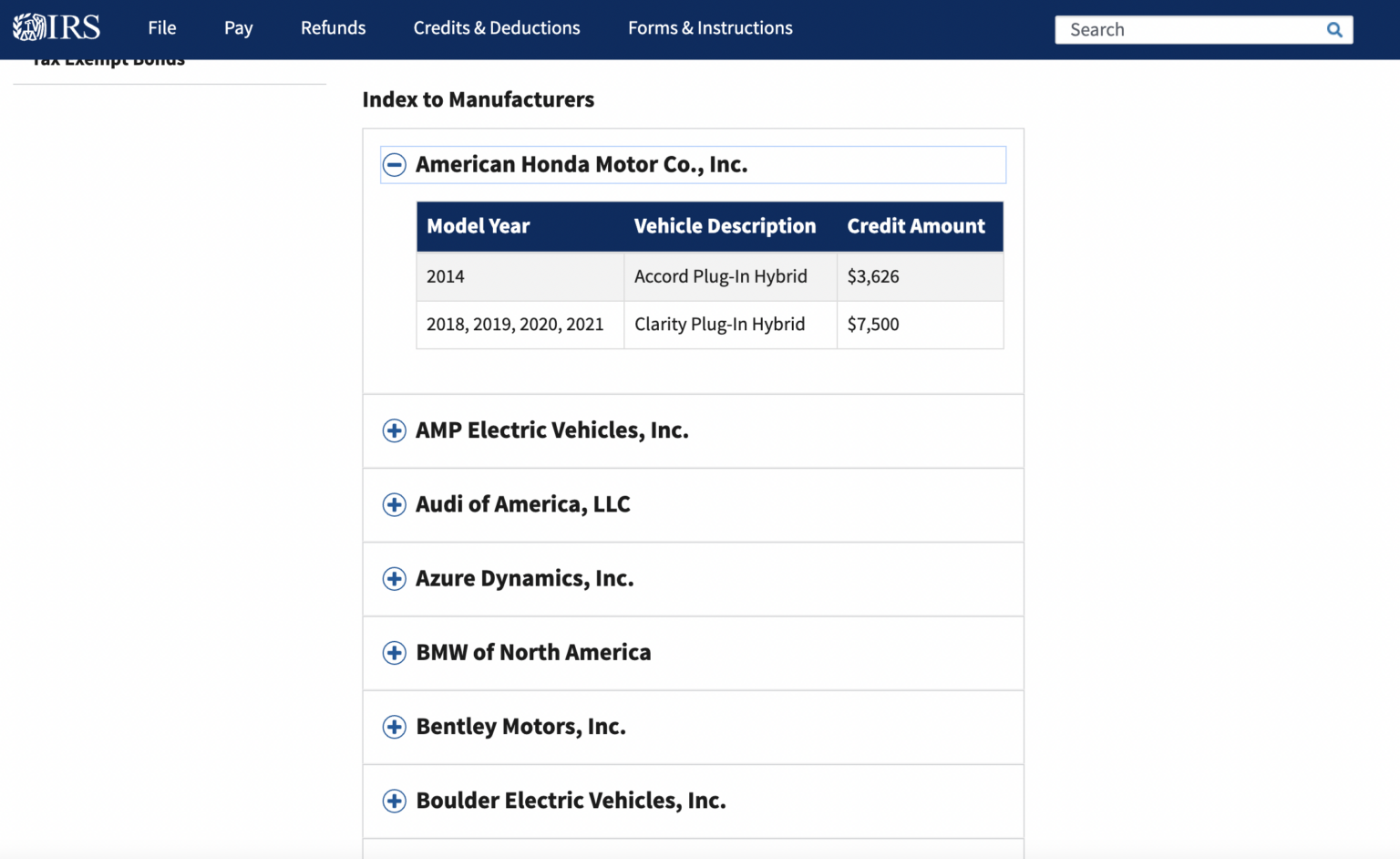

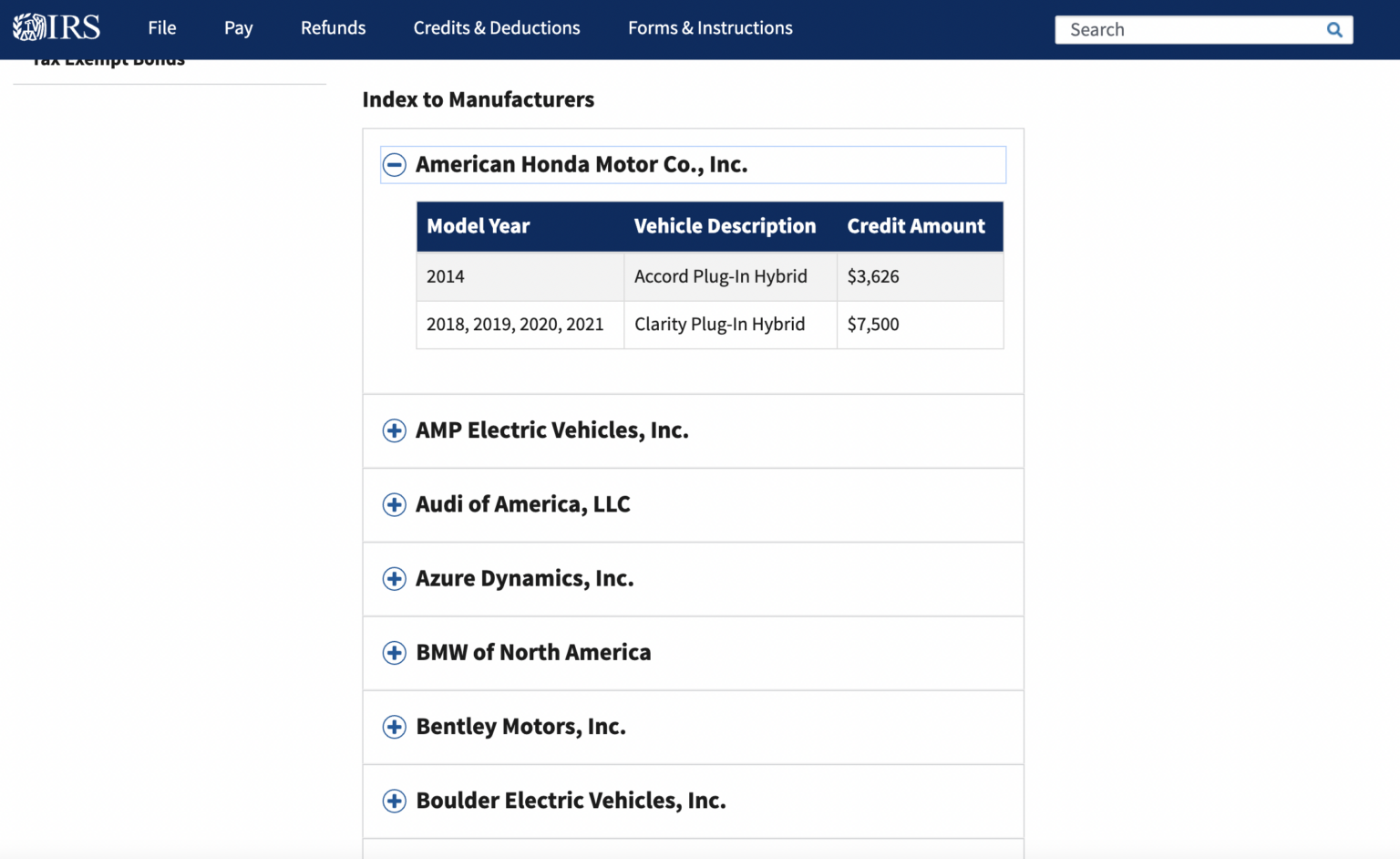

Federal Tax Credit Electric Car Lease You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

There is a tax credit available for leased electric vehicles There s also a catch The tax credit belongs to the lessor not to you the lessee Qualified buyers who meet certain income limits can We ll help you determine whether your purchase of an electric vehicle EV or fuel cell vehicle FCV qualifies for a tax credit based on whether you are Planning to buy a new clean vehicle

Federal Tax Credit Electric Car Lease

Federal Tax Credit Electric Car Lease

https://www.aesinspect.com/wp-content/uploads/2022/11/AdobeStock_535970711-scaled.jpeg

Why The Electric Vehicle Tax Credit Was Removed OsVehicle

https://cdn.osvehicle.com/do_any_electric_cars_qualify_for_new_tax_credit.jpg

These 34 Electric Cars Won t Qualify For Biden s New EV Tax Credits

https://www.carscoops.com/wp-content/uploads/2022/08/EVs-tax-credits.jpg

The EV tax credit plays a critical role for buyers when considering an EV since it amounts to an instant 7 500 discount at time of purchase while the lease tax credit brings Under Section 45W of the legislation commercial buyers of a qualifying clean vehicle are eligible for the federal tax credit but without the same vehicle assembly income and other restrictions of the consumer EV tax

Leases on new electric vehicles may be eligible for a tax credit of up to 7 500 through the manufacturer and the dealer Thanks to a boost from the government leasing not buying is becoming the most affordable way to get your hands on an electric vehicle Last year s Inflation Reduction

Download Federal Tax Credit Electric Car Lease

More picture related to Federal Tax Credit Electric Car Lease

Want To Lease An EV There s A Tax Credit Loophole For That

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1cuSyS.img?w=1920&h=1080&m=4&q=79

Tax Credits For Electric Vehicles Are About To Get Confusing The New

https://static01.nyt.com/images/2022/12/28/multimedia/28ev-credits-1-5aaf/28ev-credits-1-5aaf-videoSixteenByNine3000.jpg

Income Tax Credit Electric Vehicle Update Income Tax Payments Deferred

https://www.taxproadvice.com/wp-content/uploads/tax-credits-drive-electric-northern-colorado-932x1024.png

If you bought or leased a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under IRC 30D IRS states in their fact sheet topic G Q5 that businesses that lease vehicles are allowed to claim the commercial EV tax credit for each leased vehicle

You ve probably heard about the revised federal electric vehicle tax credit now officially named the Clean Vehicle Tax Credit that offers up to 7 500 for the purchase of Purchases of used EVs and PHEVs after Jan 1 are now eligible for a tax credit of 30 of the sale price up to a maximum of 4 000 The credit also has restrictions though

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

https://www.autopromag.com/usa/wp-content/uploads/2022/08/EV-Federal-Tax-Credits-5MgJUp.jpeg?is-pending-load=1

Tax Credit For Electric Vehicles Khou

https://media.khou.com/assets/KHOU/images/fda45742-0ba4-4512-b143-375cf49d3da4/fda45742-0ba4-4512-b143-375cf49d3da4_1920x1080.jpg

https://www.irs.gov › credits-deductions › credits-for...

You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022

https://www.kiplinger.com › taxes › ev-lea…

There is a tax credit available for leased electric vehicles There s also a catch The tax credit belongs to the lessor not to you the lessee Qualified buyers who meet certain income limits can

Has Federal EV Tax Credit Been Saved The Green Car Guy

Here Are The Cars Eligible For The 7 500 EV Tax Credit In The

Can You Get Federal Tax Credit For Leasing An Electric Car

Official Toyota s 7 500 Federal Tax Credit Phaseout Is Underway

Electric Vehicle Tax Credit What Qualifies How To Save Money KB

The Federal Tax Credit For Electric Cars How To Save 7 500

The Federal Tax Credit For Electric Cars How To Save 7 500

Most Electric Vehicles Won t Qualify For Federal Tax Credit

Federal Tax Credit Use It Or Lose It

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24015542/226268_CHEVY_EV_LINEUP_PHO_ahawkins_0006.jpg)

Only Six EVs Still Qualify For The 7 500 Federal Tax Credit After New

Federal Tax Credit Electric Car Lease - Thanks to a boost from the government leasing not buying is becoming the most affordable way to get your hands on an electric vehicle Last year s Inflation Reduction