Tax Credit On Health Insurance Premiums The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan

The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on behalf of the Center for Medicare Medicaid Services sharing information about obtaining Marketplace healthcare coverage A premium tax credit also called a premium subsidy lowers the cost of your health insurance You can apply the discount to your insurance bill every month or you can get the credit as a refund on your federal income taxes Catastrophic coverage health plans aren t eligible for premium tax credits

Tax Credit On Health Insurance Premiums

Tax Credit On Health Insurance Premiums

https://www.nevadainsuranceenrollment.com/wp-content/uploads/2022/10/2023-Health-Insurance-Subsidy-Chart-Federal-Poverty-Levels-768x427.jpg

The Cost Of Health Care Insurance Taxes And Your W 2

https://imageio.forbes.com/blogs-images/thumbnails/blog_1479/pt_1479_10092_o.jpg?format=jpg&width=1200

2023 Medicare Premiums And Open Enrollment

https://www.myfederalretirement.com/wp-content/uploads/2021/11/2023-medicare-premiums.jpg

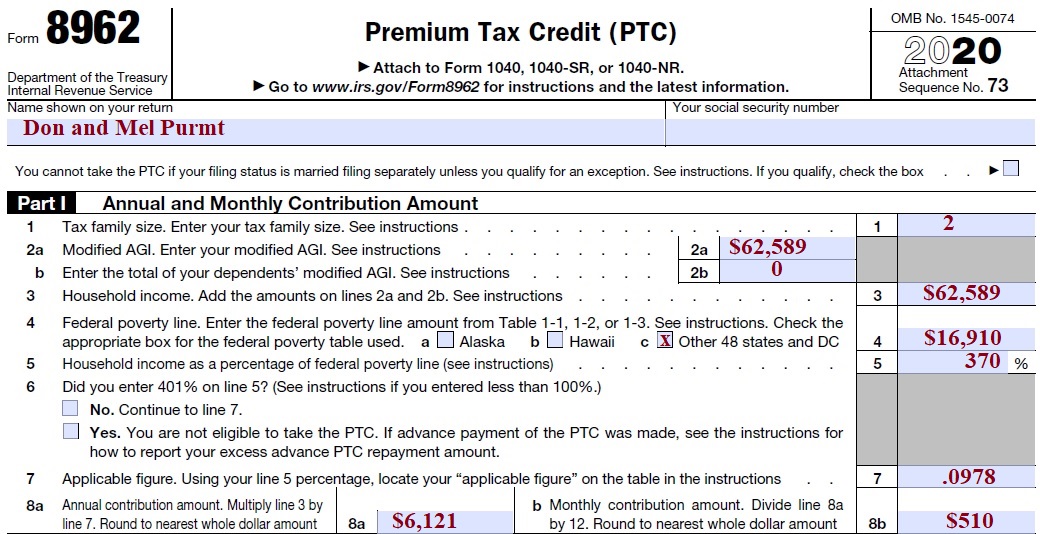

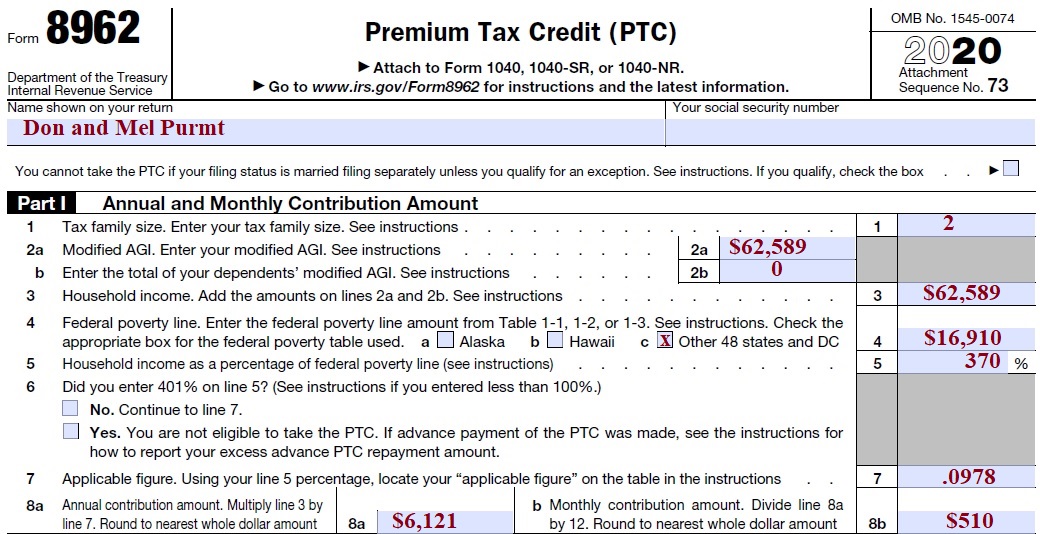

Making a claim during the year click the Manage your tax link in PAYE Services select Claim tax credits select Medical Insurance Relief under the category Health For 2019 and subsequent years sign into myAccount click on Review your tax 2019 2022 link in PAYE Services request Statement of Liability This tax credit helps make purchasing health insurance coverage more affordable for people with low to moderate incomes The premium tax credit is refundable so even if you have little or no income tax liability you still may benefit Eligible taxpayers may choose to have the Health Insurance Marketplace make advance payments of the premium

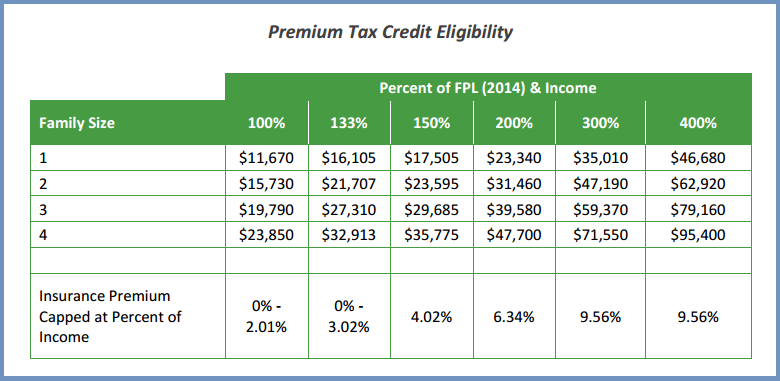

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit The Premium Tax Credit is a tax credit intended to subsidize the purchase of health plans offered through the federal and state health benefit exchanges The size of your credit will

Download Tax Credit On Health Insurance Premiums

More picture related to Tax Credit On Health Insurance Premiums

FAQs Health Insurance Premium Tax Credits

https://www.peoplekeep.com/hs-fs/hub/149308/file-2079603627-png/tax_credit_chart.png?width=1815&name=tax_credit_chart.png

Which Is Better Paying Health Insurance Premiums Pre Tax Or Post Tax

https://i1.wp.com/goneonfire.com/wp-content/uploads/2019/12/014b_Which-is-Better_-Paying-Health-Insurance-Premiums-Pre-Tax-or-Post-Tax_.png?fit=1200%2C800&ssl=1

AGH Health Care Tax Credit Is Your Business Eligible

http://aghlc.com/images/health-care-tax-credit.jpg

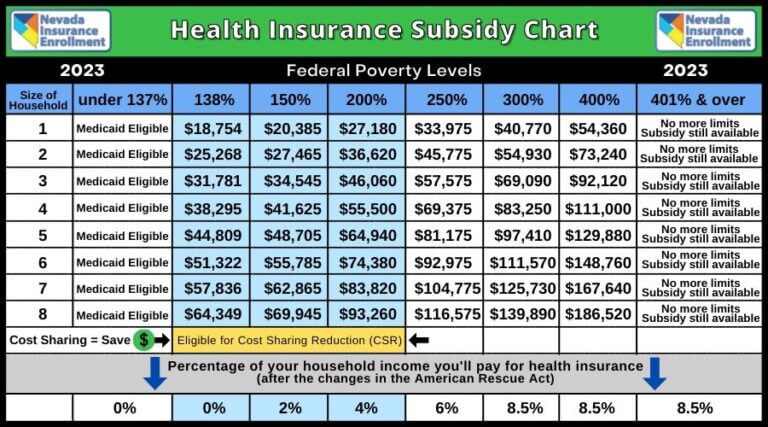

Premium tax credit A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put on your Marketplace application Refer to glossary for more details As part of the American Rescue Plan Act ARPA of 2021 the Biden administration s first tax base bill the premium tax credit was opened up to far more taxpayers via a temporary extension for individuals with incomes above 400 of the FPL and a more generous subsidy for those below 400

The premium tax credit is a refundable tax credit that can help lower your insurance premium costs when you enroll in a health plan through the Health Insurance Marketplace You can receive this credit before you file your return by estimating your expected income for the year when applying for coverage in the Marketplace Everything You Need to Know About The Health Care Tax Credit Need to get health insurance through an Affordable Care Act exchange You may be eligible for help Image credit Getty

Pin On Health Insurance PNG

https://i.pinimg.com/originals/98/9d/d3/989dd30feffdf2541e4ede7aea07ac03.png

What Is Health Insurance Marketplace What You Need To Know Health

https://www.healthplansinoregon.com/wp-content/uploads/2017/06/Photo-minimal-new-product-neutral-social-media-4-2.png

https://www.nerdwallet.com/article/taxes/premium-tax-credit

The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan

https://www.irs.gov/affordable-care-act/individuals...

The Premium Tax Credit helps eligible individuals and families afford health insurance purchased through the Health Insurance Marketplace The IRS will soon mail letters on behalf of the Center for Medicare Medicaid Services sharing information about obtaining Marketplace healthcare coverage

.png)

Health Insurance Income Limits For 2023 To Receive ACA Premium S

Pin On Health Insurance PNG

Health Insurance 101 What You Need Before Choosing A Plan

Health Insurance Premiums Continued To Rise In 2018 Arkansas Business

Insurance Premium Tax Increase Connect Insurance

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

GST And Its Effects On Health Insurance Premium

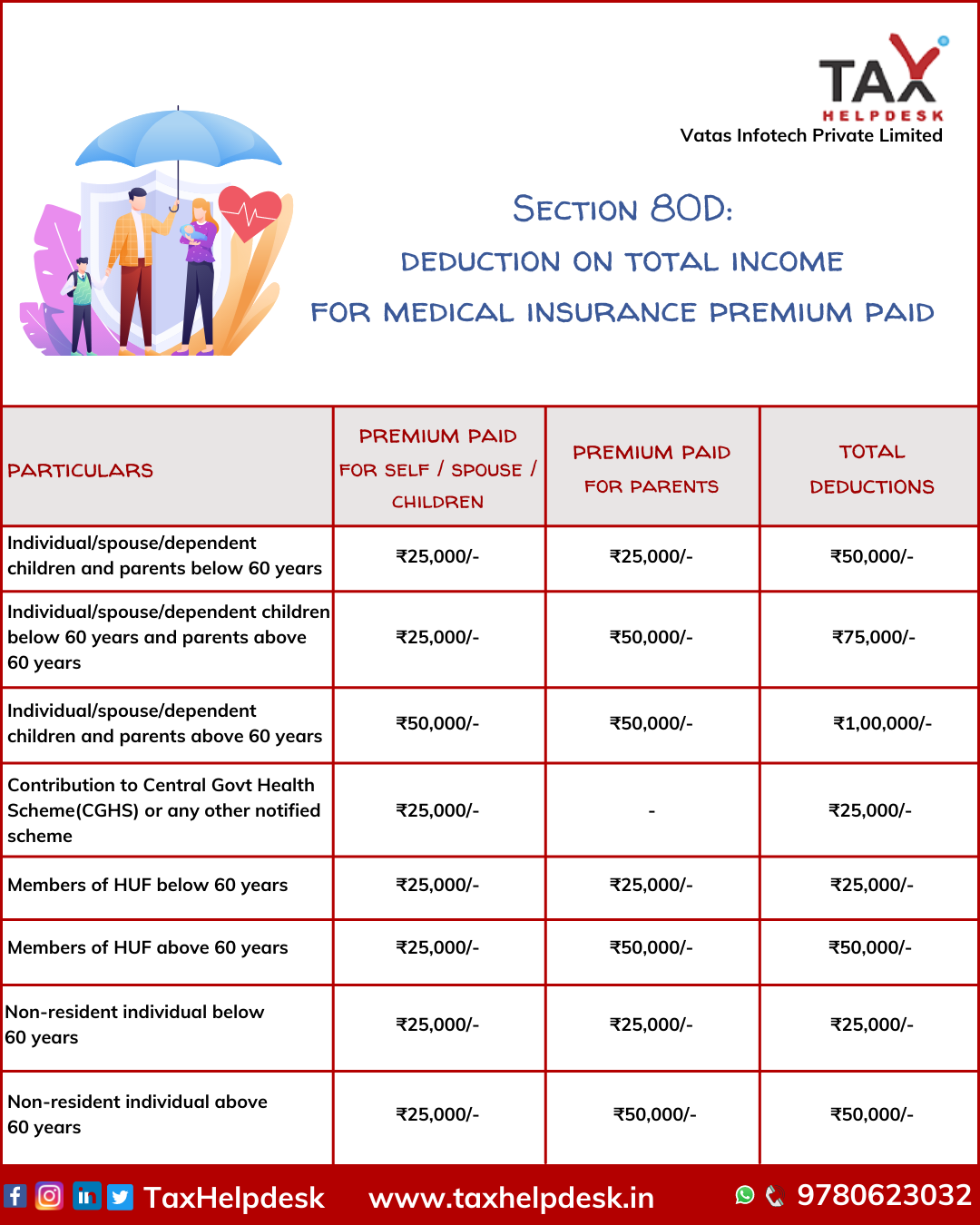

Know Tax Benefits On Health Insurance And Medical Expenditure TaxHelpdesk

How To Save Money On Health Insurance Premiums Save On Health

Tax Credit On Health Insurance Premiums - The Premium Tax Credit is a tax credit intended to subsidize the purchase of health plans offered through the federal and state health benefit exchanges The size of your credit will