Energy Credit Water Heater 2022 Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit Certain ENERGY STAR certified gas water heaters meet the requirements for this tax credit Water heaters account for 12 of the energy consumed in your home

Energy Credit Water Heater 2022

Energy Credit Water Heater 2022

https://www.lochinvar.com/news/737246ShieldNewsThumb6_20.png

Buy GESAIL 1500W Electric Immersion Heater Bucket Water Heater With

https://m.media-amazon.com/images/I/61c0wNl9koL.jpg

Northeastern Commercial Water Heater Electric 30 Gallon 3 Year

https://www.statewaterheaters.com/media/commercial/jpg/pce_30.jpg

The federal tax credits for energy efficiency were extended as part of the Inflation Reduction Act IRA of 2022 So if you made any qualifying home improvements to your primary residence after December 31 2021 you Beginning 2023 the expanded version of 25C now called the Energy Efficient Home Improvement Tax Credit under the Inflation Reduction Act of 2022 will provide up to 2 000 in tax credits for

The Inflation Reduction Act of 2022 P L 117 169 expanded and renamed the nonbusiness energy property credit as the energy efficient home improvement Up to 2 000 for efficient heating cooling and water heating equipment such as a heat pump Up to 1 200 for measures that reduce home energy waste like efficient windows doors and insulation

Download Energy Credit Water Heater 2022

More picture related to Energy Credit Water Heater 2022

ENERGY STAR Certified Gas Water Heaters At Lowes

https://mobileimages.lowes.com/product/converted/035505/035505167675.jpg

Bathtub Heater 3000w Electric Immersion Heater Travel Immersion Heater

https://img.fruugo.com/product/6/15/190385156_max.jpg

How Much Does It Cost To Repair Or Replace A Water Heater HomeServe USA

https://library.homeserve.com/m/4bd46ca29f141947/Blog-HOMESERVEUSA-PSEG-2019ModernFotographicbyDaveNoonan-99.jpg

Oil furnaces or hot water boilers if they meet or exceed 2021 Energy Star efficiency criteria and are rated by the manufacturer for use with fuel blends at least 20 of the volume of In August 2022 the Inflation Reduction Act amended two credits available for energy efficient home improvements and residential clean energy equipment so that they last longer and have a greater

The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide Electric heat pump water heaters qualify for the home improvement tax credit only if they have a Uniform Energy Factor of at least 2 2 Natural gas oil or propane hot water

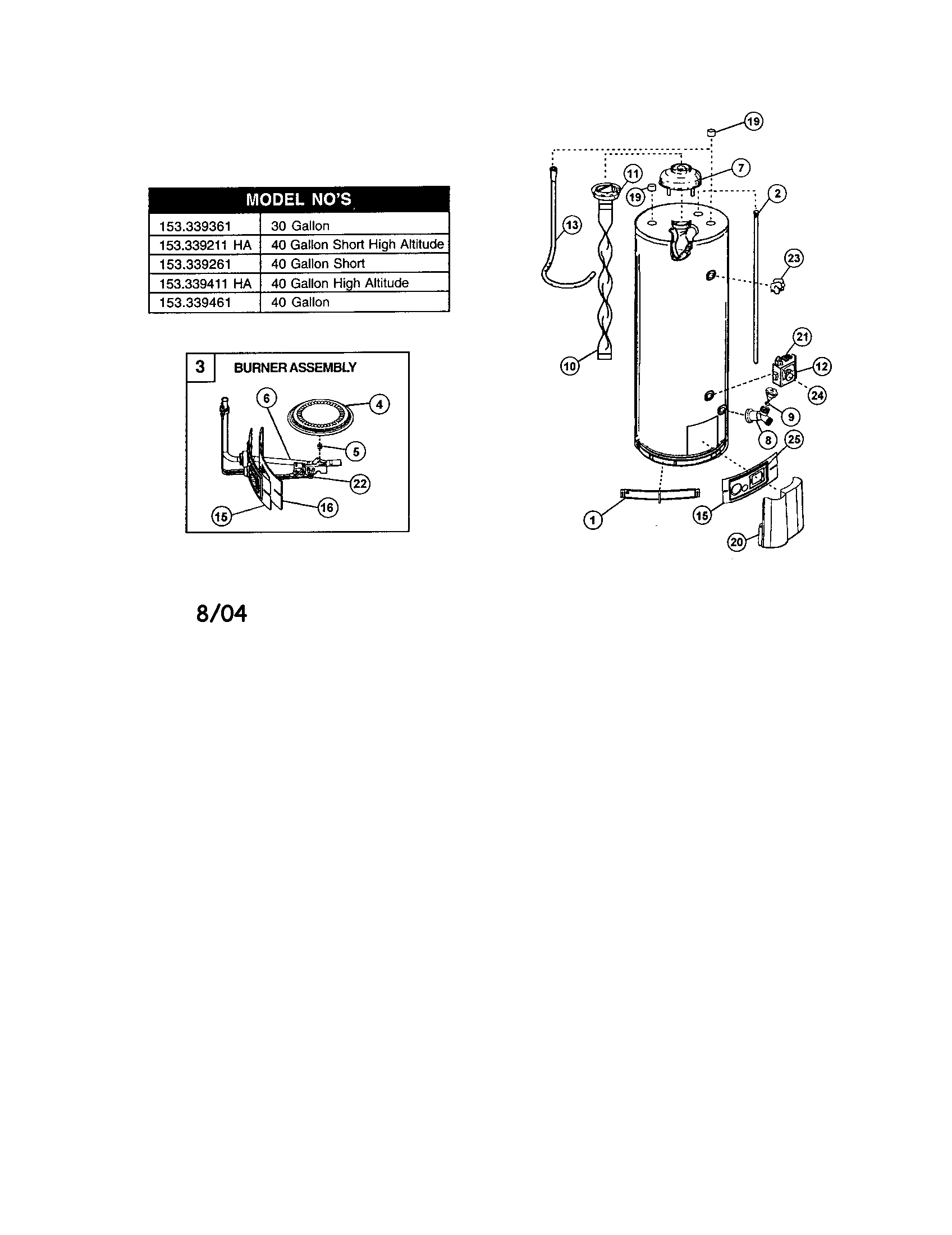

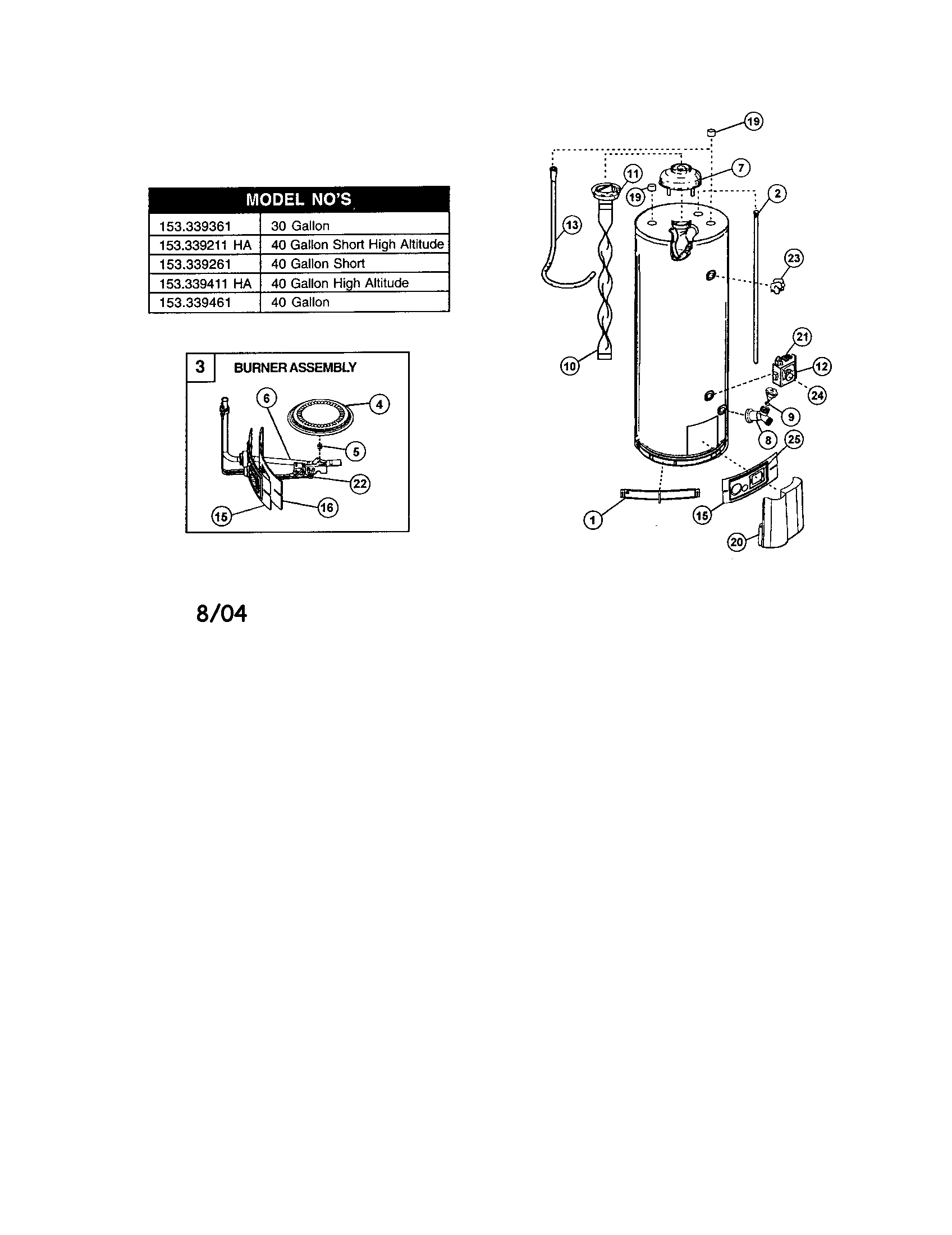

KENMORE WATER HEATER Parts Model 153339461 Sears PartsDirect

http://c.searspartsdirect.com/lis_png/PLDM/P0408099-00001.png

Heat Pump Boiler

https://whsisi.com/asset/files/urun/elektrikli-termosifon.png

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

Through December 31 2022 the energy efficient home improvement credit is a 500 lifetime credit As amended by the IRA the energy efficient home improvement credit is

https://www.irs.gov/credits-deductions/home-energy-tax-credits

2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit

KENMORE WATER HEATER Parts Model 153339461 Sears PartsDirect

Rooftop Solar Water Heater Installation At Rs 20000 Solarizer Solar

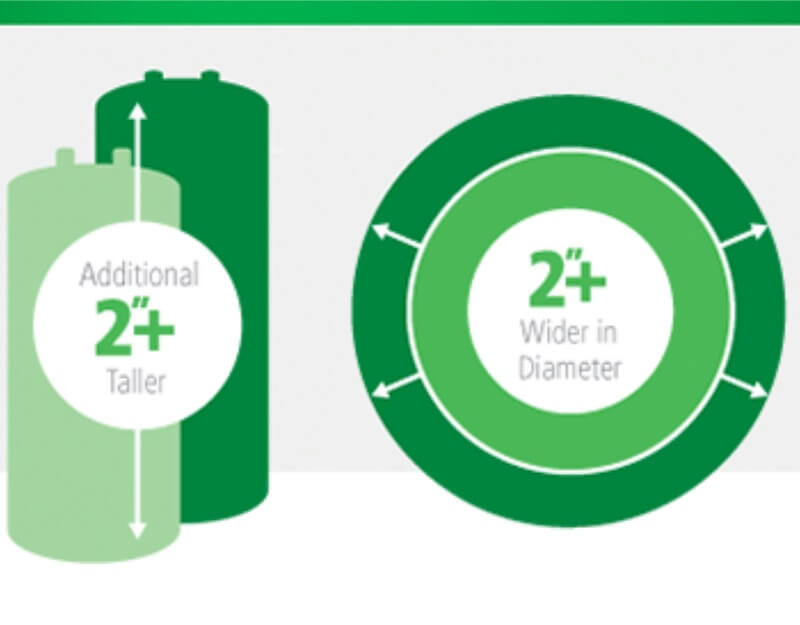

New Water Heater Energy Standards

Fischer Best Gas Saver Water Heater Eco Models Order Now

How Does A Hot Water Heater Work

How Does A Hot Water Heater Work

Buy HQMPC Tankless Water Heater Isolation Valves Tankless Water Heater

Direct Indirect Fired Water Heater ECOTHERM

Electric Water Heater Tune Up Kit DIY Home Improvement Forum

Energy Credit Water Heater 2022 - As part of the Inflation Reduction Act of 2022 signed into law on August 16 2022 residential energy efficiency tax credits have been extended through 2032 Prior tax