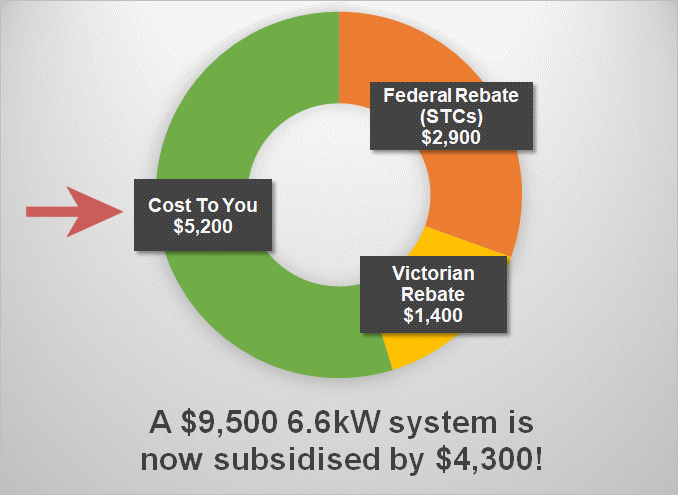

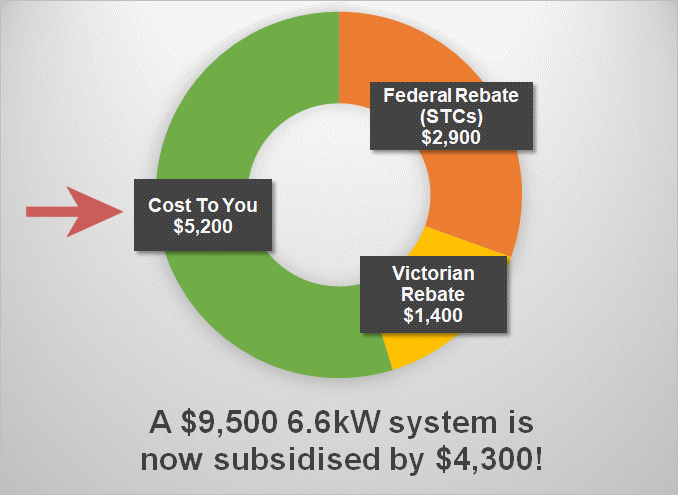

Federal And State Rebates For Solar Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

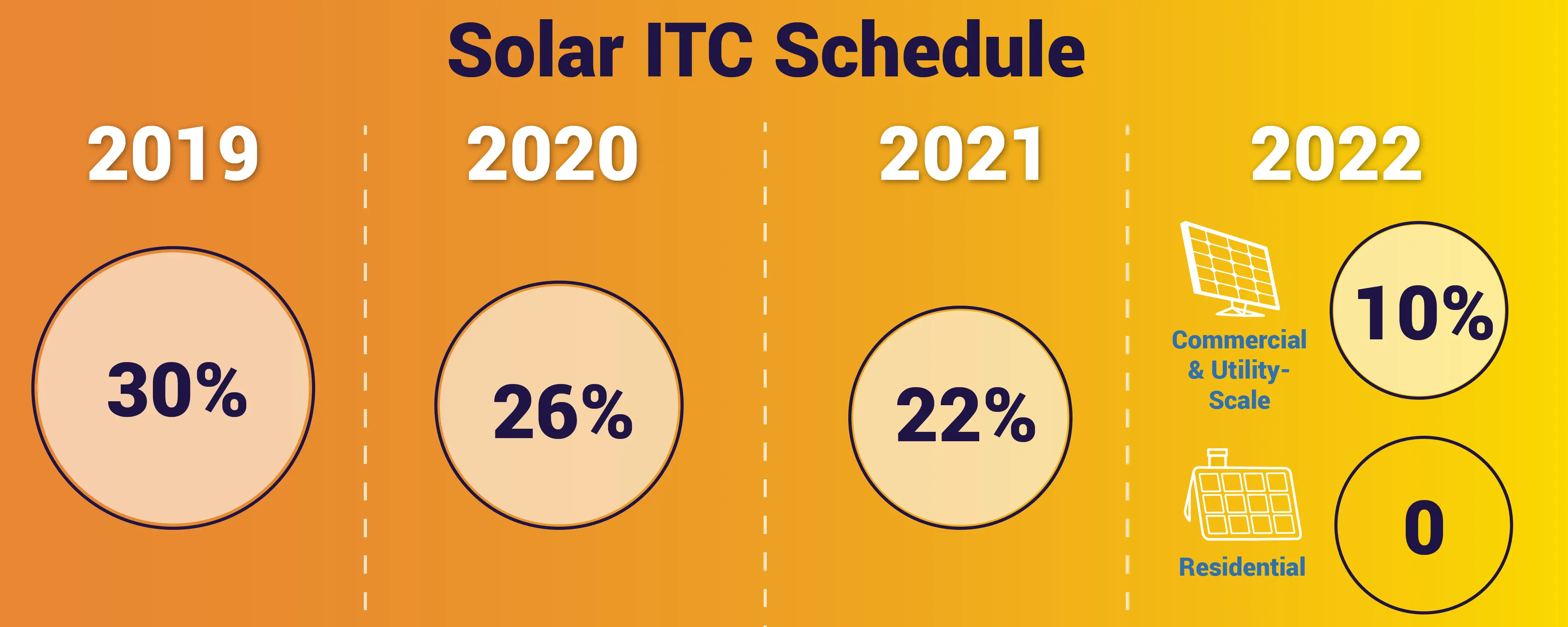

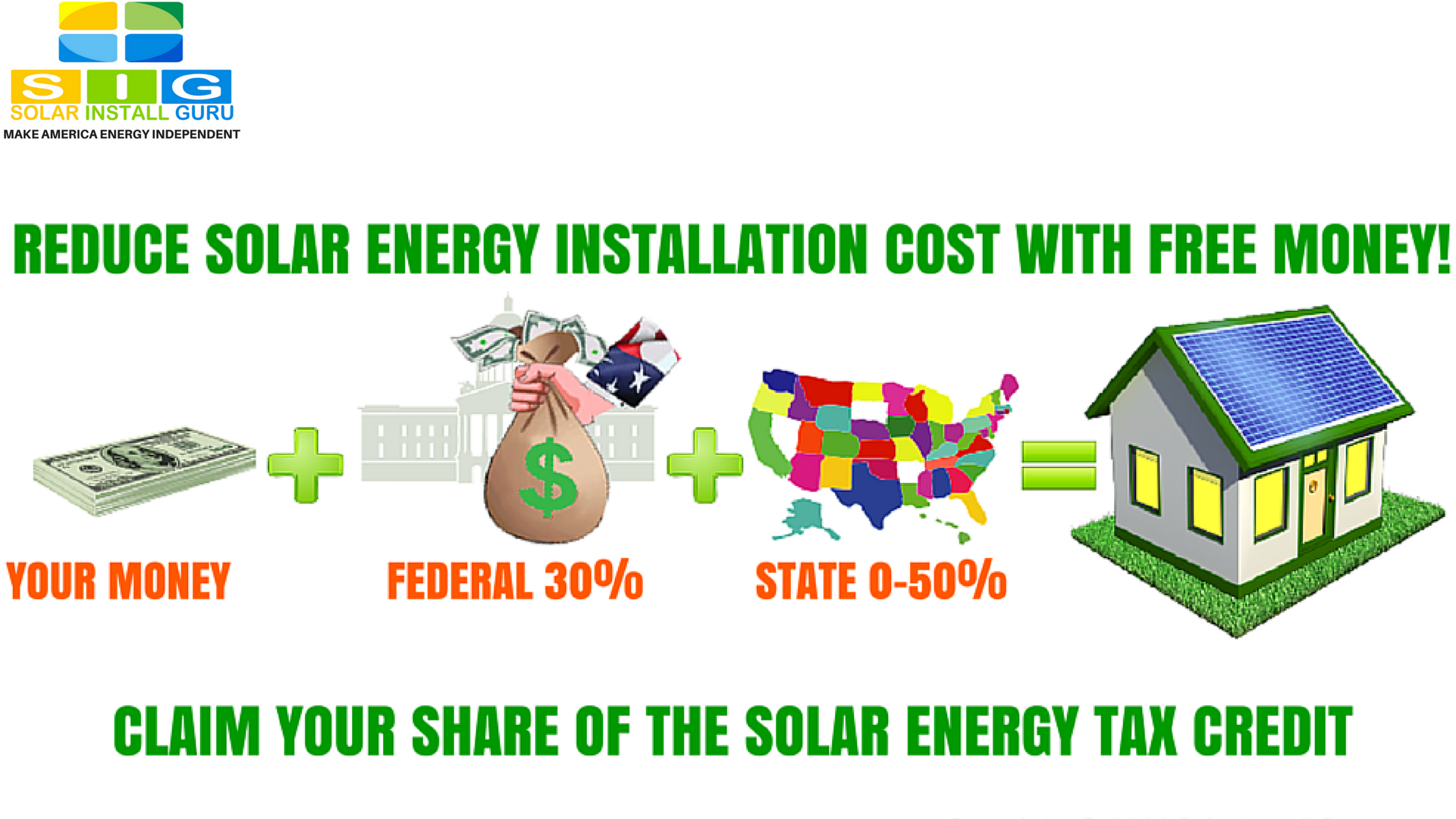

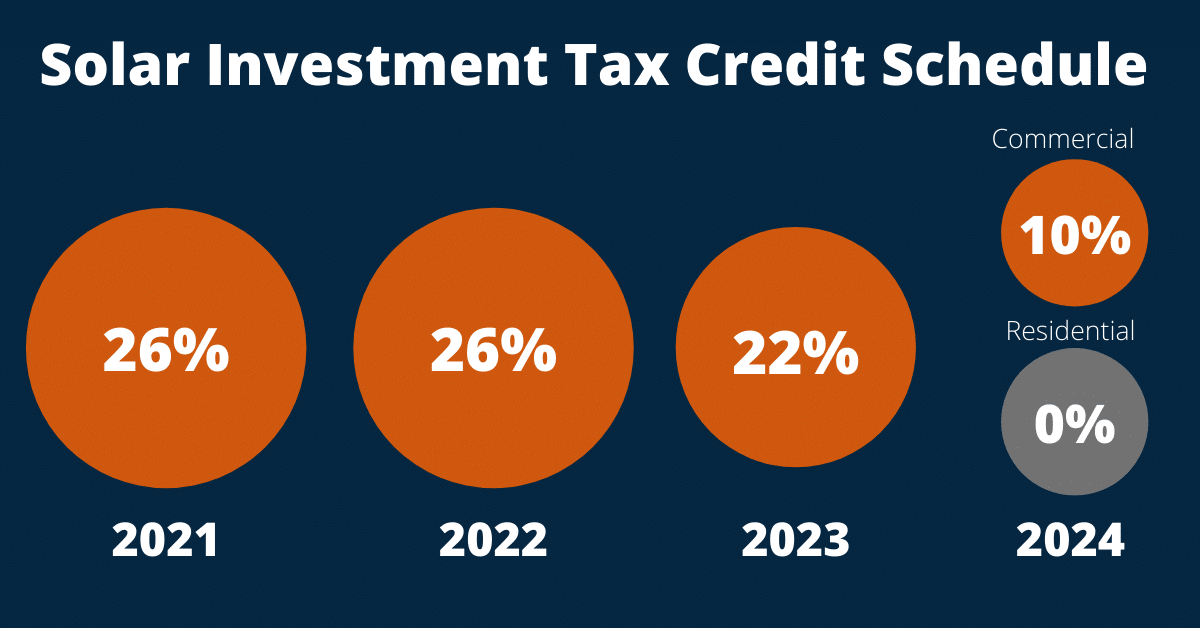

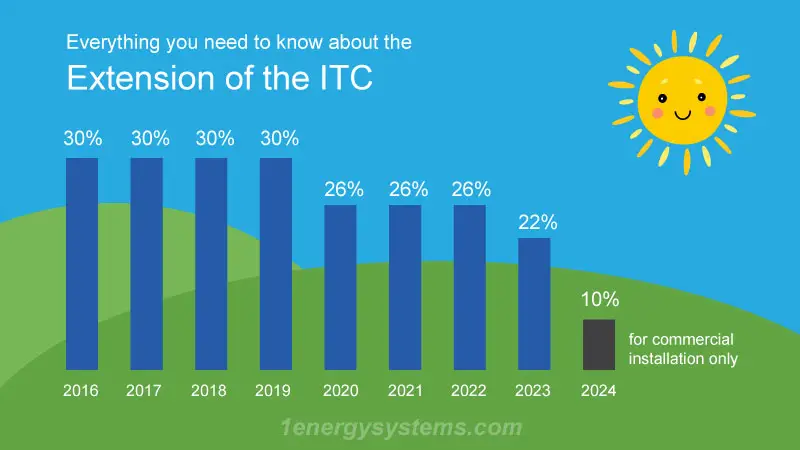

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the Web Thanks to the Inflation Reduction Act the Federal Solar Investment Tax Credit is at 30 until the end 2032 which is a great start to reducing the cost of your solar system

Federal And State Rebates For Solar

Federal And State Rebates For Solar

https://blog.solarinstallguru.com/wp-content/uploads/2016/12/Federal_Solar_Tax_Credit_and_solar_rebates_Can_Slash_Solar_Panel_Installation_Cost_by_30_to_80_Percent.png

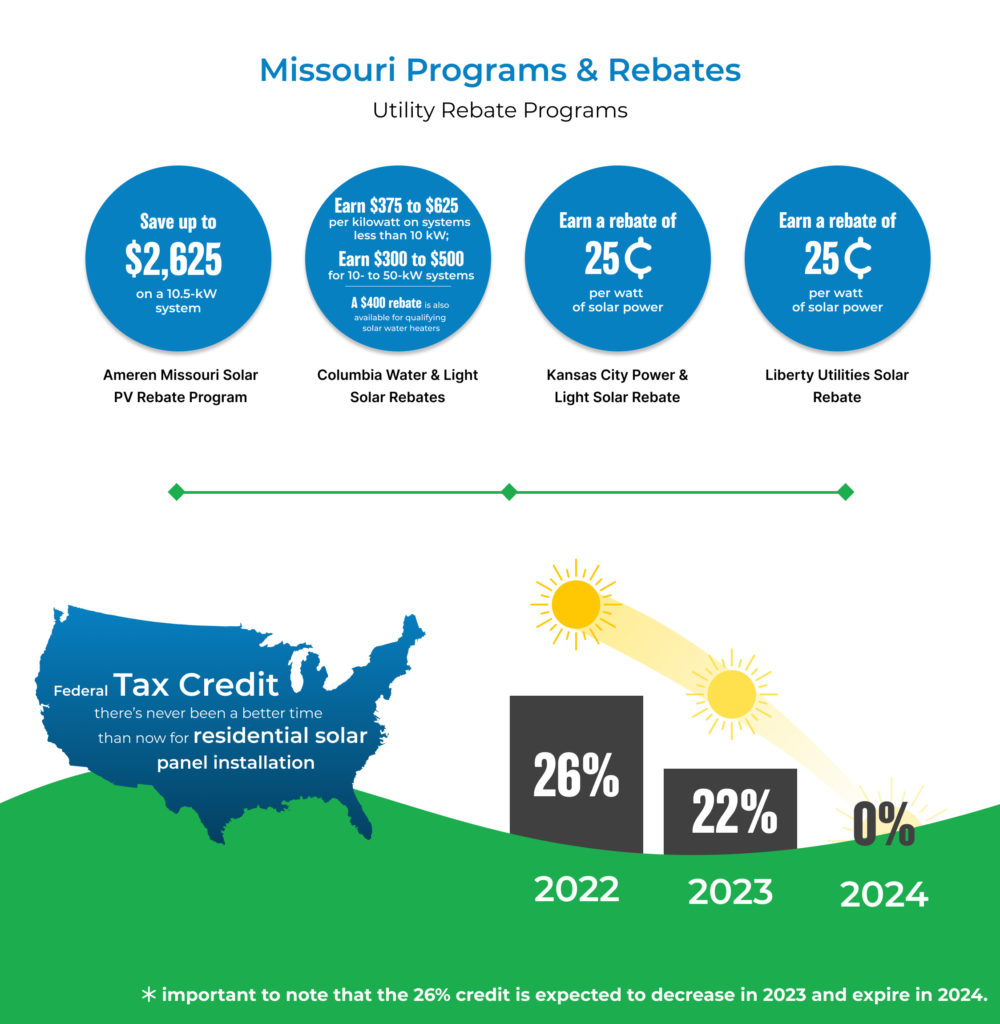

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Free Definitive Solar Tips 2022 Solar Panels Price Guide

https://www.datocms-assets.com/15768/1573550821-solar-rebates-state-level.png?fit=max&w=640

Web 13 mars 2023 nbsp 0183 32 Almost all state tax credits have a maximum with current amounts between 500 and 5 000 depending on the state Solar panel rebates States utility companies and solar panel manufacturers offer Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic PV system 2 Other

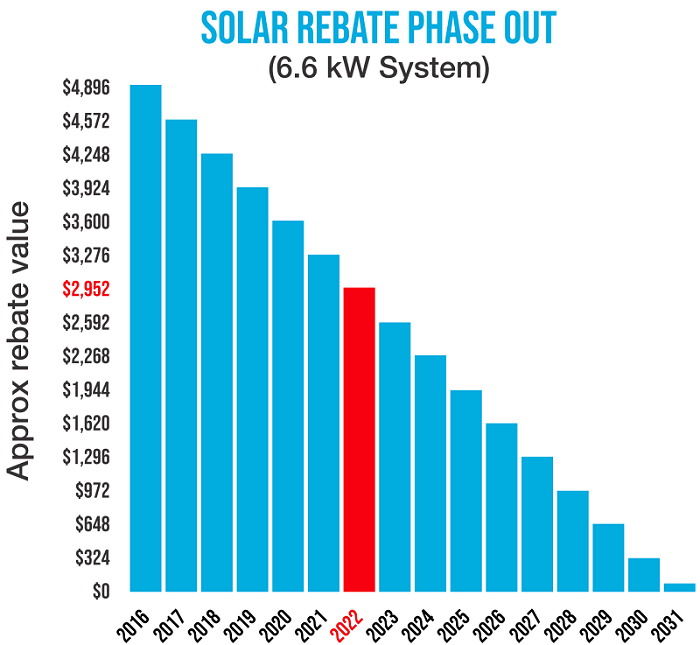

Web 8 sept 2022 nbsp 0183 32 The U S Department of Energy DOE Solar Energy Technologies Office SETO developed three resources to help Americans navigate changes to the federal solar Investment Tax Credit ITC Web There is a federal investment tax credit ITC for solar energy systems in place until December 31st 2023 Both residential and commercial customers can take advantage of

Download Federal And State Rebates For Solar

More picture related to Federal And State Rebates For Solar

Federal Government Solar Tax Credit KnowYourGovernment

https://www.knowyourgovernment.net/wp-content/uploads/solar-panel-rebates-solar-tax-incentives-greenlight.png

Solar Rebate Programs For Solar By State

https://4.bp.blogspot.com/-f4ExFGx6hiA/U5d022BzDgI/AAAAAAAARs0/gyegmJh5N9Y/s1600/solar+rebate+programs+by+state.PNG

2020 Guide To Oregon Solar Incentives Rebates Tax Credits More

https://www.solarpowerrocks.com/wp-content/uploads/2020/01/2020-OR-solar-rebates--ranked.png

Web On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act IRA into law The law includes 391 billion to support clean energy and address climate Web 28 ao 251 t 2023 nbsp 0183 32 Business use up to 20 full credit Business use more than 20 credit based on share of expenses allocable to nonbusiness use Find more on who can claim

Web On a 10 000 solar project the credit would put 2 600 back in your pocket significantly speeding up your payback period Read our quick primer on the federal solar tax credit Web 18 mai 2023 nbsp 0183 32 Key takeaways The federal solar tax credit gives you 30 percent of the cost of your solar system in credit when you file your taxes Many states offer local solar

Victorian Solar Rebate Explained SolarQuotes

https://www.solarquotes.com.au/wp-content/uploads/2021/07/victoria-rebate-chart.png

Every Year We Rank The Best States For Solar Power And The Worst

https://i.pinimg.com/originals/e3/2f/82/e32f82ce99fdbbd2b87076c99735920d.png

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit...

Web For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing

https://www.energy.gov/sites/default/files/2023-03/Homeown…

Web The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar PV system paid for by the

2019 Texas Solar Panel Rebates Tax Credits And Cost

Victorian Solar Rebate Explained SolarQuotes

Solar Rebates By State In 2021 Solar

2018 Guide To Florida Home Solar Incentives Rebates And Tax Credits

Solar 101 A Guide To Buying Solar Power Systems

The Future Of Solar Energy Rebates Solaris

The Future Of Solar Energy Rebates Solaris

Do Solar Batteries Qualify For Tax Credit At Alexander Roberts Blog

New Mexico Solar Power For Your House Rebates Tax Credits Savings

Solar Panel Rebates And Incentives A Comprehensive Guide

Federal And State Rebates For Solar - Web 3 avr 2018 nbsp 0183 32 To encourage more homeowners like you to go solar governments electric utilities and other organizations offer financial incentives rebates and tax credits that