Federal Tax Rebate For Solar 2024 The federal tax credit is sometimes referred to as an Investment Tax Credit or ITC though is different from the ITC offered to businesses that own solar systems What is the federal solar tax credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every Key Takeaways The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the

Federal Tax Rebate For Solar 2024

Federal Tax Rebate For Solar 2024

https://blog.calculatesolarsavings.com/wp-content/uploads/2023/02/2023-federal-solar-tax-rebate.png

30 Federal Solar Tax Rebate Extension Announced For Solar Installations In Florida Newswire

https://cdn.newswire.com/files/x/bc/b8/aa7c5e885eb71a7a5f40ca76b67f.jpg

Federal Tax Filing Season Has Started EKS Associates

https://eksassociates.com/wp-content/uploads/2022/03/tax-season-loading.jpeg

A percentage of the cost of a solar PV system paid for by the taxpayer 2 Other types of renewable energy are also eligible for similar credits but are beyond the scope of this guidance Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 Let s say you spent 20 000 on solar the tax credit is 6 000 If you owed 20 000 in taxes but withheld 25 000 throughout the year on your paychecks your refund would be 11 000 6 000 from the federal tax credit and 5 000 from the income taxes However you won t always get the tax credit back in your refund check

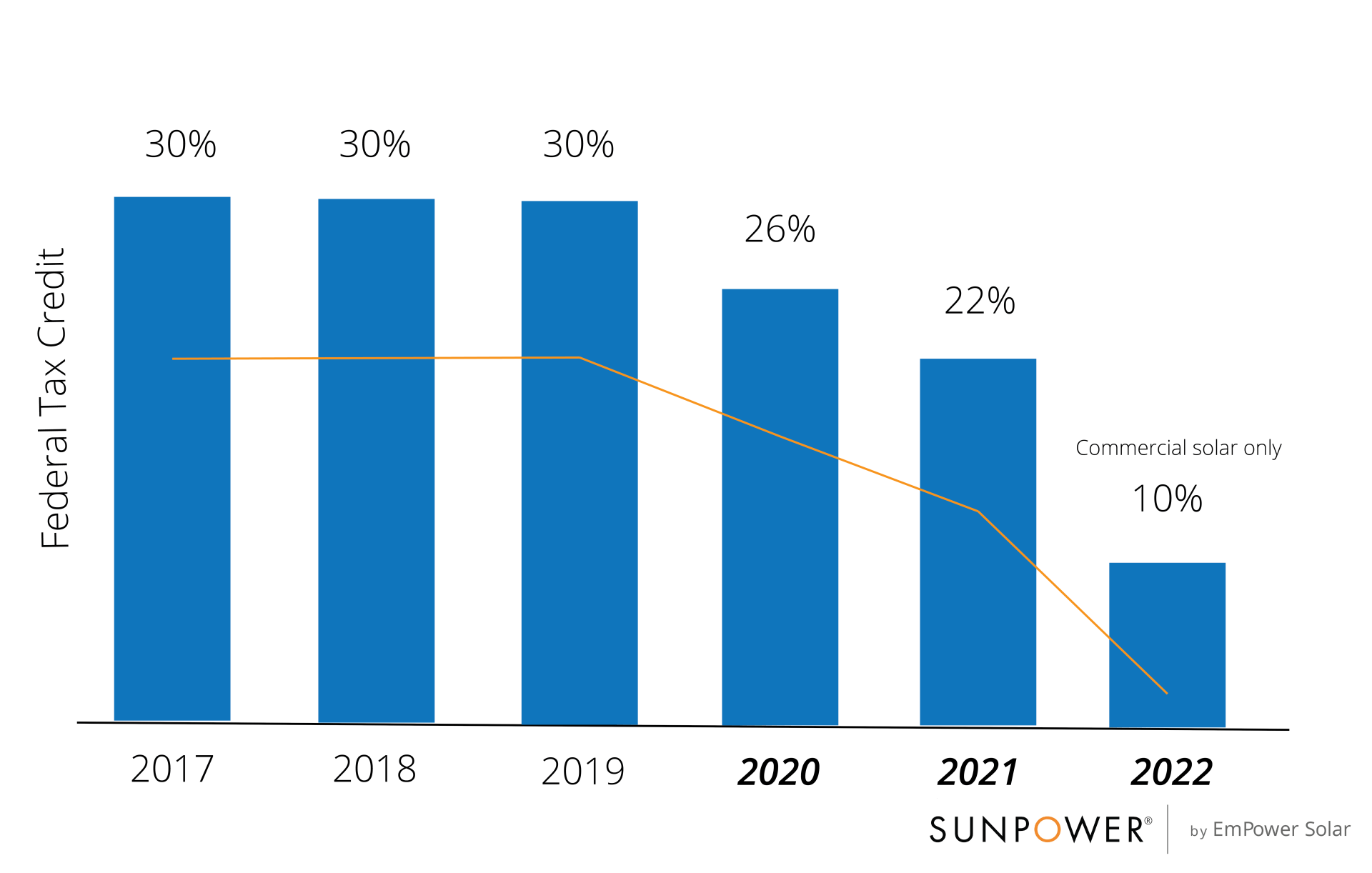

What Is the Solar Tax Credit If you install solar energy equipment in your residence any time this year through the end of 2032 you are entitled to a nonrefundable credit off your federal Installing renewable energy equipment on your home can qualify you for Residential Clean Energy credit of up to 30 of your total qualifying cost depending on the year the equipment is installed and placed in service 30 for equipment placed in service in tax years 2017 through 2019 26 for equipment placed in service in tax years 2020

Download Federal Tax Rebate For Solar 2024

More picture related to Federal Tax Rebate For Solar 2024

How Do You Find Out If I Am Due A Tax Rebate Leia Aqui How Do You Know When Your Tax Rebate Is

https://images.ctfassets.net/ifu905unnj2g/5KwPoo8zZu1ZPIrfn2FdSo/94bf8ce97dc0bc624b3626de0e452578/Screenshot_110422_105531_AM.jpg

Solar Tax Credits Rebates Missouri Arkansas

https://soleraenergyllc.com/wp-content/uploads/2022/07/Graphic-1000x1024.jpg

Tax Refund Gambaran

https://g.foolcdn.com/editorial/images/230742/getty-tax-refund.jpg

U S Department of the Treasury IRS and Department of Energy Announce Remarkable Demand for Solar and Wind Energy in Low Income Communities Thanks to Groundbreaking Inflation Reduction Act Program December 4 2023 Communities across the U S experiencing the most significant effects of poverty represent a quarter of applications received The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which

Fact Checked The solar investment tax credit ITC also called the federal solar tax credit allows qualifying property owners to get a tax credit for 30 of the cost to install a solar energy Solar Energy Systems How to Claim the Federal Tax Credits These credits are managed by the U S Internal Revenue Service IRS and can be claimed with your federal income taxes for the year in which the upgrades are made

Missouri Solar Incentives StraightUp Solar

https://straightupsolar.com/wp-content/uploads/2020/04/FederalIncentives2021_Updated_V1-1536x512.jpg

What You Need To Know Federal Carbon Tax Takes Effect In Ont Manitoba Sask And N B Today

https://i.cbc.ca/1.4875360.1540329689!/fileImage/httpImage/image.png_gen/derivatives/original_620/federal-government-s-carbon-tax-and-rebate-plan.png

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

The federal tax credit is sometimes referred to as an Investment Tax Credit or ITC though is different from the ITC offered to businesses that own solar systems What is the federal solar tax credit

https://www.nerdwallet.com/article/taxes/solar-tax-credit

The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

Albertans Will Pay Either Provincial Or Federal Carbon Tax Which Will Hurt Less Globalnews ca

Missouri Solar Incentives StraightUp Solar

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

The 26 Federal Tax Credit Has Been Extended Through 2022 But Scheduled To Decline During The

Income Tax Rebate Under Section 87A

UAE s Federal Tax Authority FTA Initiates Corporate Tax Registration For Public Joint Stock

UAE s Federal Tax Authority FTA Initiates Corporate Tax Registration For Public Joint Stock

Fixing The Federal EV Tax Credit Flaws Redesigning The Vehicle Credit Formula EVAdoption

Solar Scams Deceptive But Legal Solar Practices Creative Solar USA

How Does The Federal Solar Tax Credit Work

Federal Tax Rebate For Solar 2024 - When you invest in a solar photovoltaic PV system you become eligible for the Federal Solar Tax Credit This credit can be claimed on your federal income taxes and it constitutes a percentage of the cost of the solar system Tax Years 2022 Through 2032