Invite to Our blog, an area where interest satisfies details, and where day-to-day topics become appealing conversations. Whether you're looking for insights on lifestyle, technology, or a little bit of every little thing in between, you've landed in the appropriate place. Join us on this exploration as we dive into the realms of the common and remarkable, understanding the globe one blog post at once. Your trip right into the interesting and varied landscape of our Exemption Under Section 10 10d On Maturity Amount Received begins right here. Check out the fascinating web content that awaits in our Exemption Under Section 10 10d On Maturity Amount Received, where we unravel the intricacies of various subjects.

Exemption Under Section 10 10d On Maturity Amount Received

Exemption Under Section 10 10d On Maturity Amount Received

Exemption Under Section 10 10d

Exemption Under Section 10 10d

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Section 10D Of Income Tax Act 1961 Section 10d Income Tax 1961

Gallery Image for Exemption Under Section 10 10d On Maturity Amount Received

Examples Related To Section 10 10D Exemption In Respect Of Sum

Tax Exemption On Life Insurance Policy Under Section 10 10D Plan

Examples Related To Section 10 10D Exemption In Respect Of Sum

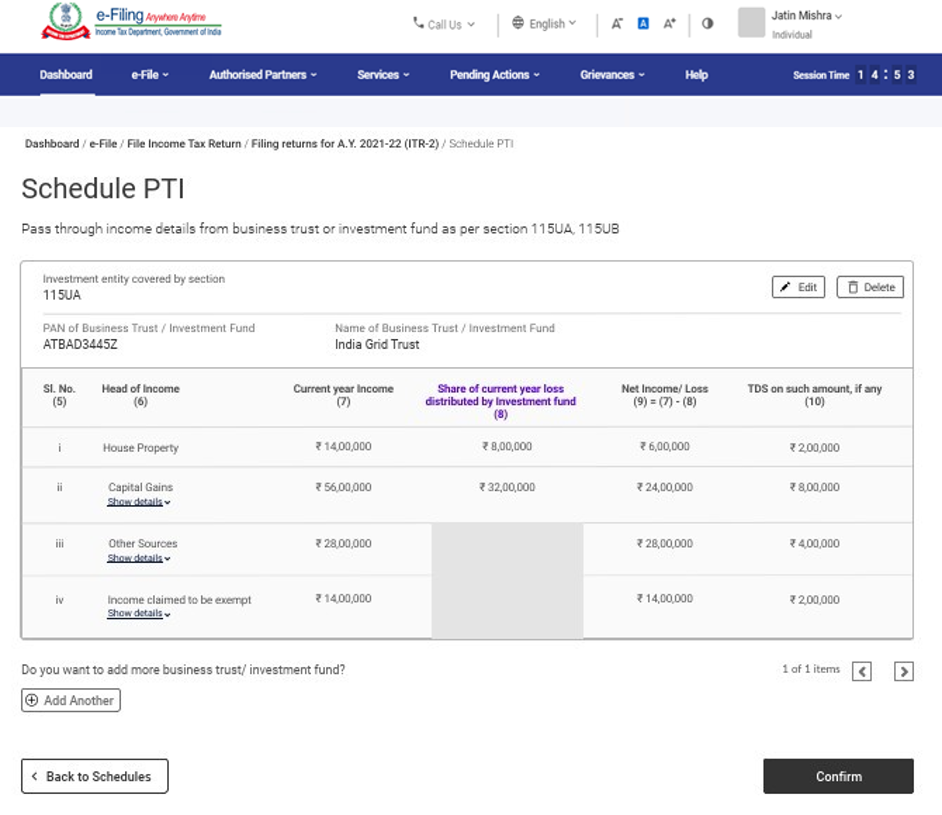

2 Income Tax Department

Section 80d Sec 80d Deduction In Income Tax Deduction Under 80c

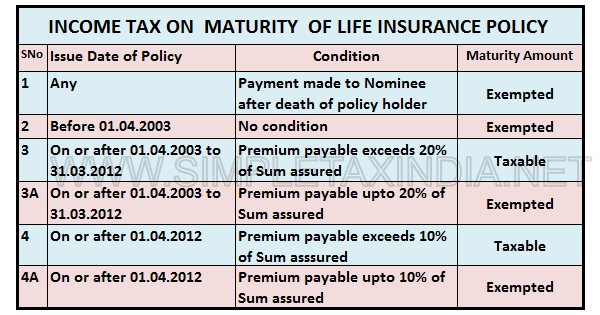

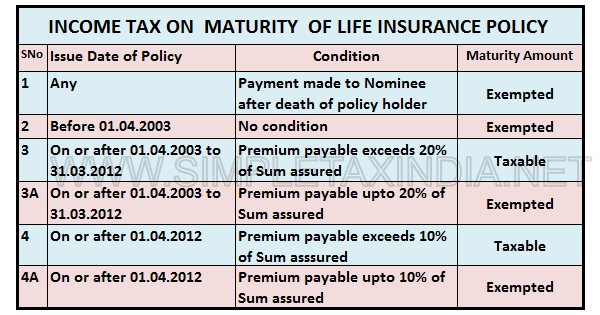

INCOME TAX ON MATURITY OF LIFE INSURANCE POLICY SIMPLE TAX INDIA

INCOME TAX ON MATURITY OF LIFE INSURANCE POLICY SIMPLE TAX INDIA

CBDT Notifies Rule 8AD To Compute Capital Gains On Maturity Of ULIPs

Thank you for choosing to discover our site. We all the best wish your experience surpasses your expectations, which you discover all the details and resources about Exemption Under Section 10 10d On Maturity Amount Received that you are seeking. Our dedication is to offer an easy to use and interesting platform, so do not hesitate to navigate through our pages with ease.