Excess Rent Paid Over 10 Of Salary Means B Rent Paid in excess of 10 of salary 24000 6480 Rs 17 520 c 50 of Salary Rs 32 400 Therefore Rs 17520 shall be the House Rent Allowance HRA that is exempted from levy of

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes Iii Excess of annual rent paid over 10 of annual salary The calculation is based on the basic salary and if applicable Dearness Allowance DA and commission received on

Excess Rent Paid Over 10 Of Salary Means

Excess Rent Paid Over 10 Of Salary Means

https://www.marketing91.com/wp-content/uploads/2020/09/What-is-Net-Salary.jpg

2 Different Types Of Salary

https://thedestinyformula.com/wp-content/uploads/2018/09/types-of-salary.jpg

The Best Way To Collect Rent From Tenants Millionacres

https://m.foolcdn.com/media/millionacres/images/paying_rent_contract.width-1440.jpg

Excess rent paid annually over 10 per cent of the annual salary Note here that salary means basic salary dearness allowance DA and commission received on the basis Actual house rent paid by you minus 10 of your basic salary 3 50 of your basic salary if you live in a metro or 40 of your basic salary if you live in a non metro This

So Actual Rent minus 10 of Basic Salary becomes Rs 1 20 000 Rs 24 600 Rs 95 400 This is how HRA calculation works ALSO READ How to Calculate Income Tax using Salary Quantum of Deduction The deduction under Section 80GG is calculated as the least of the following three amounts 1 Rent paid minus 10 of total income The excess of

Download Excess Rent Paid Over 10 Of Salary Means

More picture related to Excess Rent Paid Over 10 Of Salary Means

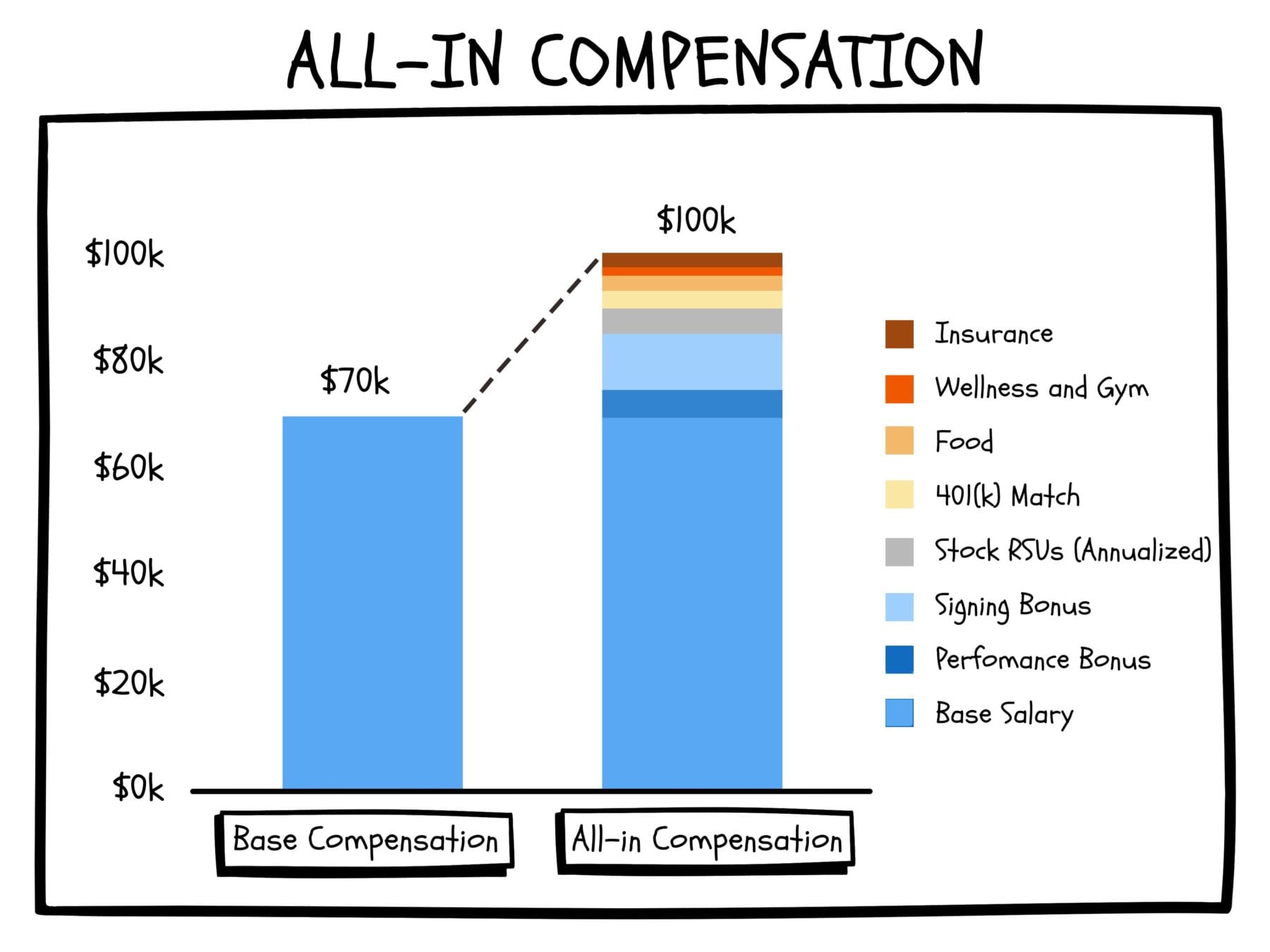

Understanding Base Salary And All in Compensation

https://uploads-ssl.webflow.com/6125cbde7cab0781deddec9e/613a7d621ae8b3837518c948_All-in-comp-fixed.jpeg

Ashok Spends 1 5 Of His Salary On Rent 1 10 Of Salary On Cloths And 3

https://hi-static.z-dn.net/files/dfd/f16f78a8f58d0ddbe01ecd891a5a3f68.jpg

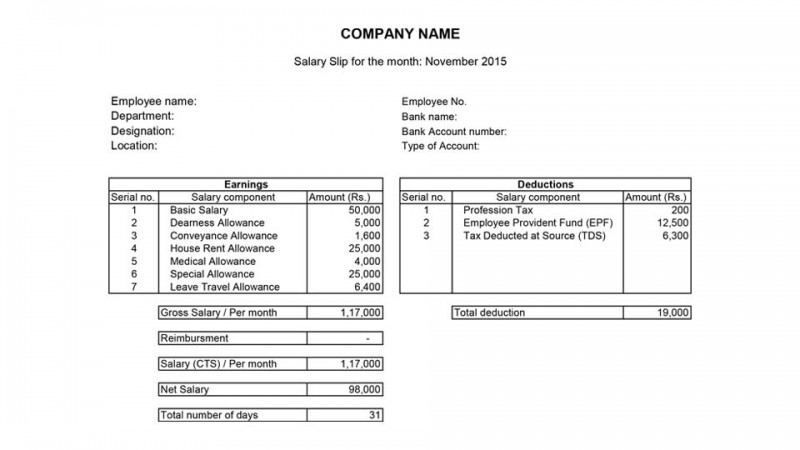

Income From Salary Taxes Guide Learn By Quicko

https://learn.quicko.com/wp-content/uploads/2022/08/Salary-Slip.jpg

Excess of rent paid over 10 of Adjusted Gross Total Income What is Adjusted Gross Total Income It means gross total income excluding capital gains short term capital Calculation HRA is exempt to the extent of the minimum of the following 3 amounts Actual HRA Amount Received Excess of Rent paid by the taxpayer over 10 of salary 50 of

Actual house rent allowance received by the employee Excess rent paid for the accommodation occupied by the employee over 10 of the salary amount 50 of the salary HRA Calculation Know how to Calculate HRA with examples calculate HRA from basic salary HRA Exemption Rules House Rent Allowance Calculation more

10 Simple Ways To Reduce Your Monthly Expenses MGNOM

https://mgnom.com/wp-content/uploads/2023/02/xkarbducuee.jpg

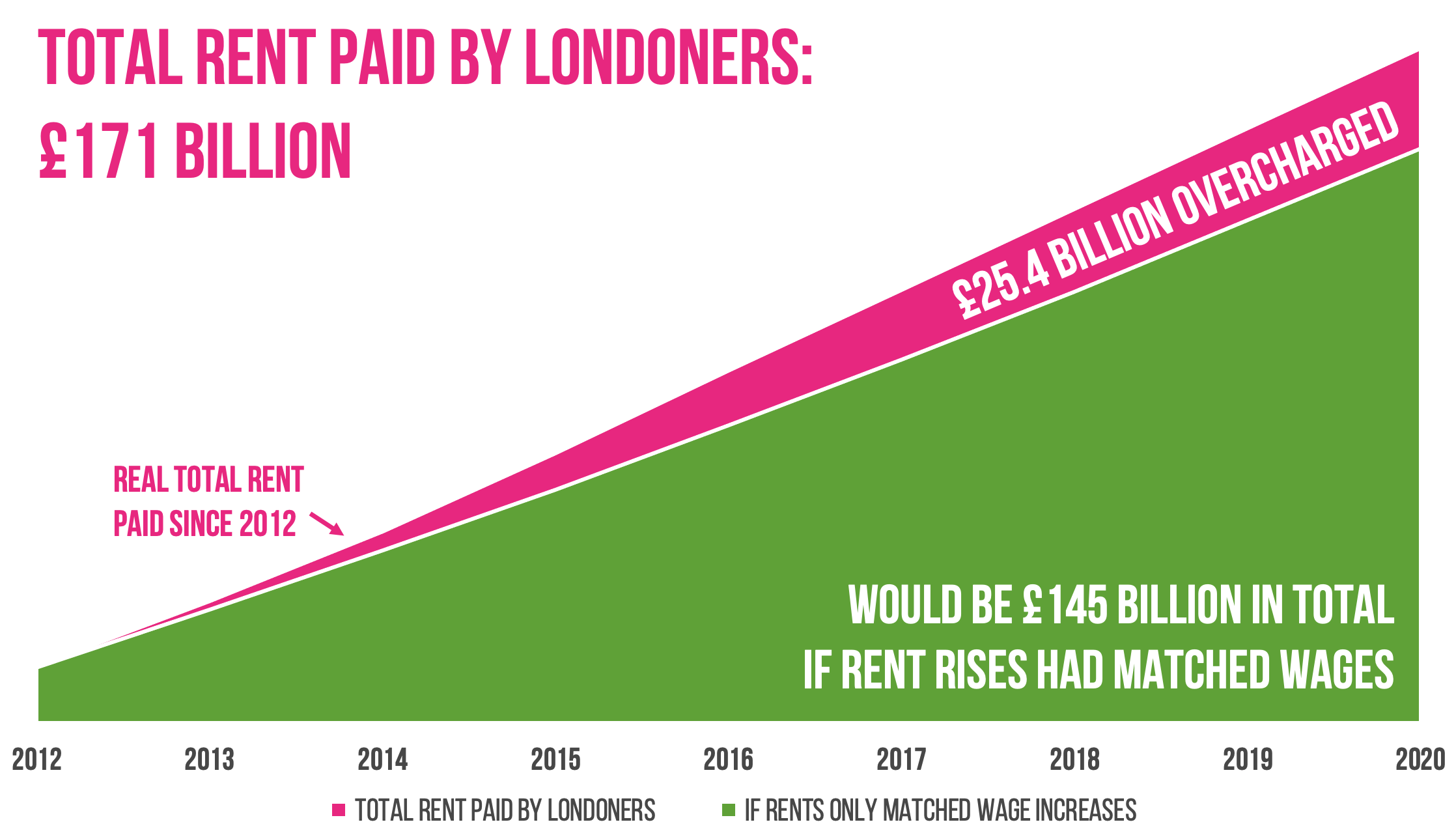

London s Overcharged Renters Sian Berry Green Party AM

https://www.sianberry.london/wp-content/uploads/2021/11/Chart_graphic_long_London.png

https://www.charteredclub.com › house-rent-allowance

B Rent Paid in excess of 10 of salary 24000 6480 Rs 17 520 c 50 of Salary Rs 32 400 Therefore Rs 17520 shall be the House Rent Allowance HRA that is exempted from levy of

https://tax2win.in › guide › hra-house-rent-a…

Section 80GG of the Income Tax Act in India allows individuals who pay rent but don t receive House Rent Allowance HRA to claim deductions for that rent on their taxes

Sofa On Rent Cheap Clearance Save 61 Jlcatj gob mx

10 Simple Ways To Reduce Your Monthly Expenses MGNOM

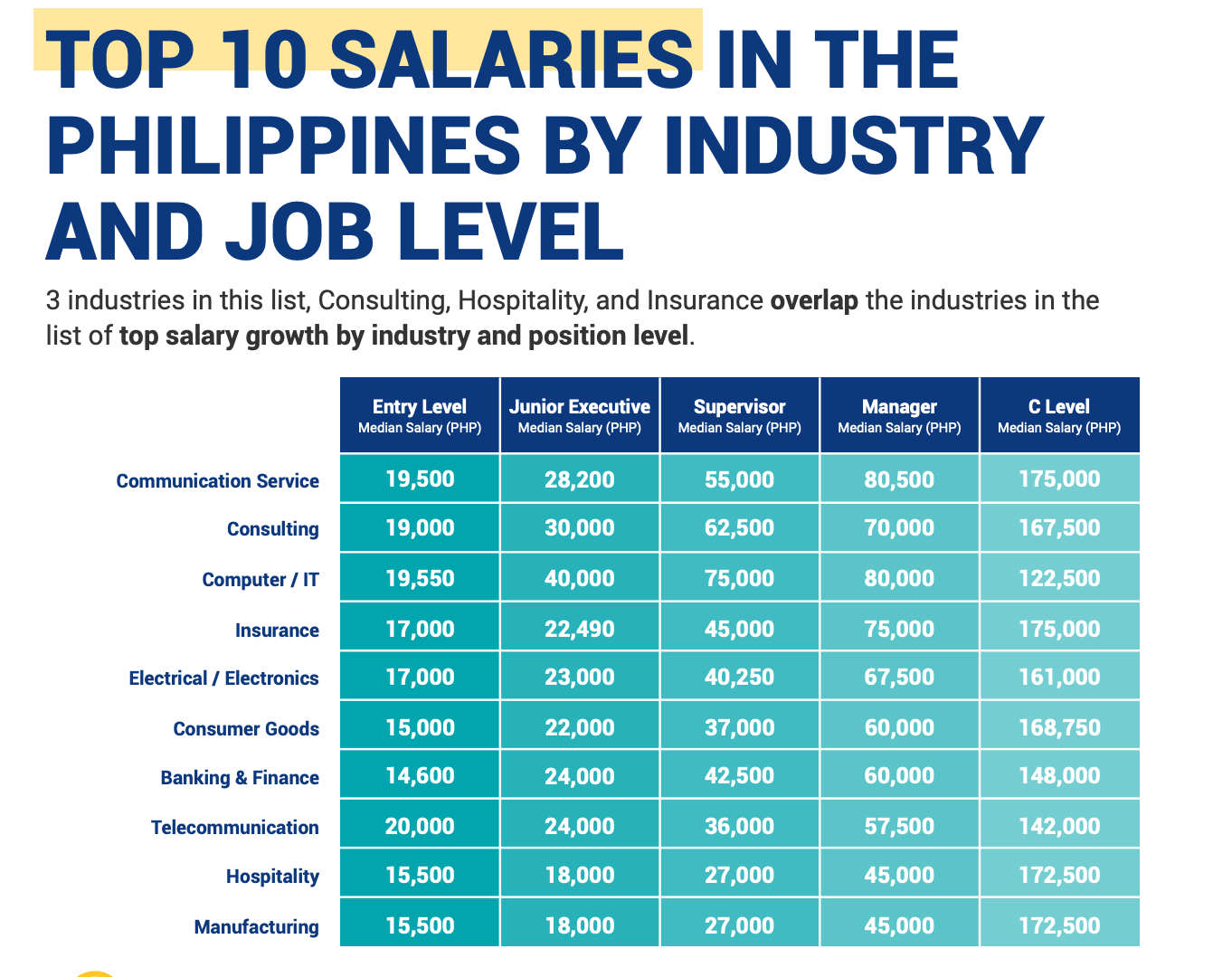

Jobstreet Reveals Jobs With Highest Pay Deepest Pay Cuts ABS CBN News

What Is Base Salary Definition And Ways To Determine It Snov io

How Much Is The Variable Pay At Jpmc Is It 10 O Fishbowl

How To Determine Salary Increases Paying Rewarding Employees

How To Determine Salary Increases Paying Rewarding Employees

Basic Salary Gross Salary Net Salary

What Is Gross Salary And The Formula To Calculate Gross Salary

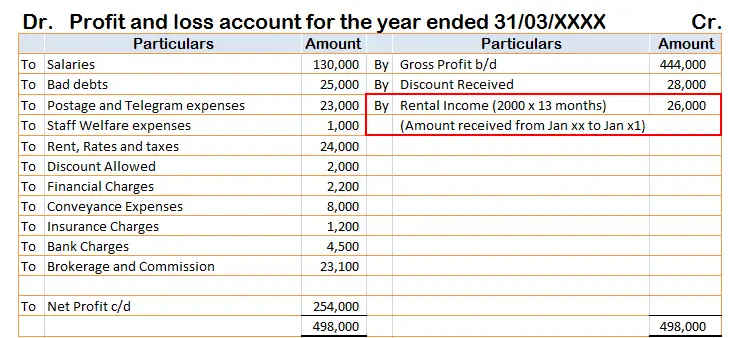

Is Rent Received In Advance Included In Taxable Income

Excess Rent Paid Over 10 Of Salary Means - HRA is calculated by considering the lowest value among the following actual HRA received 50 of basic salary DA for individuals in metro cities or 40 for non metro cities and