Energy Rebates 2024 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving

Energy Rebates 2024

Energy Rebates 2024

https://atlantickeyenergy.com/wp-content/uploads/2022/10/what-solar-energy-rebates-and-incentives-are-available-1-1278x581.jpg

Energy Rebates Don t Leave Money On The Table Schmidt Associates

http://schmidt-arch.com/wp-content/uploads/2018/02/Energy-Rebates-Charts.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

Program Overview Questions 1 What is the Inflation Reduction Act 2 Which provisions in the Inflation Reduction Act IRA establish home energy rebates 3 HOW MUCH MONEY IS THERE FOR HOME ENERGY REBATES 4 What is U S Department of Energy s timeline for distributing these funds to states and Indian Tribes 5 The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

The Inflation Reduction Act of 2022 has a bunch of incentives aimed at helping you make your home more energy efficient This year and next a few more incentives will roll out Kara Saul Rinaldi Energy Efficiency Tax Credits for 2024 Update The tax credits listed below became available on January 1 2023 and can be claimed when you file your income taxes for 2023 If you don t qualify for energy efficiency rebates there are tax credits in the Inflation Reduction Act that can reduce the cost of home electrification projects

Download Energy Rebates 2024

More picture related to Energy Rebates 2024

Apply Energy Rebates Ontario

https://assets.cdn.filesafe.space/2ONudgiDZKVQR7h1o2sC/media/6411ebd362300014f8cee92c.png

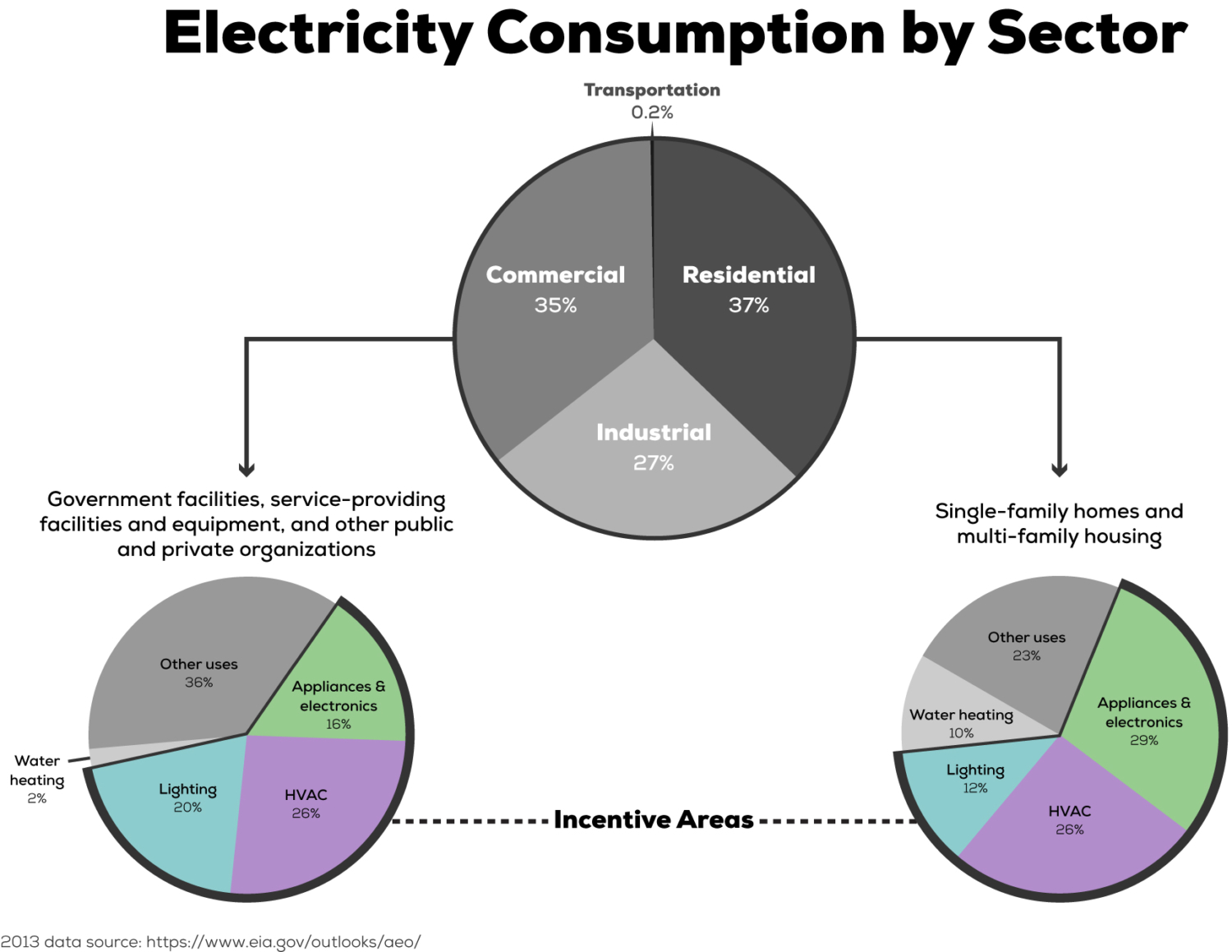

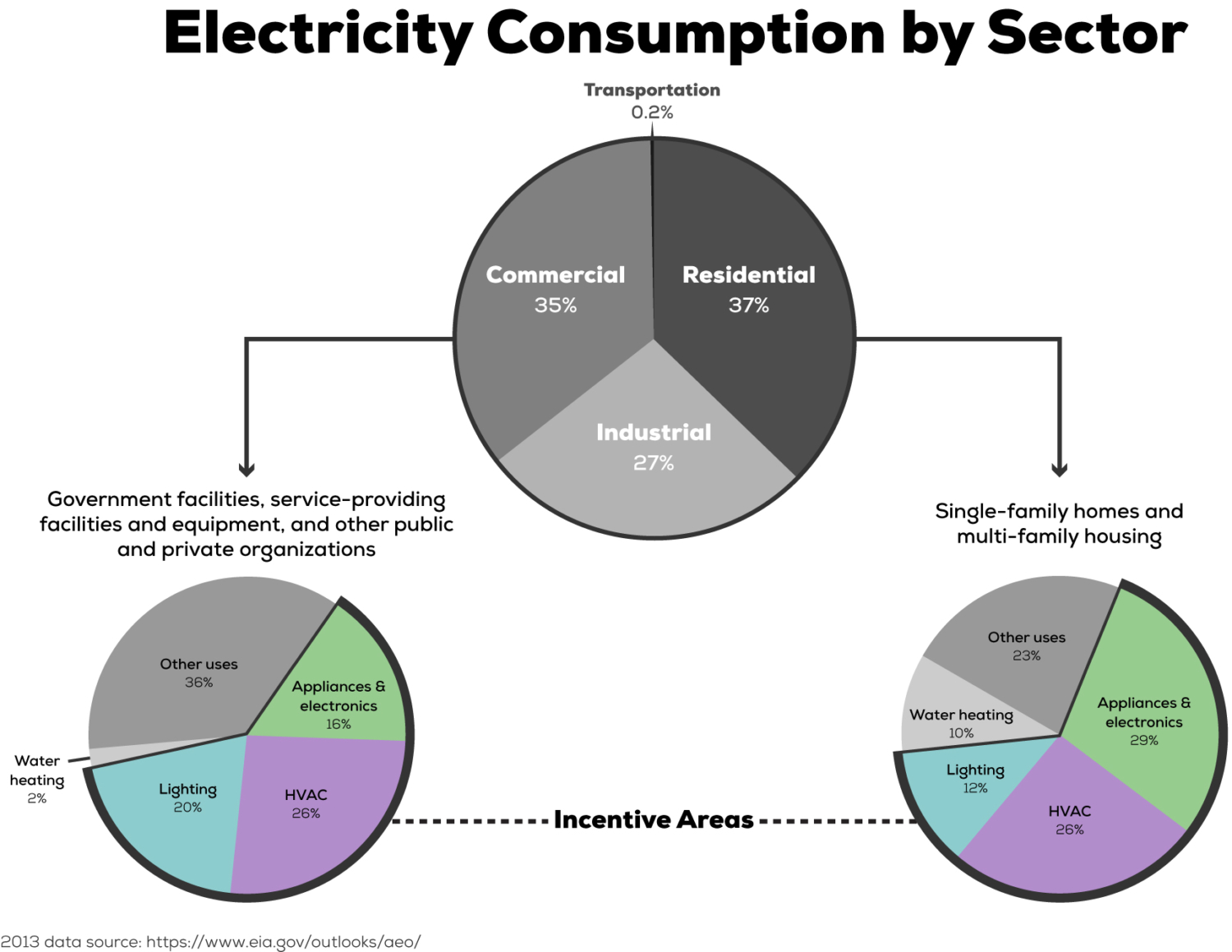

Energy Rebates And Incentives For Single Family Housing Pay Off

https://s.propertyware.com/wp-content/uploads/2014/05/energy-rebates.jpg

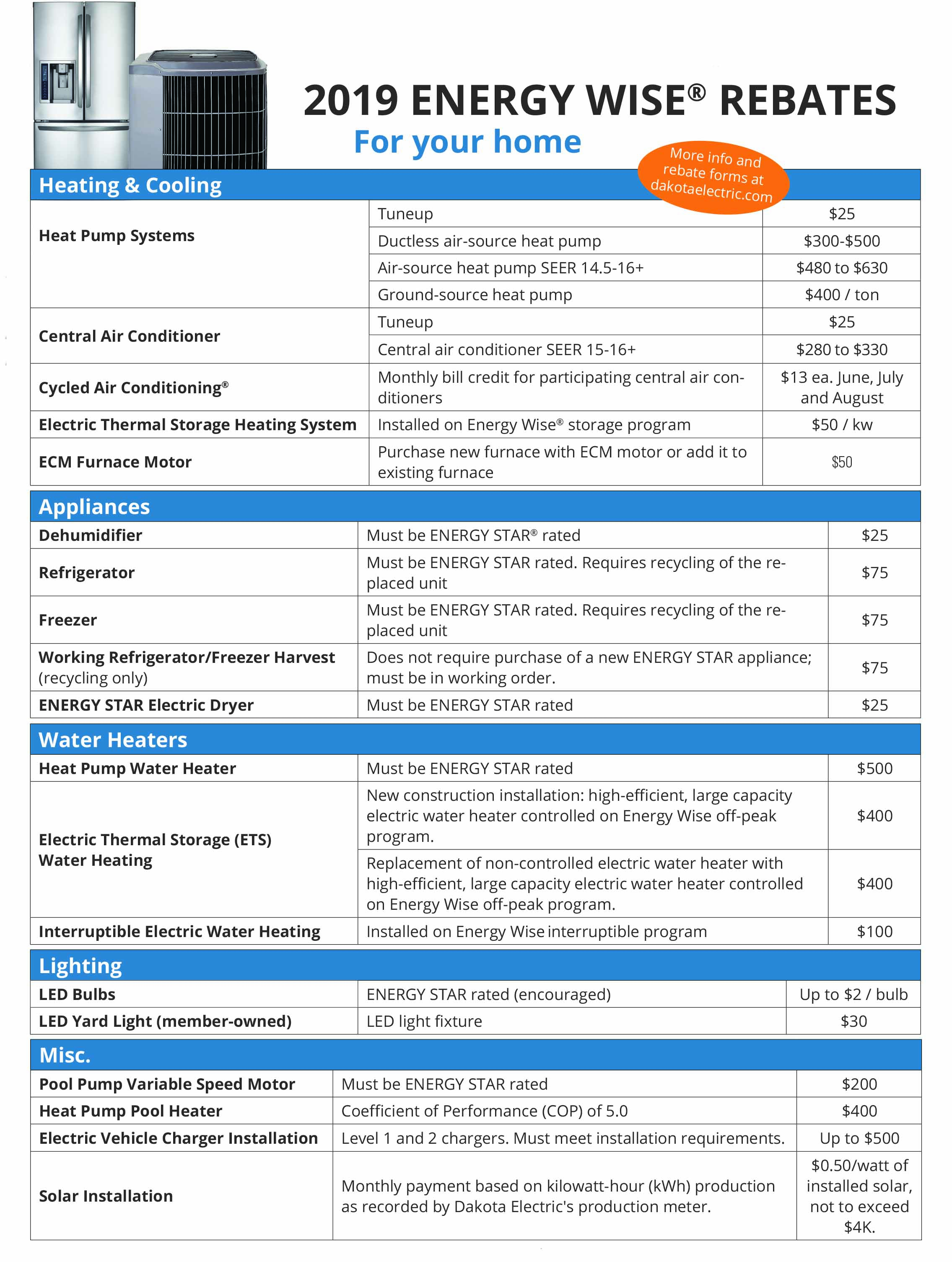

2019 Energy Wise Rebates Dakota Electric Association

https://www.dakotaelectric.com/wp-content/uploads/2019/01/RebateSummary2019-e1548880063852.jpg

Jan 13 2023 The Inflation Reduction Act also includes a 2 000 federal tax credit for heat pumps which can be taken now Some states and utilities also offer their own rebates For heat pump and heat pump water heater projects the tax credit amount is 30 of the total project cost includes equipment and installation up to a 2 000 maximum So if your project

The act includes funding for contractor training The Inflation Reduction Act Home Energy Rebate Programs will be designed and implemented in accordance with the requirements established by the United States Department of Energy DOE The DOE released updated program guidance to states on October 15 2023 The estimated energy savings of the products or measures 3 the workmanship of any third parties 4 the installation of use of the products or measures including but not limited to effects on indoor pollutants or 5 any other matter with respect to the 2024 Home Energy Efficiency Rebate Program I waive any and all claims against

Canadian Clean Energy Rebates Incentives The Sundamentals Project

https://sundamentals.ca/wp-content/uploads/2022/02/Rebates-1.png

Compare Energy Rebates And Concessions In Vic LIFESTYLE BY PS

https://cdn.shopify.com/s/files/1/0162/2116/articles/Energy_Rebates_1200x1200.jpg?v=1629980940

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

2022 Home Energy Rebates Grants And Incentives Top Rated Barrie Windows Doors Company

Canadian Clean Energy Rebates Incentives The Sundamentals Project

How To Look For Energy Rebates In Your Location YouTube

Energy Efficiency Rebates And Tax Credits 2023 New Incentives For Home Electrification Solar

Energy Rebates YouTube

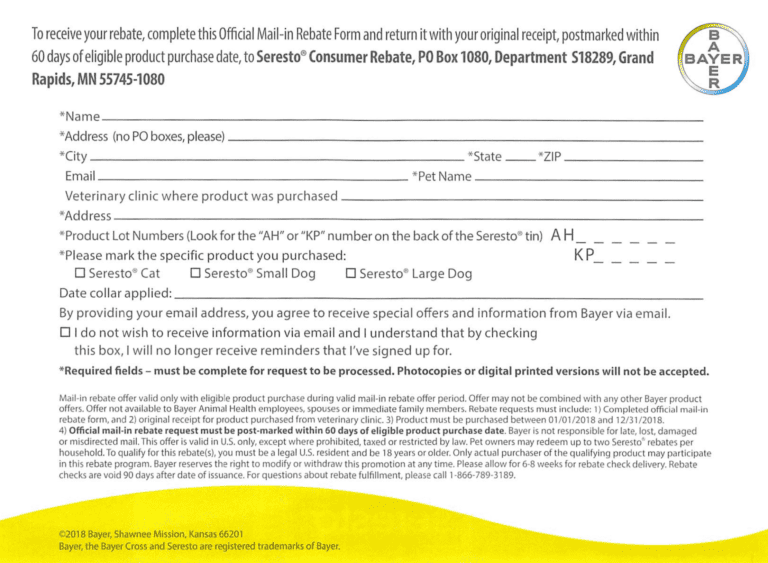

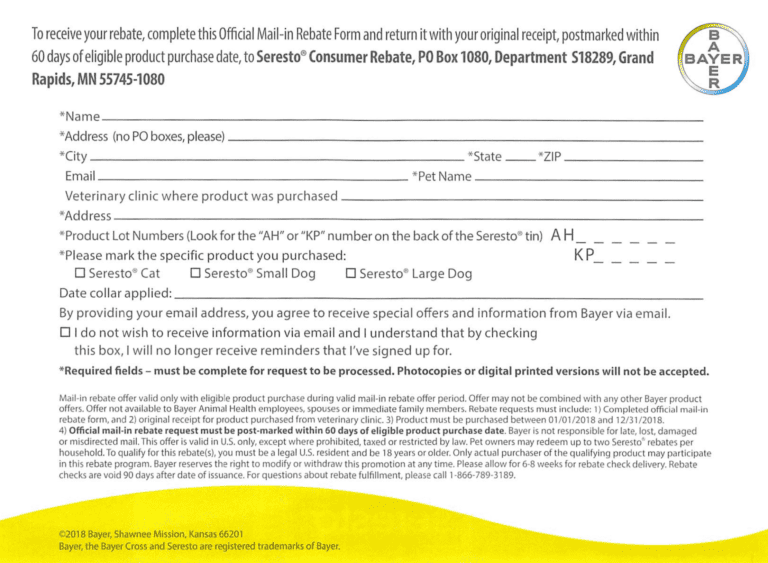

Seresto Rebate Form PrintableRebateForm

Seresto Rebate Form PrintableRebateForm

InlandNWrealestategal

2024 YouTube

InnoLED Lighting Understanding Energy Rebates

Energy Rebates 2024 - As of January 2024 DEQ is applying for the planning grant funding for the Home Rebate programs With those funds DEQ will continue designing the state rebate program and application The State Energy Office will release more information as soon as it is available