Federal Tax Deductions Medical Insurance Premiums Your health insurance premiums can be deductible on your federal taxes depending on your total medical costs employment status whether you itemize deductions

You can only deduct medical expenses after they exceed 7 5 of your adjusted gross income This threshold had been scheduled to increase to 10 but a tax law passed at the end of 2020 For the 2022 and 2023 tax years you re allowed to deduct any qualified unreimbursed healthcare expenses you paid for yourself your spouse or your dependents but only if they exceed 7 5 of

Federal Tax Deductions Medical Insurance Premiums

Federal Tax Deductions Medical Insurance Premiums

https://hp-prod-wp-data.s3.us-west-1.amazonaws.com/content/uploads/02x.jpeg

Are Health Insurance Premiums Tax Deductible Triton Health Plans

http://static1.squarespace.com/static/623b48a3293e2847ebe155cc/625e95a79c5ec522c5f3c38d/628632b30484eb3b330be95b/1654612213254/are-health-insurance-premiums-tax-deductible.png?format=1500w

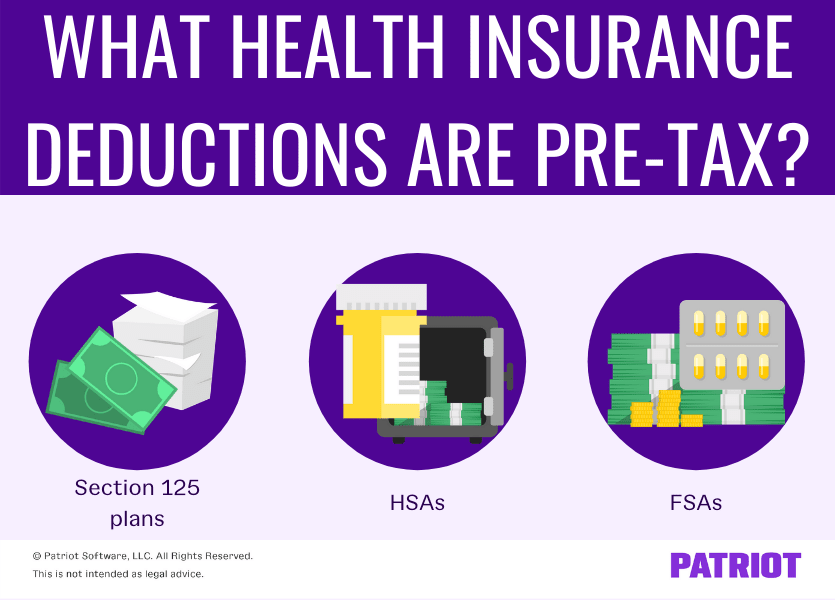

Are Payroll Deductions For Health Insurance Pre Tax Details More

https://www.patriotsoftware.com/wp-content/uploads/2021/06/health-insurance-pre-tax-1.png

You may be able to claim health insurance premiums on your tax return depending on how much you spent on medical care how you paid for premiums and if you were self employed But you cannot deduct any The contribution you make to your HSA is 100 tax deductible up to a limit in 2024 of 4 150 if your HDHP covers just yourself and 8 300 if it also covers at least one

You can t deduct qualified medical expenses as an itemized deduction on Schedule A Form 1040 that are equal to the tax free distribution from your HSA Insurance premiums You In order to deduct medical expenses including health insurance from your taxes your total medical costs must exceed 7 5 of your adjusted gross income AGI and you can only deduct the amount above

Download Federal Tax Deductions Medical Insurance Premiums

More picture related to Federal Tax Deductions Medical Insurance Premiums

Top 10 Tax Deductions For Medical Professionals Affinitas Accounting

https://affinitasaccounting.com.au/wp-content/uploads/AdobeStock_69649061-min.jpeg

/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg)

Are Health Insurance Premiums Tax Deductible

https://www.investopedia.com/thmb/MlLHZTpP13VHUZz-t-fGGQ9EC7c=/2122x1415/filters:fill(auto,1)/171106288_Aslan-Alphan_E-_GettyImages-56a6361f3df78cf7728bd97e.jpg

Claim Medical Expenses On Taxes Income Tax Preparation Us Tax

https://i.pinimg.com/originals/7b/37/05/7b37052b2fb0ea107a6dd3af15498805.jpg

Claiming medical expense deductions on your tax return is one way to lower your tax bill To accomplish this your deductions must be from a list approved by the Internal Revenue Service and you must itemize your Health insurance premiums can be tax deductible under a few circumstances Here is how it works

Health insurance premiums are tax deductible but only if your total health care expenses including premiums exceed 7 5 of your adjusted gross income and only If you pay for health insurance after taxes are taken out of your paycheck you might qualify for the medical expense deduction If you paid the premiums for a policy you obtained yourself

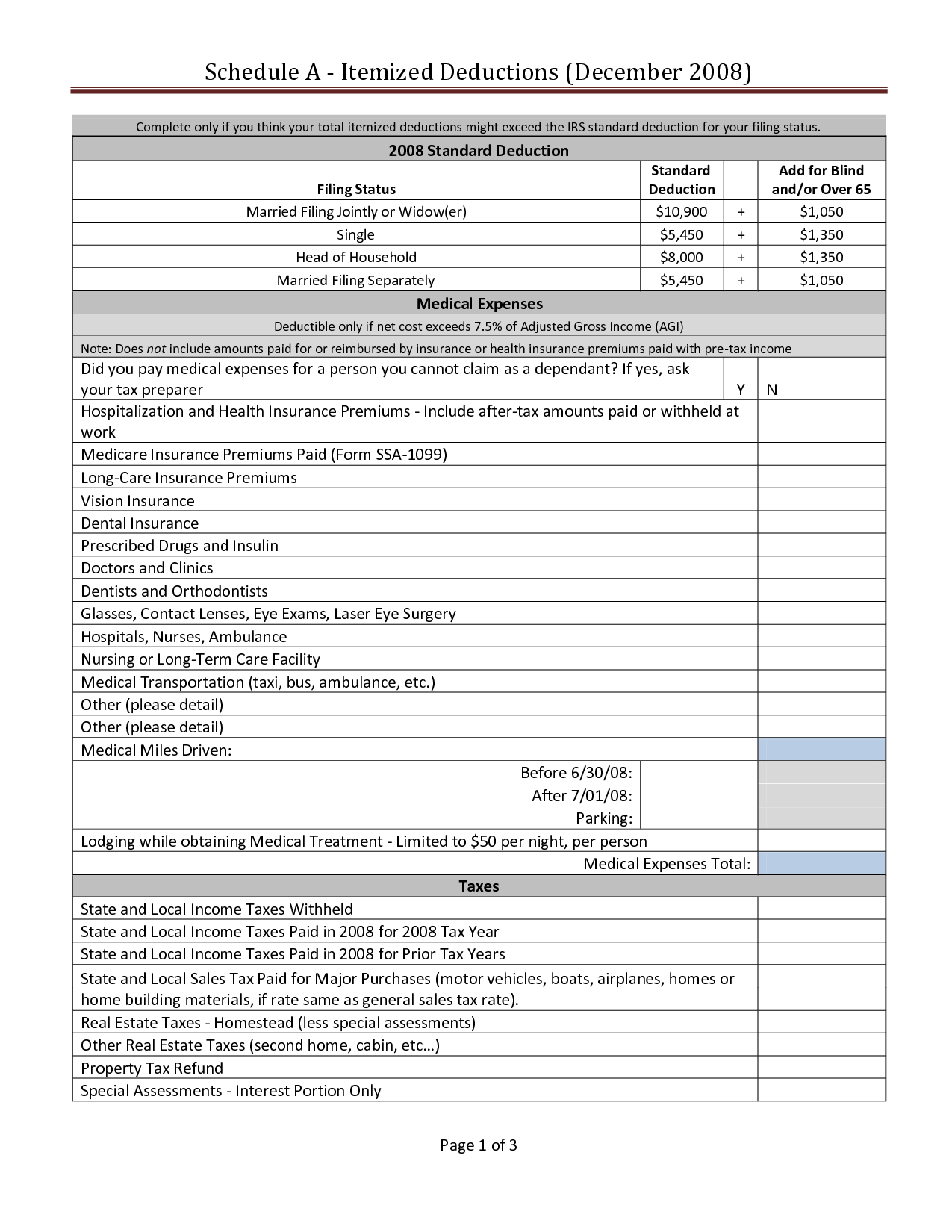

Printable Itemized Deductions Worksheet

https://i2.wp.com/www.worksheeto.com/postpic/2011/02/federal-income-tax-deduction-worksheet_472256.jpg?crop=12

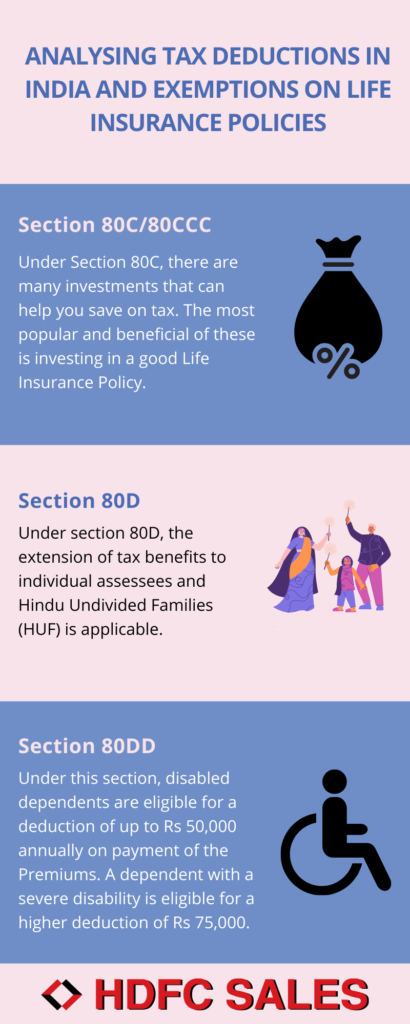

Analysing Tax Deductions In India And Exemptions On Life Insurance

https://www.hdfcsales.com/blog/wp-content/uploads/2018/04/tax-deductions-and-exemptions-on-life-insurance-policies.png

https://www.goodrx.com › insurance › taxes › deduct...

Your health insurance premiums can be deductible on your federal taxes depending on your total medical costs employment status whether you itemize deductions

https://money.usnews.com › money › p…

You can only deduct medical expenses after they exceed 7 5 of your adjusted gross income This threshold had been scheduled to increase to 10 but a tax law passed at the end of 2020

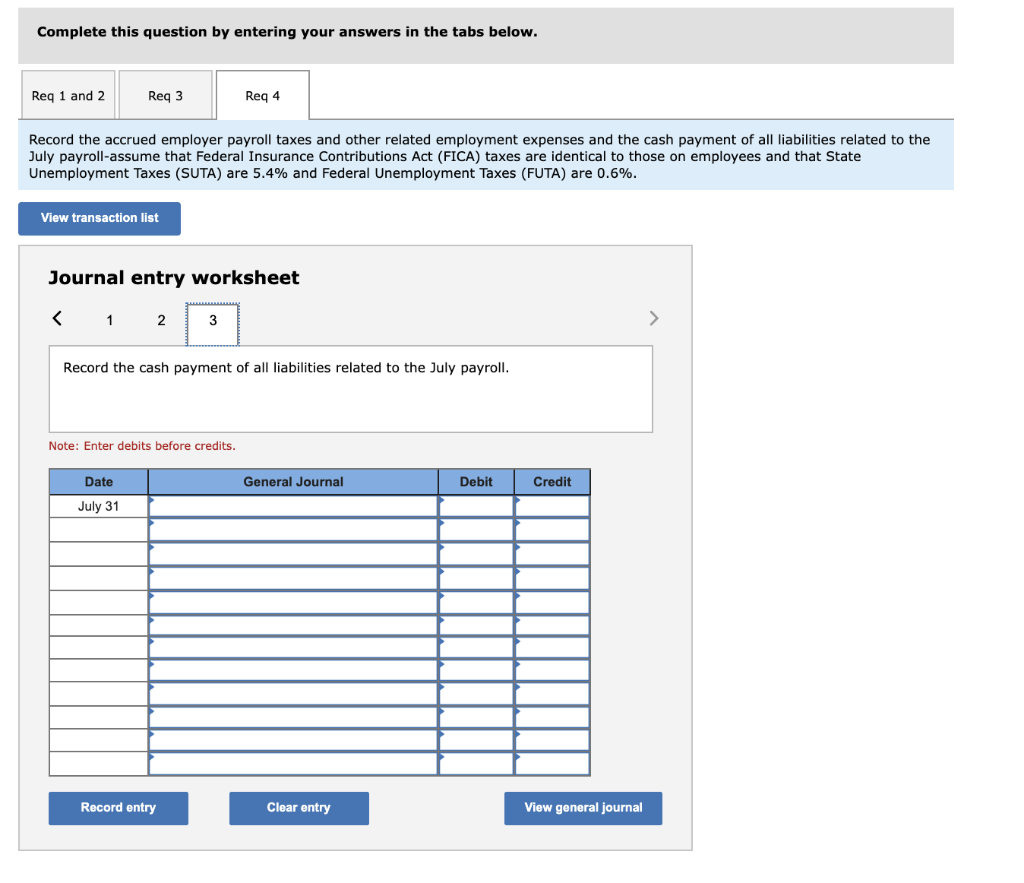

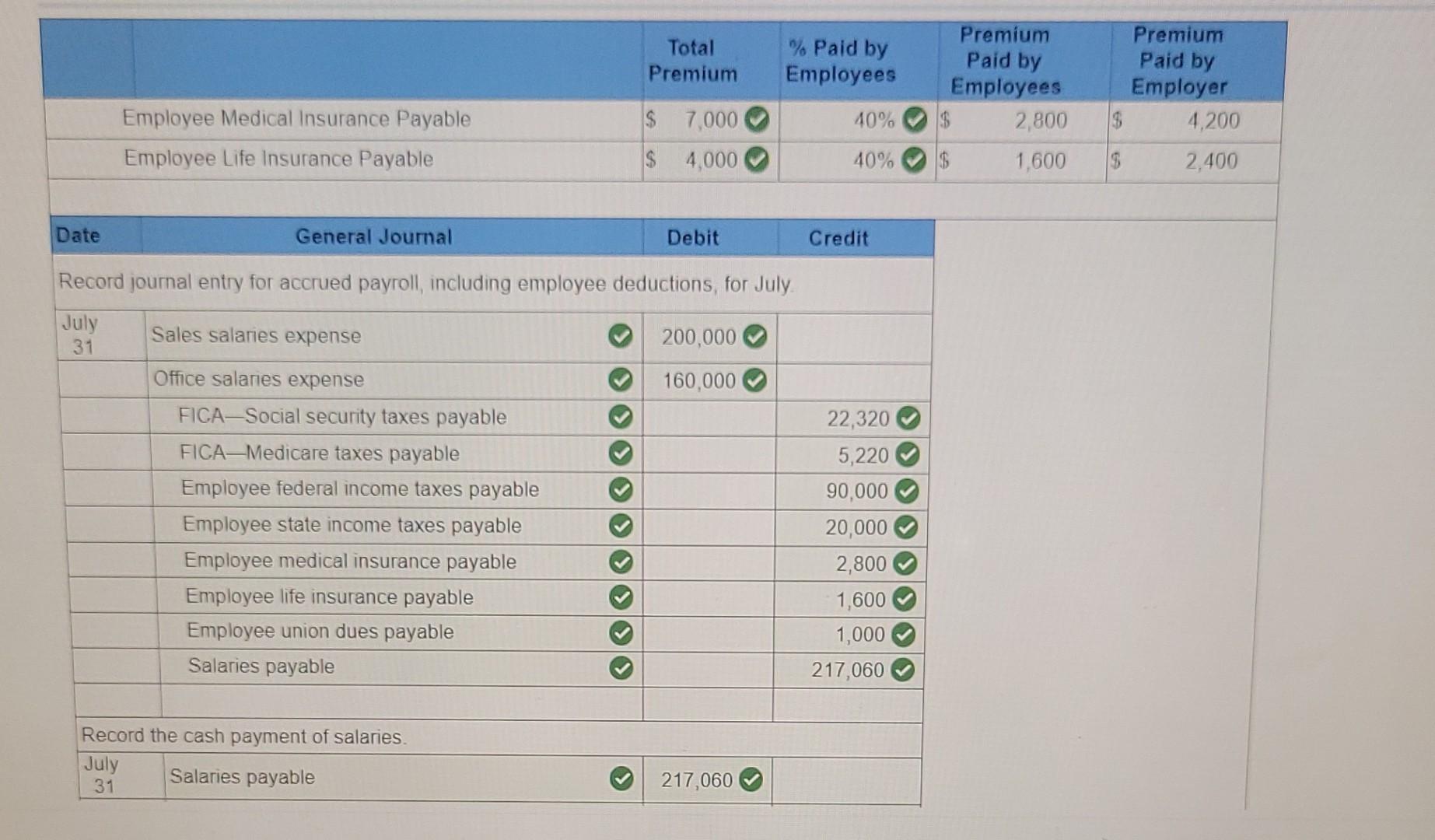

Solved The Following Monthly Data Are Taken From Ramirez Chegg

Printable Itemized Deductions Worksheet

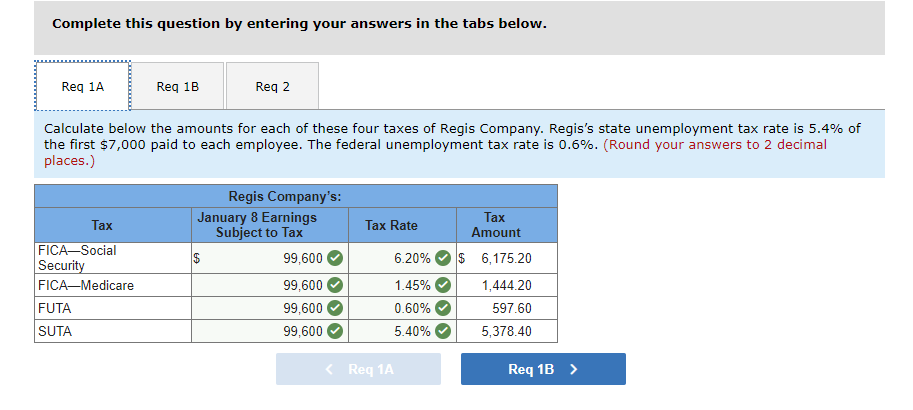

Solved On January 8 The End Of The First Weekly Pay Period Chegg

Qualified Business Income Deduction And The Self Employed The CPA Journal

Solved The Following Monthly Data Are Taken From Ramirez Chegg

Solved On January 8 The End Of The First Weekly Pay Period Of The

Solved On January 8 The End Of The First Weekly Pay Period Of The

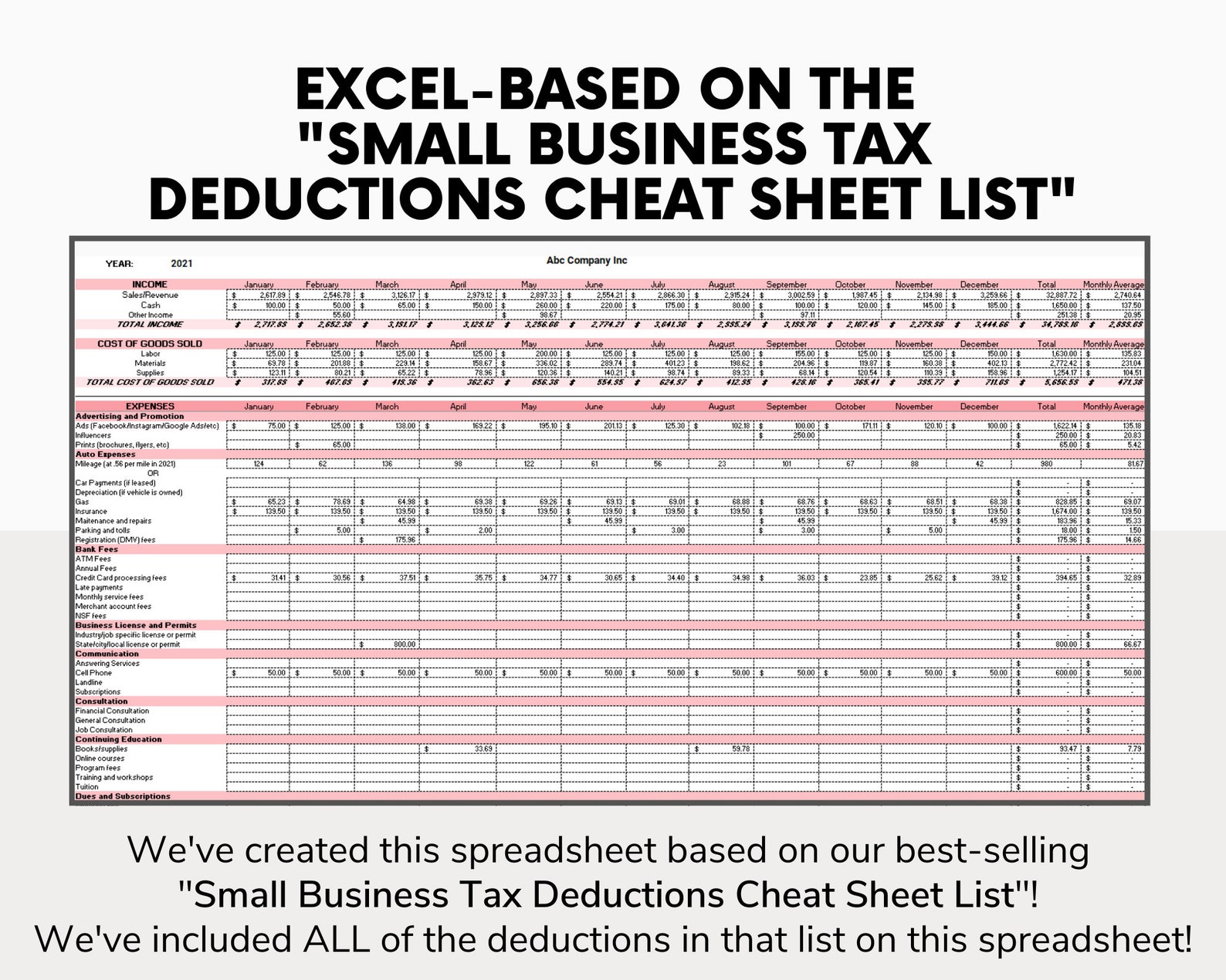

Business Tax Deductions Cheat Sheet Excel In PINK Tax Etsy

Tax Deductions For Medical Expenses

5 Itemized Tax Deduction Worksheet Worksheeto

Federal Tax Deductions Medical Insurance Premiums - Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health insurance