Electric Vehicle Tax Credit 2023 Used Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

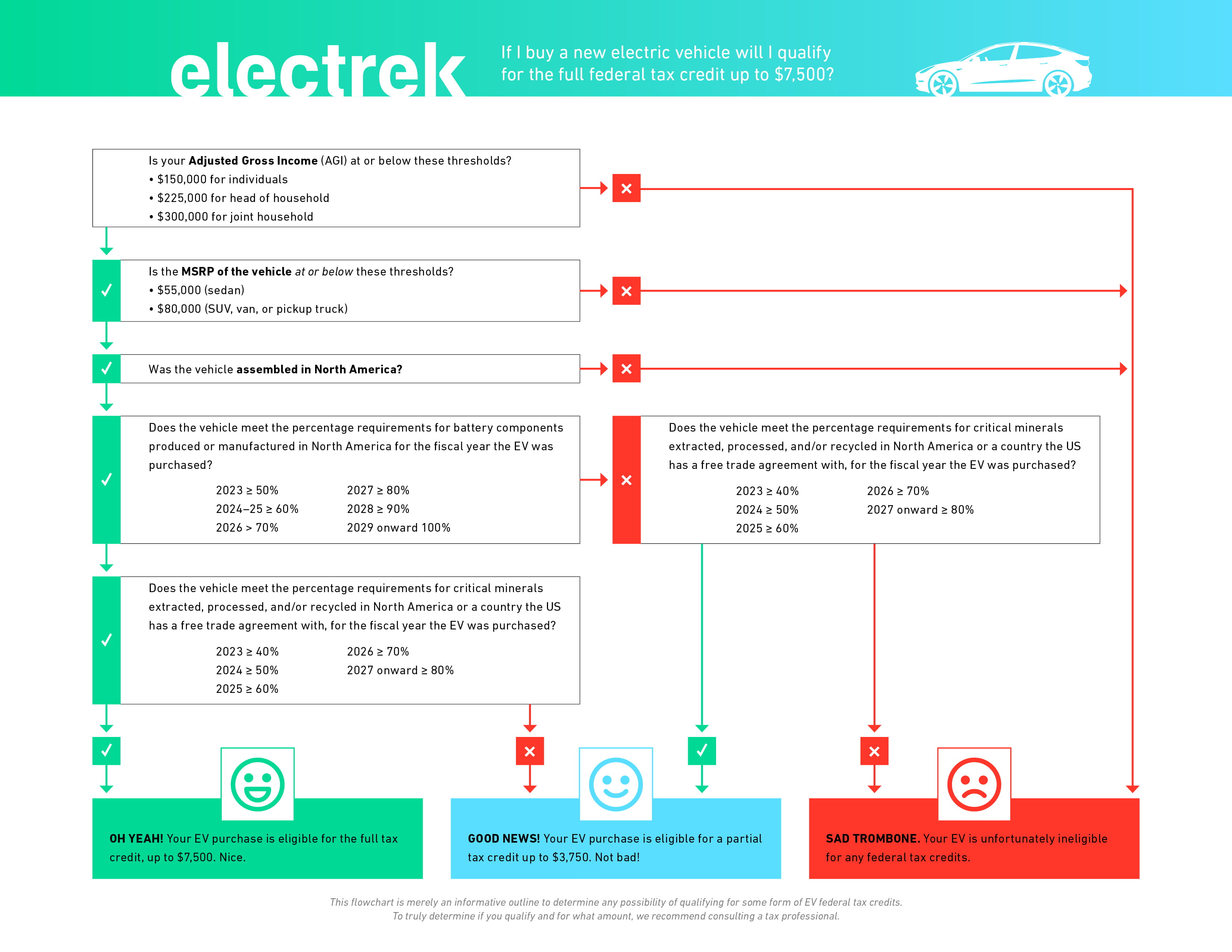

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the tax credit Beginning January 1 2023 eligible vehicles may qualify for a

Electric Vehicle Tax Credit 2023 Used

Electric Vehicle Tax Credit 2023 Used

https://cdn.osvehicle.com/how_is_tax_credit_for_ev_calculated.png

Electric Car Tax Credit Everything That You Have To Know Get

https://getelectricvehicle.com/wp-content/uploads/2020/03/20200323_222104_0000-2137228502-683x1024.png

How To Receive A Tax Credit On Your Electric Vehicle Colvin Electric

https://colvinelectric.com/wp-content/uploads/2019/03/AdobeStock_191818438-e1551736282603.jpeg

Pre owned all electric plug in hybrid and fuel cell electric vehicles purchased on or after January 1 2023 may be eligible for a federal income tax credit The credit equals 30 percent of the sale price up to a maximum credit of 4 000 The Inflation Reduction Act IRA provides new opportunities for consumers to save money on clean vehicles offering multiple incentives for the purchase or lease of electric vehicles EVs plug in hybrid vehicles fuel cell vehicles and associated equipment such as

Starting January 1 consumers may be eligible for a tax credit for used or previously owned cars and businesses may be eligible for a new commercial clean vehicle credit Starting January 2024 people who buy qualified used electric cars from a dealership for less than 25 000 could be eligible for a tax credit of up to 4000 This guide and lookup tool helps you figure out if a car you re interested in is eligible and if you qualify

Download Electric Vehicle Tax Credit 2023 Used

More picture related to Electric Vehicle Tax Credit 2023 Used

Everything You Need To Know About The IRS s New EV Tax Credit Guidance

https://electrek.co/wp-content/uploads/sites/3/2022/11/EV-tax-credit-flowchart.jpg

How Electric Vehicle Tax Credit Works Web2Carz

https://www.web2carz.com/images/articles/201610/electric_vehicle_tax_credit_1476984869_800x600.jpg

Learn The Steps To Claim Your Electric Vehicle Tax Credit

https://andersonadvisors.com/wp-content/uploads/2023/04/Electric-vechiles.jpg

Shoppers considering a used electric vehicle EV costing less than 25 000 could obtain up to a 4 000 tax credit The Clean Vehicle tax credit is available to buyers within certain federal If you buy a new all electric plug in hybrid or fuel cell electric vehicle in 2023 or after you can claim a clean vehicle tax credit of up to 7 500 The tax credit is available to both

If you buy a used electric vehicle model year 2021 or earlier you can get up to 4 000 back as a tax credit This tax credit has an income cap too 150 000 for a household 75 000 for a Those who meet the income requirements and buy a qualifying vehicle must claim the electric vehicle EV tax credit on their annual tax filing for 2023 However starting in 2024 car

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

https://www.mcgillhillgroup.com/FS/CO/3732/electric-vehicle-tax-credits.jpg

Summary Of The Electric Vehicle Tax Credit

https://www.troutcpa.com/hubfs/Electric-Car-Tax-Credit.jpg

https://electrek.co/2024/03/18/here-are-all-the...

Beginning January 1 2023 if you buy a qualified previously owned electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a

https://www.irs.gov/newsroom/qualifying-clean...

Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

Which Electric Cars Qualify For The New EV Tax Credit

How To Qualify For The Maximum Electric Vehicle Tax Credit McGill

Electric Vehicle Tax Credit Explained Rhythm

These 19 Plug In Electric Cars Qualify For Full 7 500 Tax Credit

Electric Vehicle Tax Credit Survives In Latest Tax Bill But Phase Out

The State Of Electric Vehicle Tax Credits Clean Charge Network

The State Of Electric Vehicle Tax Credits Clean Charge Network

Utah Electric Vehicle Tax Credit Federal EV Tax Credits

How Californians Have Taken Advantage Of The Federal Electric Vehicle

Report Warns Of Dire Consequences If Lawmakers Lift Electric Vehicle

Electric Vehicle Tax Credit 2023 Used - For 2023 you may qualify for the EV tax credit if your modified adjusted gross income MAGI is less than the following thresholds 300 000 for married couples or qualifying widowed