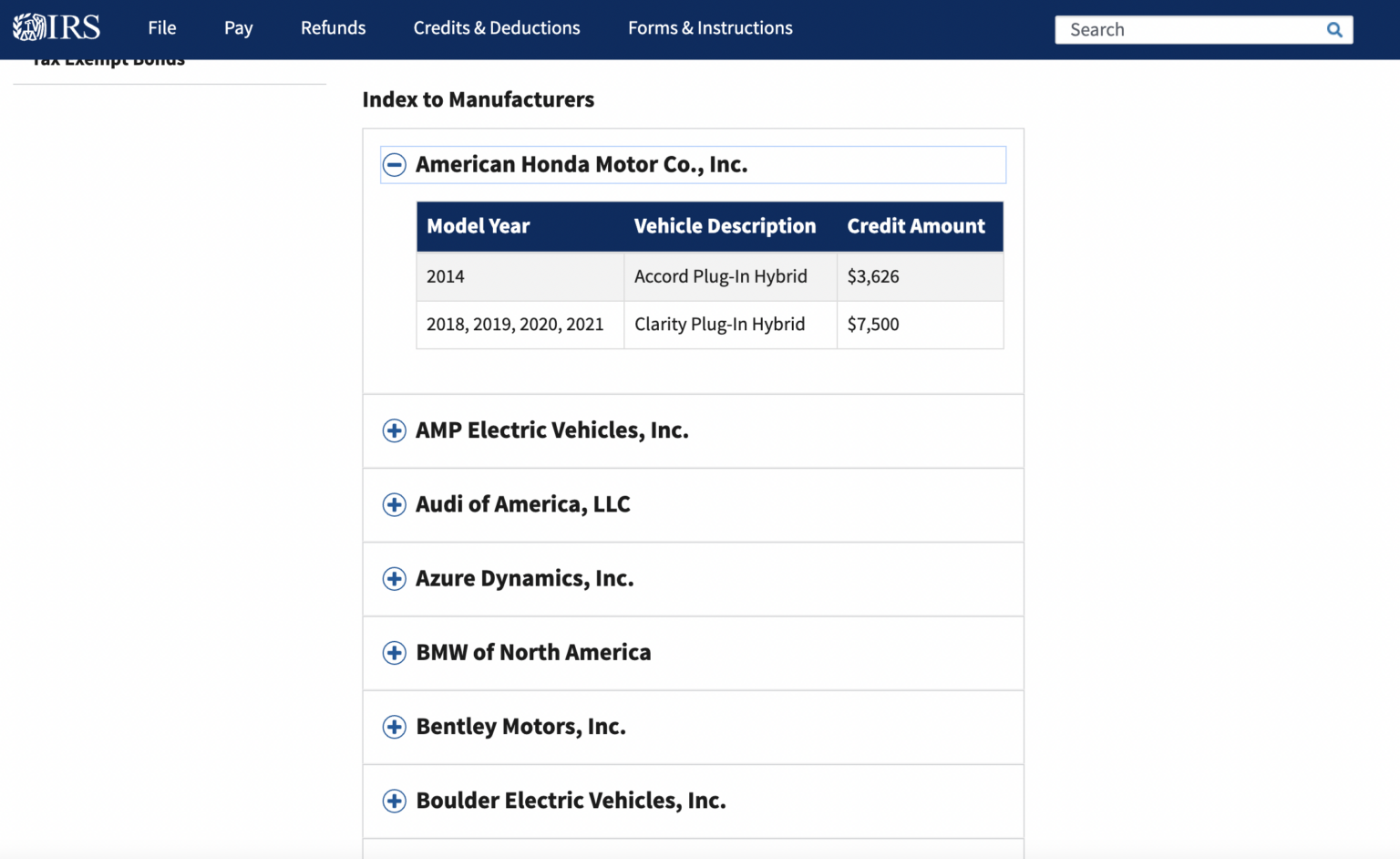

Electric Vehicles 2022 Federal Tax Credit Verkko If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

Verkko 1 jouluk 2023 nbsp 0183 32 Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 in 2023 and 2024 By Verkko 2 elok 2023 nbsp 0183 32 If you bought a new qualified plug in electric vehicle in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 dollars The total amount of the credit is based on the vehicle s battery capacity This credit is available to individuals and businesses

Electric Vehicles 2022 Federal Tax Credit

Electric Vehicles 2022 Federal Tax Credit

https://michiganadvance.com/wp-content/uploads/2022/02/IMG_5264-3-2048x1362-1.jpeg

2023 EV Tax Credit How To Save Money Buying An Electric Car Money

https://img.money.com/2022/12/News-Save-buying-electric-car-using-tax-credits.jpg?quality=85

2020 Chevy Bolt EV Values Cars For Sale Kelley Blue Book

https://file.kelleybluebookimages.com/kbb/base/evox/CP/13130/2020-Chevrolet-Bolt EV-front_13130_032_1855x931_GD1_cropped.png

Verkko 1 jouluk 2023 nbsp 0183 32 As of 2023 people who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car buyers may qualify for up to 4 000 in tax breaks The Verkko All electric and plug in hybrid vehicles purchased new from 2010 through 2022 may be eligible for a federal income tax credit of up to 7 500 The credit amount will vary based on the capacity of the battery used to power the vehicle

Verkko 16 toukok 2022 nbsp 0183 32 What is the Electric Vehicle Tax Credit Currently the plug in electric drive vehicle tax credit is up to 7 500 for qualifying and eligible vehicles This is a combination of the base amount of 4 000 Verkko 17 elok 2022 nbsp 0183 32 The electric vehicle tax credit also known as the EV tax credit is a nonrefundable credit meant to lower the cost of qualifying plug in electric or other clean vehicles The credit is worth between 2 500 and 7 500 for the 2022 tax year and eligibility for claiming the credit depends on the number of electric vehicles sold by

Download Electric Vehicles 2022 Federal Tax Credit

More picture related to Electric Vehicles 2022 Federal Tax Credit

EVs That Are Eligible For A Federal Tax Credit In 2024

https://www.moneydigest.com/img/gallery/evs-that-are-eligible-for-a-federal-tax-credit-in-2024/l-intro-1706717045.jpg

2022 Federal Tax Credit Update The Key Takeaways For EVs YouTube

https://i.ytimg.com/vi/44VFIUhLjuM/maxresdefault.jpg

The Clock Is Ticking Toyota Closes In On EV Federal Tax Credit Limit

https://www.motorbiscuit.com/wp-content/uploads/2022/04/2022-Toyota-Prius-Hybrid-1024x576.jpg

Verkko Published Dec 29 2022 Updated Dec 30 2022 The Treasury Department on Thursday published a partial list of new electric and plug in hybrid cars that will qualify for tax credits of up to 7 500 Verkko 7 tammik 2023 nbsp 0183 32 Buying an electric car You can get a 7 500 tax credit but it won t be easy Updated April 3 202311 10 AM ET Camila Domonoske Enlarge this image For the first time in years some Teslas

Verkko 29 marrask 2023 nbsp 0183 32 Inflation Reduction Act EV Federal Tax Credit EVs with Chinese parts won t qualify for the full 7 500 tax credit from 2024 Michelle Lewis Dec 1 2023 11 25 am PT The US government has Verkko You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

https://www.austincartransport.com/wp-content/uploads/2021/03/electric-charge-2301604_1920-1536x1128.jpg

New Rules Which Electric Vehicles Qualify For The Federal Tax Credit

https://s.hdnux.com/photos/01/27/02/00/22814758/4/rawImage.jpg

https://www.irs.gov/credits-deductions/manufacturers-and-models-for...

Verkko If you bought a new qualified plug in electric vehicle EV between 2010 and 2022 you may be eligible for a new electric vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D Manufacturers and Models for New Qualified Clean Vehicles Purchased in 2022 and Before Internal Revenue Service

https://www.consumerreports.org/cars/hybrids-evs/electric-cars-plug-in...

Verkko 1 jouluk 2023 nbsp 0183 32 Electric Cars and Plug In Hybrids That Qualify for Federal Tax Credits Here s how to find out which new and used EVs may qualify for a tax credit of up to 7 500 in 2023 and 2024 By

New Regulations Could Impact The Price Of Certain Electric Vehicles

Electric Vehicles Qualifying For US Federal Tax Credit In 2021

Level of sale EV Rebates Consumers Choose Might Have Saved 2 Billion

Federal Tax Update Manual Western CPE

Volkswagen Confirms 7 500 Federal Tax Credit For ID 4

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

The Federal Tax Credit For Electric Cars How To Save 7 500

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

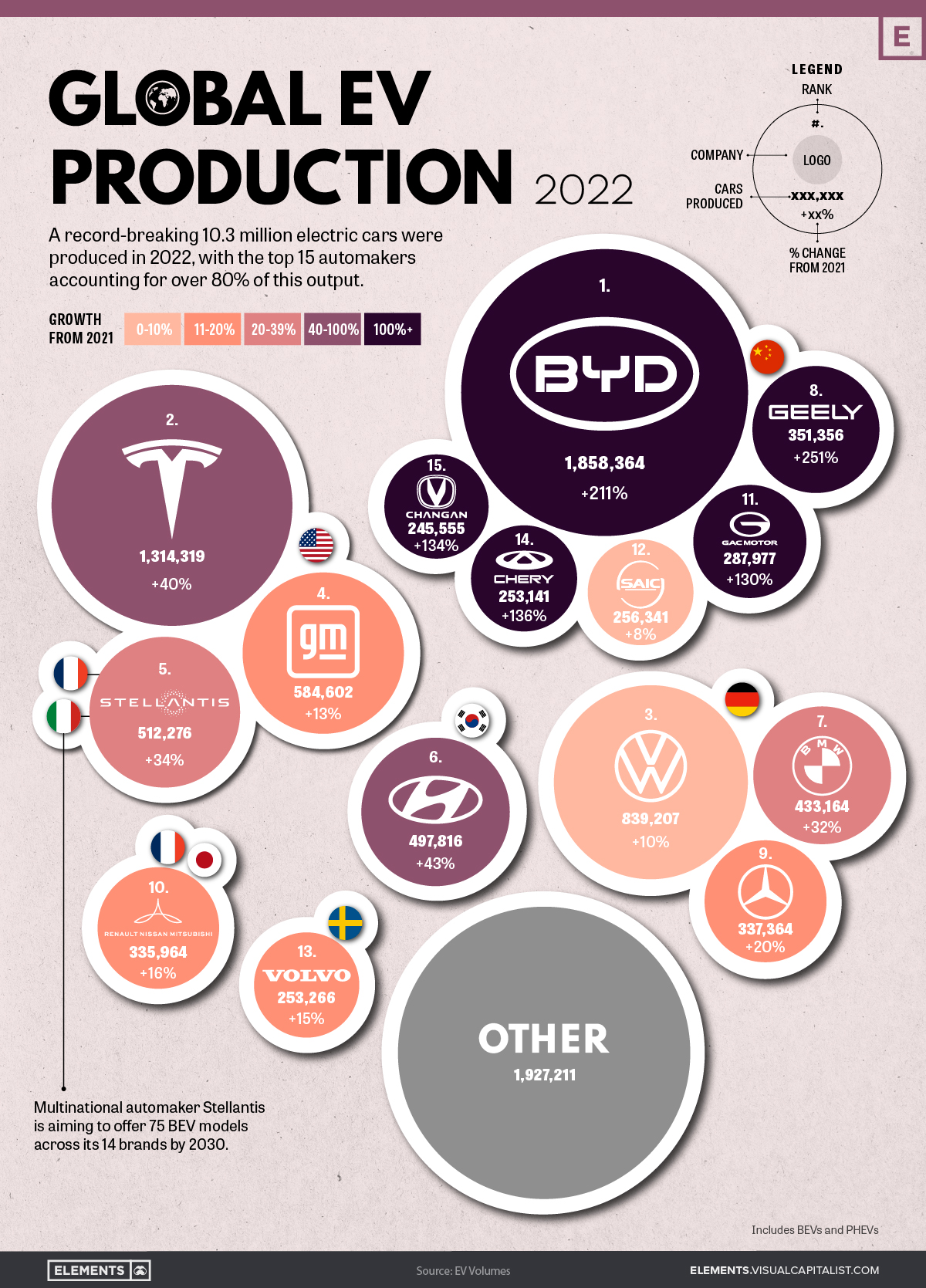

Visualizing Global EV Production In 2022 By Brand

Electric Vehicles 2022 Federal Tax Credit - Verkko 15 lokak 2022 nbsp 0183 32 The historic climate legislation President Joe Biden signed in August offered a federal tax break worth up to 7 500 to households that buy new electric vehicles But it may be tough for