Electric Car Rebate Taxable Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000

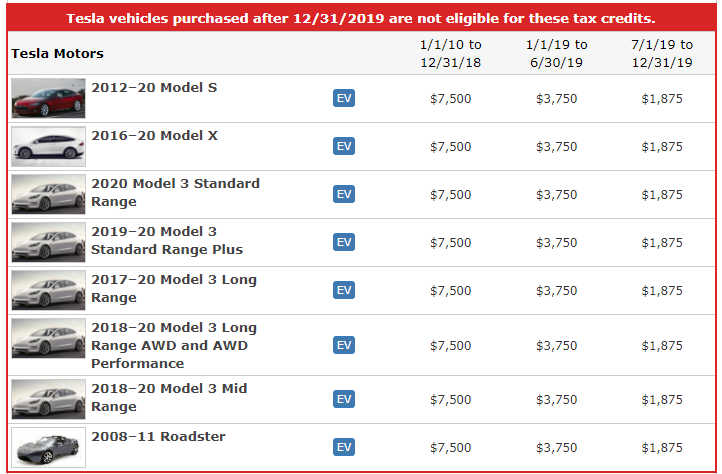

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Electric Car Rebate Taxable

Electric Car Rebate Taxable

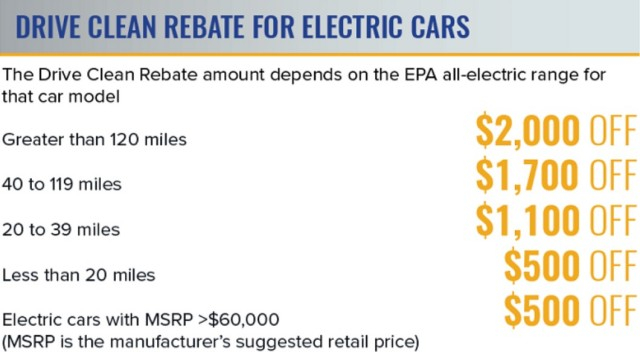

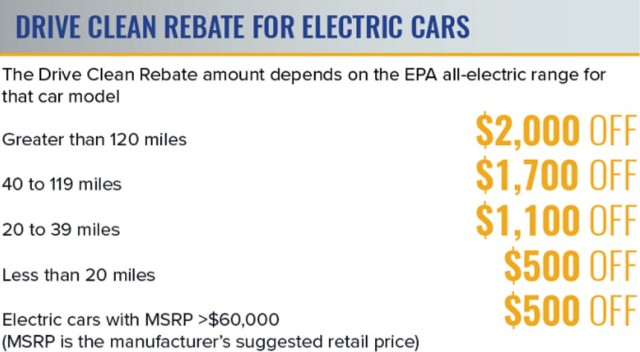

https://www.carrebate.net/wp-content/uploads/2022/08/ny-2-000-electric-car-rebate-falls-to-500-if-it-s-over-60k-sorry.jpg

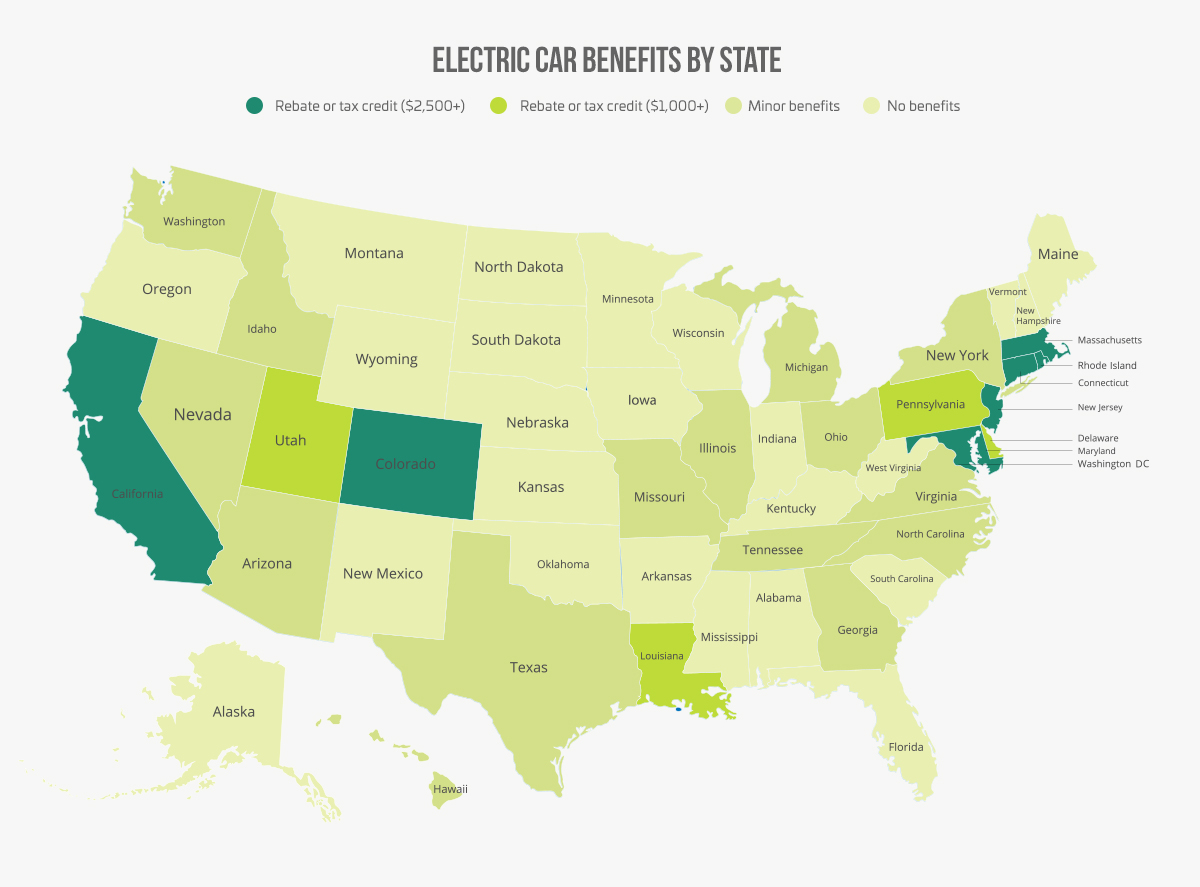

Electric Car Rebates By State ElectricRebate

https://www.electricrebate.net/wp-content/uploads/2022/09/green-misconceptions-5-myths-about-electric-cars-busted.jpg

Electric Car Available Rebates 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/electric-vehicle-rebates-now-available-in-maine-nrcm-1.jpg

Web If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section Web 17 ao 251 t 2022 nbsp 0183 32 Some popular electric vehicles may become eligible for a tax credit once again while other cars that were eligible this month will not be for the foreseeable future

Web 25 ao 251 t 2022 nbsp 0183 32 If you meet the income requirements and buy a qualifying vehicle you must claim the electric vehicle EV tax credit on your annual tax filing for 2022 and 2023 Web 22 ao 251 t 2022 nbsp 0183 32 Sedans have to be under 55 000 to qualify and the cost of trucks vans and sports utility vehicles can t exceed 80 000 The price caps for used electric

Download Electric Car Rebate Taxable

More picture related to Electric Car Rebate Taxable

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/californians-can-get-an-electric-vehicle-for-free-sly-credit-1.png

Ca Electric Car Rebate Income ElectricRebate

https://i0.wp.com/www.electricrebate.net/wp-content/uploads/2022/09/california-income-based-electric-vehicle-rebate-program-expected-to-4.jpg

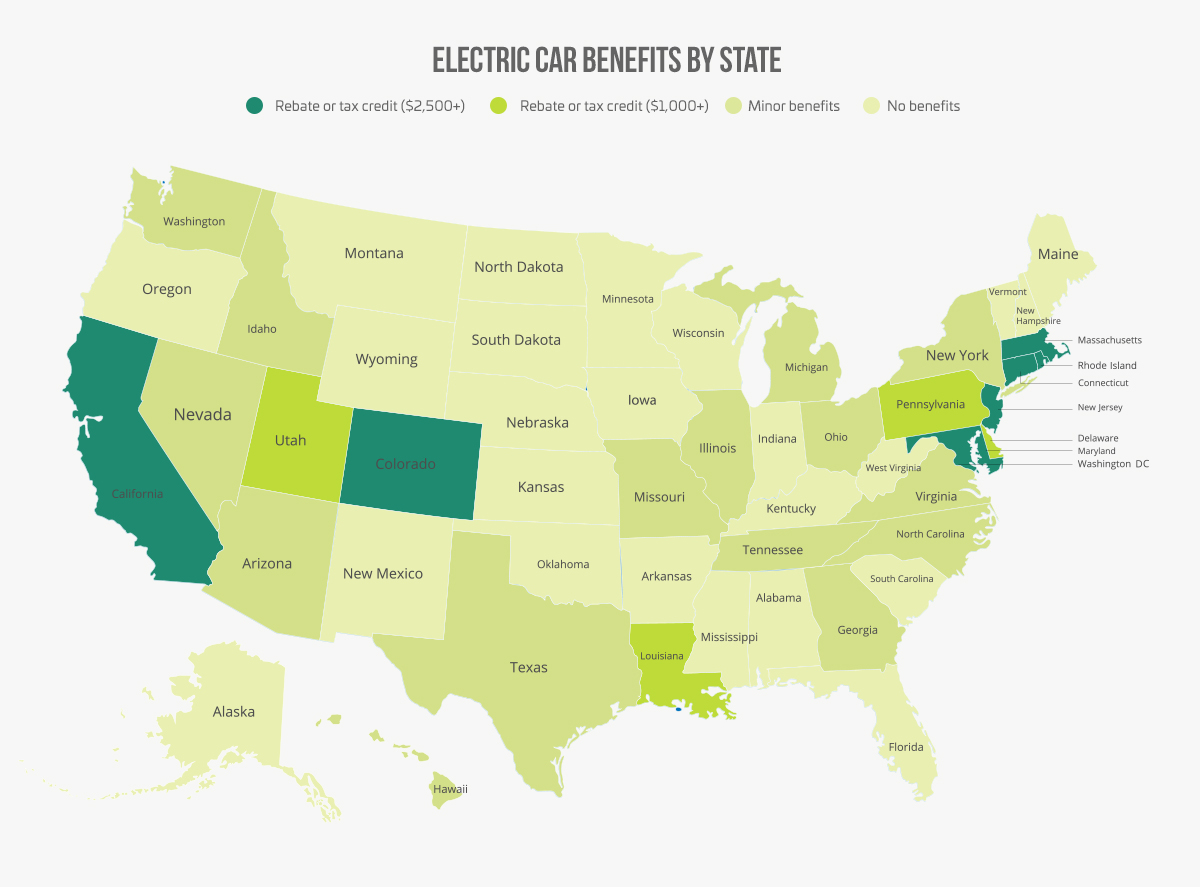

Electric Car Rebates By State Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/electric-car-rebates-by-state.jpg

Web 1 f 233 vr 2022 nbsp 0183 32 New car buyers in California can get a cash rebate of 2 000 for electric vehicles and 1 000 for PHEVs Under that same program buyers of FCEVs may be Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation

Web 6 juin 2023 nbsp 0183 32 First you must buy a new EV that qualifies Then you ll need to fill out IRS Form 8936 to claim your credit of up to 7 500 against your tax bill when you file your Web 19 oct 2022 nbsp 0183 32 Federal electric vehicle tax credits are non refundable At most they will reduce your tax liability to zero If you don t owe taxes for the year in which the vehicle

Electric Car Rebates By State ElectricCarTalk Rebate2022

https://i0.wp.com/www.rebate2022.com/wp-content/uploads/2023/03/electric-car-rebates-by-state-electriccartalk.png

Ca Electric Car Rebate 2022 Carrebate

https://www.carrebate.net/wp-content/uploads/2022/08/california-electric-car-rebate-taxable-car-gallery-1.jpg

https://www.npr.org/2023/01/07/1147209505

Web 7 janv 2023 nbsp 0183 32 If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric...

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks as of

California Electric Car Rebate

Electric Car Rebates By State ElectricCarTalk Rebate2022

Electric Car Rebates Washington State 2023 Carrebate

Does California Offer Electric Car Rebates

Canada Rebates For Electric Cars 2023 Carrebate

Is CA EV Rebate Taxable

Is CA EV Rebate Taxable

Electric Vehicles Canada Rebate

Tax Rebates For Electric Cars Michigan 2023 Carrebate

Cal Electric Car Rebate 2023 Carrebate

Electric Car Rebate Taxable - Web 25 ao 251 t 2022 nbsp 0183 32 If you meet the income requirements and buy a qualifying vehicle you must claim the electric vehicle EV tax credit on your annual tax filing for 2022 and 2023