Tax Deduction On Health Insurance Premium You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet

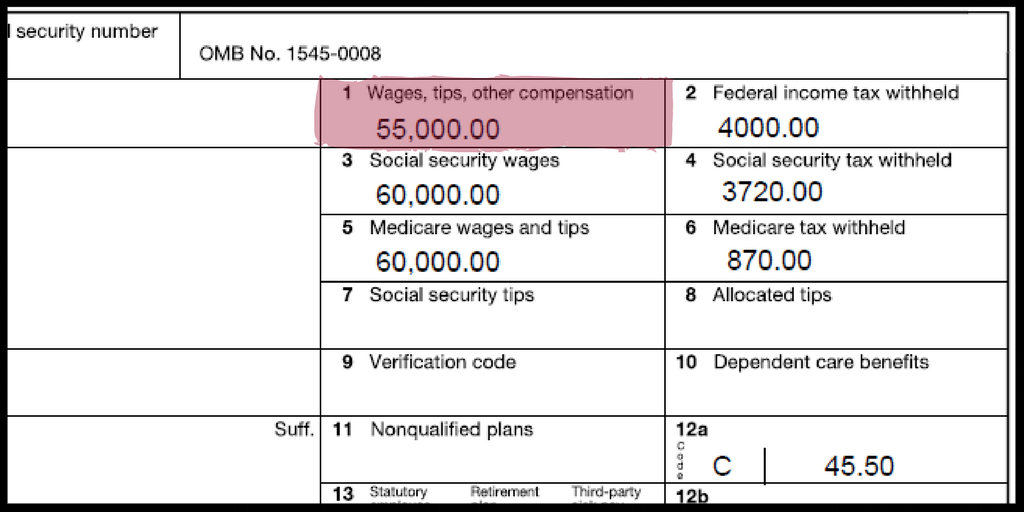

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath If you didn t pay for health insurance you can t take a tax deduction for it If your employer pays your health insurance premiums you can t deduct those costs However if an employer only pays for part of your premiums you still may be able to claim a deduction for the portion you paid

Tax Deduction On Health Insurance Premium

Tax Deduction On Health Insurance Premium

https://www.forbes.com/advisor/wp-content/uploads/2022/08/tax-calculator.jpeg.jpg

5 Powerful Tax Deduction Tips Every Insurance Agency Owner Must Know

https://blog.club.capital/hubfs/CC_Social 5 Tax-Saving Strategies for Insurance Agents-png-1.png

Tax Deduction Letter PDF Templates Jotform

https://files.jotform.com/jotformapps/tax-deduction-letter-c1c1da39f77a424f295c2df1cb0f2b87.png

The answer Maybe depending on various factors including how you get your coverage whether you re self employed whether you itemize your deductions and how much you spend on medical costs including your health insurance premiums This is an adjustment to income rather than an itemized deduction for premiums you paid on a health insurance policy covering medical care including a qualified long term care insurance policy for yourself your spouse and dependents

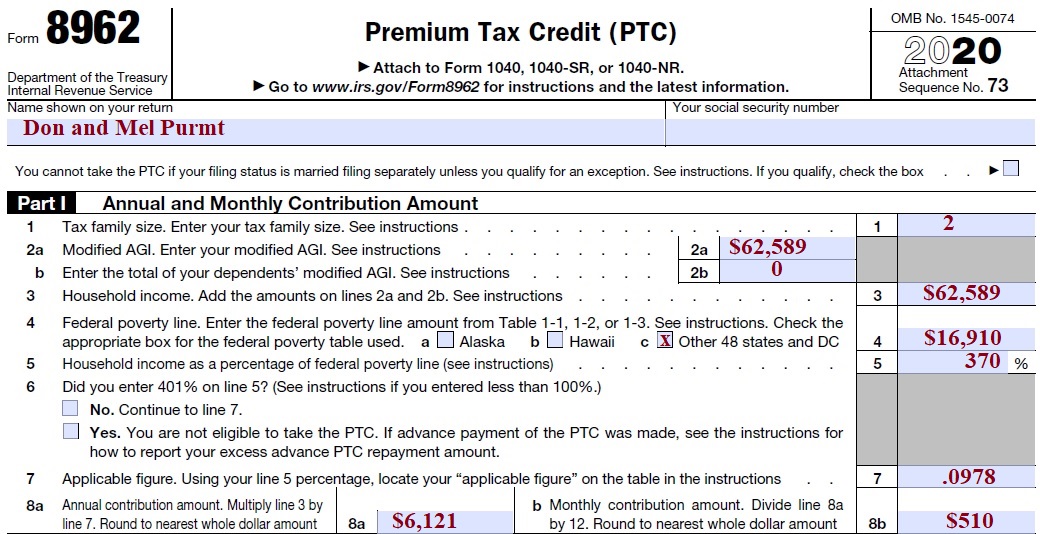

You may be able to deduct the cost of health insurance premiums on your income tax return You may need to itemize your deductions to take this deduction What is the Premium Tax Credit updated Feb 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium Tax Credit updated Feb 24 2022 Q4 What happens if my income family size or other circumstances changes during the year updated Feb 24 2022 Eligibility Q5

Download Tax Deduction On Health Insurance Premium

More picture related to Tax Deduction On Health Insurance Premium

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

https://carajput.com/blog/wp-content/uploads/2023/05/Deduction.jpg

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Preventive Check Up 80d Wkcn

https://emailer.tax2win.in/assets/guides/all_images/Section-80D-Summary.jpg

You can deduct on Schedule A Form 1040 only the part of your medical and dental expenses that is more than 7 5 of your adjusted gross income AGI This publication also explains how to treat impairment related work expenses and health insurance premiums if you are self employed Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only the amount above that threshold Few taxpayers qualify for the deduction

Your health insurance premiums can be tax deductible if you have income from self employment and you aren t eligible to participate in a health plan offered by an employer or your spouse s Even with tax subsidies health insurance premiums are often costly You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows you to deduct up to 100 of your premiums

Health Insurance Tax Deductions On Premium

https://www.acko.com/wp-content/uploads/2019/07/10-Things-to-Know-About-Tax-Deductions-on-Health-Insurance-Premium.png

Employee Income Tax Deduction Form 2023 Employeeform

https://i0.wp.com/www.employeeform.net/wp-content/uploads/2022/07/pdf-form-16a-tax-deduction-certificate-pdf-download-instapdf.jpg

https://www.investopedia.com/are-health-insurance...

You can deduct your health insurance premiums and other healthcare costs if your expenses exceed 7 5 of your adjusted gross income AGI Self employed individuals who meet

https://www.forbes.com/advisor/health-insurance/is...

Health insurance premiums and costs may be tax deductible but whether you should deduct health care from your taxes depends on how much you spent on medical care and how you get heath

Epf Contribution Table For Age Above 60 2019 Frank Lyman

Health Insurance Tax Deductions On Premium

Are Health Insurance Premiums Tax Deductions In Canada

Health Insurance 1095A Subsidy Flow Through IRS Tax Return

Tax Deduction Template

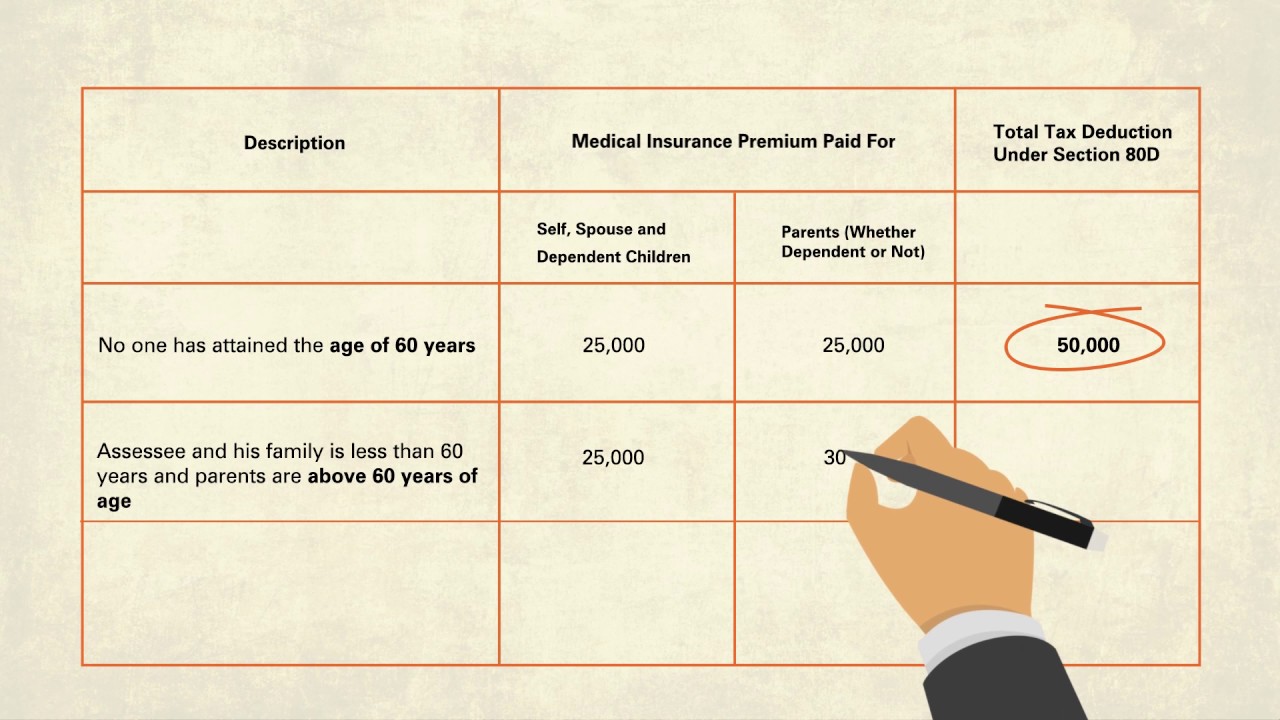

Section 80D Deduction For Medical Insurance Health Checkups 2019

Section 80D Deduction For Medical Insurance Health Checkups 2019

Tax Deduction Of Health Insurance Premium YouTube

DEDUCTION FOR MEDICAL INSURANCE PREMIUM PREVENTIVE HEALTH CHECK UP

W 2 Doctored Money

Tax Deduction On Health Insurance Premium - What is the Premium Tax Credit updated Feb 24 2022 Q2 What is the Health Insurance Marketplace Q3 How do I get advance payments of the Premium Tax Credit updated Feb 24 2022 Q4 What happens if my income family size or other circumstances changes during the year updated Feb 24 2022 Eligibility Q5