Exemption On Education Allowance Web rate allowance equal to the standard limit for the education allowance i e 283 82 per month If the child attends an establishment of higher education which is located at least 50 km from your place of residence you may receive double the limit for the education allowance i e 567 64 per month

Web Education allowance This is fixed at Rs 100 each month for each child Note that the exemption is limited only to 2 children If CEA is applied for a 3 rd child it will not be eligible for reimbursement Hostel charges allowance Currently this allowance is Rs 300 per child only for 2 children of a family Web a Total HRA received from your employer b Rent paid less than 10 of basic salary DA c 40 of salary Basic salary DA for non metros and 50 of salary Basic salary DA for metros Read more about how to claim HRA exemption Standard Deduction For FY 2022 23 the limit of the standard deduction is Rs 50 000 in the old regime

Exemption On Education Allowance

Exemption On Education Allowance

https://i.pinimg.com/originals/c1/26/8a/c1268ac9346fdab3aa47e016b56c251d.jpg

Children Education Allowance Exemption Eligibility Tax Benefits

https://i0.wp.com/saral.pro/wp-content/uploads/2022/05/Children-education-allowance-and-tuition-fee-featured-image.png?fit=1300%2C740&ssl=1

Religious Exemption Letter N J 2023 PDF AirSlate SignNow

https://www.signnow.com/preview/572/589/572589452/large.png

Web 23 M 228 rz 2022 nbsp 0183 32 Tutoring costs are tax deductible if they take place after a child has switched schools or if they have a medically certified language disability Parents can deduct many costs from their taxes Education expenses Relief amount for single parents Tuition costs Child allowances Wundertax Web 5 Apr 2023 nbsp 0183 32 The following exemption is provided to a salaried taxpayer in India Childrens Education Allowance INR 100 per month per child up to a maximum of 2 children Hostel Expenditure Allowance INR 300 per month per child up to a maximum of 2 children

Web 24 Juni 2022 nbsp 0183 32 Increase in the basic tax free allowance The basic tax free allowance Grundfreibetrag will also increase retroactively from January 1st 2022 The increase raises the allowance by 363 euros from 9 984 euros to 10 347 euros This is beneficial as tax is only due on income earned above this basic amount Web Education allowances Pre school allowance 102 18 per month and per child value as of 01 07 2019 Education allowance up to a maximum of 283 82 value on 01 07 2019 per month for each dependent child which can be doubled in some cases

Download Exemption On Education Allowance

More picture related to Exemption On Education Allowance

Sample Letter Tax Exemption Complete With Ease AirSlate SignNow

https://www.signnow.com/preview/497/332/497332566/large.png

Exemption Advisor

https://www.netcetera.com/dam/jcr:0d5ba8a7-cfcd-4526-b256-fe707e98809f/Group 645.png

Claim For Exemption

https://s2.studylib.net/store/data/015290925_1-c28b6785682afa346c6300cf0893f532-768x994.png

Web 19 Aug 2019 nbsp 0183 32 This generally applies Parents are entitled to either the child allowance Kindergeld or to the child tax exemption Kinderfreibetrag It isn t possible to receive the child allowance and then try to deduct the complete amount of Web 25 Jul 2023 419 155 Views 40 comments Income tax Act contains provisions for taxability of various allowances received by a taxpayer These allowances are either in the nature of income which is exempt from tax or is an expenditure which provides weighted deductions to the taxpayer

Web 28 Dez 2023 nbsp 0183 32 Discover Tax Benefits on Children s Education Learn how Section 80C offers deductions for Education Allowance Tuition Fees and School Fees Maximize your tax savings while investing in your child s future Web 11 Jan 2023 nbsp 0183 32 What Are Section 10 Allowances Section 10 contains all the exemptions that an individual can opt for under the Income Tax Act They include gratuity travel allowance rent allowance allowance for children education allowance exemption etc Is Leave Encashment Exempted From Income Tax

The FLSA s Exemptions Are Becoming More fair For Employers

https://4.bp.blogspot.com/-wXV9HjER5MU/W4_EGMeq_bI/AAAAAAAAlIk/bDvRPKGa0QcAJZVxpGQIJPmDVGLnO08swCK4BGAYYCw/s1600/dept-of-labor.jpg

How To Claim Rent Exemption Without An HRA Component In Your Salary

https://www.kanakkupillai.com/learn/wp-content/uploads/2023/10/How-to-Claim-Rent-Exemption-Without-an-HRA-Component-in-Your-Salary.jpg

https://ec.europa.eu/pmo/allocations-scolaires/allocations-scol…

Web rate allowance equal to the standard limit for the education allowance i e 283 82 per month If the child attends an establishment of higher education which is located at least 50 km from your place of residence you may receive double the limit for the education allowance i e 567 64 per month

https://groww.in/p/tax/children-education-allowance

Web Education allowance This is fixed at Rs 100 each month for each child Note that the exemption is limited only to 2 children If CEA is applied for a 3 rd child it will not be eligible for reimbursement Hostel charges allowance Currently this allowance is Rs 300 per child only for 2 children of a family

2017 PAFPI Certificate of TAX Exemption Certificate Of

The FLSA s Exemptions Are Becoming More fair For Employers

Religious Exemption Example 2021 08 22B pdf DocDroid

Exemption

Exemption

Income Tax Benefits And Deductions For Expenditure On Children

Income Tax Benefits And Deductions For Expenditure On Children

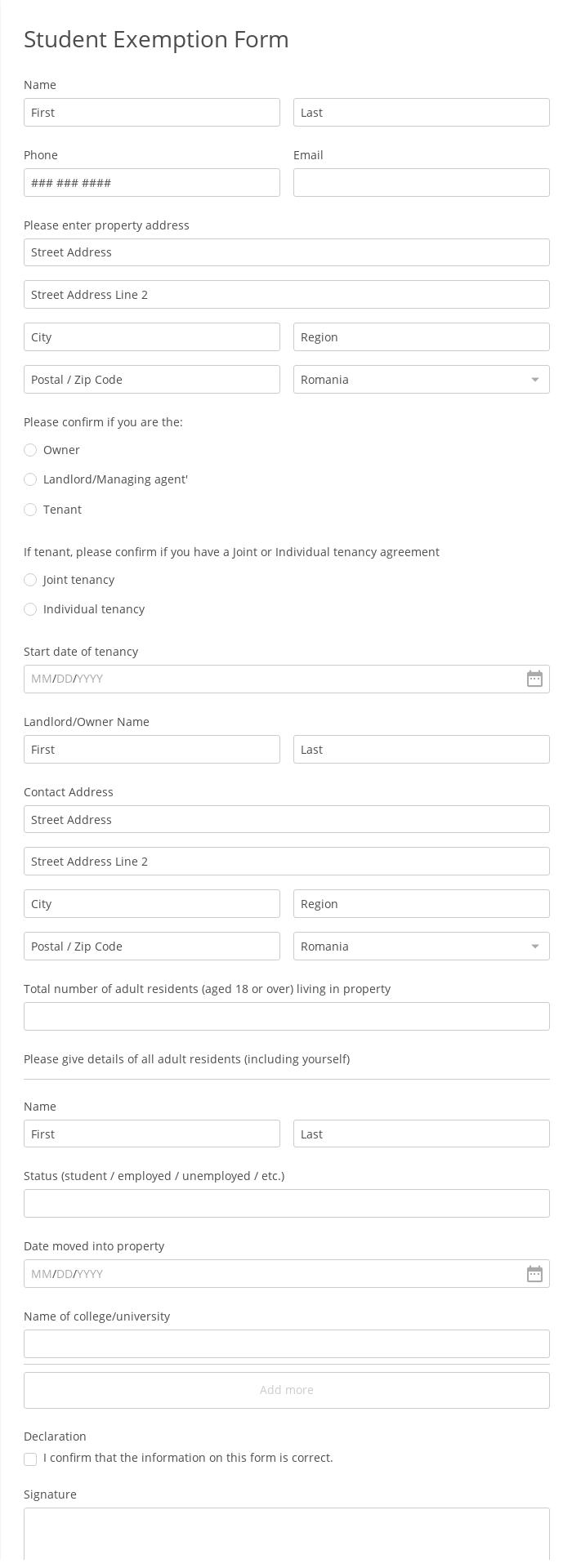

Student Exemption Form Template 123 Form Builder

Income Tax Exemption Of Nonstock Charitable Institutions Rodina News

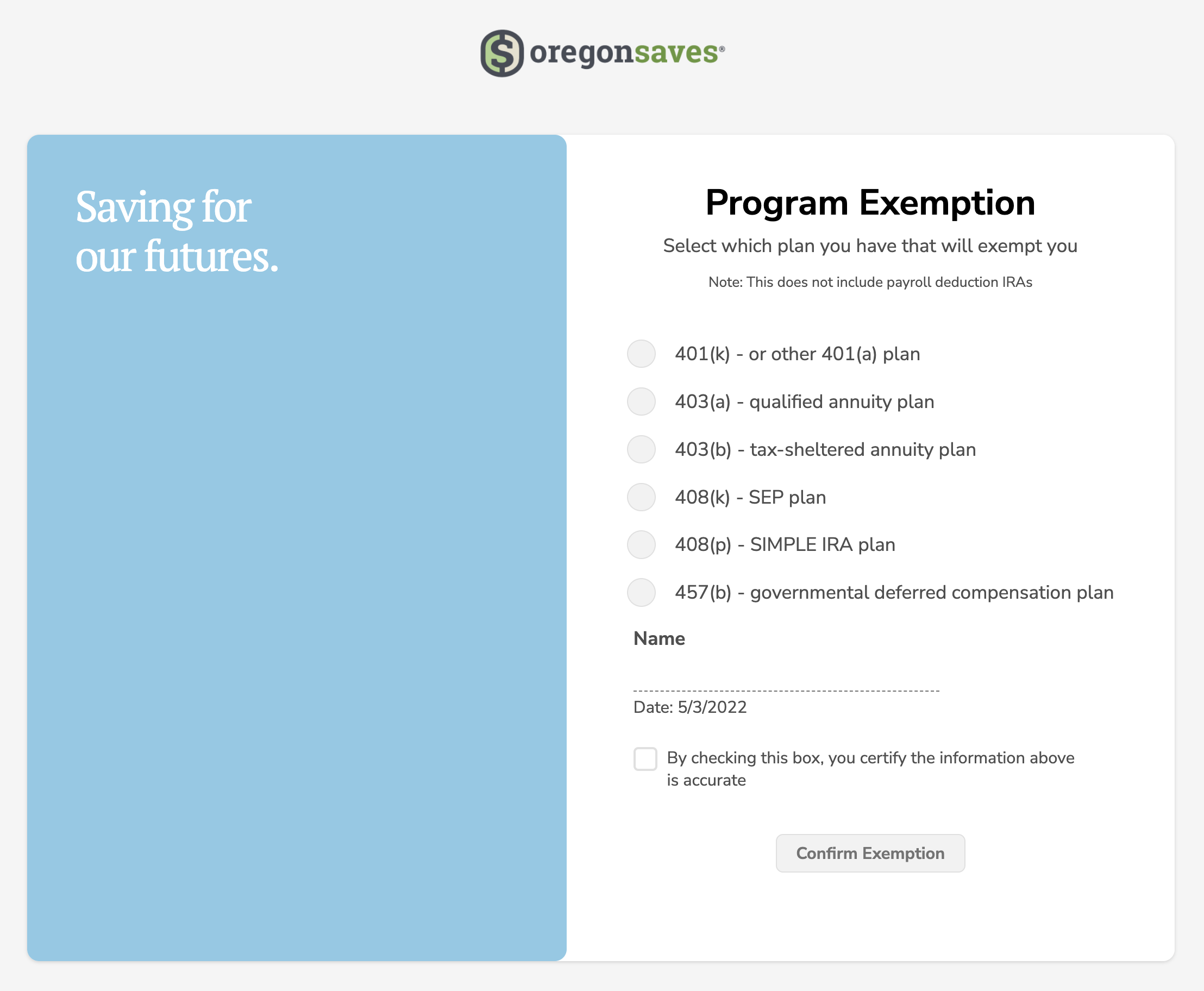

Certify Your Business Exemption From OregonSaves Oregon Saves

Exemption On Education Allowance - Web You can claim a deduction of up to Rs 1 5 Lakh under Section 80C of the Income Tax Act on your child s school or college fees and reduce your taxable income You can claim this deduction on the tuition fee of two children on an annual basis Invest in Sukanya Samriddhi Yojna for your young daughter