Family Tax Benefit Part B Rates Read more about FTB Part B payment rates You can also find out about the income test for FTB Part B Your relationship changes can affect what payments you can get and your payment

Family Tax Benefit Part B is for single parents or carers and some couples who meet a 2 part income test You won t be eligible for FTB Part B if your annual adjusted taxable income is This document outlines how the rate of Family Tax Benefit FTB Part B is calculated FTB Part B is automatically included in an individual s FTB entitlement if FTB Part B eligibility

Family Tax Benefit Part B Rates

Family Tax Benefit Part B Rates

https://flast.com.au/s/bx_posts_photos_resized/qzcn8hzfsz5nrttexf4rngmdepayyzfb.png

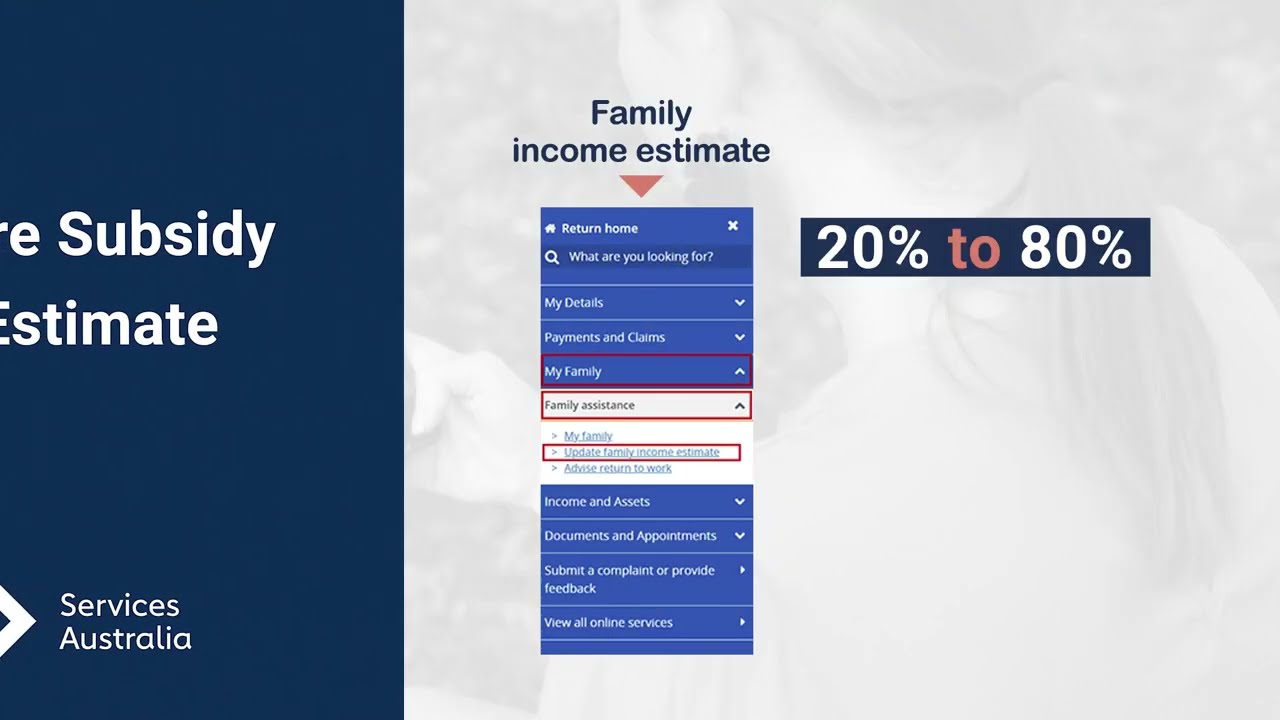

Child Care Subsidy Income Estimate YouTube

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

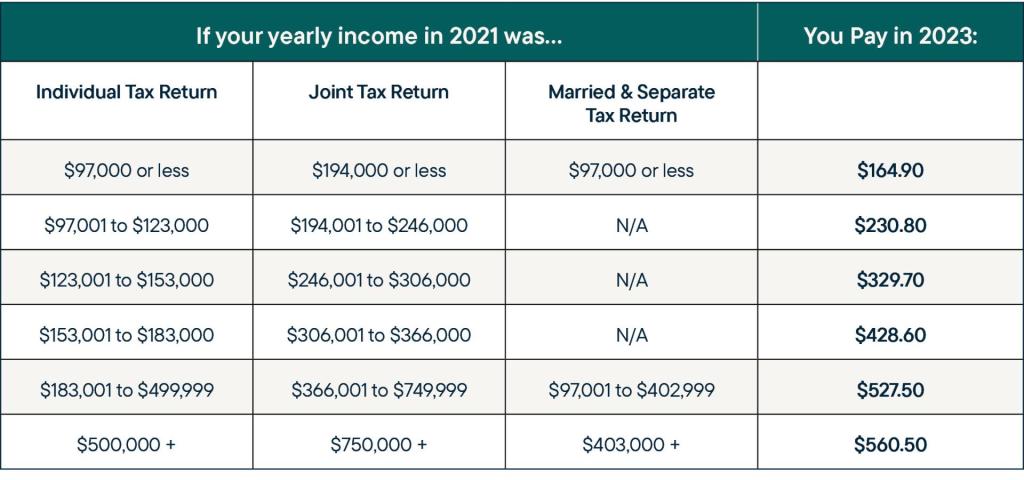

What Is Medicare Part B Your 2023 Costs Coverage Simplified RetireMed

https://www.retiremed.com/sites/default/files/styles/half/public/2022-11/RetireMed_New Brand_IRMAA Chart-Part B 2021 Income.jpg?itok=UmXlfMwe

FTB Part B standard rates The standard rate of FTB Part B is the maximum annual amount payable for a child based on their age without including the supplement and without The maximum rate of FTB Part B is payable to single parent families when their income is equal to or below the primary earner income limit For couple families the maximum rate of FTB Part

Family Tax Benefit FTB Part B related rates per fortnight The majority of Families related rates are paid based on income from for full financial years The current financial year is 2020 21 Part B supplement is payable to eligible individuals after the financial year at reconciliation For blended family couples the total FTB rate for the family is calculated and then split according

Download Family Tax Benefit Part B Rates

More picture related to Family Tax Benefit Part B Rates

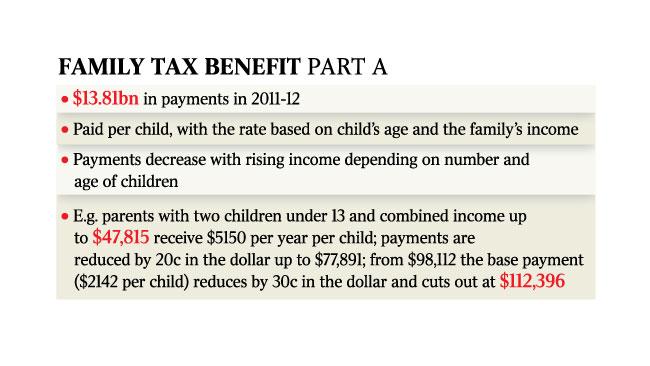

Which Families Are Losing Their Family Tax Benefits

https://singlemum.com.au/wp-content/uploads/2015/05/centrelink-family-tax-benefit-part-b-1.jpg

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Serviceability

https://pic1.zhimg.com/v2-97da941f526f8173122b9e43cee46fe8_r.jpg

FTB Part B Supplement Maximum of 448 95 per family FY 2023 24 The actual supplement amount you receive will be less than the maximum and will be determined by To qualify for FTB Part B you must Be a single parent grandparent or foster carer or Be part of a couple where one partner earns a low income The youngest child must be 0 12 years old if in a couple or

FTB Part B eligibility you re a member of a couple with 1 main income and care for a dependent child aged under 13 you re a single parent or non parent carer or a grandparent carer and Part A is paid for every child and the Australia Family Tax Benefit Amount which is paid is based on the circumstances of the family Part B is paid to every family and it gives

Family Tax Benefit Calculator HaleafSylvi

https://i.pinimg.com/originals/41/63/8f/41638fad4707b0e86cf27ceae235b0fc.jpg

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

https://content.api.news/v3/images/bin/5e7d357683d858fd878fce5a66ee1348?width=1280

https://www.servicesaustralia.gov.au › how-much...

Read more about FTB Part B payment rates You can also find out about the income test for FTB Part B Your relationship changes can affect what payments you can get and your payment

https://www.servicesaustralia.gov.au › income-test...

Family Tax Benefit Part B is for single parents or carers and some couples who meet a 2 part income test You won t be eligible for FTB Part B if your annual adjusted taxable income is

Family Tax Benefit Part A Base Rate Tax Walls

Family Tax Benefit Calculator HaleafSylvi

Family Tax Benefit PART A PART B Care For Kids

The Law LDR Tax Amnesty

Family Tax Benefit Part A And An Earnings Credit Download Scientific

Family Tax Benefit Cuts Discriminate The Catholic Leader

Family Tax Benefit Cuts Discriminate The Catholic Leader

Budget 2014 Will I Lose Family Tax Benefit Part B

Family Tax Benefit Residential Property Or Estate Tax Concept Stock

Labor Indicates Family Tax Benefit Change SBS News

Family Tax Benefit Part B Rates - FTB Part B standard rates The standard rate of FTB Part B is the maximum annual amount payable for a child based on their age without including the supplement and without