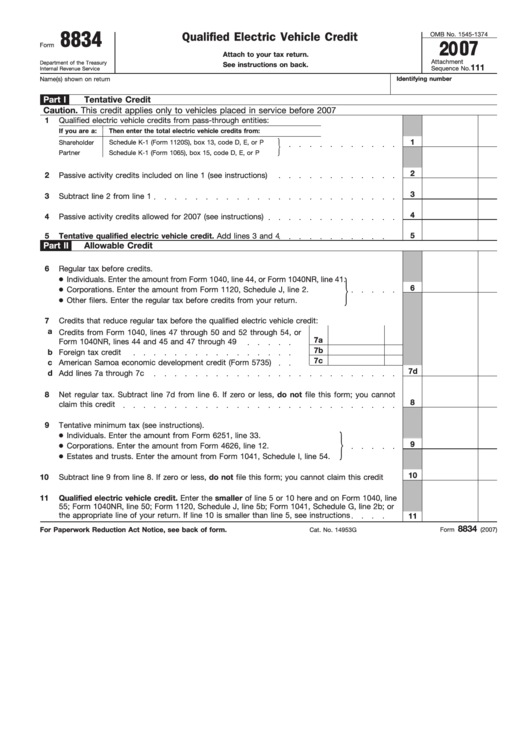

Electric Car Credit Income Limit You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

Along with price caps on cars the EV tax credit also sets limits on the modified adjusted gross income that taxpayers can make in order to qualify As of Jan 1 2024 eligible buyers can take the EV tax credit as a discount when purchasing a qualifying vehicle However one of the most important points is that there are

Electric Car Credit Income Limit

Electric Car Credit Income Limit

https://res.cloudinary.com/value-penguin/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/how-electric-car-affects-car-insurance_ubt3eo

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

https://assets.greentechmedia.com/assets/content/cache/made/assets/content/cache/remote/https_dqbasmyouzti2.cloudfront.net/content/images/articles/EV_Costs_Chart_1384_758_80.jpg

Electric Car Credit Income Limit How The Electric Car Tax Credit Works

https://data.formsbank.com/pdf_docs_html/147/1471/147139/page_1_thumb_big.png

Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in section 30D of the Internal Revenue Code Code for qualified plug in electric drive

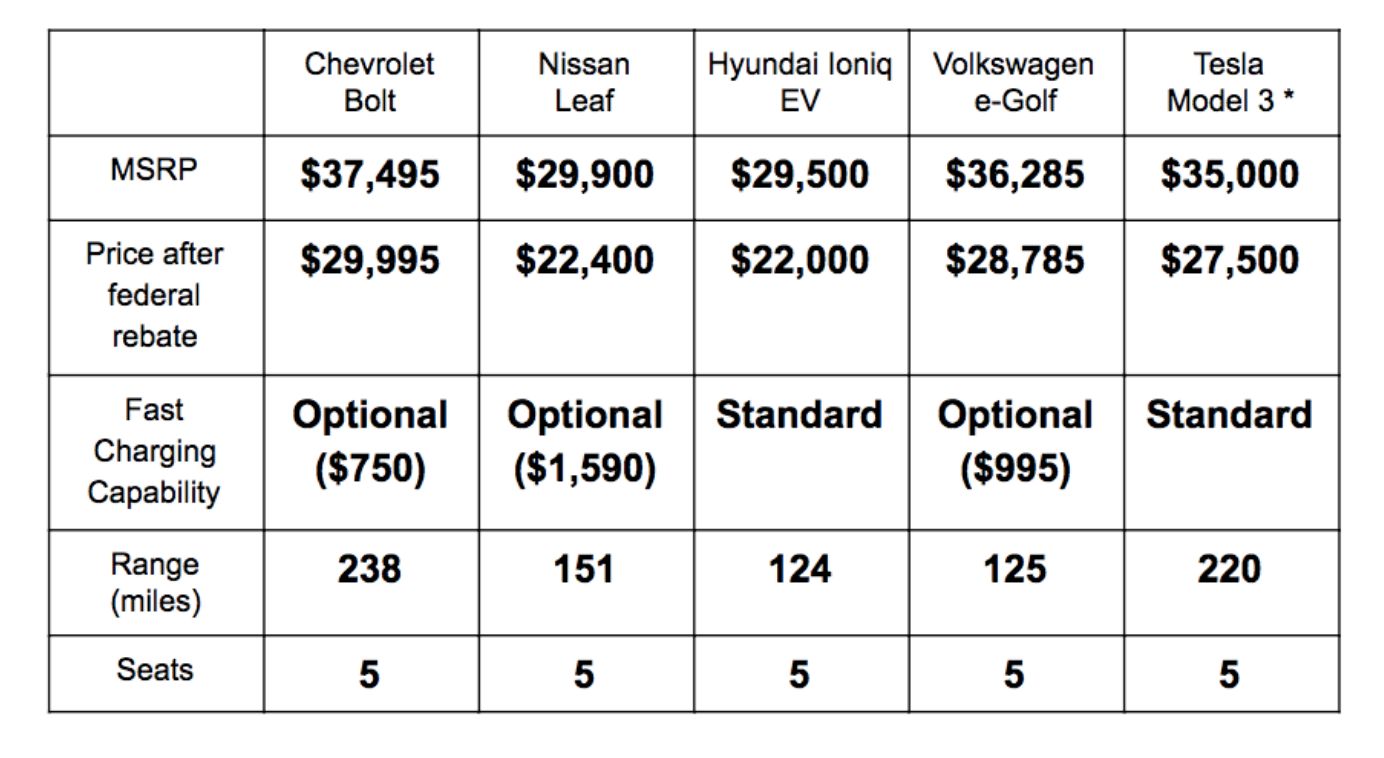

How People Qualify for the Clean Vehicle Tax Credit Income Restrictions For new clean vehicle purchases in 2023 and beyond your modified adjusted gross income MAGI see here for details for either the current year or prior year New electric vehicles must meet certain income thresholds vehicle age and price limits to qualify for the federal tax credit For example the vehicle s MSRP must not exceed specific amounts and for used EVs the models must

Download Electric Car Credit Income Limit

More picture related to Electric Car Credit Income Limit

How Many Kilowatt Hours Does It Take To Charge An Electric Car OsVehicle

https://cdn.osvehicle.com/1666180757385.jpg

Ebike Tax Credit Income Limit Marry Banuelos

https://images.prismic.io/peopleforbikes/3cf0950d-9ef1-4b8d-ad26-654db3ad0ff4_iStock-1276091849.jpg?auto=compress,format

Universal Credit Income Limit What It Is In 2022

https://www.your-benefits.co.uk/wp-content/uploads/2022/08/comppexels-rodnae-productions-5915236-1-e1659619449572.jpg

The income limits for a new vehicle are 150 000 adjusted gross income for an individual 225 000 for a head of household and 300 000 for a married couples filing jointly or surviving spouses Anyone considering a used electric car under 25 000 could obtain up to a 4 000 tax credit subject to income and other limits The IRS says the credit equals 30 of the sale

New Tax Credits for Electric Vehicles You could get money back when you buy a new or used EV but price income and other restrictions apply For the used EV tax credit Is There an Income Limit for Claiming the Electric Vehicle Tax Credit You may not claim the electric vehicle tax credit if your modified adjusted gross income exceeds certain

Universal Credit Income Limit What It Is In 2022

https://www.your-benefits.co.uk/wp-content/uploads/2022/08/comppexels-nataliya-vaitkevich-8927654-1-e1659619292835-1536x598.jpg

The Toyota Prius A Car Qualified For The Electric Car Credit OsVehicle

https://cdn.osvehicle.com/does_prius_qualify_for_ev_tax_credit.jpg

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

https://www.nerdwallet.com › article › taxe…

Along with price caps on cars the EV tax credit also sets limits on the modified adjusted gross income that taxpayers can make in order to qualify

Tax Benefits For Holiday Gifts Isler Northwest LLC

Universal Credit Income Limit What It Is In 2022

How To Claim The Federal Electric Car Credit OsVehicle

Do You Have To Pay To Charge Your Electric Car OsVehicle

Income Limit For 7500 Electric Vehicle Credit Todrivein

Ebike Tax Credit Income Limit Marry Banuelos

Ebike Tax Credit Income Limit Marry Banuelos

Earned Income Tax Credit EITC Who Qualifies

Universal Credit Income Limit What It Is In 2022

The Pros And Cons Of Charging Your Electric Car Overnight OsVehicle

Electric Car Credit Income Limit - Find out if your electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on type purchase date and business or personal use