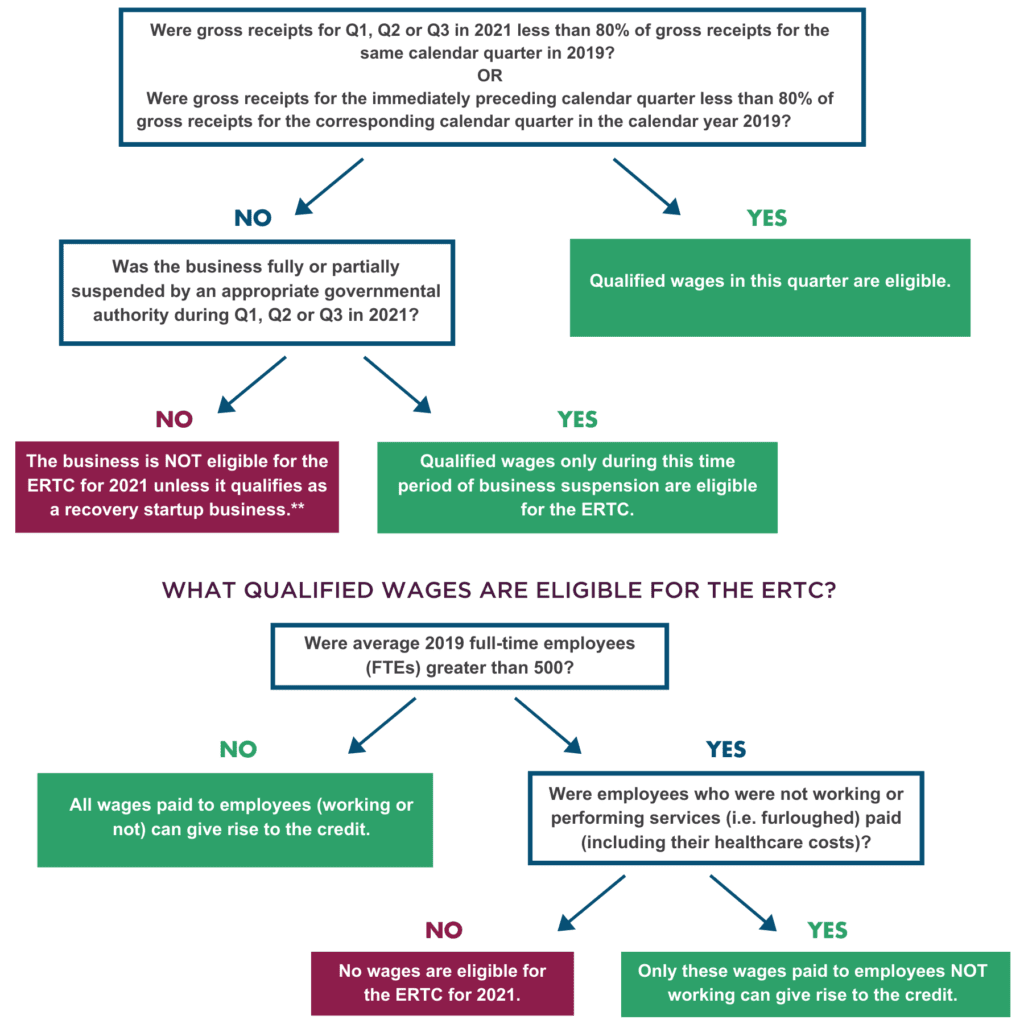

Ertc Tax Credit Qualifications The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax exempt organizations The requirements are different depending on the time period for which you claim the credit

The credit is equal to 50 percent of qualified wages paid including qualified health plan expenses for up to 10 000 per employee in 2020 The maximum credit available for each employee is 5 000 in 2020 Calculation of the Credit The amount of the credit is 50 of the qualifying wages paid up to 10 000 in total It is effective for wages paid after March 13 th and before December 31 2020 The definition of qualifying wages varies by whether an employer had on average more or less than 100 employees in 2019 Less than 100

Ertc Tax Credit Qualifications

Ertc Tax Credit Qualifications

https://i.ytimg.com/vi/MTexk06nrJQ/maxresdefault.jpg

ERTC Tax Credit Qualifications Are You Eligible KatzAbosch

https://www.katzabosch.com/wp-content/uploads/2021/01/iStock-504572064_tax-credit-1536x1024.jpg

Simple ERTC Eligibility Check Fast Application 2020 2021 Payroll

https://ampifire.com/video/images/stock-pexels-photo-3483098.jpeg

Eligibility Significant Decline in Gross Receipts Fully or Partially Suspended Operations Amount of the Employee Retention Credit For 2020 For 2021 Receiving the Employee Retention Credit Relation to other tax deductions Fraud Temporary suspension of processing new claims Employee Retention Credit after Hurricanes Employee Retention in 2021 In addition to claiming tax credits for 2020 small businesses should consider their eligibility for the ERC in 2021 The ERC is now available for all four quarters of 2021 up to 7 000 per quarter

In addition to limiting ERC claims to those filed before Feb 1 2024 the bill also contains provisions that 1 increase penalties for aiding and abetting the understatement of a tax If your business meets the criteria set by the IRS you might qualify for the Employee Retention Tax Credit ERTC Take this 2 minute quiz to learn about your ERTC eligibility This cash relief is substantial eligible companies can credit up to 26 000 per employee

Download Ertc Tax Credit Qualifications

More picture related to Ertc Tax Credit Qualifications

Easy ERTC Qualifications Check 2022 Get CARES Act Tax Credit With PPP

https://ampifire.com/files/uploaded_images/18232a69af3c7441584b73ed84e99225.jpg

Simple ERTC Tax Credit Calculator For Startups Non Profits Maximizes

https://www.dailymoss.com/wp-content/uploads/2022/09/simple-ertc-tax-credit-calculator-for-startups-amp-non-profits-maximizes-refunds-632abe74e10f0.jpg

What To Know About ERTC Tax Credit Tfmnews

https://assets.tfmnews.com/wp-content/uploads/2022/09/20220907193218-6318f1c27f6ab-1024x435.png

TAX Guidance on claiming the ERC for third and fourth quarters of 2021 By Paul Bonner August 5 2021 TOPICS The IRS issued Notice 2021 49 Wednesday that includes guidance on the extension and modification of the employee retention credit ERC under Sec 3134 added by the American Rescue Plan Act ARPA P L 117 2 For 2021 the employee retention credit ERC is a quarterly tax credit against the employer s share of certain payroll taxes The tax credit is 70 of the first 10 000 in wages per employee in each quarter of 2021 That means this credit is worth up to 7 000 per quarter and up to 28 000 per year for each employee

Eligible businesses could qualify for tax credits worth thousands of dollars per employee For 2020 an employer could claim a credit of up to 5 000 per worker An extension of the Jim Probasco Updated December 01 2023 Reviewed by Robert C Kelly Investopedia Theresa Chiechi Who Can Still Claim the Employee Retention Credit ERC How the ERC Worked What Employers

ERTC Eligibility Who Qualifies For The Employee Retention Tax Credit

https://i.ytimg.com/vi/Pt_NVlVFAos/maxresdefault.jpg

ERC Get Money Now ERTC Tax Credit ERTC Qualifications ERC Tax Credit

https://i.ytimg.com/vi/8RrHsNqq7Wc/maxresdefault.jpg

https://www.irs.gov/coronavirus/frequently-asked...

The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax exempt organizations The requirements are different depending on the time period for which you claim the credit

https://www.irs.gov/newsroom/irs-provides-guidance...

The credit is equal to 50 percent of qualified wages paid including qualified health plan expenses for up to 10 000 per employee in 2020 The maximum credit available for each employee is 5 000 in 2020

What Is ERTC Tax Credit ScottHall co

ERTC Eligibility Who Qualifies For The Employee Retention Tax Credit

What Is ERTC Tax Credit ScottHall co

Fast Free ERTC Eligibility Assessment Get Tax Credit Help In

The Employee Retention Tax Credit Or ERTC Everything You Need To Know

ERTC Qualifications Provide Solutions LLC

ERTC Qualifications Provide Solutions LLC

ERTC Tax Credit Accupay Small Business Payroll Www accupayco

Is Your Business Eligible For The ERTC Anders CPA

ERTC Qualifications Requirements For 2020 Live Rank Sniper

Ertc Tax Credit Qualifications - If your business meets the criteria set by the IRS you might qualify for the Employee Retention Tax Credit ERTC Take this 2 minute quiz to learn about your ERTC eligibility This cash relief is substantial eligible companies can credit up to 26 000 per employee