Sc Tax Rebate Checks 2023 Web 18 avr 2023 nbsp 0183 32 To be eligible for the SC tax rebate check residents must have filed their 2022 state income tax return by October 17 2023 and have a South Carolina adjusted

Web 9 f 233 vr 2023 nbsp 0183 32 South Carolina Rebate Checks Could Be Taxable By The IRS iHeart By Sarah Tate February 9 2023 Photo Getty Images If you Web 11 f 233 vr 2023 nbsp 0183 32 February 11 2023 5 30 AM An image of cash Giorgio Trovato via Unsplash Many South Carolinians who got a state tax rebate can breathe a bit easier now The

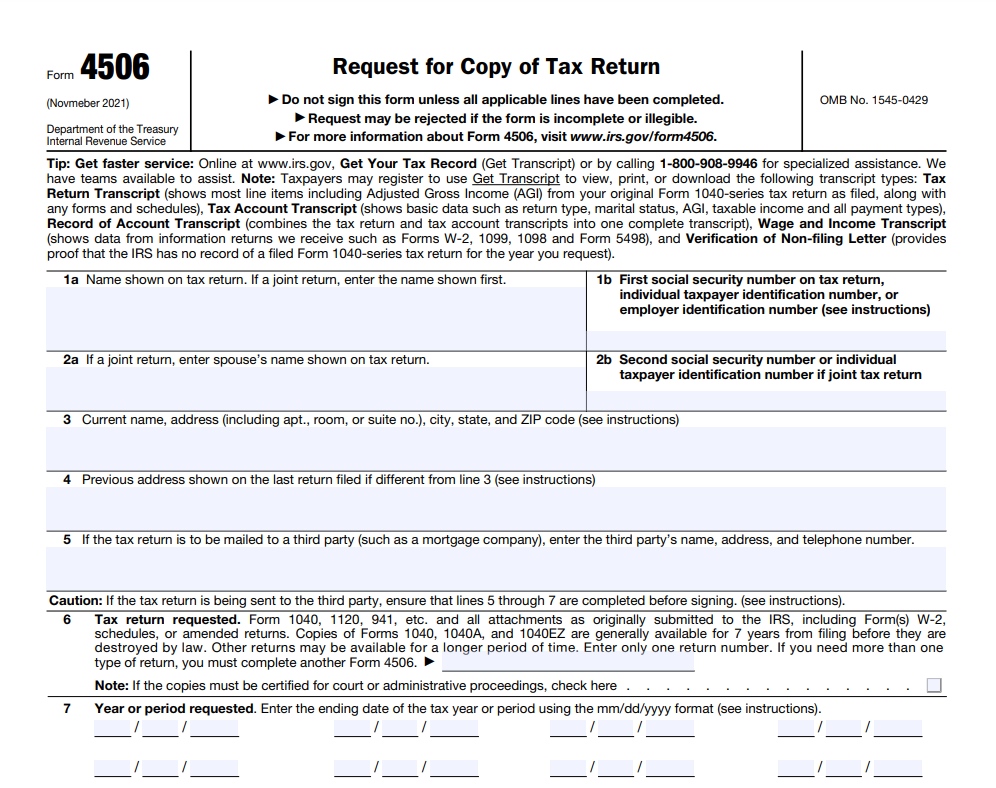

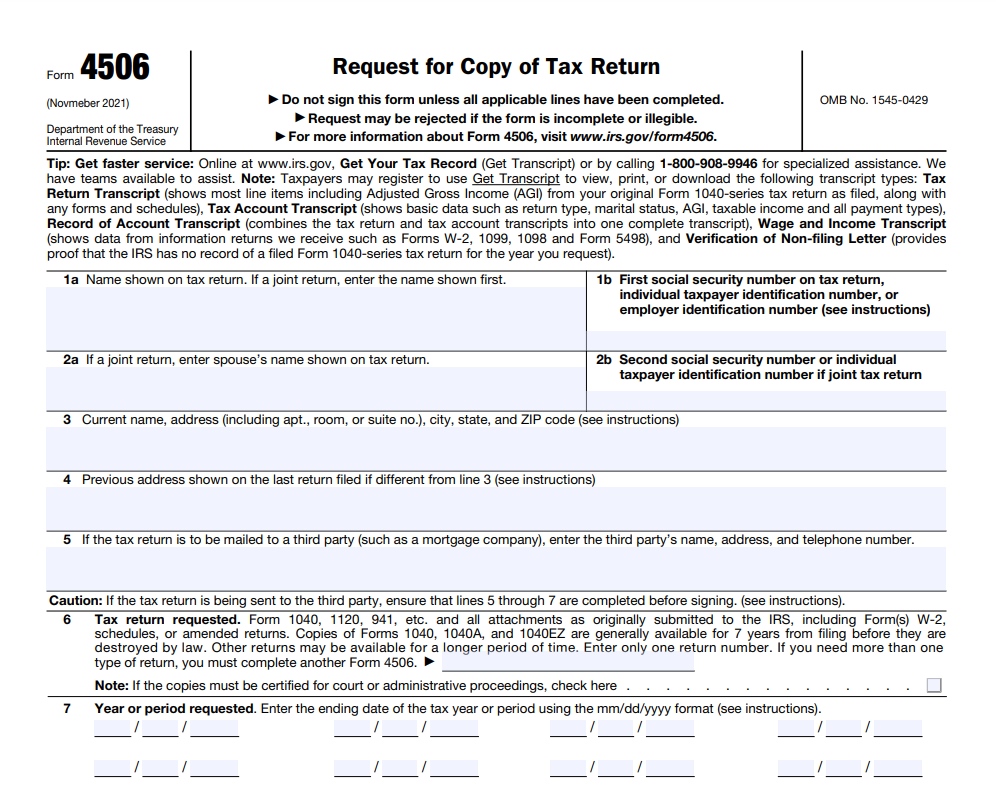

Sc Tax Rebate Checks 2023

Sc Tax Rebate Checks 2023

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/unnamed-file-1.png?fit=1200%2C600&ssl=1

South Carolina Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/04/South-Carolina-Tax-Rebate-2023.jpg

Alabama Tax Rebate Checks Are Coming In 2023

https://img-s-msn-com.akamaized.net/tenant/amp/entityid/AA1ccuv6.img?w=1920&h=1080&m=4&q=79

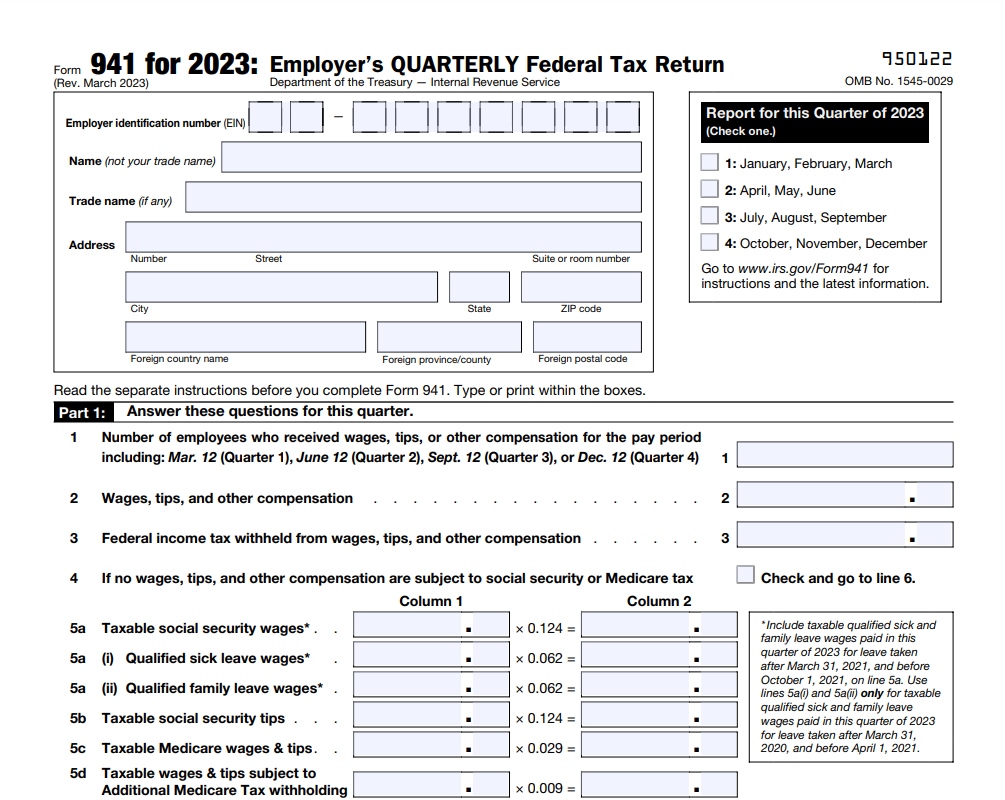

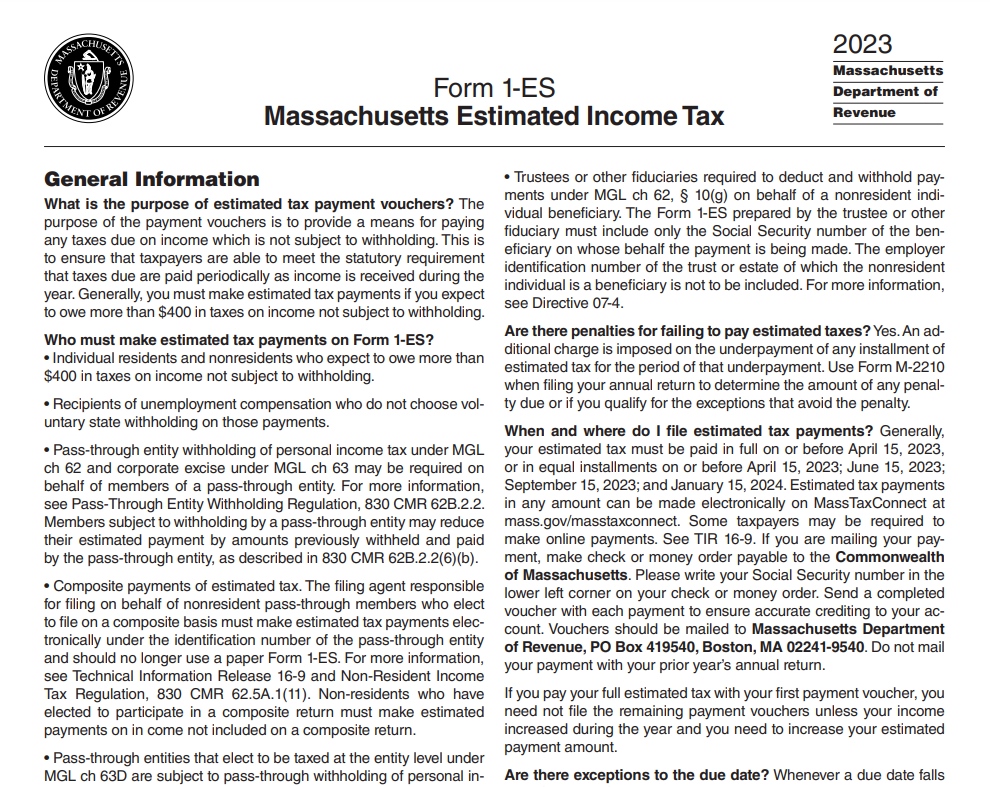

Web The full credit amount 1 200 individuals 2 400 couples 500 for children is available for individuals with AGI at or below 75 000 112 500 for heads of Web 15 avr 2023 nbsp 0183 32 Tax Rebate 2023 SC The Tax Rebate 2023 SC is an opportunity for South Carolina taxpayers to claim a tax refund and reduce their tax liability If you re eligible for

Web SC Tax Rebate Checks 2023 is a free printable for you This printable was uploaded at April 18 2023 by tamble in South Carolina SC Tax Rebate Checks 2023 can be Web 25 ao 251 t 2023 nbsp 0183 32 If you are looking for Sc Tax Rebate Check 2023 you ve come to the right place We have 35 rebates about Sc Tax Rebate Check 2023 including images

Download Sc Tax Rebate Checks 2023

More picture related to Sc Tax Rebate Checks 2023

2023 Rebate Check RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/michelob-ultra-rebate-form-2023-printable-rebate-form.png?w=706&h=516&ssl=1

Tax Rebate 2023 Illinois Qualification Criteria Claim Process And

https://i0.wp.com/www.tax-rebate.net/wp-content/uploads/2023/04/Tax-Rebate-2023-Illinois.jpg?resize=978%2C781&ssl=1

Ga Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/04/Ga-Tax-Rebate-2023.jpg

Web 30 mars 2023 nbsp 0183 32 Rebate Check 2023 Sc A rebate check is an excellent way to save on your purchases But few people know how to claim and keep track of the checks We ll Web 14 nov 2022 nbsp 0183 32 NEWS RELEASE SHARE REBATES NOW BEING ISSUED CAP AMOUNT SET AT 800 FOR IMMEDIATE RELEASE 11 14 2022 What you nee d to

Web Published January 17 2023 First group of SC tax rebates issued Published December 7 2022 Rebates now being issued cap amount set at 800 Published November 14 Web 27 janv 2023 nbsp 0183 32 Published Jan 27 2023 at 9 02 AM PST Updated Jan 27 2023 at 3 44 PM PST CHARLESTON S C WCSC If you have not yet filed your 2021 income tax

Mass Tax Rebate 2023 Tax Rebate

https://www.tax-rebate.net/wp-content/uploads/2023/04/Mass-Tax-Rebate-2023.jpg

Home Owner Tax Rebate Check 2023 RebateCheck

https://i0.wp.com/www.rebatecheck.net/wp-content/uploads/2023/04/first-time-home-owner-tax-benefits-benefitstalk.jpeg

https://www.tax-rebate.net/sc-tax-rebate-checks-2023

Web 18 avr 2023 nbsp 0183 32 To be eligible for the SC tax rebate check residents must have filed their 2022 state income tax return by October 17 2023 and have a South Carolina adjusted

https://www.iheart.com/content/2023-02-09-so…

Web 9 f 233 vr 2023 nbsp 0183 32 South Carolina Rebate Checks Could Be Taxable By The IRS iHeart By Sarah Tate February 9 2023 Photo Getty Images If you

How To Check Your Tax Rebate Eligibility Tax Rebate Check 2023 Tax

Mass Tax Rebate 2023 Tax Rebate

Millions Still Waiting For Relief Checks Between 50 To 400 See When

Nys Property Tax Rebate Checks 2023 Eligibility Application Process

Unlocking The Benefits Of Governor Whitmer Tax Rebate 2023 Tax Rebate

IRS Tax Rebate

IRS Tax Rebate

Star Rebate Checks 2023 Schedule RebateCheck

Tax Rebate 2023 Massachusetts Maximizing Tax Rebate Opportunities

Irs Rebate Checks 2023 RebateCheck

Sc Tax Rebate Checks 2023 - Web 9 ao 251 t 2023 nbsp 0183 32 If you are looking for Sc Tax Rebates 2023 you ve come to the right place We have 35 rebates about Sc Tax Rebates 2023 including images pictures photos