Fd Exemption Limit Verkko 18 tammik 2022 nbsp 0183 32 However the basic exemption limit is Rs 50 000 for a year In other words no TDS deduction will take place if interest income from FDs for a year is not

Verkko 14 marrask 2023 nbsp 0183 32 As per the Income Tax Act the exemption limit for TDS deduction on FD is Rs 40 000 for individuals excluding senior citizens and Rs 50 000 for senior Verkko 31 hein 228 k 2023 nbsp 0183 32 A tax saving fixed deposit FD account is a type of fixed deposit account that offers a tax deduction under Section 80C of the Income Tax Act 1961

Fd Exemption Limit

Fd Exemption Limit

https://help.tallysolutions.com/docs/te9rel49/Tax_Audit/Tax_Audit_1/images/TDS_-27.gif

Limit Volume 5

https://cdn.kodansha.us/statics/comics/2021/05/9781935654650-Limit_05.jpg

DigiFinex Granted Exemption License In Canada GKnews

https://cryptopotato.com/wp-content/uploads/2023/05/WeIMG101_1685437200SNMx4iakt6.jpeg

Verkko You can take advantage of the income tax deduction provision under Section 80C of the Income Tax Act by investing up to Rs 1 5 lakh in a tax saver fixed deposit account Verkko 5 lokak 2023 nbsp 0183 32 What is the Exemption Limit for TDS Deduction on FD According to the prevailing income tax regulations the threshold for TDS deduction on Fixed Deposits FD stands at Rs 40 000 for regular

Verkko Section 80TTA of the Income Tax Act 1961 provides a deduction of up to Rs 10 000 on the income earned from interest on savings made in a bank co operative society or Verkko 14 huhtik 2021 nbsp 0183 32 For those who are less than 60 years income up to Rs 2 5 lakh is exempted while for those over age 60 but under age 80 income up to Rs 3 lakh is

Download Fd Exemption Limit

More picture related to Fd Exemption Limit

How To Apply And Collect NYSC Exemption Letter Home Trained foreign

https://i1.wp.com/legitportal.com/wp-content/uploads/2019/02/nysc-exemption-letter.jpg?fit=2169%2C1496&ssl=1

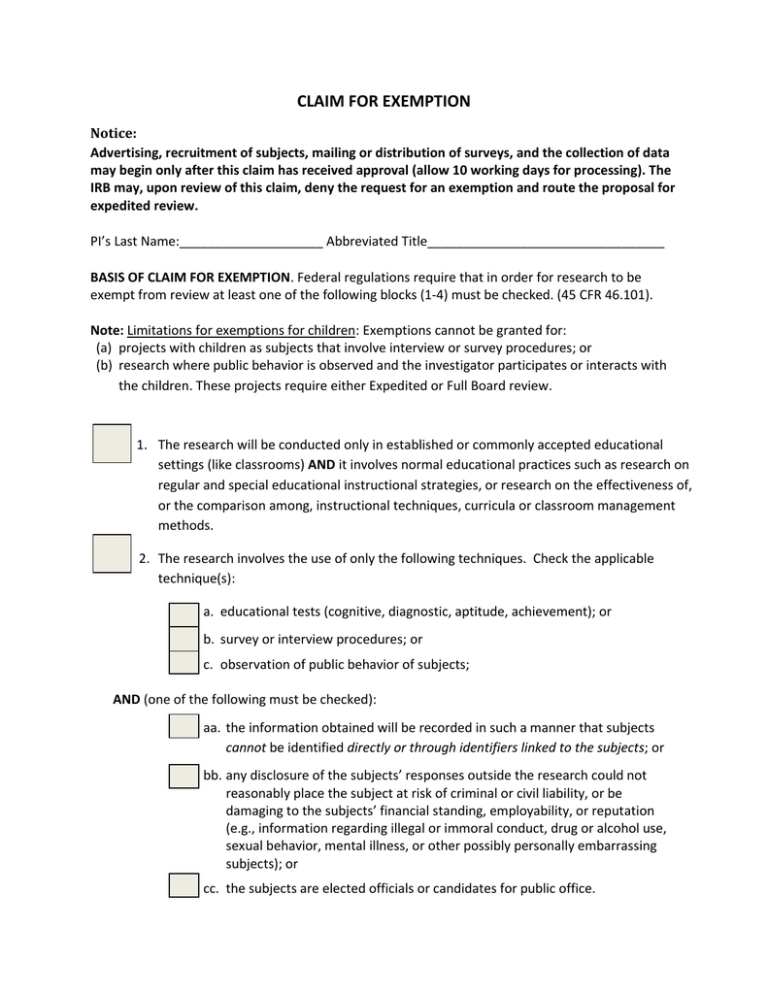

Claim For Exemption

https://s2.studylib.net/store/data/015290925_1-c28b6785682afa346c6300cf0893f532-768x994.png

00063 Manual Test Exemption

http://www.artfulcompliance.com/wp-content/uploads/2022/07/00063-Manual-Test-Exemption.png

Verkko 26 lokak 2023 nbsp 0183 32 Home Fixed Deposit Fixed Deposit Under 80C Book SBM Bank FD 6 5 p a amp Get a Lifetime Free Step Up Credit Card Safe amp Secure FD Insured by Verkko An investor can claim income tax exemption on investments up to Rs 1 5 lakh when investing in Fixed Deposits As part of a Tax Saving Fixed Deposit interest earned is

Verkko You can file or use form 15G 15H if your total income for the year is less than 2 5 lakh Because the interest on your FD is not taxable the bank will not deduct TDS You will Verkko 28 elok 2023 nbsp 0183 32 TDS On Interest On FD Exemptions and Limits Posted on Monday August 28th 2023 By IndusInd Bank Summary The taxation of fixed deposit interest

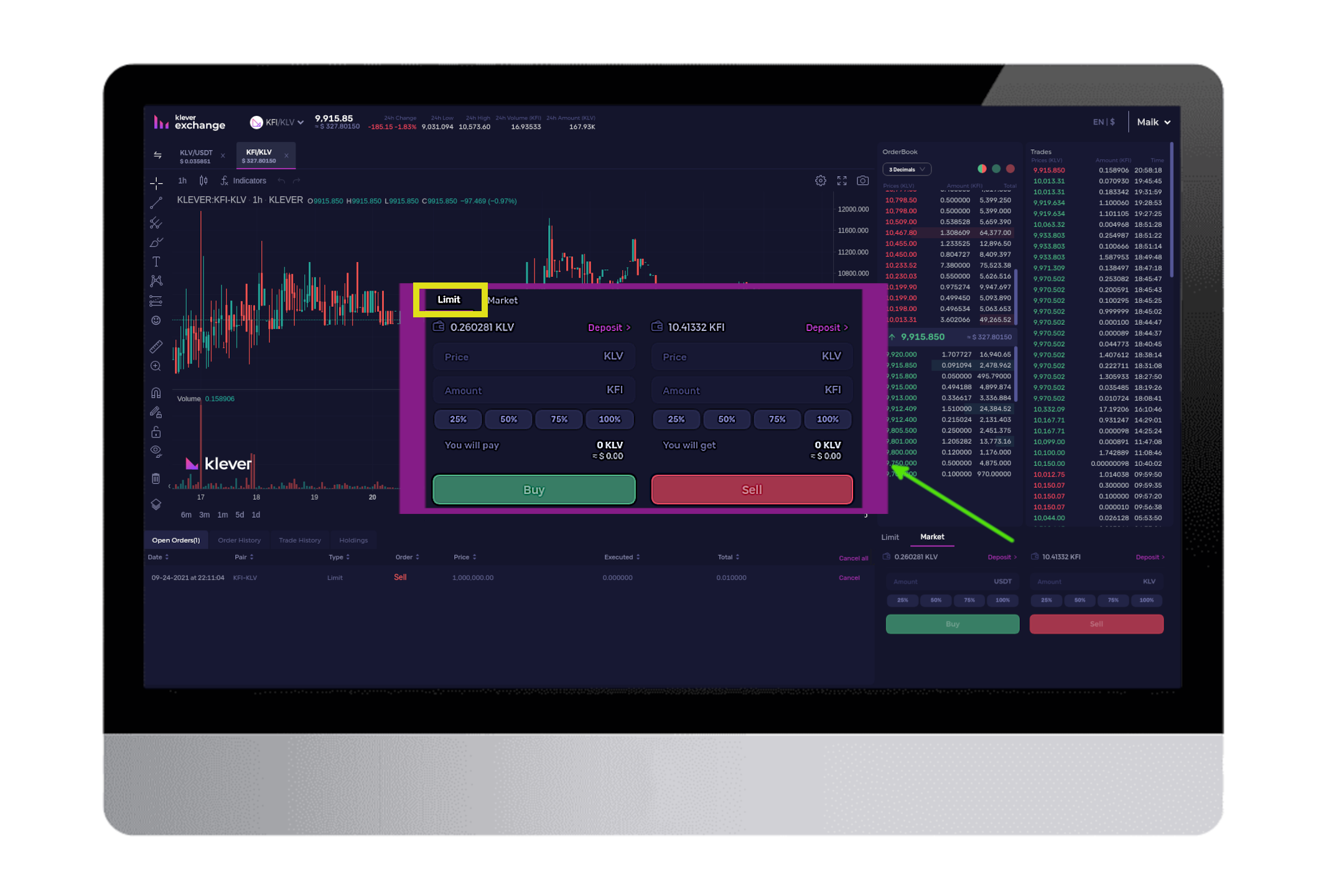

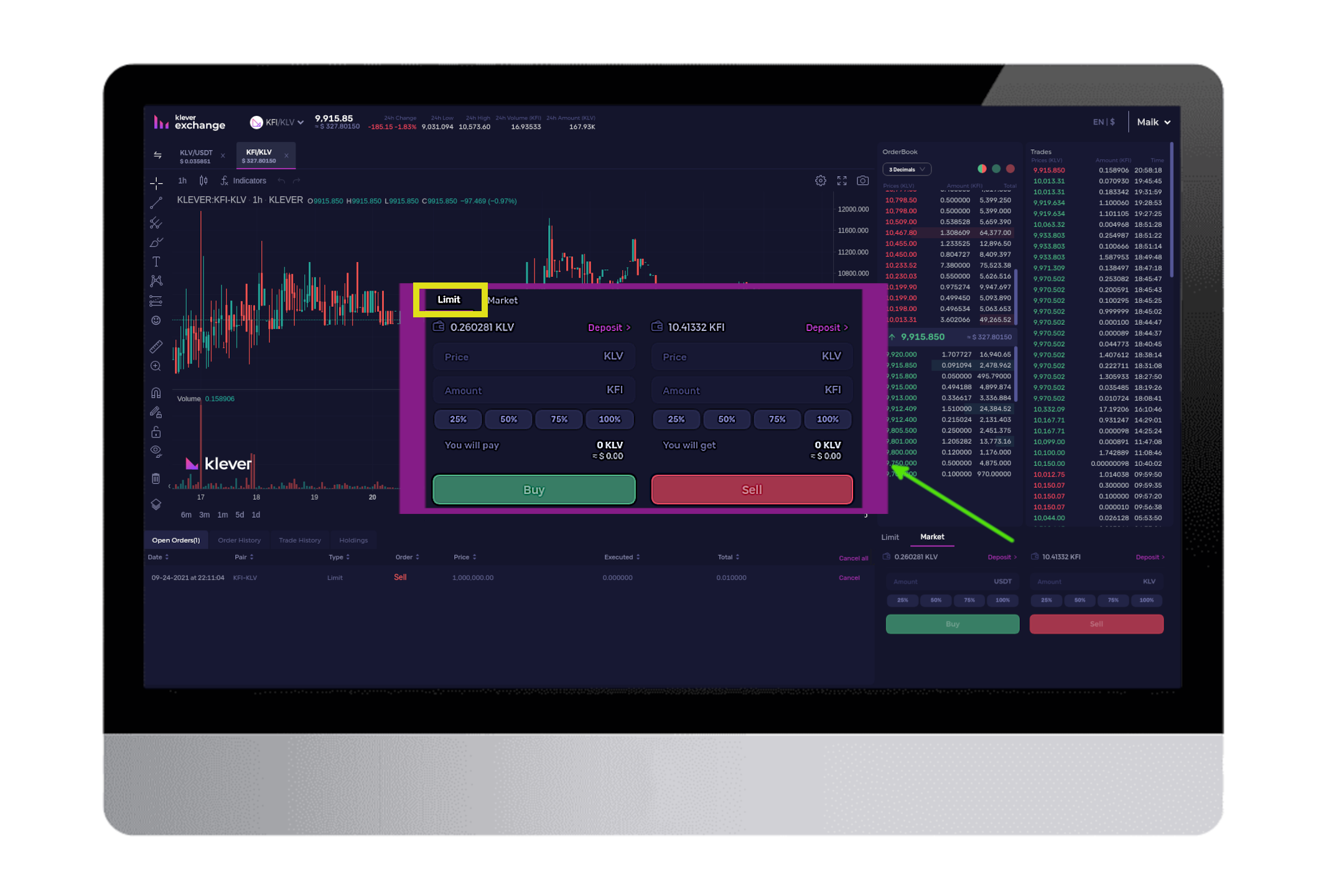

Apa Itu Limit Order Dukungan Klever

https://klever.zendesk.com/hc/article_attachments/4409380658068/Limit_Orders.png

HRDF Exemption 2021 Aug 17 2021 Johor Bahru JB Malaysia Taman

https://cdn1.npcdn.net/image/16291740015c84b8416a0ddc373dfd84136e63ef81.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1190&new_height=1000&w=-62170009200

https://navi.com/blog/taxability-of-interest-on-fixed-deposits

Verkko 18 tammik 2022 nbsp 0183 32 However the basic exemption limit is Rs 50 000 for a year In other words no TDS deduction will take place if interest income from FDs for a year is not

https://www.business-standard.com/finance/personal-finance/bank...

Verkko 14 marrask 2023 nbsp 0183 32 As per the Income Tax Act the exemption limit for TDS deduction on FD is Rs 40 000 for individuals excluding senior citizens and Rs 50 000 for senior

Section 80C Deductions List To Save Income Tax FinCalC Blog

Apa Itu Limit Order Dukungan Klever

Exemption From Fasting Al Islam

No Limit Transportation

Materi Soal Dan Pembahasan Lengkap Limit Matematika Mobile Legends Riset

Exemption

Exemption

Claim Exemption Fill Out Sign Online DocHub

Exemption

Authors Alliance Petitions For New Exemption To Section 1201 Of The

Fd Exemption Limit - Verkko 7 toukok 2019 nbsp 0183 32 Further the Interim Budget 2019 increased the limit prescribed for deduction of TDS on interest from Rs 10 000 to Rs 40 000 Thus in case the interest