Federal Income Tax Credit A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

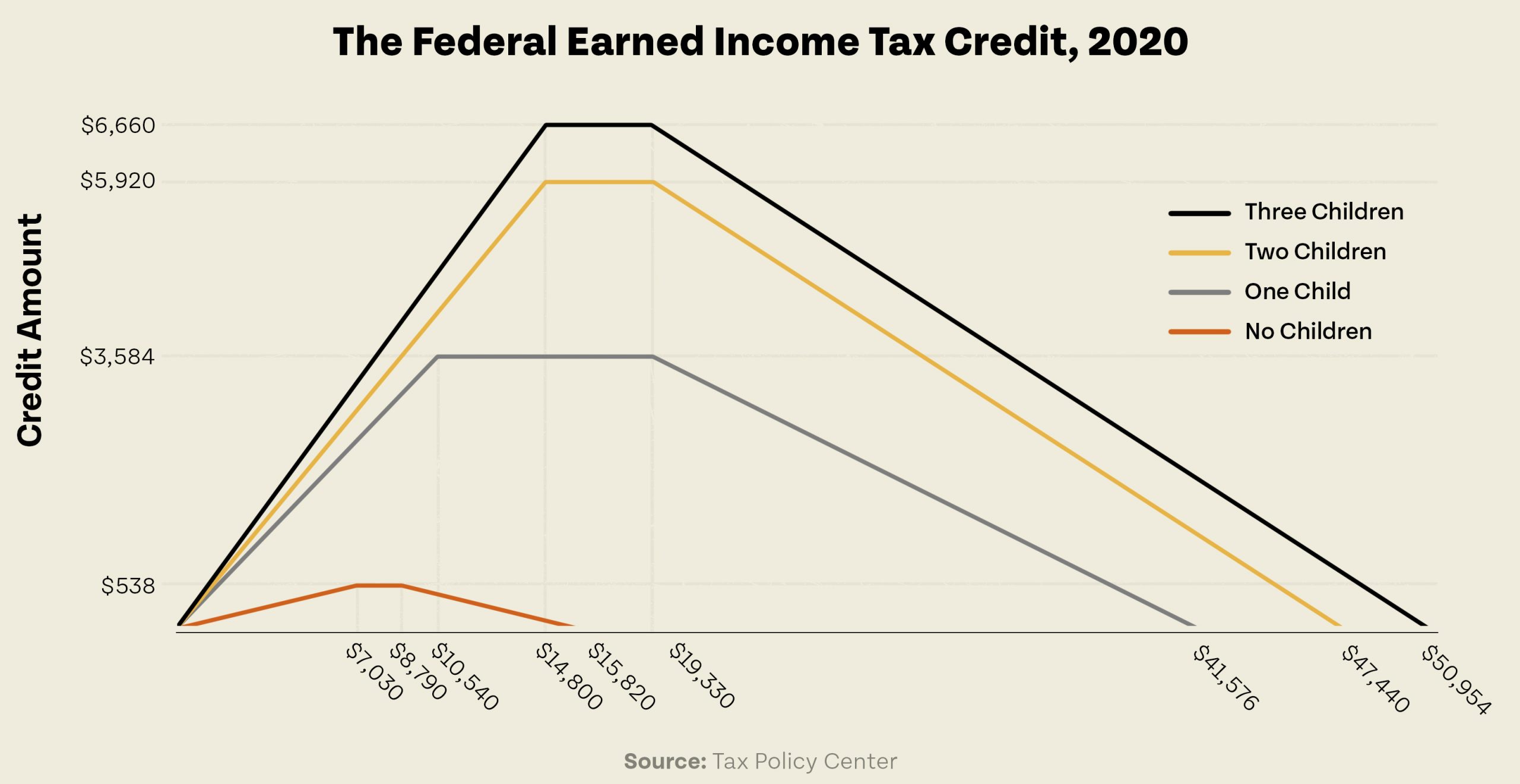

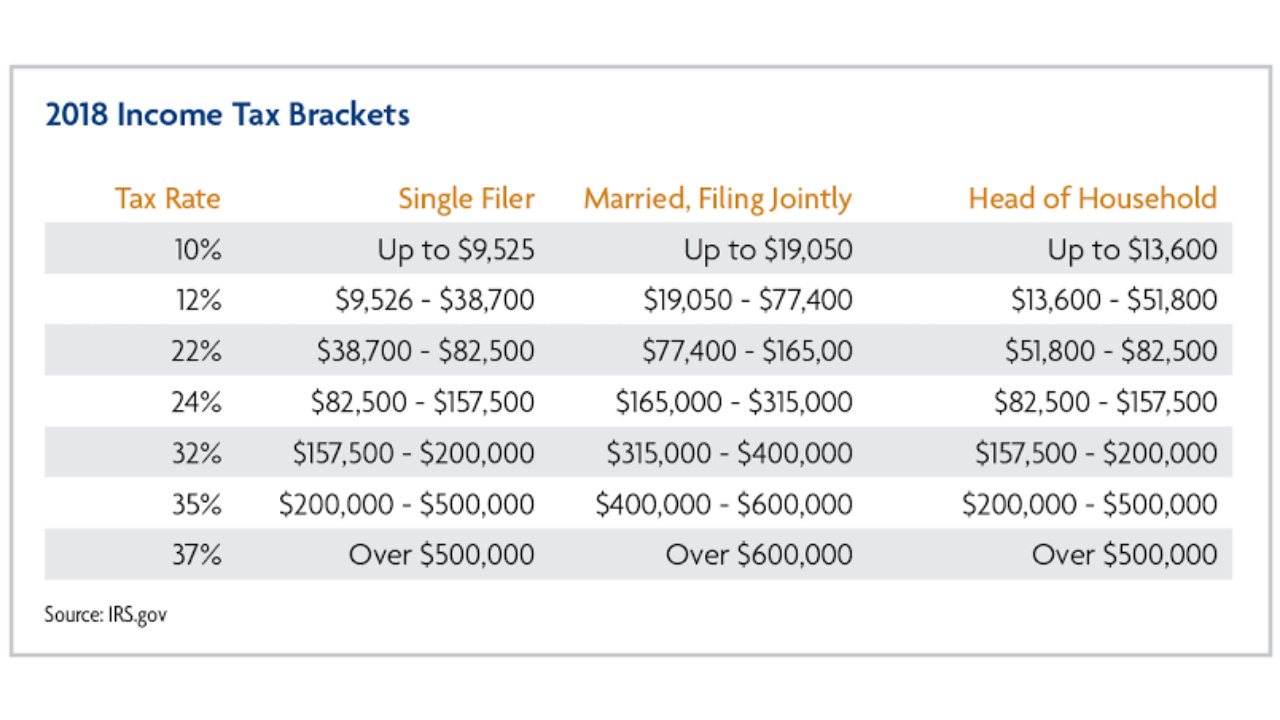

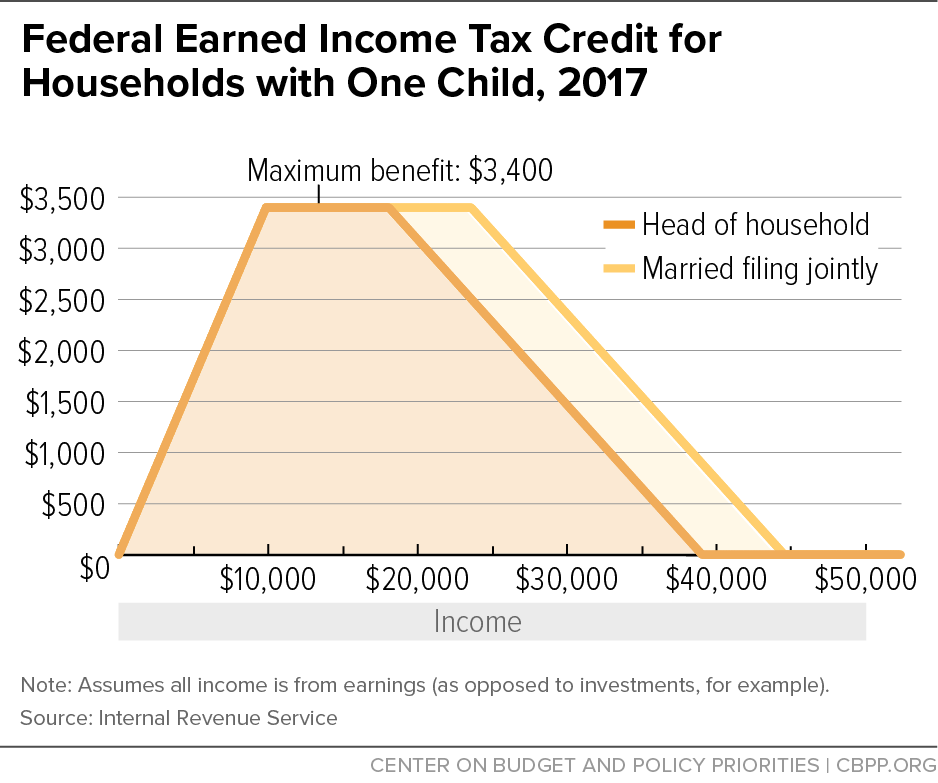

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the The earned income tax credit EITC is a refundable tax credit that helps certain U S taxpayers with low earnings by reducing the amount of tax owed on a dollar for dollar basis

Federal Income Tax Credit

Federal Income Tax Credit

https://d25skit2l41vkl.cloudfront.net/wp-content/uploads/2017/12/Child-Tax-Credit.jpg

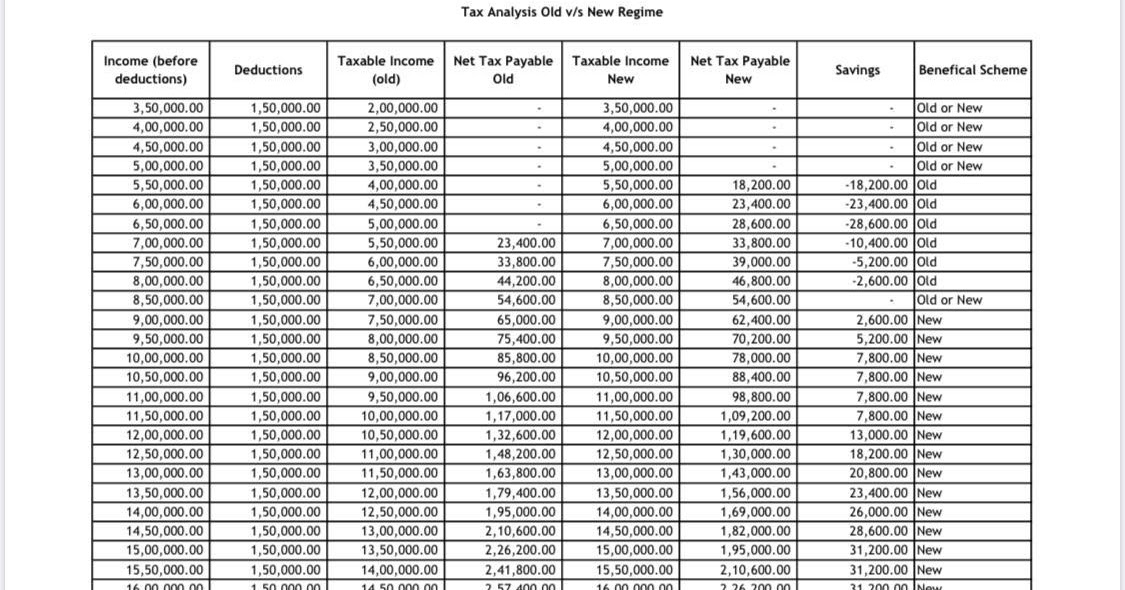

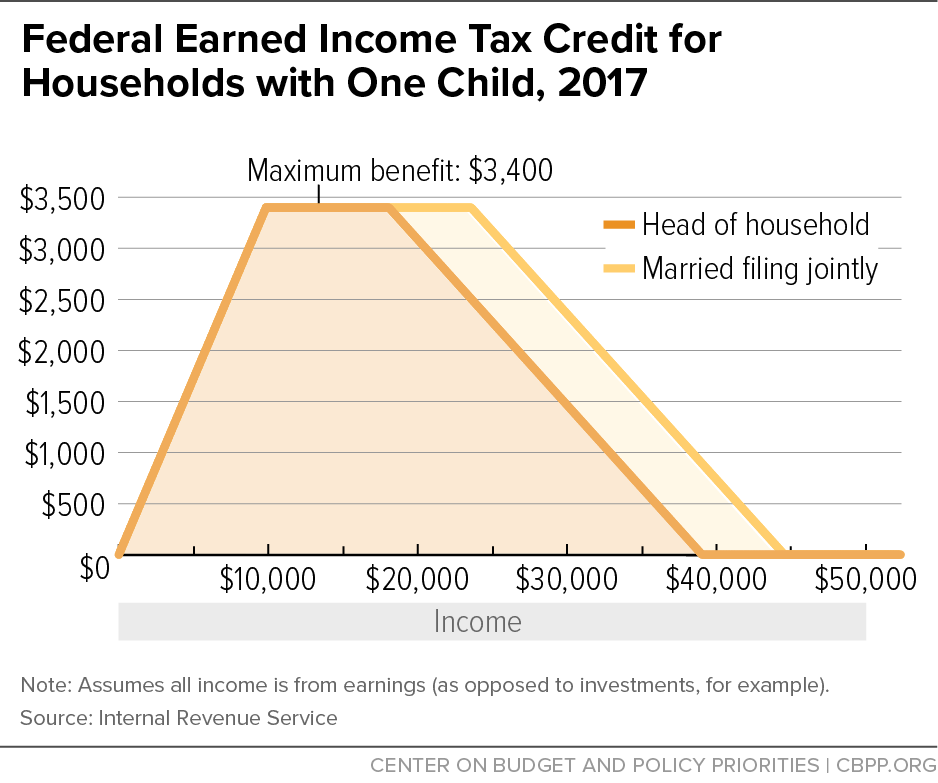

Monthly Federal Income Tax Calculator 2021 Tax Withholding Estimator 2021

https://taxwithholdingestimator.com/wp-content/uploads/2021/08/income-tax-calculator-format-for-financial-year-2020-21-13.jpg

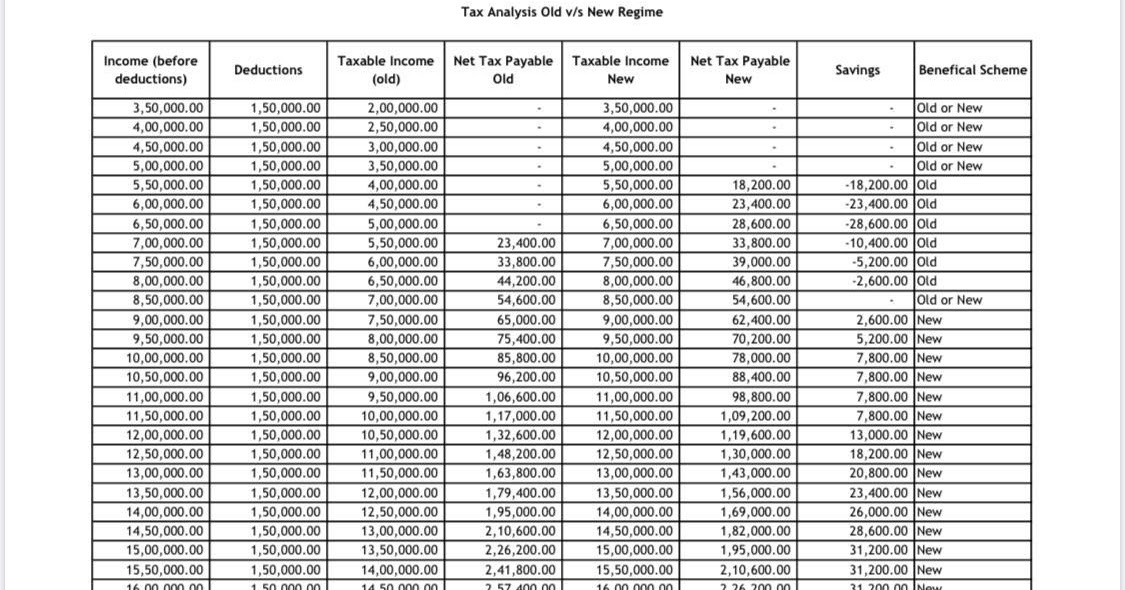

2020 2021 Federal Income Tax Brackets A Side By Side Comparison

https://i1.wp.com/goneonfire.com/wp-content/uploads/2020/11/045_2021-2020-Tax-Brackets.jpg?w=1920&ssl=1

The EITC is a federal tax credit that offers American workers and families a financial boost The EITC has been benefitting low and moderate income workers for 46 years and many working families receive more money through EITC than they pay in The average amount of EITC received nationwide in tax year 2022 was about 2 541 However there are still millions of people not taking advantage of this valuable credit Help us reach the workers who qualify but miss out on thousands of

More people without children now qualify for the Earned Income Tax Credit EITC the federal government s largest refundable tax credit for low to moderate income families In addition families can use pre pandemic income levels to qualify if Must have lived in the United States for more than half of the tax year Either you or your spouse if filing a joint return must be at least age 25 but less than age 65 Cannot qualify as the dependent of another person Special rules apply for members of the military on extended duty outside the United States

Download Federal Income Tax Credit

More picture related to Federal Income Tax Credit

See The EIC Earned Income Credit Table Income Tax Return Income

https://i.pinimg.com/originals/aa/af/be/aaafbed0a4b639f5c32ede742b5dd17b.png

:max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png)

2023 Form 1040 Tax Tables Printable Forms Free Online

https://www.thebalancemoney.com/thmb/ZkCvYf5Rle7jVPSpxSKeKFEfflo=/1500x0/filters:no_upscale():max_bytes(150000):strip_icc()/2022TaxTableExample-a04b9e0f21ae4f0080ae5017bba3cb7f.png

Why Tax Credits For Working Families Matter

https://www.bellpolicy.org/wp-content/uploads/Federal-EITC-scaled.jpg

Key Takeaways A tax credit is an amount of money that taxpayers can subtract dollar for dollar from the income taxes they owe Tax credits are more favorable than tax deductions The Earned Income Tax Credit EITC helps low to moderate income workers and families get a tax break Answer some questions to see if you qualify 1 General Info 2 Filing Status 3 AGI 4 Qualifying Children 5 Results General Information Answer a few quick questions about yourself to see if you qualify

[desc-10] [desc-11]

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

https://i0.wp.com/www.whitecoatinvestor.com/wp-content/uploads/2020/12/tax-brackets-2022-img-1024x597.jpg

W4 Printable Forms 2022 Printable Explained 2022 W 4 Form

https://2022w-4form.com/wp-content/uploads/2022/09/top-10-us-tax-forms-in-2022-explained-pdf-co-20.png

https://www. irs.gov /newsroom/tax-credits-for...

A tax credit is a dollar for dollar amount taxpayers claim on their tax return to reduce the income tax they owe Eligible taxpayers can use them to reduce their tax bill and potentially increase their refund Refundable vs nonrefundable tax credits Some tax credits are refundable

https://www. nerdwallet.com /article/taxes/can-you...

The earned income tax credit EITC sometimes shortened to earned income credit is a tax break for low and moderate income workers To qualify you have to have worked in the

Tax Return 2022 Eitc Latest News Update

Federal Income Tax Brackets 2021 Vs 2022 Klopwatch

The Federal Earned Income Tax Credit Neighborhood Legal

Federal Income Tax Rate 2020 21 Tax Brackets 2020 21

2022 Income Tax Tables Printable Forms Free Online

Federal Earned Income Tax Credit For Households With One Child 2017

Federal Earned Income Tax Credit For Households With One Child 2017

1040ez Printable Form Carfare me 2019 2020

2023 Tax Tables Australia IMAGESEE

Income Tax Marginal Rates 2021 SallieJersey

Federal Income Tax Credit - More people without children now qualify for the Earned Income Tax Credit EITC the federal government s largest refundable tax credit for low to moderate income families In addition families can use pre pandemic income levels to qualify if