Estimate Child Care Tax Credit The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe Taxpayers who are paying someone to take care of their children or another member of household while they work may qualify for child and dependent care credit regardless of

Estimate Child Care Tax Credit

Estimate Child Care Tax Credit

https://www.karladennis.com/wp-content/uploads/2022/10/KDA-blog-cdc-scaled.jpg

Your Child Care Tax Credit May Be Bigger On Your 2021 Tax Return

https://cdn.mos.cms.futurecdn.net/Q6FW9iHViwDjjo7YZxrHj3.jpg

CHILD CARE TAX Statement Form Daycare Or Childcare Printable Tuition

https://i.etsystatic.com/23403566/r/il/7a55e3/3981264249/il_1080xN.3981264249_lgte.jpg

You can use this calculator to find out what child and family benefits you may be able to get and how much your payments may be Calculating How Much the Credit is Worth to You The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses Your Adjusted

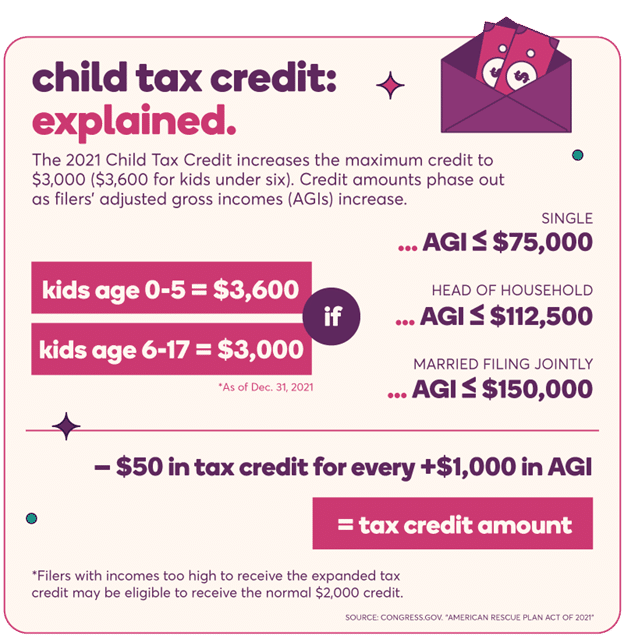

If you want to see how large your credit will be simply answer the four questions in the calculator below and we ll give you a customized estimate of 1 the amount you should The new child tax credit will provide 3 000 for children ages 6 to 17 and 3 600 for those under age 6 Here s how to calculate how much you ll get

Download Estimate Child Care Tax Credit

More picture related to Estimate Child Care Tax Credit

Child And Dependent Care Tax Credit What Is It How Does It Work

https://images.squarespace-cdn.com/content/v1/5e57c4f3791e5603fafc86ef/1bf45e9b-5d50-4c12-a2db-2083fbbed6f4/what-is-child-dependent-care-tax-credit.jpg

Is The Child Tax Credit A Good Thing Leia Aqui How Helpful Is The

https://www.nerdwallet.com/assets/blog/wp-content/uploads/2022/11/GettyImages-1398954446.jpg

Tax Statement Customize Child Care Business Daycare Parents Tuition

https://i.etsystatic.com/37448110/r/il/295c47/4564871668/il_1080xN.4564871668_jx7m.jpg

Calculate the credit using Form 2441 Child and Dependent Care Expenses Don t confuse this credit with the child tax credit Objectives At the end of this lesson using your Use our monthly child tax credit calculator to estimate how much you might receive Since July millions of families have received monthly child tax credit payments of up to 300 per

The child tax credit is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17 The credit can reduce your tax bill on a dollar for dollar basis Take advantage of the 2021 child care credit and receive a refundable tax credit of up to 8 000 This tax season an often overlooked tax credit could put up to 8 000 back in

Child And Dependent Care Tax Credit Get Ahead Colorado

https://images.squarespace-cdn.com/content/v1/6564d2f2c8c33123bbdaba64/1701106456150-IKN3BRGKF064ZU8LV88C/Other+Tax+Credits_Learn.jpg?format=1000w

Child Care Tax Credit 2021 2022 Requirements What It Is Sittercity

https://www.sittercity.com/wp-content/uploads/2020/02/GettyImages-1180592592-1-scaled-e1581105297103.jpg

https://www.nerdwallet.com/article/tax…

The child and dependent care credit CDCC is a tax credit for parents or caregivers to help cover the cost of qualified care

https://www.omnicalculator.com/finance/child-tax-credit

Unlike a tax deduction which reduces the amount of your income that is subjected to income tax child tax credit cut down your tax liability directly For example if you owe

Child And Dependent Care Credit LO 7 3 Calculate Chegg

Child And Dependent Care Tax Credit Get Ahead Colorado

CTC 2023 Amount Why Am I Not Getting The Full Child Care Tax Credit

FSA Or Tax Credit Which Is Best To Save On Child Care

Child Tax Credit Payments Begin Arriving Today For Almost One Million

Child Care Contract Template Free Printable Templates

Child Care Contract Template Free Printable Templates

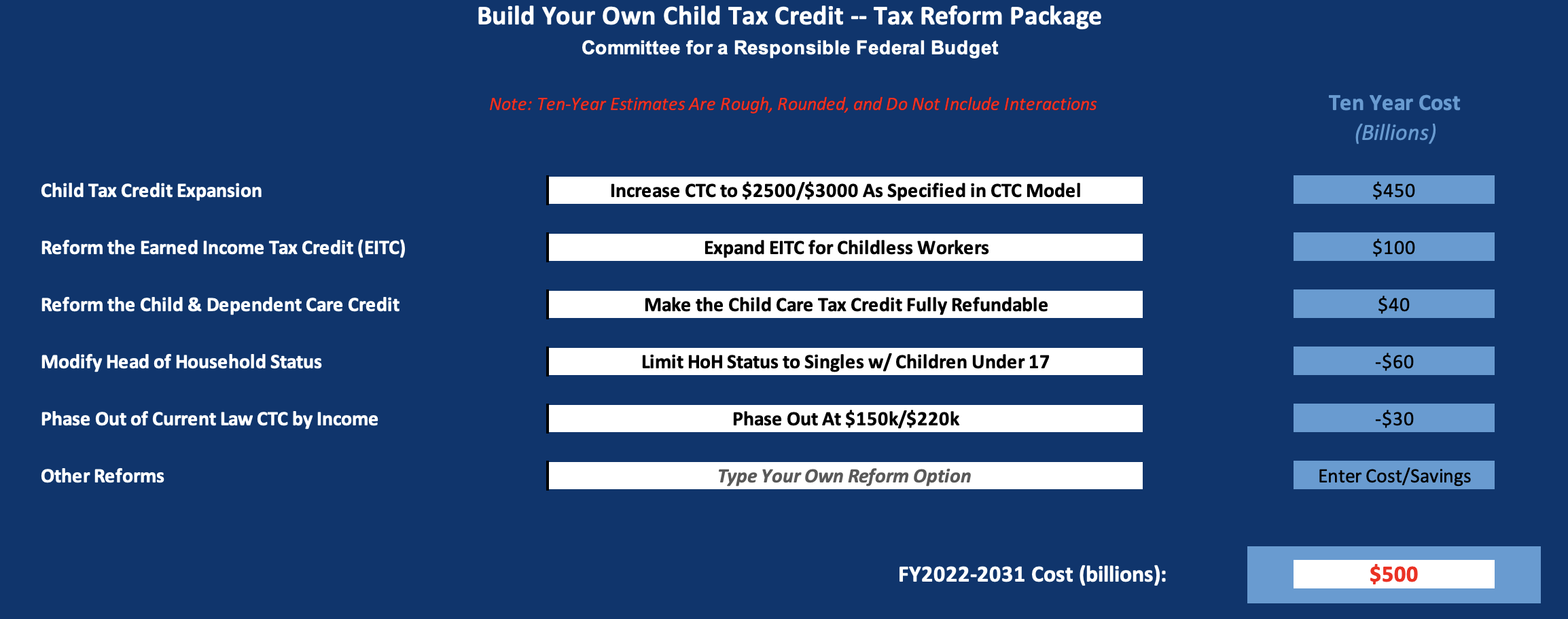

Build Your Own Child Tax Credit 2 0 2022 01 06

Child Care Tax Benefit Ontario Ericvisser

What Do I Do If I Haven t Received Child Tax Credit In August

Estimate Child Care Tax Credit - Taxpayers can now claim up to 8 000 in expenses for one child or up to 16 000 for two or more dependents The American Rescue Act also increased the rate of return on the