Family Tax Benefit Part A Income Test Calculator How much Family Tax Benefit FTB you may get How much you get depends on your situation Read more about FTB Part A payment rates You can also find out about the

Family Tax Benefit Calculator Who can get it FTB Part A eligibility you care for a dependent child who s either 0 to 15 years of age 16 to 19 years of age and meets the You need to keep your family income estimate up to date so we pay you the right amount We pay Family Tax Benefit FTB Part A for each eligible child We work out your

Family Tax Benefit Part A Income Test Calculator

Family Tax Benefit Part A Income Test Calculator

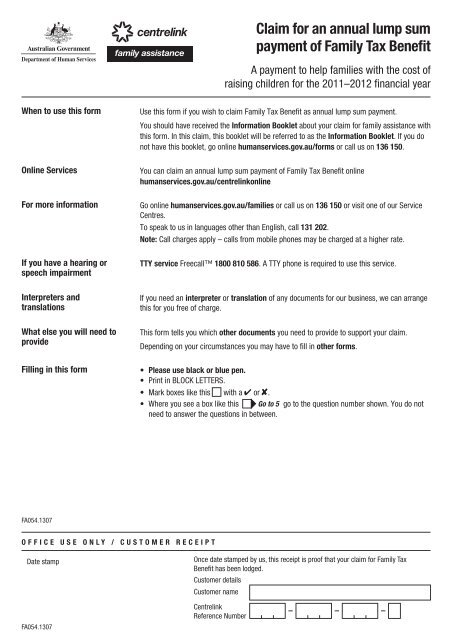

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Family Tax Benefit Calculator HaleafSylvi

https://i.pinimg.com/originals/41/63/8f/41638fad4707b0e86cf27ceae235b0fc.jpg

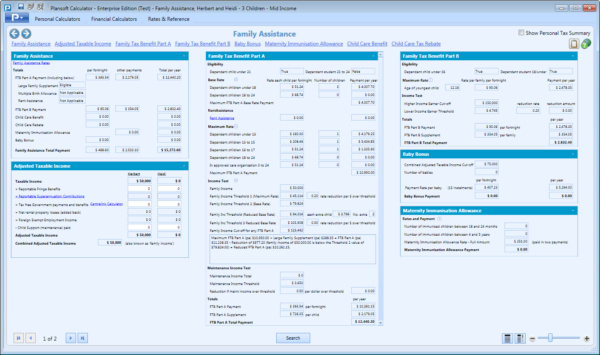

Rate calculation method FTB Part A standard rate child under 13 years 5 562 60 Method 1 FTB Part A standard rate child 13 to 15 years or FTB Part A 7 rowsThe following table shows how to calculate the family s FTB Part A rate As the family s combined ATI is greater than the higher income free area their rate

When a family s ATI is greater than the income free area and equal to or less than the higher income free area their maximum rate of FTB Part A is reduced by 20 of the Income test The amount of FTB Part A you get will depend on your family income You must lodge a tax return at the end of the financial year This needs to be completed

Download Family Tax Benefit Part A Income Test Calculator

More picture related to Family Tax Benefit Part A Income Test Calculator

Family Tax Benefit PART A PART B Care For Kids

https://www.careforkids.com.au/image/blog/socialimage/cd7ae634-c645-4db7-b26e-f7c1993bdc9d

Plansoft Products Calculator Features Family Assistance Estimates

http://www.plansoft.com.au/images/screenshots/FamilyAssistance.png

C mo Funciona La Inmunizaci n Infantil En Australia SBS Spanish

https://images.sbs.com.au/dims4/default/4f5db32/2147483647/strip/true/crop/704x396+0+0/resize/1280x720!/quality/90/?url=http:%2F%2Fsbs-au-brightspot.s3.amazonaws.com%2Fdrupal%2Fyourlanguage%2Fpublic%2Fimmunisation_aap_3.jpeg&imwidth=1280

Family Tax Benefit is a payment to help families with the cost of raising child ren To be eligible for Family Tax Benefit you must be a parent guardian carer Family Tax Benefit Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child

Meet income and residency requirements There are 2 parts to FTB Find out more about eligibility on the Services Australia website FTB Part A eligibility FTB Part B You may be eligible for FTB Part A if you care for a dependent child who s either 0 to 15 years of age 16 to 19 years of age and meets the study requirements You must also

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

https://thumbs.dreamstime.com/z/family-tax-benefit-residential-property-estate-concept-members-house-dollar-money-bags-rows-rising-coins-depicts-home-195723204.jpg

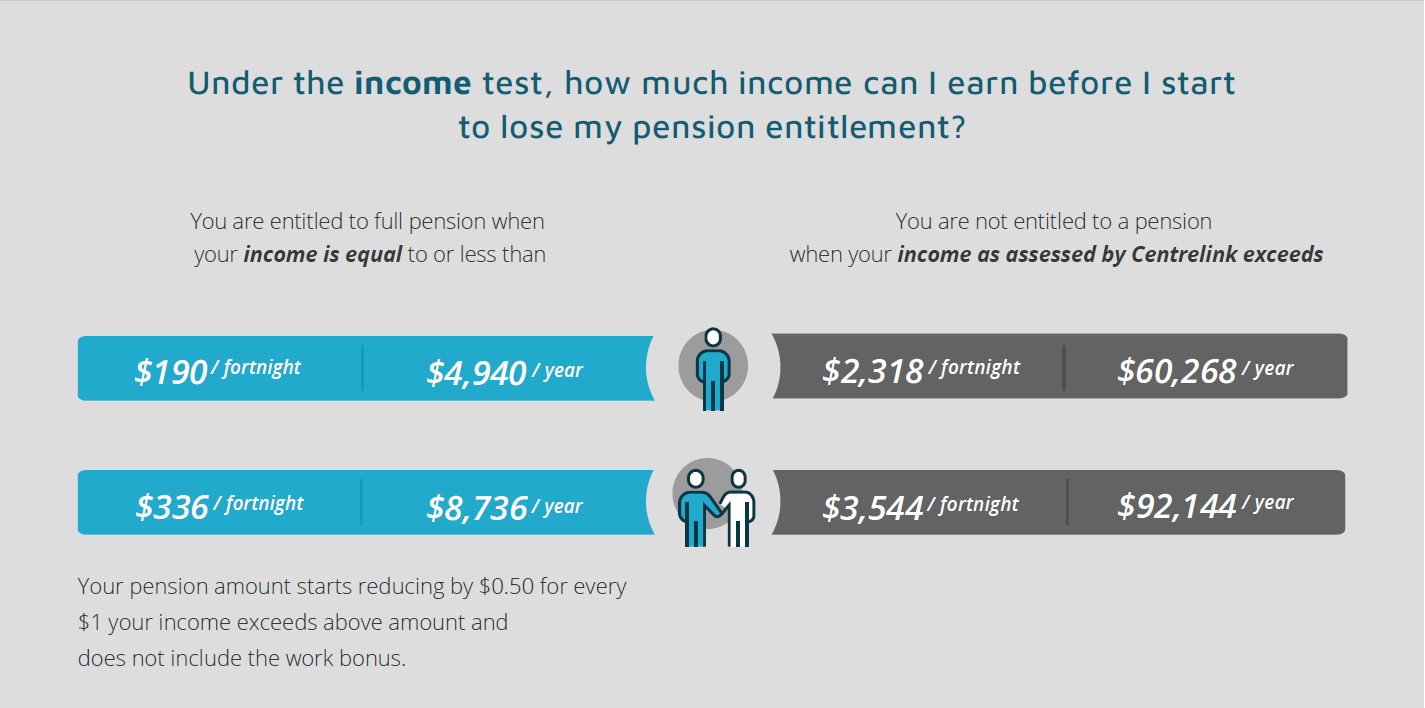

Understand How Centrelink Calculates The Age Pension Payment Amount

https://retirementessentials.com.au/wp-content/uploads/2023/03/AP_income_test_thresholds_March_2023.png

https://www.servicesaustralia.gov.au/how-much...

How much Family Tax Benefit FTB you may get How much you get depends on your situation Read more about FTB Part A payment rates You can also find out about the

https://www.bigdream.com.au/family-tax-benefit-calculator

Family Tax Benefit Calculator Who can get it FTB Part A eligibility you care for a dependent child who s either 0 to 15 years of age 16 to 19 years of age and meets the

How Does Family Tax Benefit Really Work Grandma s Jars

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

Centrelink Online Account Help Advise Non lodgement Of Tax Return

Family Tax Benefit Part A Base Rate Tax Walls

Age Pension Income Test Rules from September 2023

State Income Tax Refund State Income Tax Refund Calculator

State Income Tax Refund State Income Tax Refund Calculator

SBS Chinese

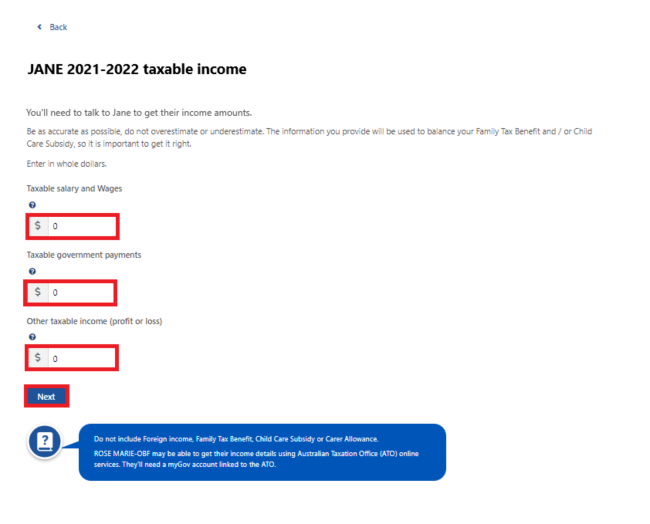

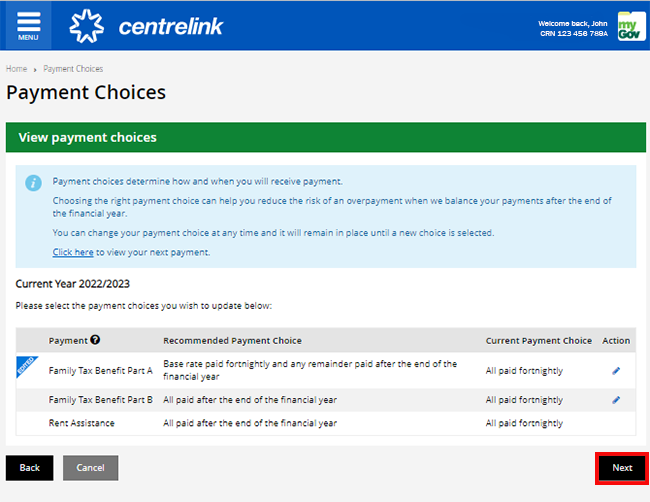

Centrelink Online Account Help Update Your Family Income Estimate And

Family Tax Benefit Calculator HaleafSylvi

Family Tax Benefit Part A Income Test Calculator - Calculating the annual rate of FTB for an individual annual rate of FTB for an ACO calculating FTB daily rate rounding the FTB rate minimum amount of FTB FTB