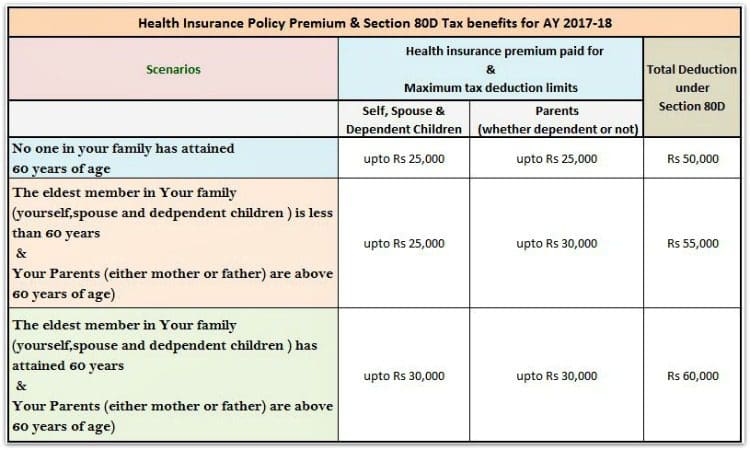

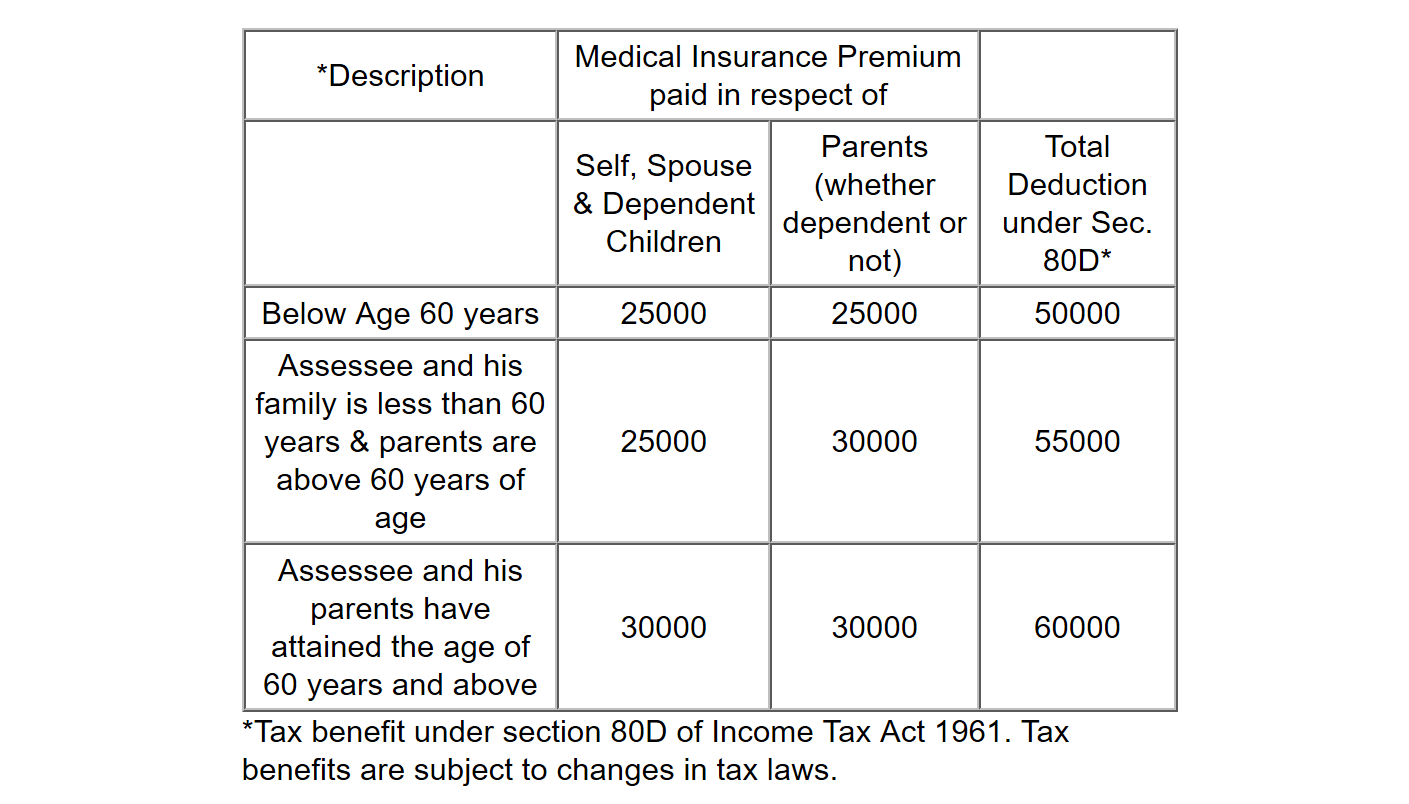

Tax Rebate On Medical Insurance Web Section 80D of the Income Tax Act 1961 allows individuals and Hindu Undivided Family HUF to avail health insurance tax benefit on the premium paid If your annual income comes under tax liability you can

Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses Web 4 mars 2019 nbsp 0183 32 What is a health insurance tax credit A premium tax credit also called a premium subsidy lowers the cost of your health insurance The discount can be applied

Tax Rebate On Medical Insurance

Tax Rebate On Medical Insurance

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

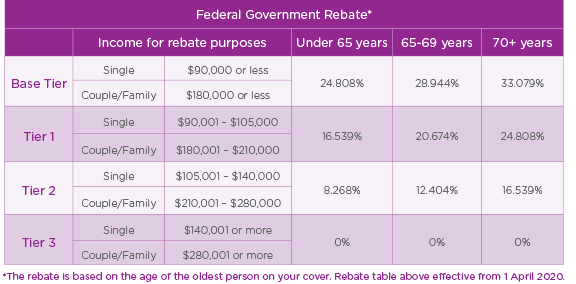

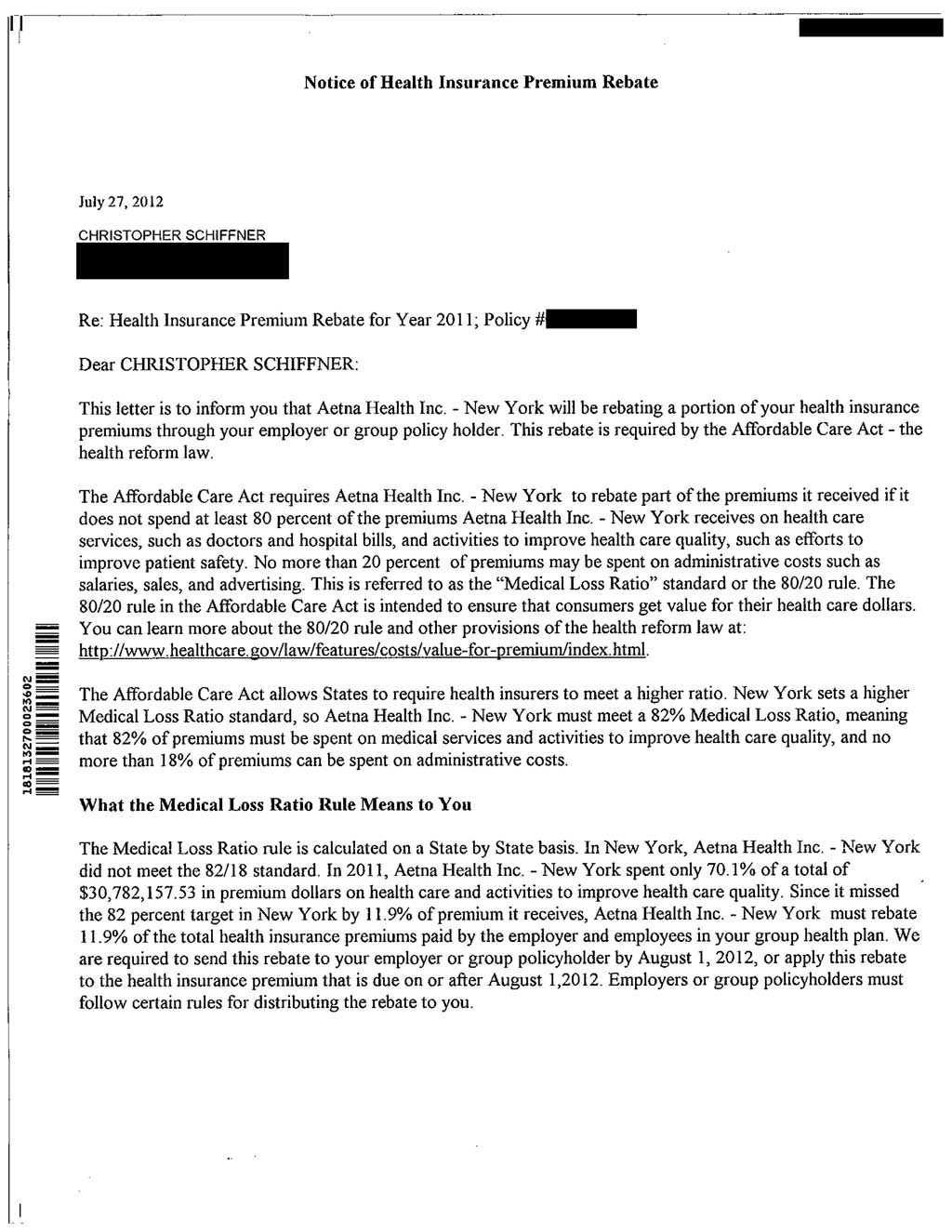

The Private Health Insurance Rebate Explained ISelect

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

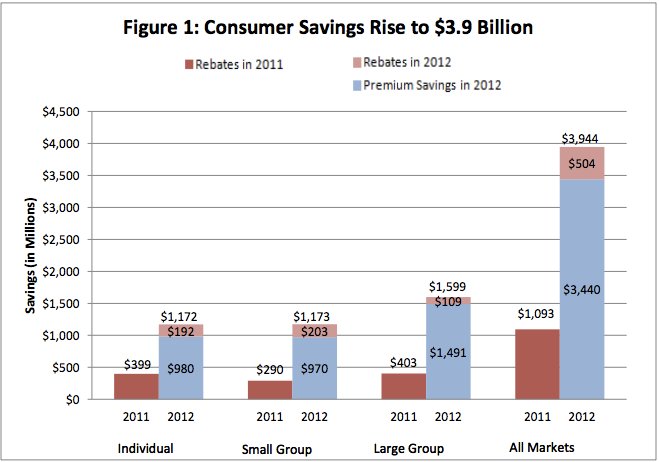

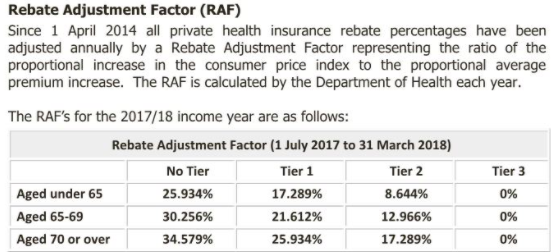

Health Insurance Rebates Sending 500 Million Back To Consumers

http://i.huffpost.com/gen/1202466/original.jpg

Web 5 oct 2022 nbsp 0183 32 Premium tax credits are refundable credits that help lower the cost of health insurance that s purchased through the Health Insurance Marketplace Your household income must fall within a specific range to Web 1 f 233 vr 2023 nbsp 0183 32 As per the Income Tax provisions the tax assessees can claim a deduction under section 80D of the Income Tax for the premium paid towards a mediclaim insurance In this article we will discuss in

Web The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased Web 27 sept 2012 nbsp 0183 32 If you had an individual insurance policy in 2011 and you claimed the standard deduction on your taxes like most taxpayers instead of itemizing you will not

Download Tax Rebate On Medical Insurance

More picture related to Tax Rebate On Medical Insurance

How Does Private Health Insurance Affect My Tax Return Compare Club

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Health Insurance Tax Benefits u s 80D For FY 2018 19 AY 2019 20

https://www.relakhs.com/wp-content/uploads/2018/02/Medical-Insurance-Premium-Tax-Benefits-Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2018-19-AY-2019-20-Medical-treatment-expenditure-bills.jpg

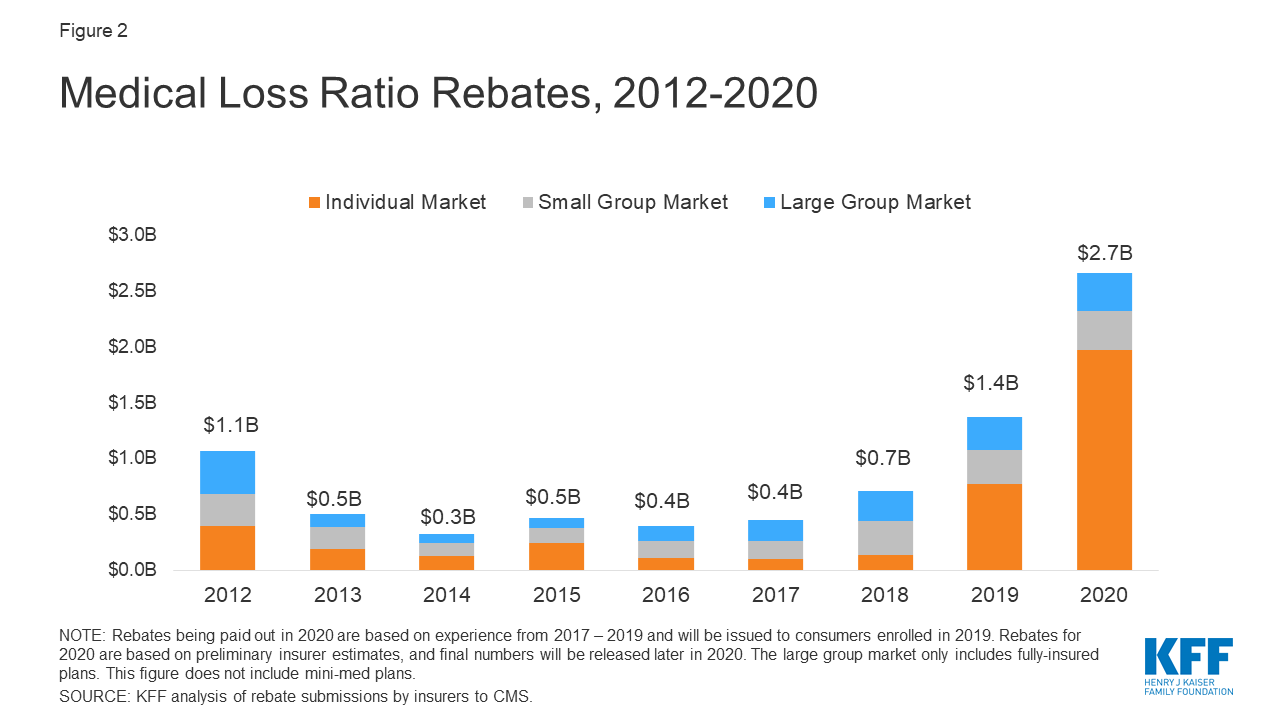

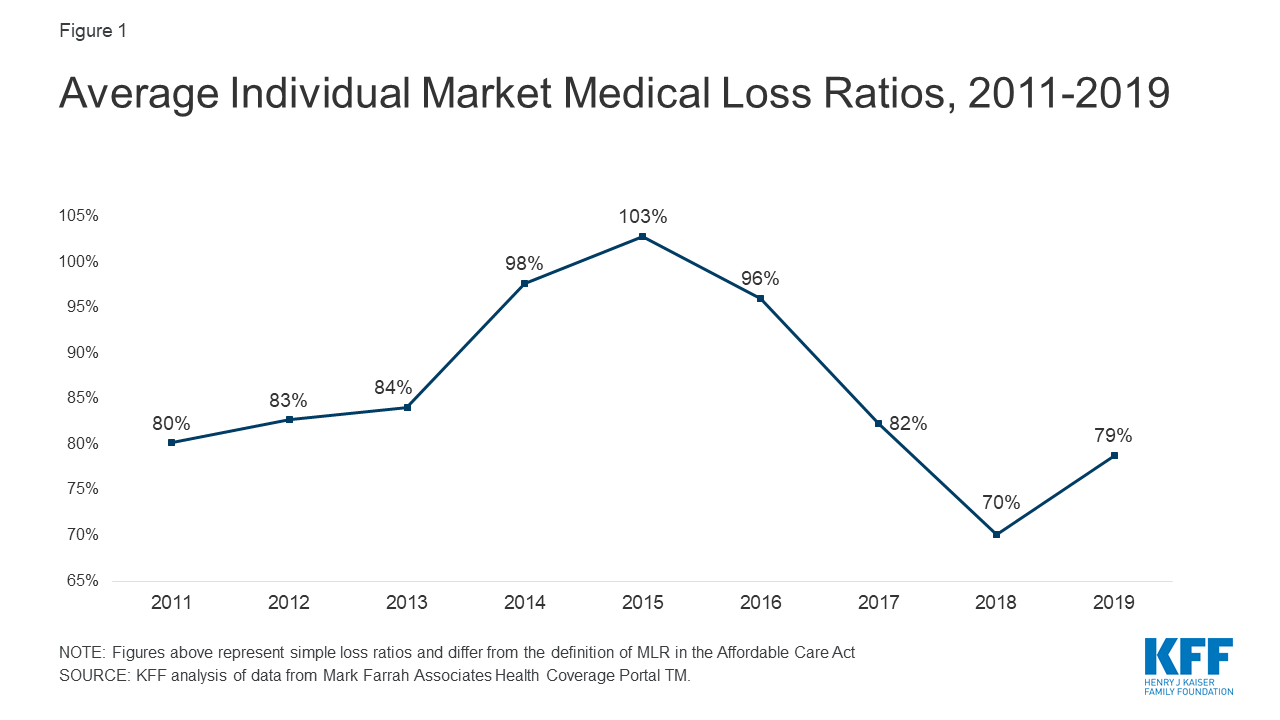

Web Choose 2022 health insurance status for steps amp tax forms If more than one situation applied at different times or for different household members start with one option and Web 6 sept 2023 nbsp 0183 32 The Affordable Care Act requires insurance companies to spend at least 80 or 85 of premium dollars on medical care with the rate review provisions

Web 9 mars 2020 nbsp 0183 32 20 of 1 000 equal to a credit of 200 Claim Your Medical Insurance Relief Today Step 1 of 4 25 Save and Continue Later Per Child Relief available is equal to the lesser of 20 of the cost of Web 10 mars 2023 nbsp 0183 32 Is Health Insurance Tax Deductible Health insurance costs may be tax deductible but it depends on how much you spent on medical care for the year and

Anthem Releases Medical Loss Ratio Rebate Information Hometown

https://i1.wp.com/hometowninsurancepros.com/wp-content/uploads/2020/08/Anthem-2019-MLR.jpg?resize=790%2C1024&ssl=1

Who Will Get Health Insurance Rebate Checks Anceinsru

https://www.kff.org/wp-content/uploads/2020/04/9346-02-Figure-2.png

https://www.acko.com/health-insurance/how-t…

Web Section 80D of the Income Tax Act 1961 allows individuals and Hindu Undivided Family HUF to avail health insurance tax benefit on the premium paid If your annual income comes under tax liability you can

https://www.policybazaar.com/health-insurance/section80d-deductions

Web Section 80D allows a tax deduction of up to Rs 25 000 per financial year on medical insurance premiums Section 80D also includes a Rs 5 000 deduction for any expenses

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Anthem Releases Medical Loss Ratio Rebate Information Hometown

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

I m Getting A Health Insurance Rebate Chris Schiffner s Corner Of

Health Insurance Tier Rebate Aca S 2017 Medical Loss Ratio Rebates

Affordable Care Act Rebate Amounts For Michigan Medical Insurance

Affordable Care Act Rebate Amounts For Michigan Medical Insurance

Why Is Medicare

Data Note 2020 Medical Loss Ratio Rebates KFF

15 Medical Insurance Tax Relief References Funaya Park

Tax Rebate On Medical Insurance - Web 4 mai 2018 nbsp 0183 32 If your employer pays annually for medical insurance and in that time you stop working for them or cancel the insurance you may need to continue to pay tax on