk

More picture related to Education Tax Deduction Uk

Special Tax Deduction On Renovation Extension Jan 20 2022 Johor

https://cdn1.npcdn.net/image/164268488608eb2865a0692287fabecd75401ae768.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Teacher Tax Deductions Teacher Organization Teaching

https://i.pinimg.com/originals/e7/70/90/e77090fd13d03aaf8c3fd56c787ff3f9.png

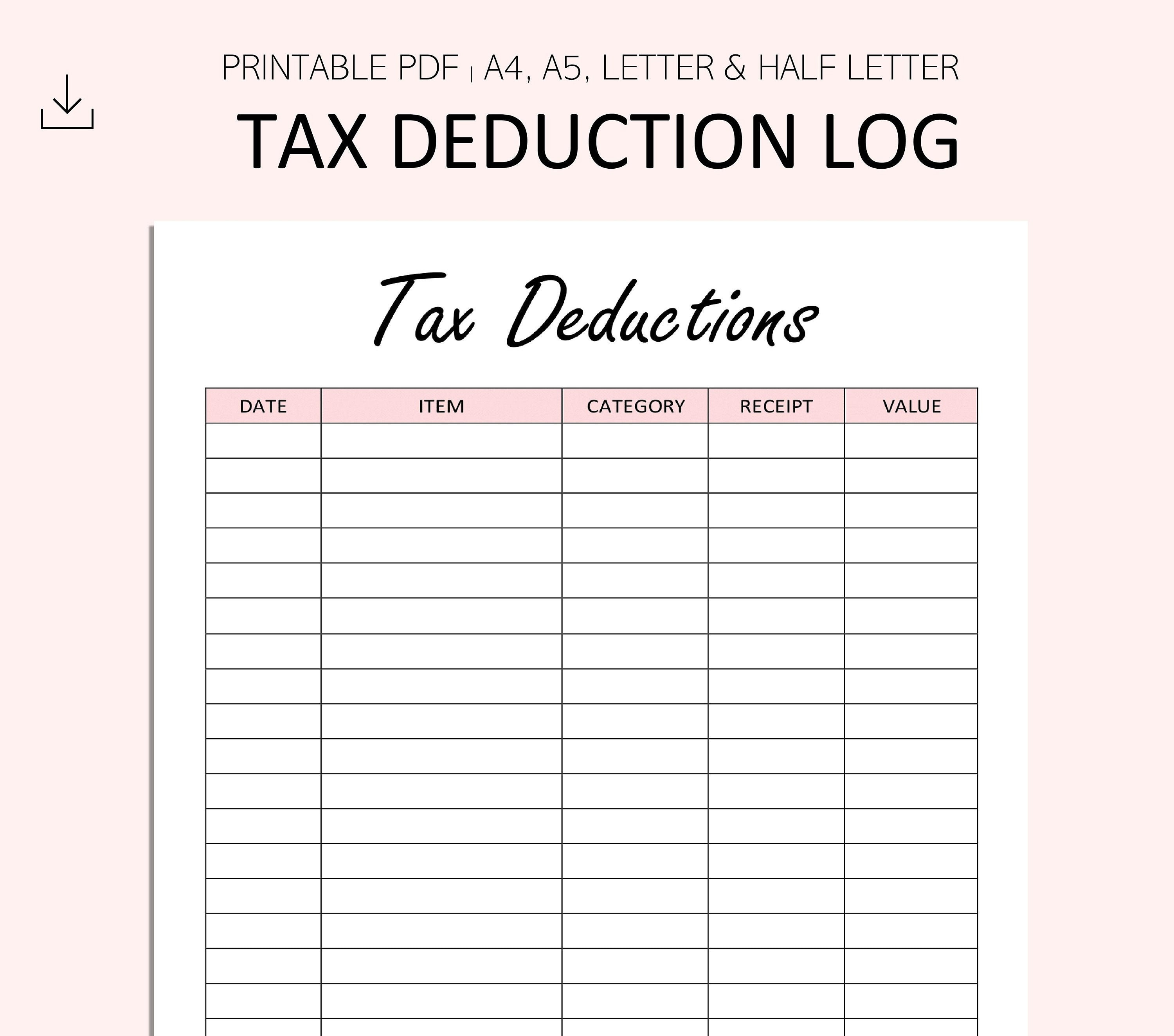

Tax Deduction Tracker Printable Tax Deduction Log Business Etsy

https://i.etsystatic.com/34842725/r/il/d7a013/4058712943/il_fullxfull.4058712943_8i57.jpg

Expenses and benefits school fees for an employee s child As an employer paying your employees children s school fees you have certain tax National Insurance and reporting United Kingdom Deductions Individual Deductions Last reviewed 08 July 2024 Employment expenses Necessary business expenses which are very narrowly defined can be deducted from employment income and are not

Whatever your take on tax it s a fact of life From VAT on the weekly shop to pounds deducted from pay we all add to the public purse But new Deloitte research Are private school fees tax deductible The short answer is no but there are several ways to pay less tax and pay less in private school fees at the same time Win win In

How To Get Your Biggest Tax Deduction The Motley Fool

https://g.foolcdn.com/editorial/images/437194/tax-deduction_gettyimages-515708887.jpg

Tax Deduction Template

https://i.etsystatic.com/23926217/r/il/e2a534/3191790802/il_fullxfull.3191790802_nd0r.jpg

https://www.gov.uk › guidance › check-if-the-cost-of...

The first list of examples includes the types of scenarios where the cost of training is likely to be an allowable business expense for a self employed individual The second list of

https://www.gov.uk › hmrc-internal-manuals › ...

The circumstances in which the expense of external education can be deducted are illustrated in EIM32545

Education Tax Deductions Please Give Attribution To ccPix Flickr

How To Get Your Biggest Tax Deduction The Motley Fool

Abolition Of State Tax Deduction Keeps NJ Tax In Check

Example Tax Deduction System For A Single Gluten free GF Item And

/cloudfront-us-east-1.images.arcpublishing.com/tgam/W6JWPGS5MZAINPGV24C65SXD6Q)

Two Tax deduction Strategies For Procrastinators The Globe And Mail

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Standard Deduction For Salary Ay 2021 22 Standard Deduction 2021

Deduction Form Self Employed Tax Employment Form

Tax Deduction Tax Deduction 1040 IRS Tax Return Form And C Flickr

Maximising Tax Benefits Your Guide To Claiming A Rental Property

Education Tax Deduction Uk - Find out what work expenses you can claim tax free including if you work from home and for mileage allowance and how your tax code is used to claim them