Exemption Of Interest Income For Senior Citizens The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen Both the interest earned on saving deposits and fixed deposits are eligible for

Senior citizens also benefit from exemptions on advance tax payments if they have no business income and can claim a deduction of up to 50 000 on interest income from deposits Furthermore there is no tax Senior and super senior citizens can avoid TDS on interest income by submitting Form 15H which is a declaration under Section 197A 1C of the Income Tax Act It is applicable if interest income exceeds Rs 50 000 but total

Exemption Of Interest Income For Senior Citizens

Exemption Of Interest Income For Senior Citizens

https://resize.indiatvnews.com/en/resize/newbucket/1200_-/2021/02/eth6sfpu0auony6-1612164111.jpg

Income Investments For Senior Citizens

https://www.savingadvice.com/wp-content/uploads/2019/11/income-investments-for-senior-citizens-768x512.jpg

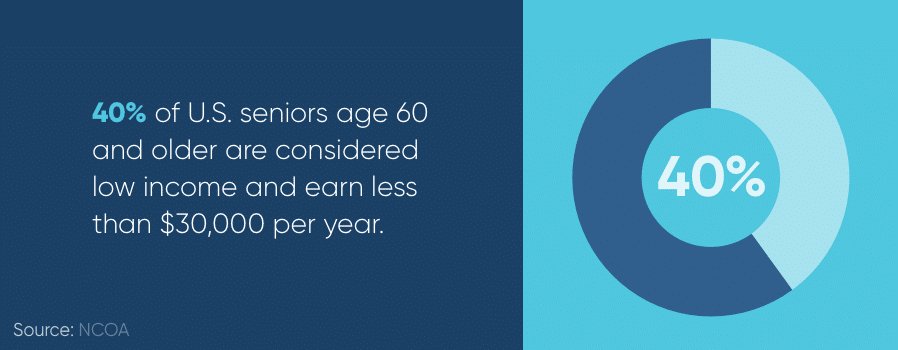

What Is Considered Low Income For Senior Citizens RespectCareGivers

https://eatm7g38er9.exactdn.com/wp-content/uploads/2022/03/What-Is-Considered-Low-Income-for-Senior-Citizens.jpg?strip=all&lossy=1&resize=720%2C405

Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on deposits from the Post Office Bank Discover the benefits of Section 80TTB a special income tax deduction for senior citizens Learn about eligibility criteria deduction limits and how to claim this tax benefit on interest income from savings accounts fixed

Section 80TTB offers deduction to senior citizens and super citizens on the interest earned from deposits held with a bank post office or co operative society This tax deduction Here are ways senior citizens can save on taxes By tax filing 1 Higher Tax Exemption Limit Senior citizens aged 60 80 enjoy a higher exemption limit of Rs 3 lakh compared to Rs 2 5

Download Exemption Of Interest Income For Senior Citizens

More picture related to Exemption Of Interest Income For Senior Citizens

Interest Income Formula And Calculation

https://wsp-blog-images.s3.amazonaws.com/uploads/2022/06/21155832/Interest-Income-Example-Calculation.jpg

10 Best Government Schemes For Senior Citizens In India 2022

https://www.uniquenewsonline.com/wp-content/uploads/2022/04/9-4.jpg

2017 PAFPI Certificate of TAX Exemption Certificate Of

https://www.certificateof.com/wp-content/uploads/2018/06/2017-PAFPI-Certificate-of-TAX-Exemption.jpg

For Senior citizens the basic exemption limit is set Rs 3 Lakhs This means Senior citizens who are aged 80 years or more do not have to pay any tax up to Rs 5 Lakhs annual income A new standard A vital income tax exemption for senior residents in 2024 is beneath Section 80TTB which mainly addresses interest profits Senior residents can declare a deduction of up to 50 000 on hobby income from savings

Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or The Budget 2018 has introduced a new Section 80 TTB in the Income Tax Act The new section offers a tax deduction to assessees in lieu of the existing Section 80TTA deduction Under Section 80TTB deduction senior citizens can claim income tax exemption of upto Rs 50 000 on interest income earned

The Ultimate Guide To Tax Saving Investments For Senior Citizens

https://www.imperialfin.com/wp-content/uploads/2023/01/Blog-30012023-1024x576.png

Fixed Deposit Accounts For Senior Citizens Special Features And

https://coinswitch.co/switch/wp-content/uploads/2023/03/Fixed-deposit-accounts-for-senior-citizens-Special-features-and-benefits-1.jpg

https://www.incometax.gov.in › iec › foportal › help › individual

The deduction is allowed for a maximum interest income of up to 50 000 earned by the Senior Citizen Both the interest earned on saving deposits and fixed deposits are eligible for

https://taxguru.in › income-tax › what-are-th…

Senior citizens also benefit from exemptions on advance tax payments if they have no business income and can claim a deduction of up to 50 000 on interest income from deposits Furthermore there is no tax

Four Pension Schemes Offered By The Government For Senior Citizens

The Ultimate Guide To Tax Saving Investments For Senior Citizens

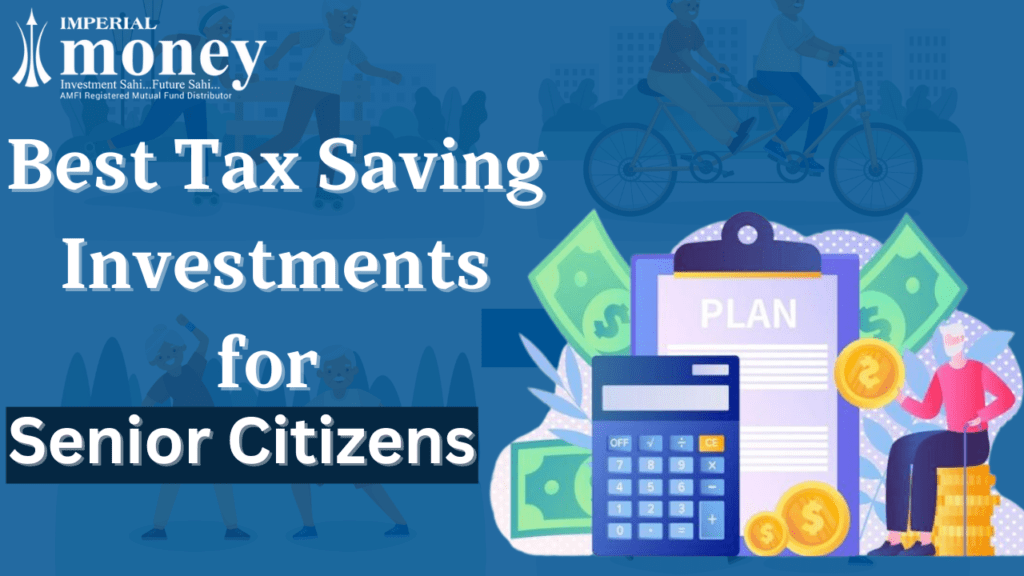

Solved Scenario 1 Individual Retirement Accounts IRAs Chegg

Senior Citizens Get Special Exemption In Income Tax Know 5 Big

Good Income Option For Senior Retired Citizens From Government Schemes

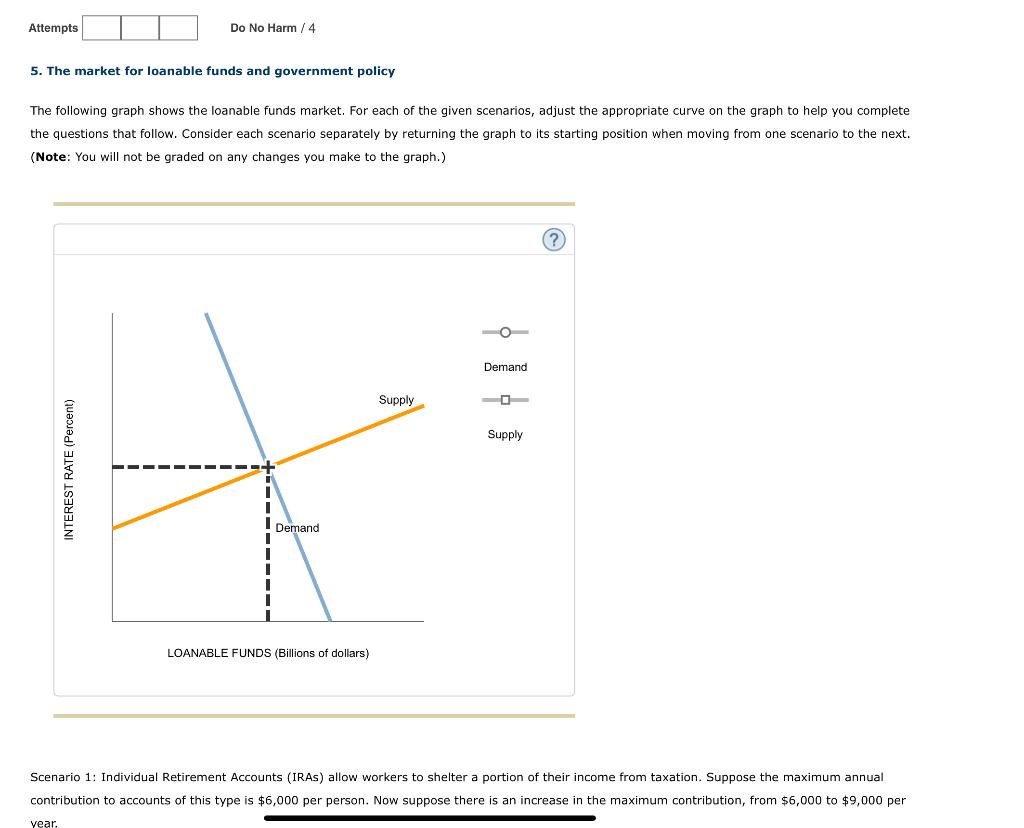

What Is Considered Low Income For Senior Citizens GoodLife 2022

What Is Considered Low Income For Senior Citizens GoodLife 2022

Exemption Certificate Edhi Welfare Organization

Budget 2018 Arun Jaitley Hikes Exemption Limit On Interest Income For

Exemption Of Interest Income For Senior Citizens - Section 80TTB of the Income Tax Act provides tax benefits for senior citizens on interest income from deposits allowing a deduction of Rs 50 000 on deposits from the Post Office Bank