Ertc Tax Credit The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax exempt organizations The requirements are different depending on the time period for which you claim the credit

Part A Checking your eligibility Part B Claiming the ERC if you re eligible Part C Resolving an incorrect ERC claim You can use this question and answer tool to see if you might be eligible for the Employee Retention Credit ERC or ERTC The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit ERTC is a U S federal tax credit that was available to certain employers most recently during the COVID 19 pandemic

Ertc Tax Credit

Ertc Tax Credit

https://assets.tfmnews.com/wp-content/uploads/2022/09/20220907193218-6318f1c27f6ab-1024x435.png

Contact ERTC ERTC Employee Retention Tax Credit

https://ertc.io/wp-content/uploads/2022/01/ERTC-Logo-1.png

.jpg)

Where To Mail 941 X Baron Payroll

https://www.baronpayroll.com/hubfs/MicrosoftTeams-image (43).jpg

The Employee Retention Credit ERC was a refundable payroll tax credit for qualified wages paid to retained employees originally from March 13 2020 to Dec 31 2020 It was created by The credit is 50 of up to 10 000 in wages paid by an employer whose business is fully or partially suspended because of COVID 19 or whose gross receipts decline by more than 50

Introduced as part of the 2020 pandemic relief package known as the CARES Act the employee retention credit is a refundable payroll tax credit for employers The ERC was intended to The ERC was created as part of the CARES Act to provide companies with a refundable tax credit to incentivize employers to continue to pay workers while their businesses are affected by

Download Ertc Tax Credit

More picture related to Ertc Tax Credit

What Is ERTC Tax Credit ScottHall co

https://scotthall.co/wp-content/uploads/2022/04/figuring-out-what-is-ERTC-Tax-Credit-1536x1024.jpg

Easy ERTC Calculator

https://public-files.gumroad.com/variants/emtc6c11k4xc96nwlgbwztt3mw3m/3298c3eb001bbed90f1d616da66708480096a0a1b6e81bd4f8a2d6e9b831d301

Employee Retention Tax Credit ERTC Key 2021 Updates MP

https://mp-hr.com/wp-content/uploads/2021/03/ERTC-324.jpg

The employee retention tax credit ERTC also known as the employee retention credit ERC is a refundable credit available to eligible businesses that paid qualified wages after March 12 2020 through the end of the program to keep their staffs employed during the height of the COVID 19 pandemic A part of the 2020 CARES Act the Employee Retention Credit ERC also referred to as the Employee Retention Tax Credit ERTC is a refundable payroll tax credit designed to help small

[desc-10] [desc-11]

ERTC Tax Credit Qualifications Manage In

https://www.managein.org/storage/2023/04/ERTC-Tax-Credit-Qualifications.jpg

IRS Auditing ERTC Tax Credit Fraud The Tech Savvy CPA

https://www.thetechsavvycpa.com/wp-content/uploads/2022/10/IRS-Auditing-ERTC-Tax-Credit-Fraud.jpg

https://www.irs.gov/coronavirus/frequently-asked...

The Employee Retention Credit ERC sometimes called the Employee Retention Tax Credit or ERTC is a refundable tax credit for certain eligible businesses and tax exempt organizations The requirements are different depending on the time period for which you claim the credit

https://www.irs.gov/newsroom/employee-retention...

Part A Checking your eligibility Part B Claiming the ERC if you re eligible Part C Resolving an incorrect ERC claim You can use this question and answer tool to see if you might be eligible for the Employee Retention Credit ERC or ERTC

ERTC Tax Credit 2022 For Business Small Business Recovery YouTube

ERTC Tax Credit Qualifications Manage In

ERTC Qualifications Requirements For 2020 Live Rank Sniper

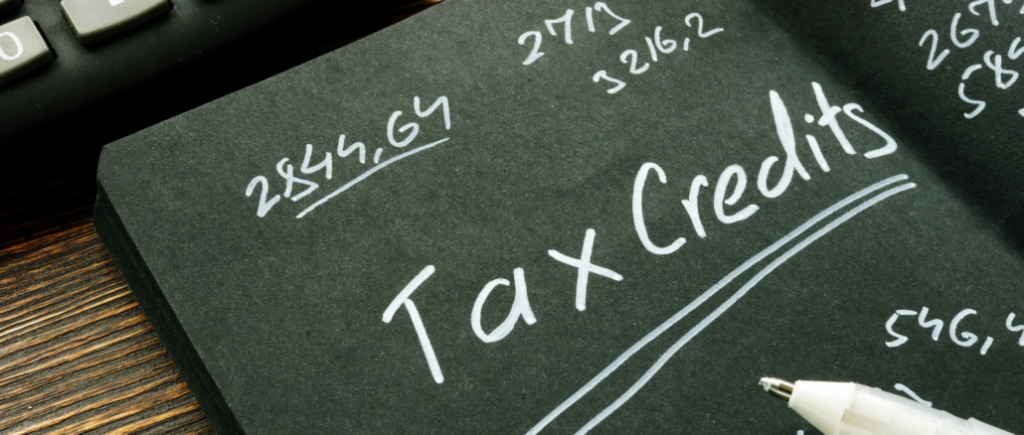

What You Should Know About The Employee Retention Tax Credit Webinar

Tax Attorney Explains ERTC Tax Credit 2023 Update YouTube

ERTC Employee Retention Tax Credit See Link Below 28 000 PER

ERTC Employee Retention Tax Credit See Link Below 28 000 PER

Easy ERTC Qualifications Check 2022 Get CARES Act Tax Credit With PPP

WEBINAR NUEVO ESTIMULO ECONOMICO EMPLOYEE RETENTION TAX CREDIT ERTC

Employee Retention Tax Credit How It Works And How To Get It Payroll

Ertc Tax Credit - [desc-13]