What Is Family Tax Benefit Part B We may pay you Family Tax Benefit FTB Part B if you re a single parent a grandparent carer or if you re a member of a couple with one main income

The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and some couples who meet a 2 part income test Family Tax Benefit FTB is a payment from Services Australia Who can get it To get this you must have a dependent child or full time secondary student aged 16 to 19 who isn t getting a pension payment or benefit like Youth Allowance care for the child for at least 35 of the time meet income and residency requirements There are 2

What Is Family Tax Benefit Part B

What Is Family Tax Benefit Part B

https://geniuswriter.net/wp-content/uploads/2021/11/top-view-of-tax-form-laptop-and-blue-card-with-tax-word-at-workplace-1536x1025.jpg

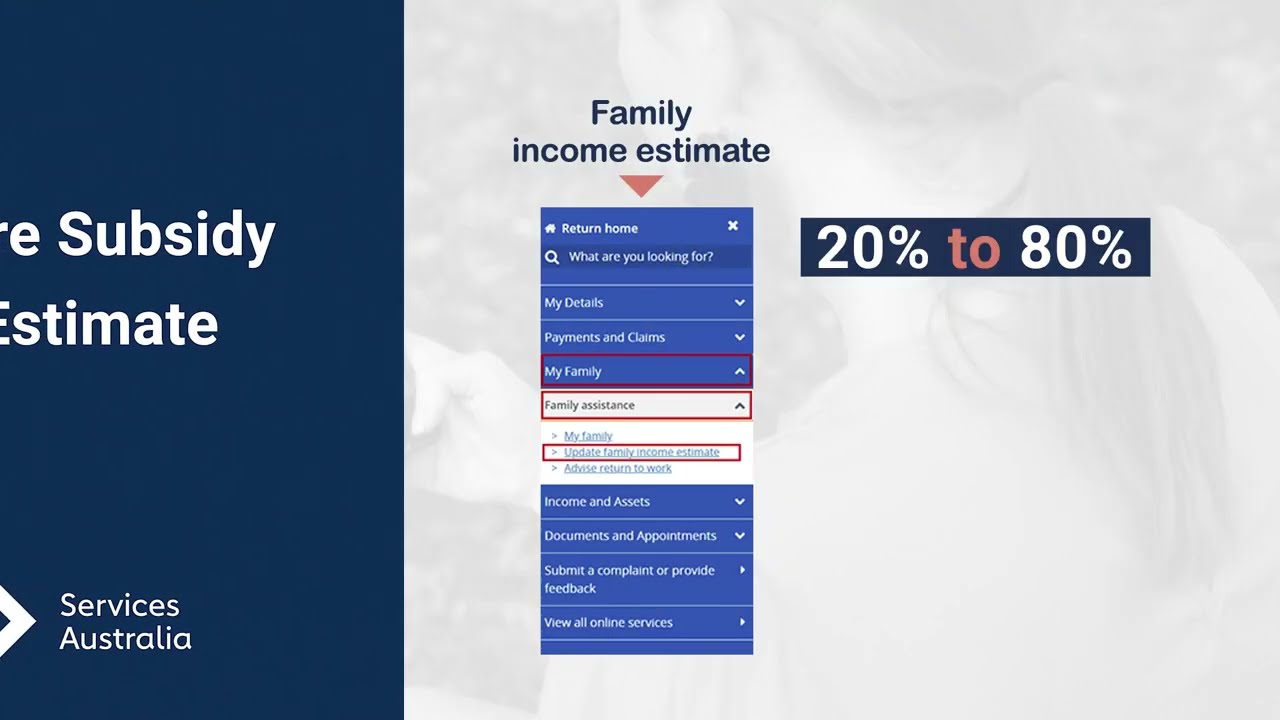

Child Care Subsidy Income Estimate YouTube

https://i.ytimg.com/vi/2AgLUdh9nOw/maxresdefault.jpg

What Is Family Tax Recovery Canadian Tax Refunds

https://canadiantaxrefunds.ca/wp-content/uploads/2022/08/family-tax-recovery.jpg

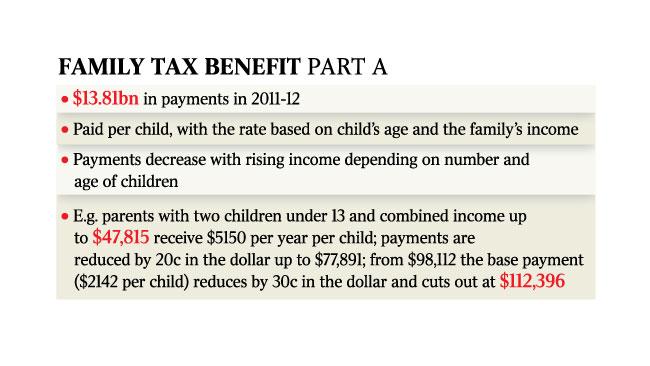

Family Tax Benefit FTB is a payment that helps eligible families with the cost of raising children It is made up of two parts FTB Part A is paid per child and the amount paid is based on the family s circumstances What are the rates for the Family Tax Benefit Part A and Family Tax Benefit Part B in 2022 Find out about eligibility and how to claim

FTB Part B supplement The FTB Part B supplement is part of the maximum rate and base rate of FTB Part B The current maximum FTB Part B supplement is 448 95 per family The supplement is only available after the end of the income year after FTB has been reconciled FTB is a family assistance payment that consists of 2 parts FTB Part A and FTB Part B FTB Part A is designed to help families with the cost of raising children Payment of FTB Part A is based on the combined income of a family and generally is paid in respect of each eligible dependent child

Download What Is Family Tax Benefit Part B

More picture related to What Is Family Tax Benefit Part B

Family Tax Benefit Form Pdf Australian Guid Step by step Instructions

https://fatlosslabs.com/blogimgs/https/cip/data.formsbank.com/pdf_docs_html/347/3479/347914/page_1_thumb_big.png

Family Tax Benefit In 2019 Calculator Threshold Eligibility Online

https://s3-ap-southeast-2.amazonaws.com/vacancy-care-enthusiast/~www/wp/aws/wp-content/uploads/2019/08/02110051/brothers-457237_1280-768x512.jpg

Claim For An Annual Lump Sum Payment Of Family Tax Benefit

https://img.yumpu.com/32296971/1/500x640/claim-for-an-annual-lump-sum-payment-of-family-tax-benefit.jpg

Family Tax Benefit FTB is a 2 part payment for eligible families to help with the cost of raising children The Family Tax Benefit is made up of 2 parts Part A a payment made per child depending on your family s circumstances Part B a payment made per family to give extra help to families that need it FTB Part B provides extra help for single parent families and couple families 1 1 M 50 with one main income earner FTB eligibility General provisions for eligibility apply to individuals 1 1 I 90 Eligibility of ACO s is covered separately 1 1 A 80

FTB Part B eligibility you re a member of a couple with 1 main income and care for a dependent child aged under 13 you re a single parent or non parent carer or a grandparent carer and care for a dependent child aged under 18 The child must meet study requirements if they re aged 16 to 18 Pass FTB Part B income test Fulfill The Family Tax Benefit FTB is a payment that s designed to help eligible families with the cost of raising children It s made up of two parts Part A a payment made per child that s based on the family s circumstances and Part B a payment made per family that provides extra support to single parents and some couple families with

Serviceability

https://pic1.zhimg.com/v2-97da941f526f8173122b9e43cee46fe8_r.jpg

23 Australian Family Tax Benefit Part B

https://i.ytimg.com/vi/QxyXvw5odaE/maxresdefault.jpg

https://www.servicesaustralia.gov.au/family-tax...

We may pay you Family Tax Benefit FTB Part B if you re a single parent a grandparent carer or if you re a member of a couple with one main income

https://www.servicesaustralia.gov.au/how-much...

The amount of Family Tax Benefit FTB Part A you get depends on your family s income Income test for FTB Part B Family Tax Benefit Part B is for single parents or carers and some couples who meet a 2 part income test

Update On The Future Of Family Tax Benefit Part B

Serviceability

Understanding The Family Tax Benefit TaxLeopard

Family Tax Benefit Calculator HaleafSylvi

Family Tax Benefit Cuts Could Save 1bn A Year The Australian

Family Tax Benefit PART A PART B Care For Kids

Family Tax Benefit PART A PART B Care For Kids

The Law LDR Tax Amnesty

Australia Family Tax Benefit Part A Part B What Is Family Tax

What Is Family Tax Bracket Management

What Is Family Tax Benefit Part B - A 2 part payment that helps with the cost of raising children To get this you must have a dependent child or full time secondary student aged 16 to 19 who isn t getting a pension payment or benefit like Youth Allowance care for the